Brazil: March 50bps Cut?

Though the BCB remain focused on getting inflation converging towards the centre of the inflation target range at 3%, the January statement does suggest that an easing move will be delivered at the March meeting. With headline inflation falling, the real interest rate is going up and policy is becoming more restrictive. The BCB will likely frame any easing as offsetting an increase in real policy rates due to falling inflation, with the January statement leaning against a more aggressive pace or size. This should mean a 50bps step in March 2026 followed by a moderate pace of easing in the remainder of 2026.

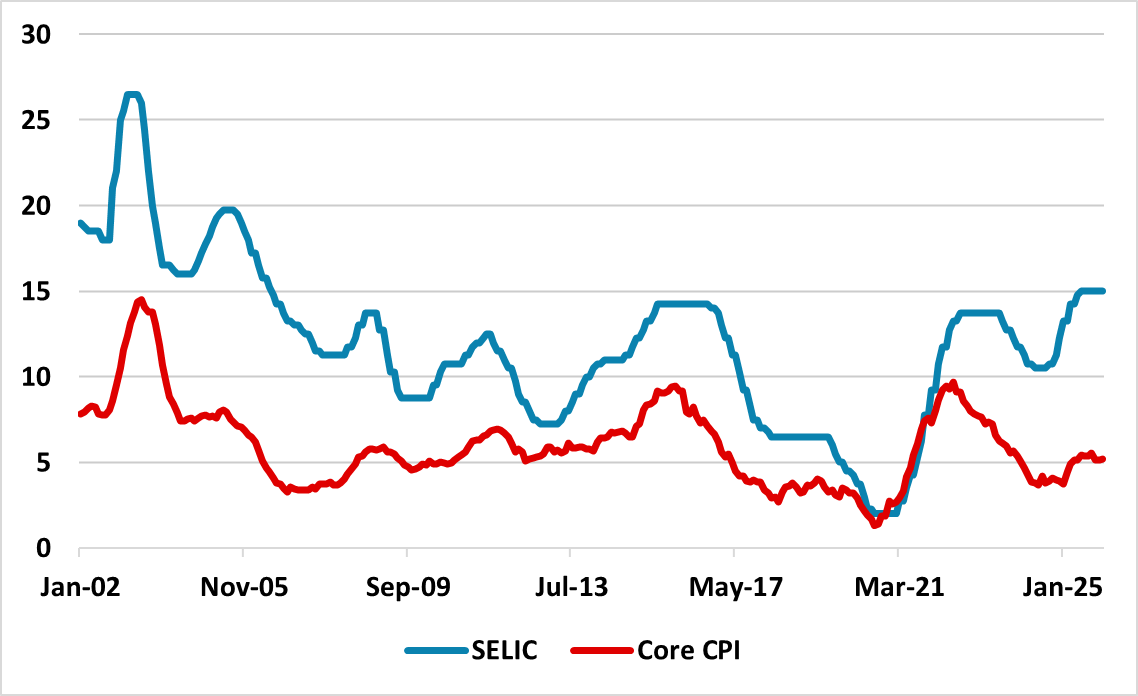

Figure 1: Brazil Core CPI and SELIC Policy Rate (%)

Source: Datastream/Continuum Economics

The January BCB statement did provide major clues on prospective policy easing. Key points include

· Amended forward guidance. The BCB statement noted slower inflation is more evident and that at the next meeting it would initiate the flexibilization of its monetary policy (i.e. rate cut). The statement did caution that monetary policy still needed to be contractionary and the pace and magnitude require serenity. This certainly argues against 100bps cut and some see this meaning 25bps. However, the scale of real policy rates and incoming data leaves us forecasting 50bps in March. It is worth noting that two seats were vacant in January, as Lula new appointees were not on board.

· Data shaping the debate. Inflation and inflation expectations continue to ease, which builds the case for a return to 3% inflation. Market expectations are now down to 3.74% for the policy relevant Q4 2027. Meanwhile, though GDP picked up in November, the lagged effects of ultra-restrictive policy is still feeding through and intermittent softness will likely be seen in 2026. The rebound in the Brazilian Real (BRL) is also likely to leave BCB more comfortable in easing in the future. Indeed, with inflation falling the real policy rate has now pushed up to 10% compared with BCB neutral real policy rate estimate of 5.0%. Greater confidence in hitting the inflation target would mean an easing cycle to below a 10% SELIC rate.

· March cut? The data and forward guidance are building an argument to reduce the degree of restrictive policy at the March 18 2026 BCB meeting. However, the BCB will likely frame any easing as offsetting an increase in real policy rates due to falling inflation, rather than signalling a more aggressive pace or size. BCB are also likely wary that 2026 will see an easing of fiscal policy before what is expected to be a tight presidential election. This should mean a 50bps step in March 2026 followed by a moderate pace of easing in 2026. We see a 50bps cut in June, before a further 150bps in H2 to take the SELIC down to 12%. H2 will likely see more inflation convergence and this can see BCB ensuring that policy moves from ultra-restrictive to restrictive. Nevertheless, in 2027 the BCB easing is likely to be moderate rather than aggressive and will be data dependent and we see a further 250bps to 9.5%. This would still be mildly restrictive policy rate level, with the market viewing 8% as being around nominal neutral policy rates, with the BCB having estimated a 5% neutral real policy rate in the past (here).