Financial Stability Risks: Vulnerable To A Recession

The November Fed financial stability review highlights continued concern over hedge funds and insurance company leverage, while the IMF GSFR is concerned about U.S. equity market overvaluation and growing links between banks and non-bank financial intermediaries. However, the main adverse shock would be a U.S. recession and we are reducing the odds of such a scenario in the next 12 months from 30% to 20% -- given that peak Trump tariff problems have passed. We are more worried about the 2ND tier of China banking system that also needs to be watched, given the continued feedthrough of the residential property sector bust. A surge in government bond term premia or a turn to a central bank tightening cycle could also be a shock, but this is low to modest probability in the next 12-24 months excluding Japan.

Growing concern has been raised about financial stability risks, but where are they and how threatening are they?

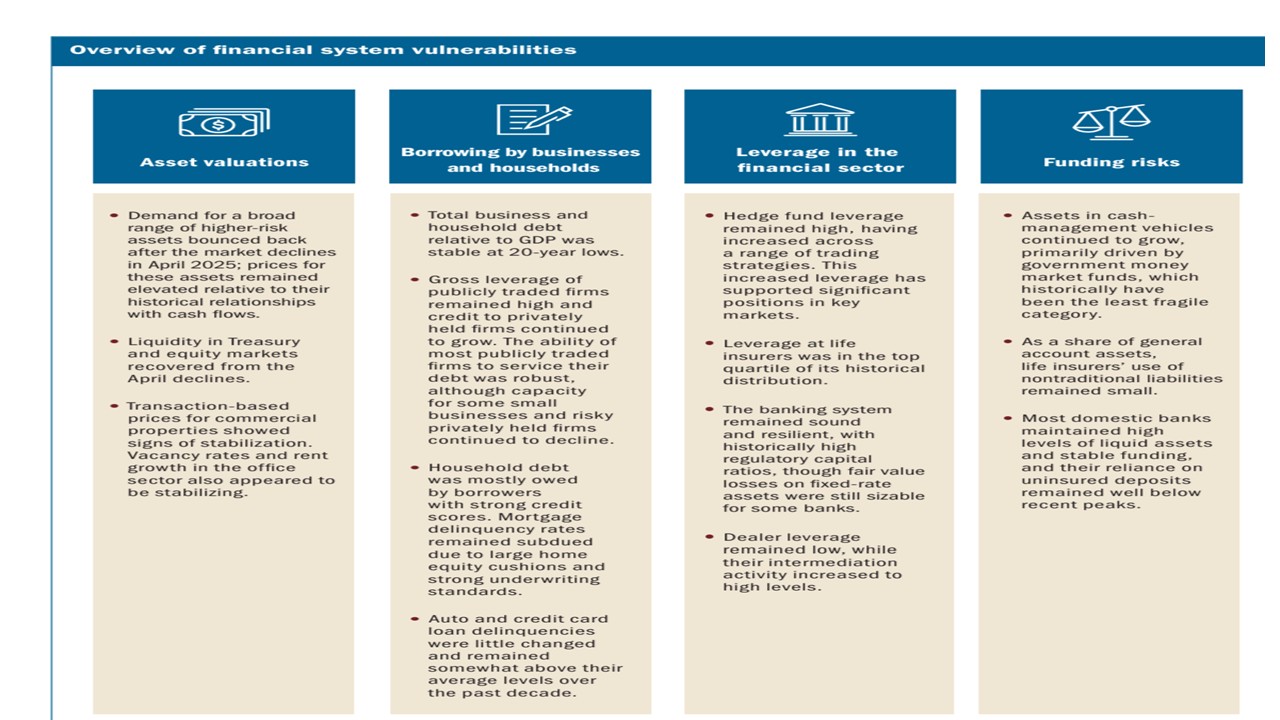

Figure 1: U.S. Margin Debt (USD Blns)

Source: FINRA

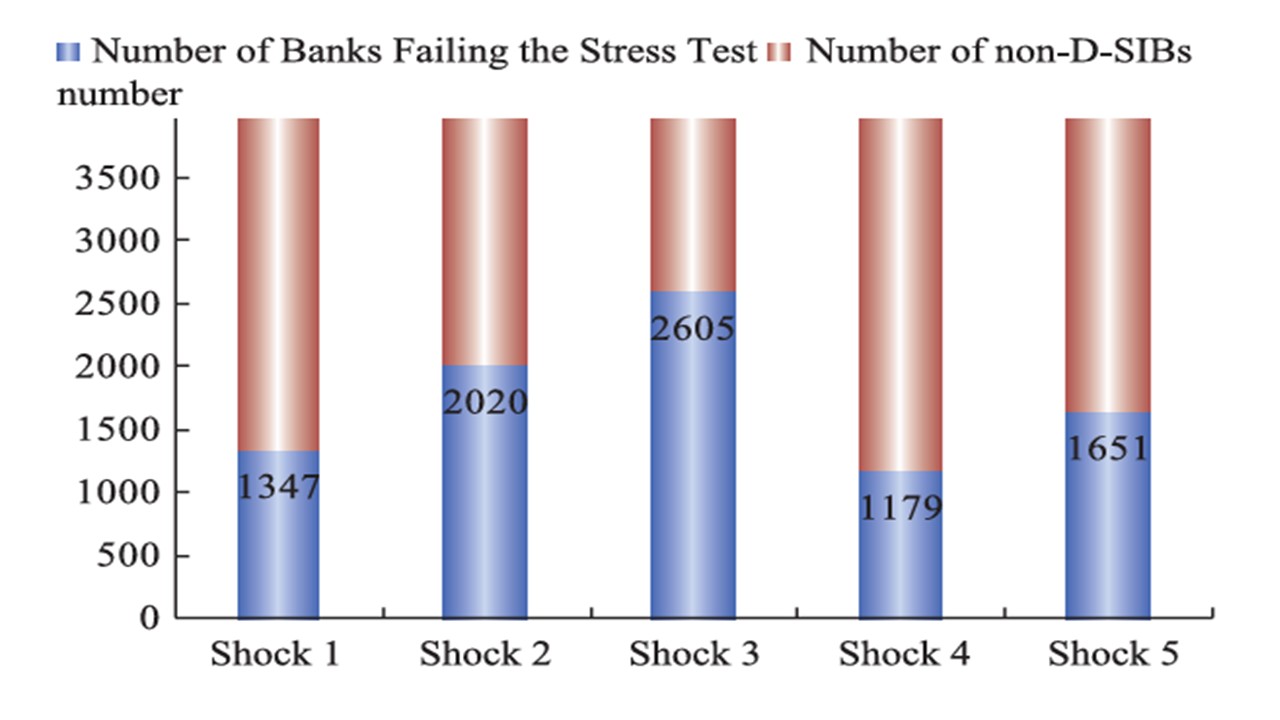

November sees central banks releasing financial stability reports (Fed on Nov 7 here), which provide an opportunity to assess current risks and vulnerabilities should a major adverse shock hit. The post 2008 environment has intermittently left market players looking at central bank solvency and liquidity stress tests for banks to help assess evolving risk in banking systems. Though concern is currently low, we have noted that the 2nd tier of China’s banks are still vulnerable to an adverse growth and NPL scenario (here and Figure 2) as the large damage from China’s residential property bust continues to feedthrough. Central banks in other countries are less worried about the banking system generally, though a weak tail exists in other countries (which could be resolved worst case without major systemic spillover).

Figure 2: 2023 PBOC Stress Tests

Source: PBOC Financial Stability Report 2023 Special Topic 4 Stress Tests Shock 1 NPL up 100%; Shock 2 NPL’s up 200%, Shock 3 NPL’s up 400%, Shock 4 50% of Special Mentioned Loans converted to NPL’s, Shock 5 100% of Special Mentioned Loans converted to NPL’s.

The major financial stability focus in DM countries is on the overvalued U.S. equity market and non-bank financial intermediaries (NFBI’s). The surge in the U.S. equity market has been accompanied by a sharp rise U.S. margin debt (Figure 1) and this could amplify a downturn in U.S. equities in the face of a major shock. Buybacks, plus liquidity, are supporting the U.S. equity market in the face of modest shocks, so it would really require a major shock (e.g. recession/end of AI optimism) to cause a U.S. equity bear market. While we feel that risks of a U.S. equity market correction are high in the next 12 months (here), the probability of a major adverse shock is a low to modest risk.

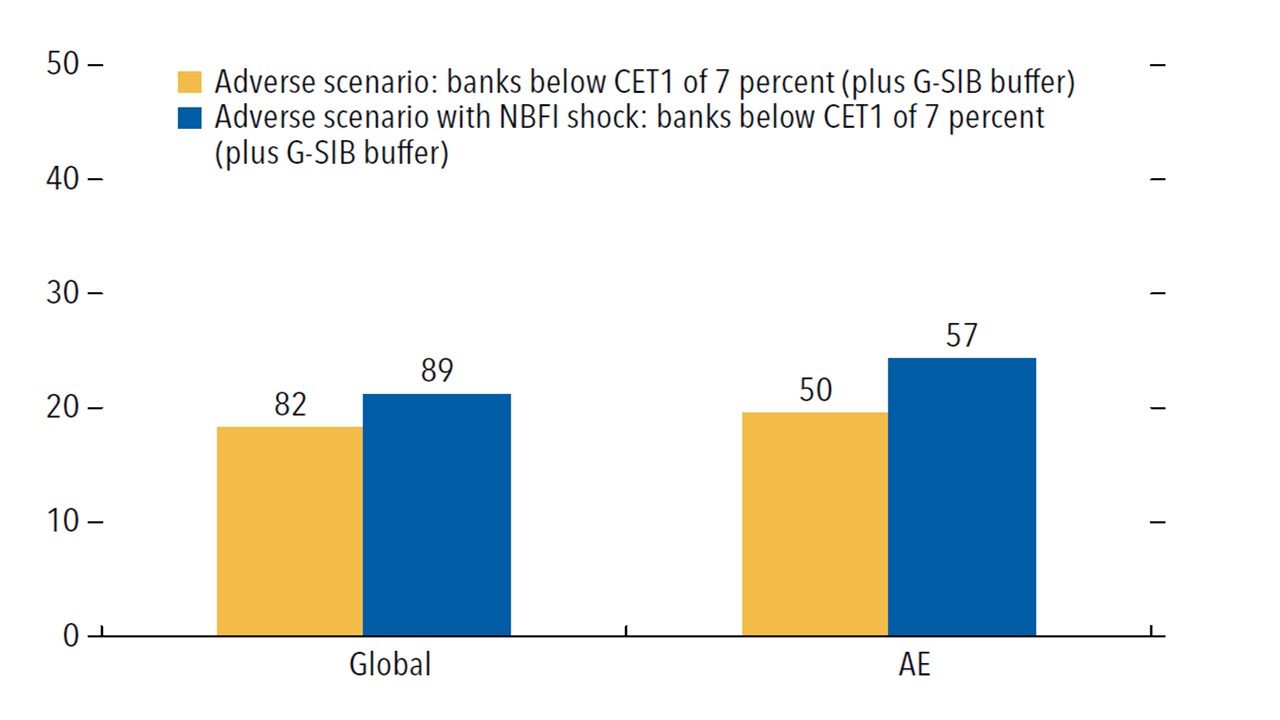

What about other areas including non-banks? BIS research shows that non-banks reduce lending quicker than banks in a crisis (here), as they are more transaction focused and pro cyclical in their behavior. The October 2025 IMF GSFR p23 also highlighted that the growing interlinkage between banks and NFBI’s (including mortgage companies/investment funds/private equity and credit /hedge funds) in the U.S. and Europe could result in a larger deterioration in banks capital ratio in an adverse scenario. The IMF GSFR highlights some large banks in the Eurozone, but mid-sized banks in the U.S. would take a capital hit, that would require some recapitalization (Figure 3) – the results though are better than the 2023 IMF stress tests. However, the IMF shock in this scenario is a large stagflationary shock, which produces a jump in government bond yields and larger rise in corporate bond and loan rates. This is a low to modest probability event, given that Trump tariffs are disinflationary outside the U.S., a 17% effective tariff rate have not materially boosted U.S. inflation trends and we are passed peak Trump tariff threats.

Figure 3: Share of Total Assets of Weak Banks, by Region (Percent of assets, vertical axis; number of banks, bars)

Source: IMF Oct 25 Financial Stability Report (here)

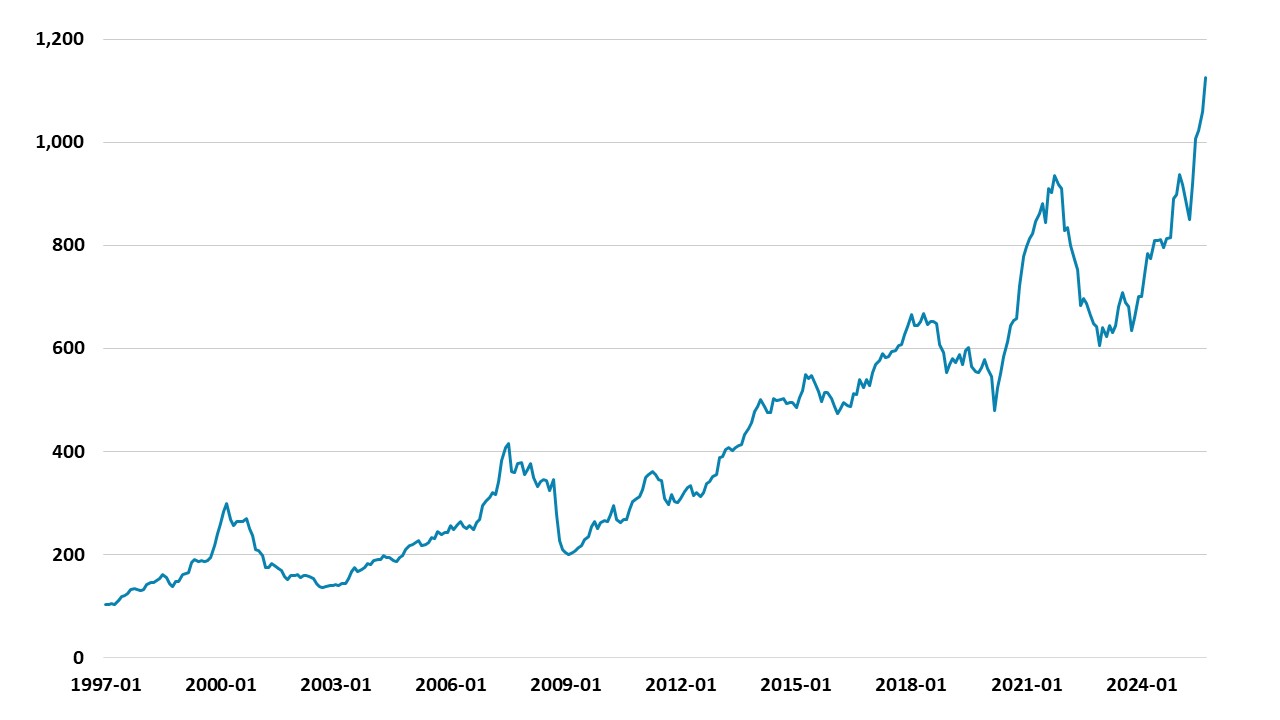

The IMF, and separately the Fed, focused more deeply on some NFBI’s. For the Fed, they remain focused over growing leverage of hedge funds and U.S. insurance companies (Figure 4), which could cause vulnerability in the face of a major adverse market of economic shock. The problem in the U.S. is that the Trump administration is pushing for a relaxation of lending standards, while financial stability tools remain fragmented and do not always deal with risks. This means that vulnerabilities could get larger, though the main adverse shock would be a U.S. recession and we are reducing the odds in the next 12 months from 30% to 20% -- given that peak tariff problems have passed.

Figure 4: November 2025 Fed Assessment of Financial System Vulnerabilities

Source: Nov 2025 U.S. Federal Reserve Financial Stability Report (here)

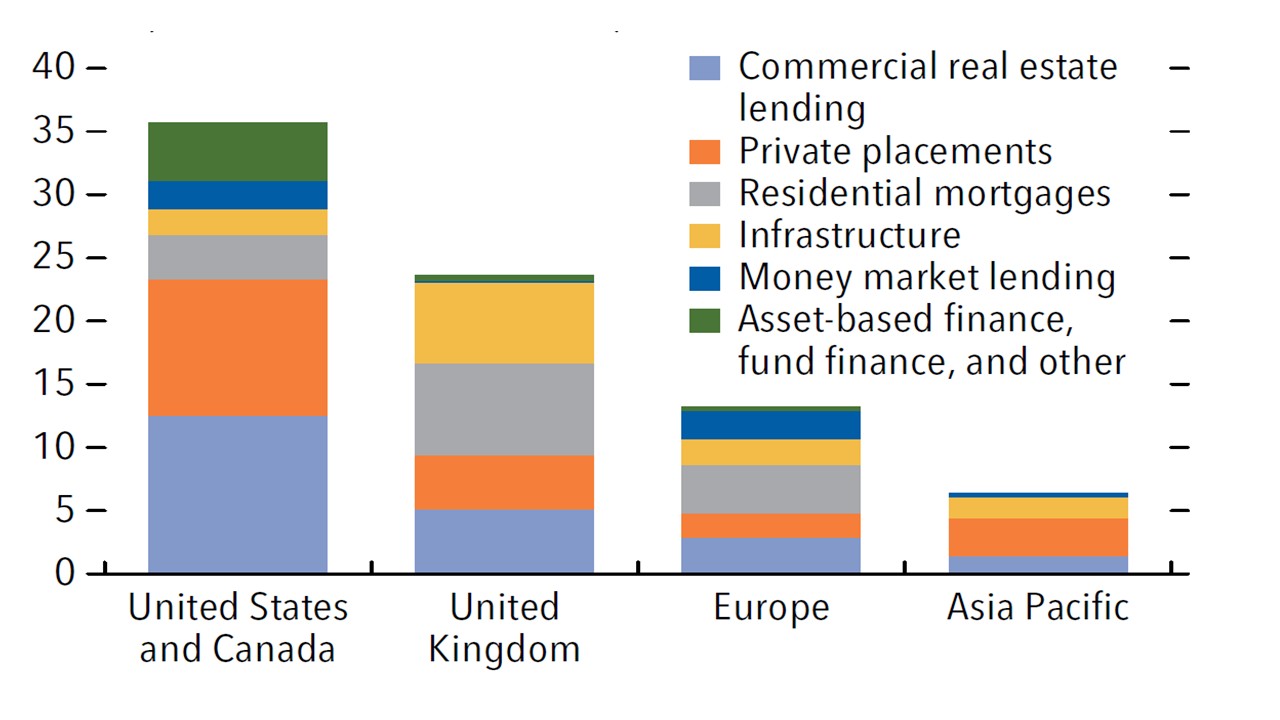

For the IMF, concern is voiced over the growing vulnerability of some U.S. funds to high yield securities and also rising lending to private equity and credit. This is not a major global banking issue with IMF GSFR estimate of USD497bln end Q2 2025 lending to private equity/credit. The focus for the Fed is U.S. insurance companies which have a lot of private credit (Figure 5), which would be vulnerable to a major shock. This major shock in either case would most likely be a U.S. recession, but as noted this is becoming less probable. A major crisis in private equity could cause a sector specific problem, but this would probably need a global recession – which looks low risk in the next 12-24 months.

Figure 5: Moody’s Survey of Insurers’ Average Positions in Private Credit Instruments (Percent of total investments)

Source: IMF Oct 25 Financial Stability Report

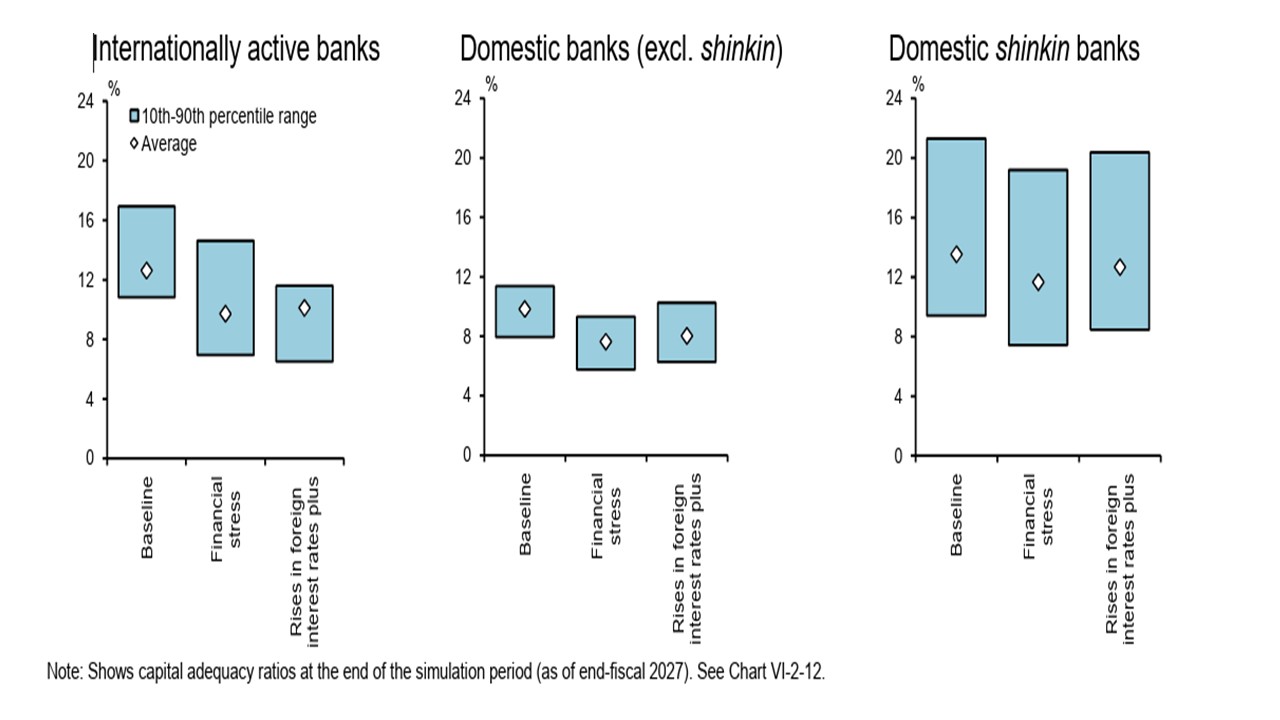

Elsewhere, a surge in government bond term premia or a turn to a central bank tightening cycle could also be a shock that crystalizes vulnerabilities in the financial system. However, this is a low to modest probability in the next 12-24 months for DM countries excluding Japan. Our 10yr yield forecasts in the U.S. (here) looks for choppy but no major change in 10yr yields and decline in 2yr yields with the Fed easing to the neutral policy rate. In the EZ (here), we see two further 25bps ECB rate cuts, plus a slowing of APP and PEPP QT, as the ECB are overestimating growth momentum and inflation. One potential shock is the May 2027 French presidential election, which could either intensify fiscal pressures or worst case cause a French crisis. The ECB financial stability report is due November 26. In terms of Japan (here), we are worried that aggressive BOJ QT can push 10yr yields above 2.0% in H1 2026 and could cause a bigger spike that causes temporary spillover effects in Japanese markets. However, the October 2025 BOJ financial stability review (here) stress tests banks for a 2.5-3.0% 10yr JGB yield and the system remains above the regulatory minimum.

Figure 6: Distribution of capital adequacy ratios under each scenario

Source: BOJ Oct 2025 Financial Stability Report