Outlook Overview: Turbulent Times

· The U.S. slowdown remains in focus as the lagged effects of President Trump’s tariff increases continues to feedthrough, though our baseline is for a 2026 soft-landing. The Supreme court will likely rule against part of Trump’s reciprocal tariffs, which will create short-term uncertainty. However, Trump will likely increase other tariffs, but also codify tariffs in the trade framework deals that have been struck in 2025. Some H1 2026 softness of the U.S. economy remains our baseline and a temporary increase in inflation. The Fed will likely pause in early 2026, but then resume down to a 3.00-3.25% Fed Funds rate (here). While Trump appointees will increase at the Fed, they are unlikely to dominate voting or actual policy rate levels but could led to internal Fed disagreements and communication problems (here). Our new 2027 forecasts are for a Fed on hold, as it waits for economic recovery to broaden. The Democrats are likely to regain the House and this will mean fiscal deadlock until at least 2029.

· The U.S. slowdown remains in focus as the lagged effects of President Trump’s tariff increases continues to feedthrough, though our baseline is for a 2026 soft-landing. The Supreme court will likely rule against part of Trump’s reciprocal tariffs, which will create short-term uncertainty. However, Trump will likely increase other tariffs, but also codify tariffs in the trade framework deals that have been struck in 2025. Some H1 2026 softness of the U.S. economy remains our baseline and a temporary increase in inflation. The Fed will likely pause in early 2026, but then resume down to a 3.00-3.25% Fed Funds rate (here). While Trump appointees will increase at the Fed, they are unlikely to dominate voting or actual policy rate levels but could led to internal Fed disagreements and communication problems (here). Our new 2027 forecasts are for a Fed on hold, as it waits for economic recovery to broaden. The Democrats are likely to regain the House and this will mean fiscal deadlock until at least 2029.

· Meanwhile, tariffs outside the U.S. are disinflationary, as they hurt exports and employment as China is seeking to redirect excess production at competitive prices. Other DM economies recoveries are also being restrained by population aging, slow productivity and cautious consumers in certain countries. This points to further easing from the ECB and BOE, though fiscal policy is mixed with UK tightening but Germany easing. Meanwhile, we think further BOJ rate normalization will be just 25bps, as inflation slows. A sharp spike in JGB yields (QT at 6% of GDP in 2026) could see the BOJ also doing a partial U turn on the pace of QT. In 2027, the French presidential election will attract attention, but is unlikely to lead to an acceleration of fiscal consolidation which could cause increased fiscal tensions.

· For China, economic momentum is slowing into 2026 due to a modest consumer, plus continued drag from residential investment and slowing exports pointing to a trend slowdown to 4%. However, further fiscal stimulus is highly likely and suggests 2026 GDP growth of 4.4%. India should prove resilient, due to domestic stimulation. Brazil growth will likely slow as the lagged effects of very tight monetary policy feeds through, but we foresee BCB will start easing by spring 2026 with more cuts in 2027. The key October 2026 Brazil presidential election is currently too close to call. In terms of DM and EM financial stability our review highlights the most serious issue remains the 2nd tier bank problems in China (here).

· AI will provide a boost to U.S./Asia and China economies, as heavy investment in semiconductors/data centers/enterprise AI is partially funded out of cash flow. Cost savings via labor shedding has started to appear (here), but for the next 1-2 years is unlikely to be at a faster pace than the ICT revolution (manual jobs are unlikely to be cost effectively replaced until the 2030’s due to battery life problems with humanoid robots). However, fear that AI could replace jobs could impact consumer behavior, and this needs to be monitored in the U.S. New revenue from AI services are taking off, but may not match exponential expectations due to lags in adoption beyond the early movers. Profit margin questions also exist from expensive cost of AI services and competition from open source AI. By 2027, this could see some AI companies that depend on external finance having some volatility in their financing (here) that adversely impacts aggressive expansion plans and the boost to U.S. growth could be less. AI will also boost productivity in DM and China multi-year.

· Geopolitically, we do not see China invading or blockading Taiwan in 2026 or 2027, as this is an ultra-high risk strategy with the U.S. maintaining its strategic ambiguity. Our baseline remains for ongoing grey warfare, with a 20% probability of a temporary China coastguard partial quarantine operations in 2027 (here). Re Ukraine, our baseline (70%) remains for a Russia friendly peace deal in Q4 2026/Q1 2027, with both sides making little military progress – the alternative is for the war to continue (30%). Removal of sanctions will be slow, while Europe will likely be reluctant to become addicted to cheap Russian gas again.

· For financial markets, the muddle through for global economics and policy provides support for risk assets, combined with solid earnings prospects from some of the magnificent 7. However, U.S. equities are once again significantly overvalued and we look for a 5-10% correction in 2026, before a recovery to end-2026 around 7,300 for the S&P500. Risks are greater in 2027 and we forecast 6,850. The risk of some AI disappointment is greater in 2027, while rates will have bottomed and the U.S. Treasury market will be debating the risk of Fed tightening into 2028. DM equity markets ex Japan will find it difficult to outperform, though we think Brazil and India can beat the U.S. in 2026 and 2027. Meanwhile, we favor 2026 bullish yield curve steepening in U.S./EZ and UK government bond markets, as further rate cuts help short-end yields to move lower. 2027 will then likely see yield curve flattening, as markets wonder whether the next move is to higher rates. Further USD declines are forecast against DM currencies in 2026 and 2027, though at a slower pace than 2025.

· Risks to our views: A hard landing in the U.S. economy would spillover globally in GDP terms, but recent data points more to a soft landing and we have reduced the risk of a U.S. recession from 30% to 20% in the next 12 months. While any mild U.S. recession would likely trigger more aggressive Fed easing, it could still prompt a bear market in U.S. equities and a noticeable decline in the USD.

Figure 1: Economic Scenarios

Source: Continuum Economics

Market Implications

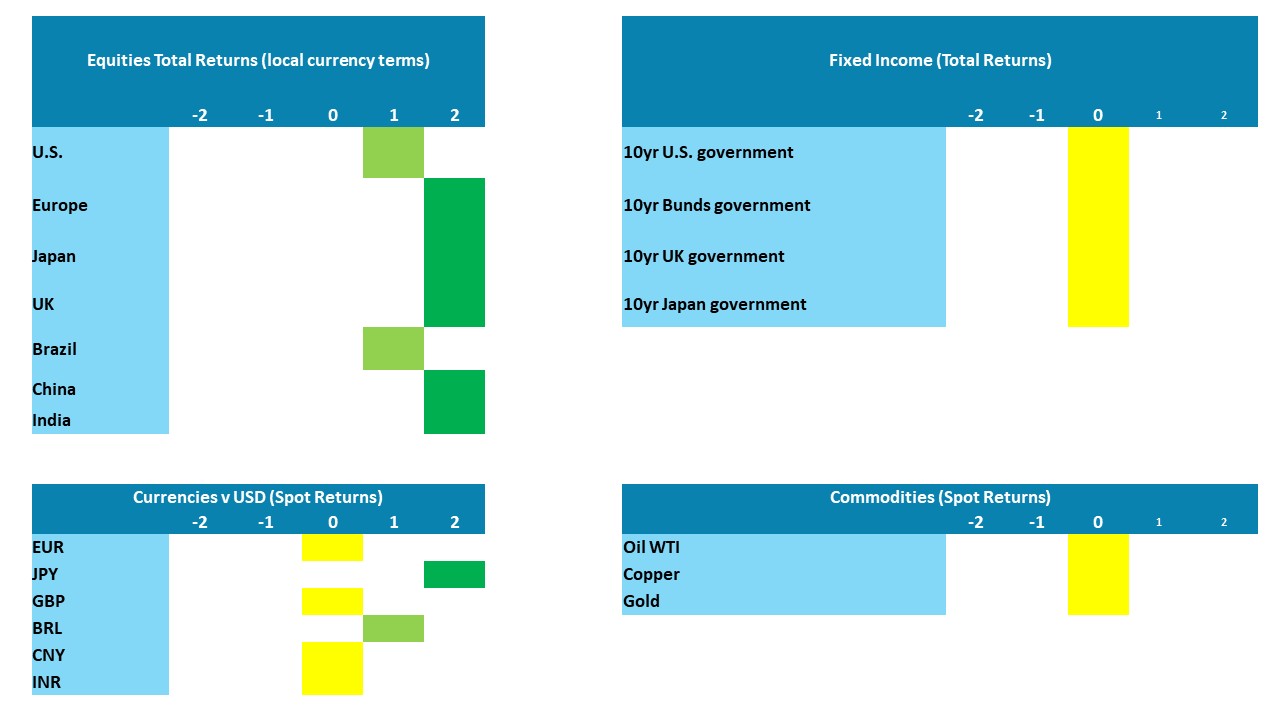

Figure 2: Asset Allocation for the Next 12 Months

Source: Continuum Economics Note: Asset views in absolute total returns from levels on December 16 2025 (e.g., 0 = -5 to +5%, +1 = 5-10%, +2 = 10% plus).

· Government Bonds. Fed, ECB and BOE rate cuts can help short-end yields decline in 2026, which will cause bullish yield curve steepening in U.S./EZ and UK government bond markets in 2026. Japan can see bearish yield curve steepening, as BOJ QT is very aggressive and likely to produce a spike in 10yr yields towards 2.25-2.50%. 2027 will then likely see yield curve flattening, as markets wonder whether the next move is to higher rates.

· Equities. A soft landing for the U.S. economy, plus 2026 solid earnings for some big Tech companies, can provide support for risk assets. However, U.S. equities are once again significantly overvalued and we look for a 5-10% correction in 2026, before a rebound to end at 7,300 for the S&P500. Risks are greater in 2027 and we forecast 6,850. The risk of some AI disappointment is greater in 2027, while rates will have bottomed and the U.S. Treasury market will be debating the risk of Fed tightening into 2028. DM equity markets ex-Japan will find it difficult to outperform, though we think Brazil and India can beat the U.S. in 2026 and 2027.

· FX. Prospects remain for DM currencies to make further moderate gains versus the USD in the next 12-24 months. Foreign investors are hedging FX for their massive U.S. asset holdings, due to erratic Trump administration policymaking and a still overvalued USD. JPY can led the way in 2026 and 2027. EM currencies will be more divergent, with Turkish Lira forecast to fall on stubborn inflation, but the Brazilian Real likely to remain firm versus the USD on very high yield spreads.

· Commodities. OPEC is trying to restrain production increases, but demand growth is modest and production is coming on stream outside of OPEC. This tends to favour a modest price decline in 2026 and we see WTI at and USD53 by end-2026.

Figure 3: Key Events

| March 2026 | France Municipal Elections | Likely to occur in the usual first-vote and then run-off manner on March 15 and 22 and will be equivalent to a high-profile opinion poll as the current three-way parliamentary split seeks to find an opening. They will take place within a context of significant restructuring of the national political landscape, where national parties will seek to “count their mayors” as they anticipate the presidential vote in 2027. |

| May 2026 | Powell Replaced as Fed Chair | Powell is set to be replaced as Fed Chair in May, with the nomination likely to come earlier. Trump appears likely to appoint either Kevin Hassett, Director of the Nation Economic Council, or former Fed Governor Kevin Warsh. Either would be likely to advocate an aggressively dovish stance, though it is unlikely such a stance would have the majority of votes on the FOMC. Still, a chairman struggling to command majority support would make Fed communication difficult. Should Trump choose a current Fed Governor such as Christopher Waller, markets would respond with relief. |

| September 13, 2026 | Sweden General Election | The current right-wing coalition still has very slim effective majority in parliament even with the far-right Sweden Democrats offering support. This is all the result of the 2022 election, which brought a fragmented result but locking out the Social Democrats even though they are the largest party. This fragmentation was a result of a more polarized parliament, and polls suggest more of the same, but with a general drip more to the left. But even if left-leaning parties return to power, it is unlikely to change much given the current focus on defence but where an election issue may be a speedier defence build-up. |

| By September 20, 2026 | Russia Parliamentary Elections | Russia is set to hold its next parliamentary elections by September 20, 2026 to determine the State Duma, the lower house of the Federal Assembly. All 450 seats are up for grabs, with 226 needed for a majority. As of current polling trends, United Russia (YeR) leads with around 53% support, potentially securing 266 seats; Communist Party (KPRF) trails with 13%, projected to win 65 seats; and Liberal Democratic Party (LDPR) holds 11%, aiming for 54 seats. We expect United Russia, led by Dmitry Medvedev, remains dominant after its 2021 victory. |

| October 4 and 25, 2026 | Brazil General Election | In 2026, Brazil will hold general elections to elect the next President, renew all the Chamber of Deputies seats, and two-thirds of the Senate, while also electing the governors of all Brazilian states. Lula will seek re-election, while opinion polls suggest Lula will likely face Freitas (an ex-Bolsonaro minister here), with the race being too close to call at this stage. Pre-election fiscal easing will likely be seen. |

| November 3, 2026 | U.S. Mid Term Elections | All seats in the House and a third of the seats in the Senate will be up for election. With the current Republican majority in the House being marginal even a modest level of disappointment in the Trump administration, which seems likely, could see the Democrats gain control of the House, but it will be a lot harder for the Democrats to make the necessary gain of 4 seats in the Senate, with only two Republicans defending swing states. We think a recession would be needed to see the Democrats take the Senate. |

| May 2027 | French Presidential Election | Opinion polls suggest that if/when a fresh legislature election occurs, this will not change parliament materially meaning insufficient fiscal consolidation. President Macron has ruled out fresh parliamentary elections and they are not due until 2029. The 2027 presidential election will likely see all other main parties supporting a candidate to stop the National Rally getting the presidency. However, it is not yet clear who this will be, but it is unlikely to resolve the slow progress in reducing the budget deficit. We feel France will face fiscal pressure and could face a fiscal crisis. |

| Aug 2027 | Spain General Election | The election has to occur by Aug 22, although one could occur much earlier if the current Socialist administration run of scandals deepens enough. PM Sanchez has tried to rule such snap vote out and insisted he will stand for office again. Either way it does look as if there would be a change in who runs the country, given the right of centre People’s Party lead in the polls, the question being how much of a swing to the right would occur depending upon who the PP go into collation with. |

| Sep-Oct 2027 | Italian General Election | The election has to occur by late December, but is more likely to occur earlier, probably in September. As for the possible result, important wins for Italy's opposition in southern regional elections recently show cracks in the ruling conservative bloc's dominance, raising doubts over PM Meloni's ability to secure a second term. However, at this juncture, Meloni’s coalition (her Brothers of Italy party, Forza Italia and the far-right League) are ahead in national polls while the opposition need to unify more after years of mutual hostility. |

| Oct 2027 | Turkiye Presidential Election | Parliamentary elections in Turkiye are scheduled to occur no later than May 7, 2028, alongside presidential elections. We expect the elections to be held in October/November 2027, earlier than the scheduled time. The presidential race will be between AKP’s candidate, -who will likely be current President Erdogan-, and an opposition candidate. Taking into account that CHP’s official presidential candidate Ekrem Imamoglu is still in jail, he will likely be replaced by someone else if he won’t be released before 2027. We expect a close race between AKP/MHP block and CHP for the parliamentary elections. |

| Oct-Nov 2027 | Argentina General Election | President Javier Milei’s administration has been boosted by October 2025 election results that saw his party (La Libertad Avanza LLA) doing better than expected in mid-term elections. USD2bln of U.S. Treasury FX purchases and a USD20bln credit line from Milei’s friend, U.S. President Trump, helped to reduce financial market volatility and boost Milei support. The continued slowing in inflation and fear of returning to economic instability should also support Milei and LLA in the 2027 general election. However, 2025 has shown how fluid voter behaviour is and the situation needs to be monitored near the 2027 elections. |