USMCA Renegotiation: Hostage To Trump

• Trump could decide to go on an early offensive over the July 2026 USMCA review or could wait until after the November congressional elections to act tough given it could cause new cost of living fears for U.S. voters. This could mean that at times the USMCA negotiations are upsetting for Canadian and Mexican markets and at other times relief is seen. The uncertainty is high in terms of Trump’s tactics and intervention and will mean a fluid view on USMCA through 2026. Ultimately though we would see a revised USMCA being agreed by the three countries, though this could be 2027.

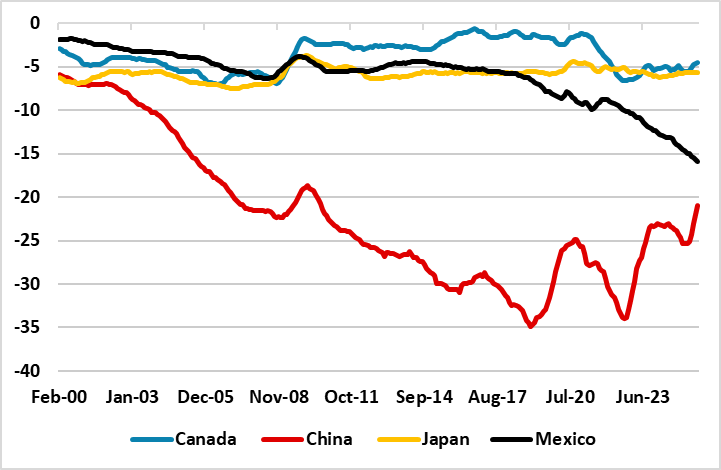

Figure 1: U.S. Bilateral Monthly Deficits Select Countries (12mma USD Blns)

Source: Datastream/Continuum Economics.

Source: Datastream/Continuum Economics.

The USMCA is up for review in 2026, with USTR scheduled to submit a report to the U.S. Congress on January 3 2026 recommending whether to support renewal; move to annual reviews or renegotiate, which is then followed by a kick off meeting on July 1 for the Free Trade Commission (FTC) between U.S./Canada and Mexico. A simple review and extension of USMCA end date from 2036 to 2042 appears unlikely, as the Trump administration battles Canada and Mexico for concessions. The initial stance from the Trump administration is likely to be a desire to renegotiate, including tougher rules of origin for 3rd countries like China. The U.S. could also seek to make adjustment for labor enforcement, agriculture (e.g. dairy with Canada) and energy market access as well to favor the U.S. (the latter especially with Mexico stated owned sector). President Trump will likely leave the technicalities to others and will set the broader thrust. The tensions between the U.S. and Canada this year contrast with the good relationship in the last 6 months between President Trump and Mexico‘s Sheinbaum. Trump could push Canada and Mexico in H1 2026 to coincide ground or repeat October threat of replacing the USMCA with separate bilateral deals. Mexico will likely want to keep good relations with the U.S. for as long as possible, but ultimately could be more willing than Canada to concede points to the U.S.

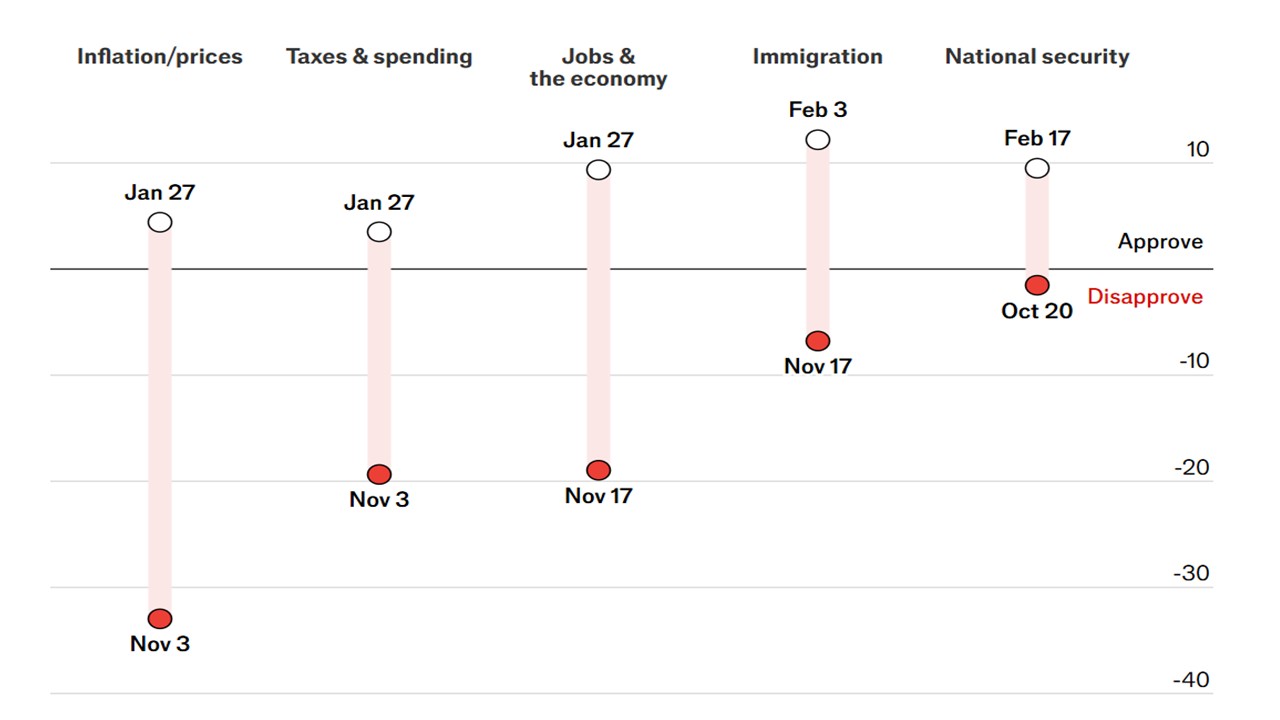

Uncertainty also exists whether Trump will raise the stakes in H1 2026 or instead delay until after the November congressional election to avoid adverse inflation worries for U.S. voters. Trump’s tactics in Q1 2025 was to go on the offensive early, as he threatened Canada and Mexico before April reciprocal tariff threats. However, Trump has sought trade framework deals though the summer and peak tariff threats appear to have passed. Part of the reason is Trump’s love of doing deals, but it also likely reflects opinion polls that shows voters are upset about the lack of progress on cost of living by the Trump administration (Figure 2). The USMCA renegotiation and review could drag out until 2027, as no deadline exists and the current agreement runs to 2036. Trump could choose to threat at times and claim progress at other times to suit the political mood and finally conclude a deal after the mid-terms.

This all makes trilateral discussions difficult, especially as Trump hates such formats and prefers bilateral leverage in negotiations. Canada and Mexico desire for trilateral negotiations will likely not last Trump’s intervention. This could mean that at times the USMCA negotiations are upsetting for Canadian and Mexican markets and at other times relief is seen. The uncertainty is high in terms of Trump’s tactics and intervention and will mean a fluid view on USMCA through 2026. Ultimately though we would see a revised USMCA being agreed by the three countries, though this could be 2027.

Figure 2: Trump Rating on Key Issues (%)

Source: Economist/You Gov