U.S. Inflows: Portfolio Dominates

· Portfolio flows have dominated U.S. C/A financing looking at the breakdown of the balance of payment data (BOP), with no material slowdown in 2025 from foreign investors. U.S. investors did accelerate buying of overseas equities but this was counterbalanced by slower U.S. buying of foreign government and corporate bonds. Trump erratic policymaking did not really impact foreign investors buying of U.S. assets and is unlikely to in 2026, as the November mid term elections acts as a restraint on Trump adventurism.

· The U.S. economy and AI revenue growth story will be the most important for portfolio inflows, but the baseline is currently reassuring. If AI revenue materially disappoints, then it would hurt U.S. equity inflows but this appears a low to modest risk in 2026. If the U.S. economy sees a hard landing and mild recession (20% probability), then a noticeable slowdown would likely be seen in U.S. equity and corporate bond inflows. In either scenario, the result would be a lower USD to cheapen U.S. assets for global investors.

Where is all the money coming from to finance the still large U.S. C/A deficit (USD1.23Trn Q4 2025-q3 2025) and what issues could impact flows?

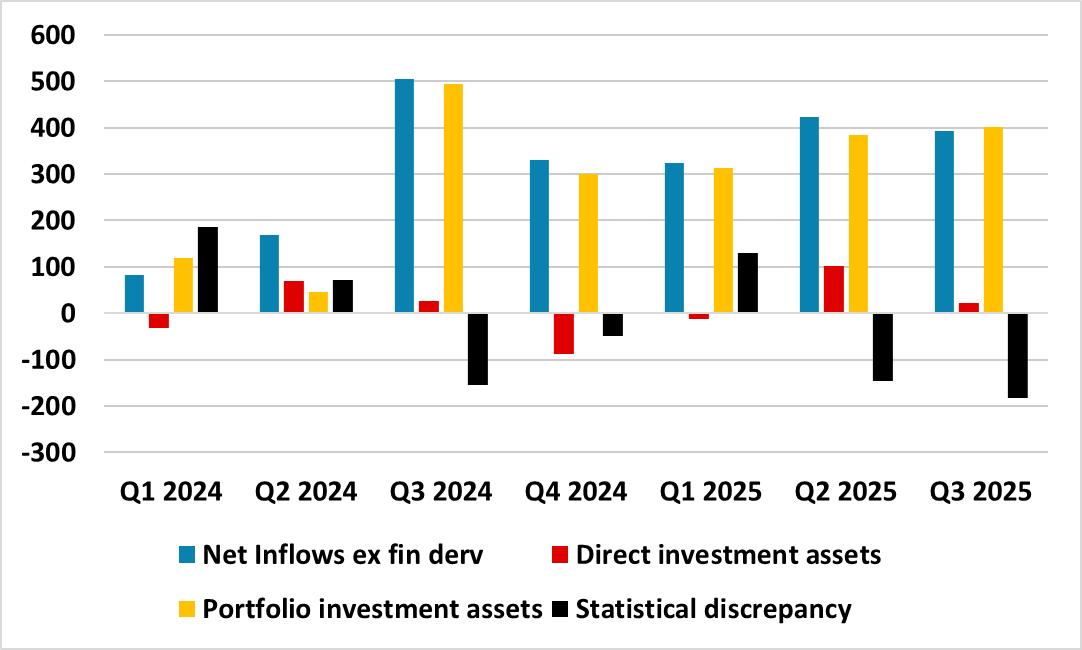

Figure 1: U.S. BOP Inflows (USD Blns)

Source: BEA/Continuum Economics

The U.S. attracts large scale inflows that finance the large current account deficit, but a number of points are worth making

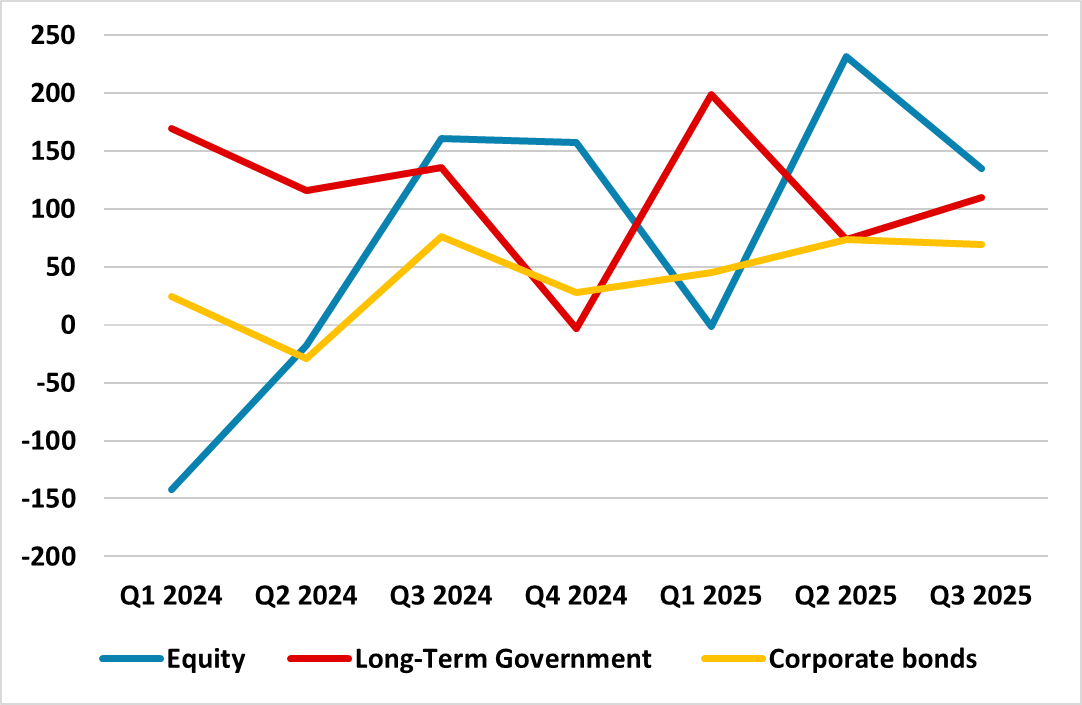

· Portfolio Flows Dominate. Figure 1 shows net inflows are dominated by portfolio inflows (from the quarterly BOP data rather than TICS), with direct and loans/deposits being modest net numbers (statistical discrepancy and seasonal adjustment factors reflects the difficulties of tracking net inflows). Despite all the promises for more direct investment in the U.S., the reality is that new overseas direct investment was only USD89bln in Q3 2025. This will likely pick-up in 2026 as some companies really want to boost U.S. production, but other companies’ investment plans could be a delaying tactic to pacify the Trump administration or due to trade/geopolitical uncertainty. The breakdown shows that the key remains net U.S. equity/long-term U.S. Treasuries and corporate bonds (Figure 2), with some volatility being seen in the 2025 data. U.S. investors accelerated their buying of overseas equities to USD71bln in Q3 2025 in line with anecdotal reports of increased U.S. interest in global equities, but U.S. buying of foreign government and corporate bonds slowed – so outbound net portfolio flows did not really accelerate. Meanwhile, the more important foreign investor buying of U.S. equities averaged USD165bln per quarter (Q4 24-Q3 25), with Q1 2025 seeing a pause before Trump reciprocal tariff announcement before heavy net buying in Q2 and Q3 2025. In the same 4 quarter period average quarterly net foreign buying of Long-dated Treasuries (attracted by 2% real rates) and Corporate bonds averaged USD105bln and USD83bln respectively. Trump erratic policymaking did not really impact foreign investors buying of U.S. assets or U.S. investor portfolio outflows. What will happen in 2026?

Figure 2: Net U.S. Portfolio Flows (USD Blns)

Source: BEA/Continuum Economics

· Lower Trust in the U.S. Global investors have become worried about U.S. policymaking fairness and consistency since Trump returned to power, but this has not translated into a material slowdown in portfolio inflows to the U.S. – though as noted a moderate pick-up in U.S. buying of overseas equities has been seen in the BOP data. It has however led to a pick-up in FX hedging (here), which accounts for the lower USD last year. The prospect of the Republicans losing the House in November is actual a comfort to global investors, as it reduces the risk of further fiscal expansion and will likely soften some of the domestic agenda. Foreign investors will also likely on balance be reassured by Kevin Warsh nomination from Fed chair (here), alongside the reappointment of district Fed presidents, provided that communications from the new Fed chair are not radically different from actual decisions. One issue to watch is whether the dot plot (Warsh and Bessant have suggested this) is scrapped with reduced forward guidance, which would be unhelpful to the long-end of the curve. The Greenland saga is important (here), as European investors have huge holdings of U.S. equities and aggressive U.S. action could trigger slower new inflows or a reduction in accumulated holdings in U.S. equities. Cuba is important to illegal immigration, but less so for portfolio flows into the U.S.. We also remain of the view that the U.S. will stop short of war with Iran to get a better deal (here) and that the Ukraine talks will breakdown in the coming months before a Russia friendly peace deal is done at the end of the year (here).

· Reciprocal tariffs. A Supreme Court ruling, partially or in full against reciprocal tariffs, would not produce a major slowdown in U.S. inflation or boost to growth, as the Trump administration would likely follow a three pronged strategy. Firstly, codify exists trade framework deals or finalize quickly, which could also explain the threat to S Korea for being slow in turning the framework into reality and the surprisingly early trade deal with India this week. Secondly, sustain existing product tariffs and associated investigations. Thirdly, threaten 122 and 301 tariffs (here) against countries that have reciprocal tariffs removed, but no framework deal. Global investors will likely be unsettled by the later, but this will likely only prove temporary.

Overall, the U.S. economy and AI revenue growth story will be the most important for portfolio inflows, but the baseline is currently reassuring. If AI revenue materially disappoints, then it would hurt U.S. equity inflows but this appears a low to modest risk in 2026, with more concern in 2027. If the U.S. economy sees a hard landing and mild recession, then a noticeable slowdown would be seen in U.S. equity inflows. Additionally, corporate bond spreads are currently low and a hard landing would likely hurt the corporate bond market and inflows. Foreign inflows into U.S. Treasuries in this scenario would be mixed, with flight to quality but a partial offset in terms of lower U.S. nominal and real yields – given that the Fed would likely cut to 2%. The USD would need to decline more rapidly to help cheapen U.S. assets and rebuild portfolio inflows.