Brazil: 15% Well Into 2026

The BCB statement was clear that the deanchored inflation picture still requires interest rates to be kept at current levels for a very prolonged period of time. The consensus for economists is that this will change in Q1 2026 with a 50bps cut, though ideas of December are fading. We suspect it will take longer and the first rate cut is unlikely to arrive until Q2 2026. Even so, BCB easing will initially be slow until it become comfortable that inflation is anchored again. We look for around 250bps of cuts in 2026, which will come gradually as inflation and inflation expectations fall.

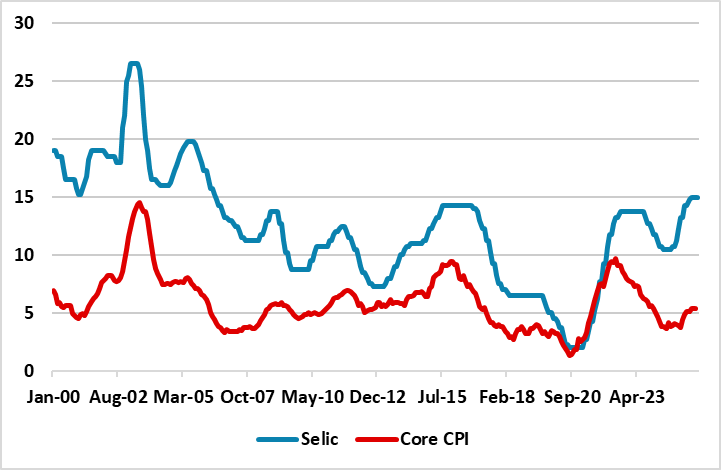

Figure 1: Brazil Core CPI and SELIC Policy Rate (%)

Source: Datastream/Continuum Economics

Source: Datastream/Continuum Economics

The September BCB statement provides a number of clues on prospective policy. Key points include

• Economy slowing, but still inflation pressures still. The BCB statement did once again note the moderation of economic activity, which reflects the three months of weak monthly activity data as the lagged impact of monetary tightening feeds through. Even so, later in the statement the BCB still describes the economy as resilient and the labour market as tight, which suggests that they would likely to see more tightening hurting the economy to help disinflation. Meanwhile, the broad inflation assessment remains that inflation is deanchored, with Focus survey median at 4.3% for 2026 and the BCB maintaining the above target forecast of 3.4% for Q1 2027.

• No early cuts. The BCB statement was also clear that the inflation picture still requires interest rates to be kept at current levels for a very prolonged period of time. While headline inflation has been choppy, underlying inflation or inflation expectations are not coming down quickly enough. BCB requires current interest rates for a very prolonged period of time and too hint at 2026 cuts would be premature. The consensus for economists is that this will change in Q1 2026 with a 50bps cut. We suspect it will take longer and the first rate cut is unlikely to arrive until Q2 2026. Even so, BCB easing will initially be slow until it become comfortable that inflation is anchored again. We look for around 250bps of cuts in 2026, which will come gradually as inflation and inflation expectations fall.