Germany

View:

October 02, 2025

DM Central Banks: Wider-Ranging Conditions More Than Neutral Rates

October 2, 2025 6:55 AM UTC

· Neutral policy rate estimates and forward guidance provide some help at the start of easing cycles, but less so at mid to mature stages. For the Fed, ECB and BOE we look at a wider array of economic and financial conditions, alongside our own projections over the next 2 years to m

October 01, 2025

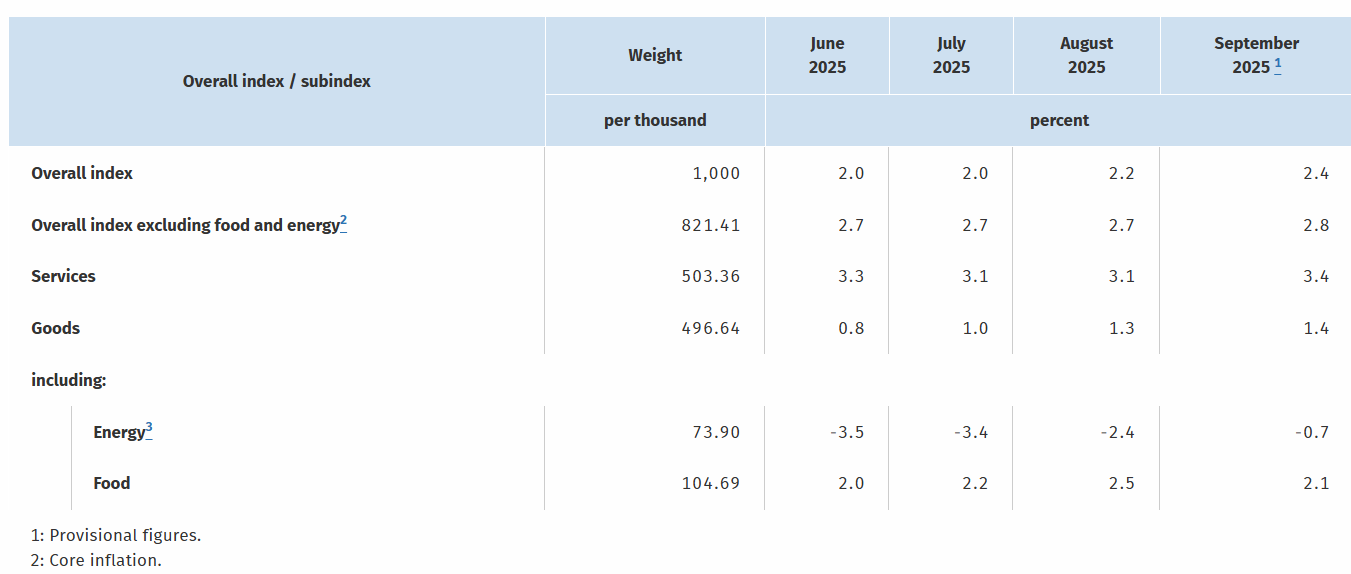

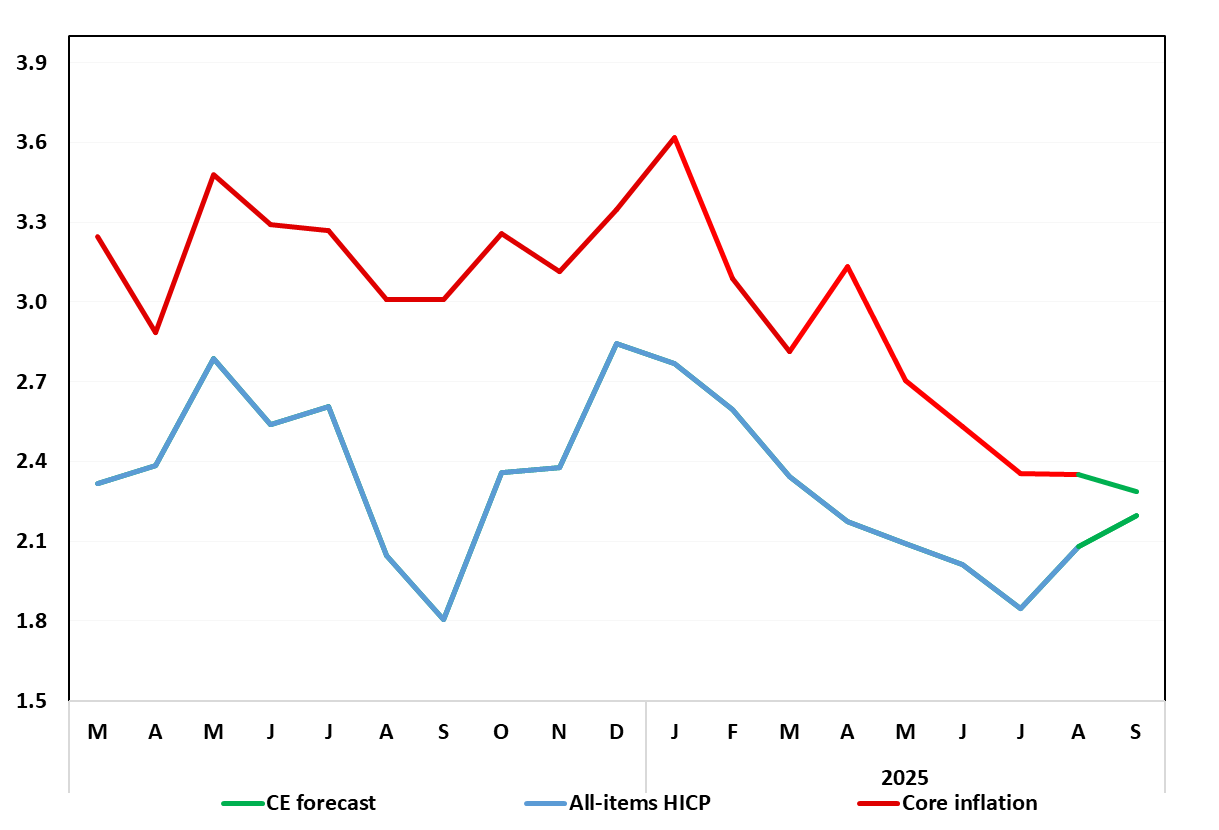

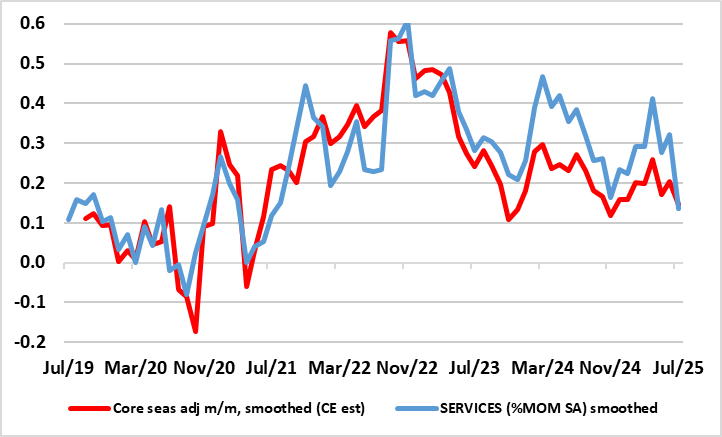

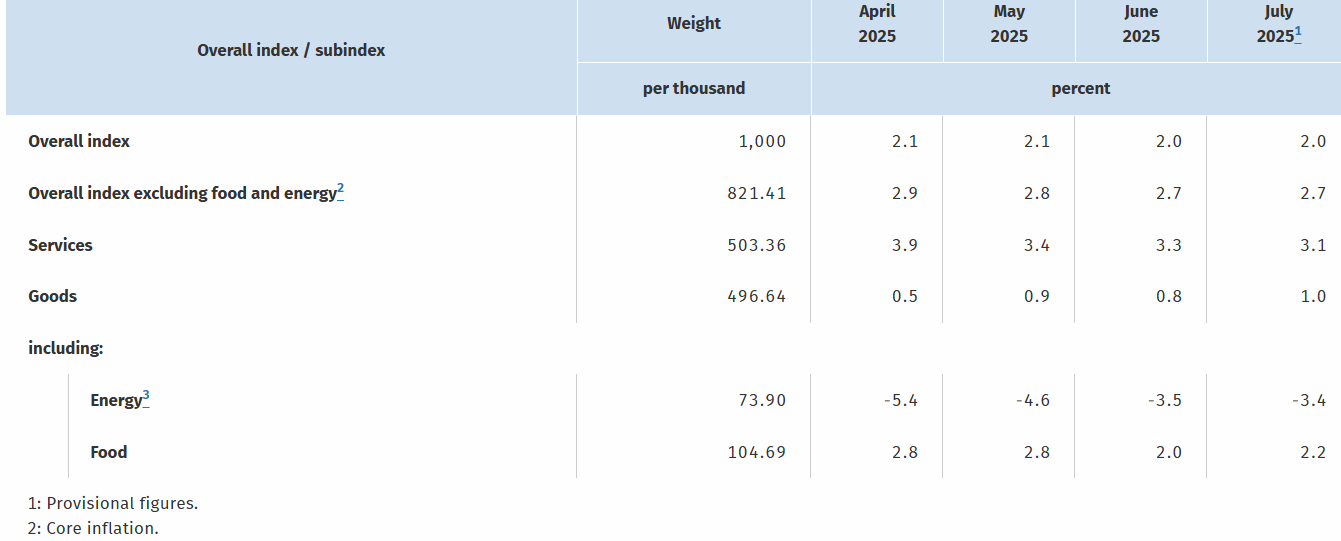

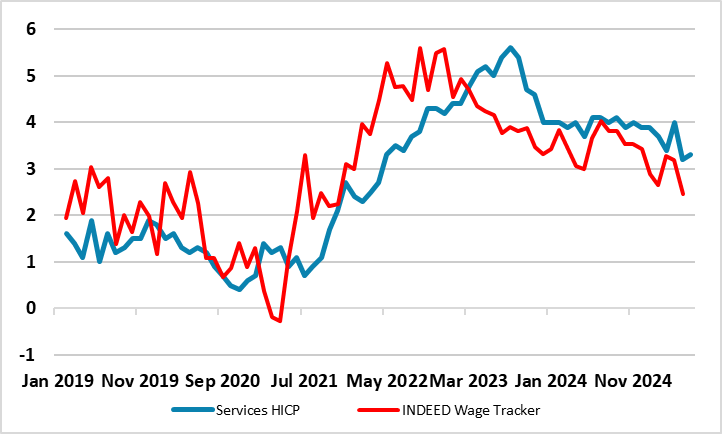

EZ HICP Review: Headline Inflation Moves Higher as Services Ticks Up From Cycle-low

October 1, 2025 10:28 AM UTC

A second successive upside surprise is unlikely to make inflation any more of an issue for the ECB at present. Instead, moderate concerns whether the apparent resilience of the real economy may yet falter should remain the order of the day, this possibly a result of a still somewhat unresponsive t

AI/Humanoid Robots and Disinflation?

October 1, 2025 9:40 AM UTC

· Overall, a number of forces from the AI wave will impact inflation. Power demand could push up power prices, but productivity enhancements and product innovation could be disinflationary like Information and Communications technology (ICT). One other key uncertainty on a 1-5 year

September 30, 2025

German HICP Review: Headline Higher And Core Rises Due to Fresh Services Push?

September 30, 2025 12:25 PM UTC

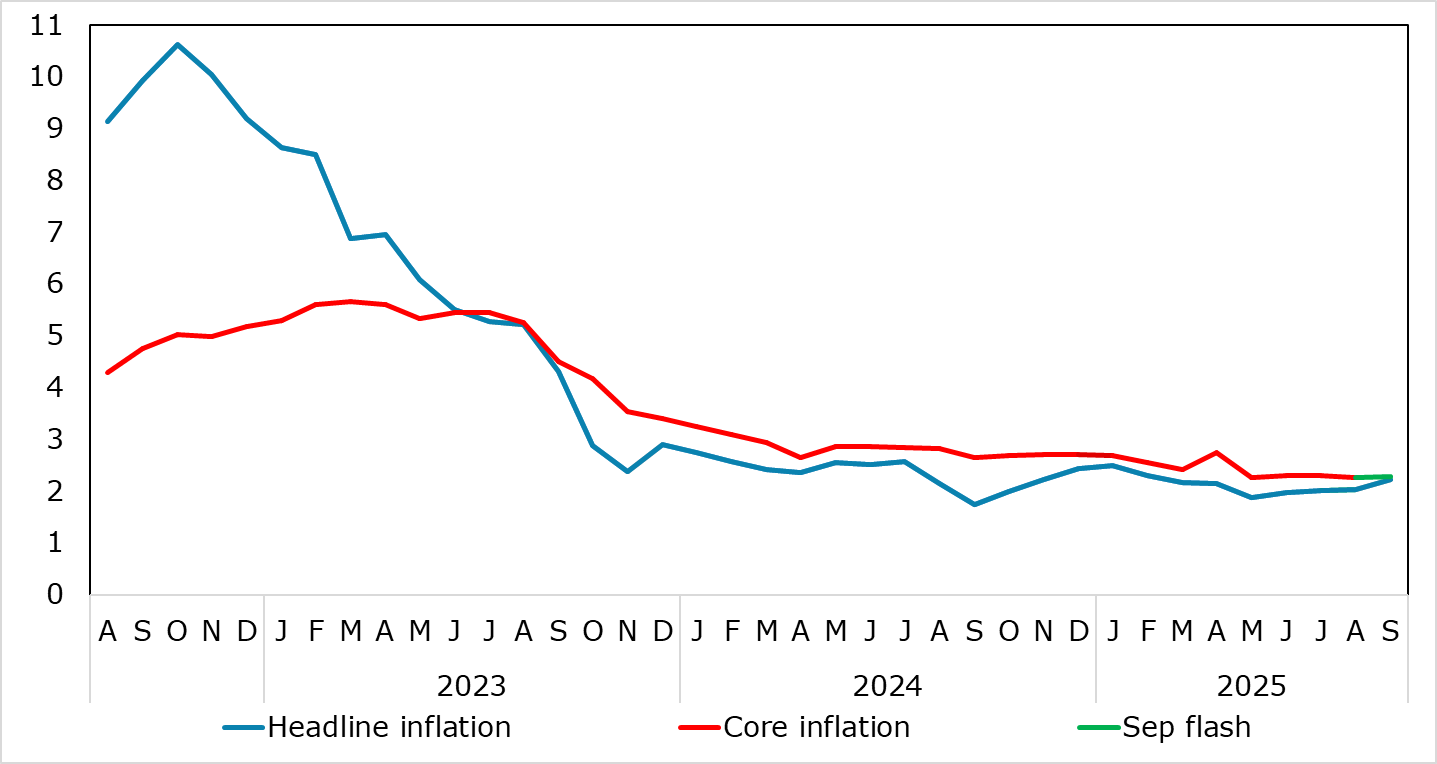

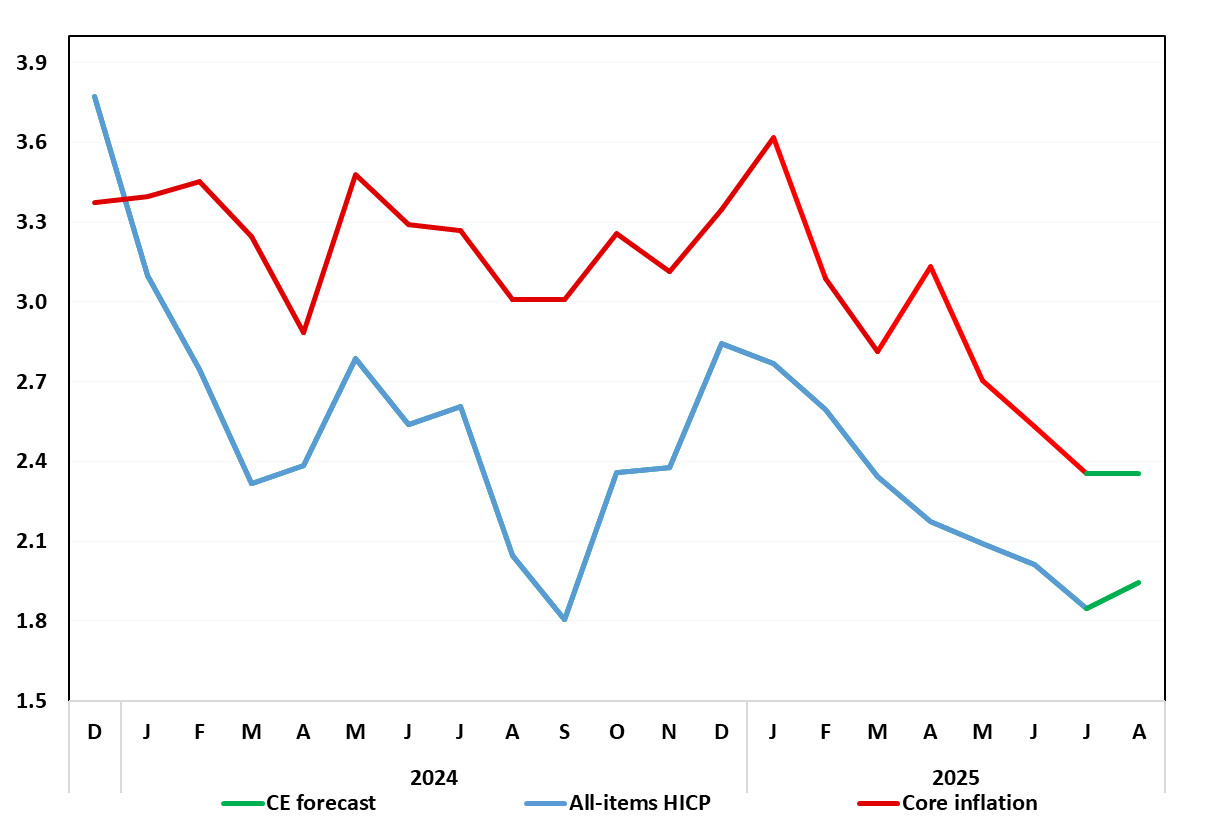

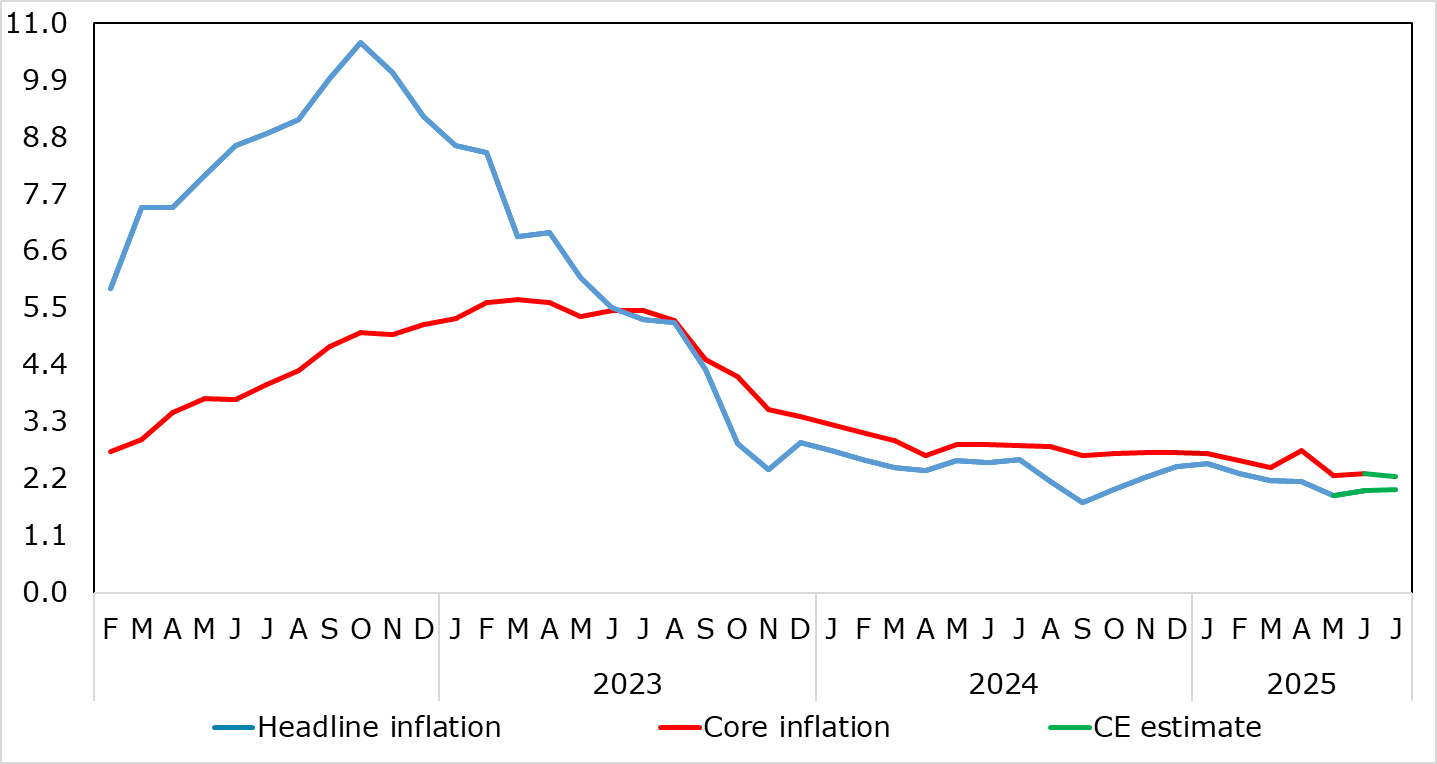

Germany’s disinflation process hit a further more-than-expected hurdle in September, as the HICP measure rose 0.3 ppt for a second successive month, thereby even more clearly up from July’s 1.8% y/y, that having been a 10-mth low (Figure 1). This (again) occurred largely due to energy base eff

September 29, 2025

DM Government Bond Saints v U.S.

September 29, 2025 7:35 AM UTC

· Overall, although the fiscal saints (Australia/Canada/Germany/Sweden) have merits over the U.S. in the scenario where Fed independence is undermined and more Fed rate cuts occur than warranted by the economics, the 10yr area of other government bond markets may not outperform. 10yr go

September 26, 2025

September 25, 2025

September 24, 2025

EZ HICP Preview (Oct 1): Headline Inflation to Edges Higher as Services Slows to Fresh Cycle-low

September 24, 2025 10:54 AM UTC

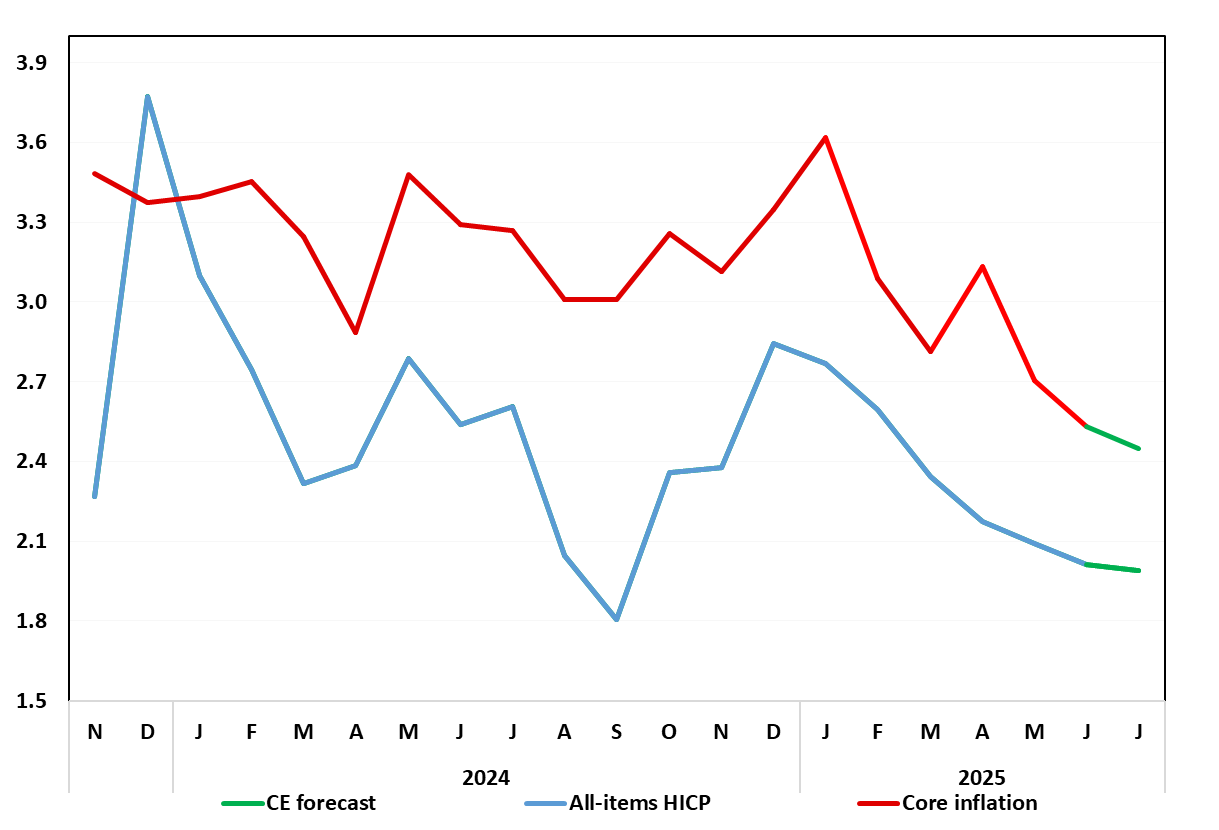

As we have underlined of late, HICP inflation – at target for the last three months – is very much a side issue for the ECB at present, offset instead by moderate concerns whether the apparent resilience of the real economy may yet falter. This mindset will not be altered by the flash HICP dat

September 23, 2025

DM FX Outlook: USD steadies but vulnerable to equity correction

September 23, 2025 2:48 PM UTC

· Bottom Line: The USD has continued to edge lower against the EUR in the last quarter as market expectations of Fed easing have increased following clear weakening in U.S. employment growth. But at this stage the data doesn’t indicate we are heading for recession, and this suggests w

German HICP Preview (Sep 30): Headline Higher But Core to Fall Further?

September 23, 2025 2:21 PM UTC

Germany’s disinflation process hit a slightly more-than-expected hurdle in August, as the HICP measure rose 0.3 ppt from July’s 1.8% y/y, that having been a 10-mth low (Figure 1). This occurred largely due to energy base effects with food prices also contributing slightly. The result was that

Outlook Overview: Into 2026

September 23, 2025 8:25 AM UTC

· The critical question is how much the U.S. economy is slowing down with the feedthrough of President Donald Trump’s tariffs to boost inflation and restrain GDP growth, with the effective rate currently around 17% on U.S. imports. Though semiconductor tariffs are likely, the bulk of

DM Rates Outlook: Steepening Yield Curve The Old Normal?

September 23, 2025 7:53 AM UTC

• We continue to forecast further yield curve steepening across the U.S./EZ and UK, driven by cumulative easing. For the U.S. this can see a modest further decline in 2yr yields, but the prospect is for a move to a premium of 2yr to Fed Funds (unless a hard landing is seen). 10yr yields

Equities Outlook: Correction Then Up In 2026

September 23, 2025 7:15 AM UTC

• The U.S. equity market’s bullishness reflects good corporate earnings reality, buybacks and the AI story. However, we feel that the U.S. economy can deteriorate still further in the coming months, as the lagged effects of tariffs boost inflation and restrain spending/hurt corporate ea

September 22, 2025

Eurozone Outlook: Resilience or Irrelevance?

September 22, 2025 9:49 AM UTC

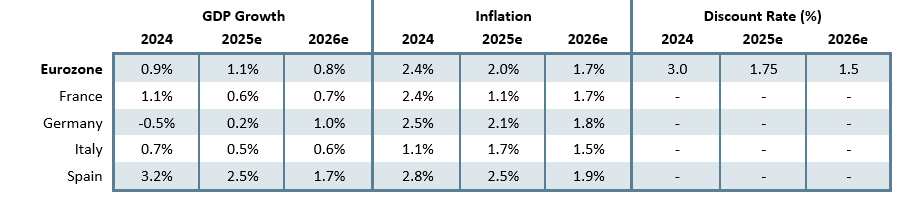

·· Yet again, and amid what may still be tightening financial conditions and likely protracted trade uncertainty, we have pared back the EZ activity forecast for 2026. However, the picture this year appears to be slightly better but this is largely a distortion and we think that the ec

September 11, 2025

ECB Council Meeting Review: Complacency Rules the Day!

September 11, 2025 2:08 PM UTC

A second successive stable policy decision was the almost inevitable outcome of this month’s ECB Council meeting resulting in the first consecutive pause in the current easing cycle, with the discount rate left at 2.0%. Also as expected, the ECB offered little in terms of policy guidance; after

September 10, 2025

DM Rates: Steeper Yield Curves: More to Come?

September 10, 2025 10:55 AM UTC

Steeper yield curves are a function of monetary easing cycles, budget deficits, lower central bank holdings of government bonds, a move towards pre GFC real rates and shifting demand from pensions funds and life insurance companies. Scope exists for further steepening in the U.S., EZ and UK with m

September 03, 2025

ECB Council Meeting Preview (Sep 11): No Change and Little Guidance

September 3, 2025 9:20 AM UTC

A second successive stable policy decision is very likely at next week’s ECB Council meeting resulting in the first consecutive pause in the current easing cycle, with the discount rate left at 2.0%. We see the ECB offering little in terms of policy guidance; after all, in July the Council sugge

September 02, 2025

EZ HICP Review: Headline Inflation Edges Higher as Services Fall to Fresh Cycle-low

September 2, 2025 9:34 AM UTC

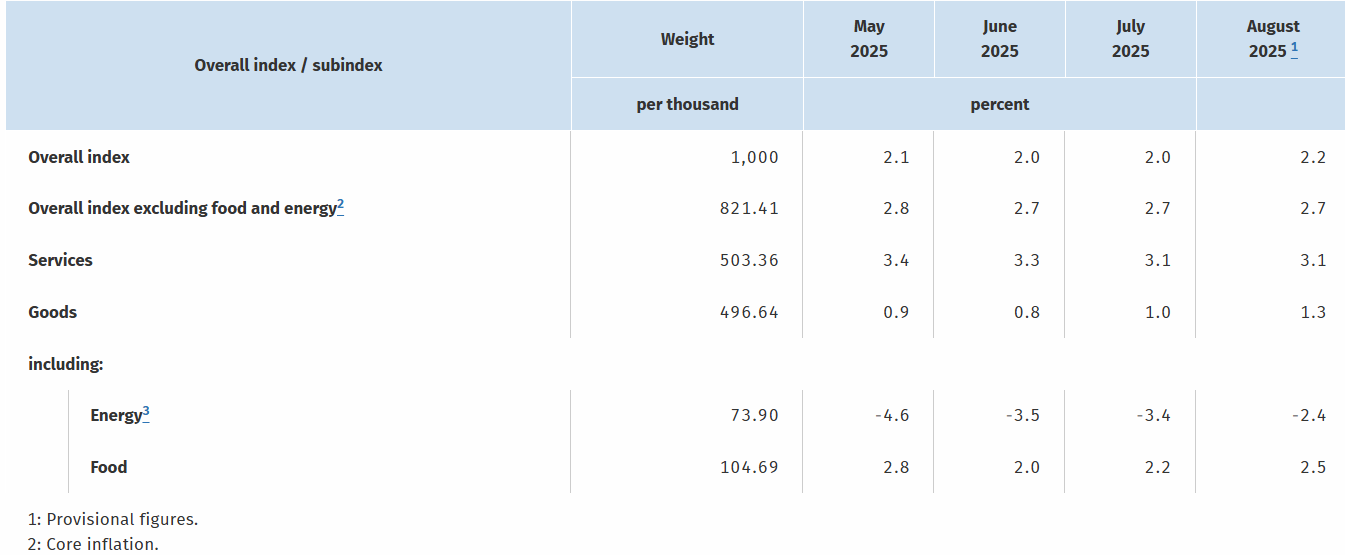

As we repeated again, HICP inflation – even now a notch above target – is very much a side issue for the ECB at present, offset instead by moderate concerns whether the apparent resilience of the real economy may yet falter. This mindset will not have been altered by the flash HICP data for Au

September 01, 2025

Aging: Slow Growth for Some in 2020’s

September 1, 2025 8:35 AM UTC

Population aging always seems to be beyond the market horizon, but the 2020’s are already seeing population aging in some countries. What is the economic impact? Aging is already causing a peak in labor force in China and the EU. Meanwhile, the population pyramid also means less consumptio

August 29, 2025

German HICP Review: Headline Back Higher But EZ Price Picture Still Reassuring?

August 29, 2025 12:12 PM UTC

Germany’s disinflation process hit a slightly more-than-expected hurdle in August, as the HICP measure rose 0.3 ppt from July’s 1.8% y/y, that having been a 10-mth low (Figure 1). This occurred largely due to energy base effects with food prices also contributing slightly. The result was that

August 28, 2025

ECB July Account: Policy ‘On Hold’ Leaves Easing Door Open But Less Widely So

August 28, 2025 12:37 PM UTC

The account of the July 23-24 ECB Council meeting saw some discussion about cutting at that juncture but with no immediate pressure to change policy rates what was then exceptional uncertainty added to arguments for keeping interest rates unchanged. In particular, it was seen that maintaining policy

August 26, 2025

EZ HICP and Jobs Review: Headline at Target as Services Inflation at Fresh Cycle-low

August 26, 2025 11:51 AM UTC

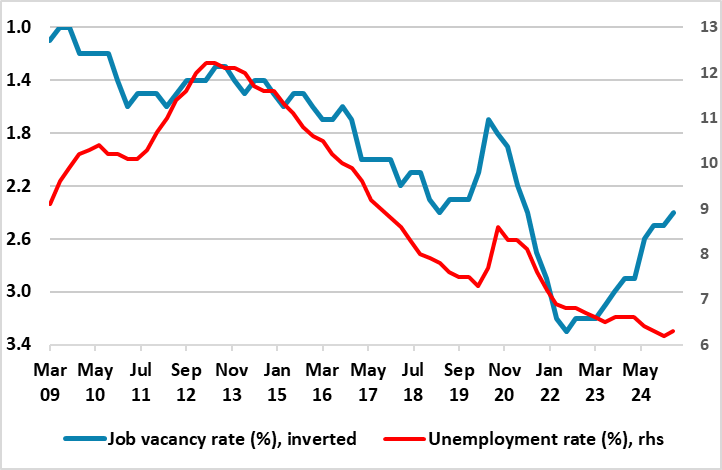

HICP, inflation – still at target – is very much a side issue for the ECB at present, albeit with the likes of oil prices and tariff retaliation and a low but far from authoritative jobless rate (Figure 3) possibly accentuating existing and looming Council divides. Regardless, despite adverse

France and Italy: Deficit, ECB QT and Foreign Debt Holders Stories

August 26, 2025 7:35 AM UTC

A large budget deficit in France, looking persistent given the current political impasse, combined with ECB QT means that the market has to absorb a very large 8.5% of GDP of extra bonds. Our central scenario is that persistent French supply causes a further rise in 5yr plus French government yields

August 25, 2025

Jackson Hole: Fed/ECB/BOJ and BOE on Labor Markets

August 25, 2025 9:02 AM UTC

Fed Powell focused on the cyclical softening of employment to back a more dovish undertone. In contrast other central bank heads focused on structural labor market issues. While ECB Lagarde was pleased with the post COVID EZ picture, current economic softness still leaves us forecasting two furt

August 21, 2025

Eurozone: ECB Feels it Has More Reason to ‘Wait and See’?

August 21, 2025 10:02 AM UTC

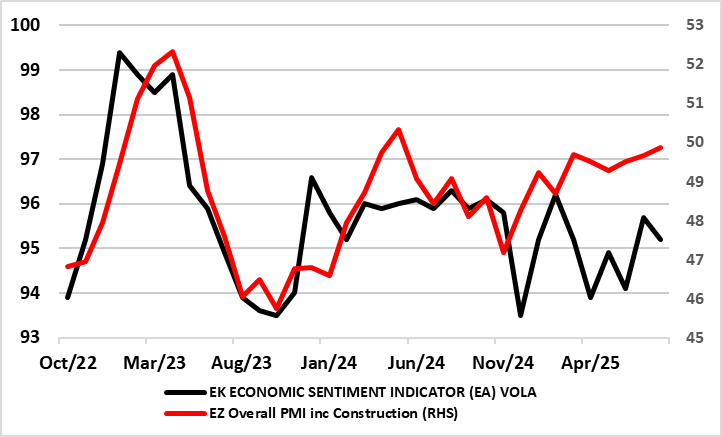

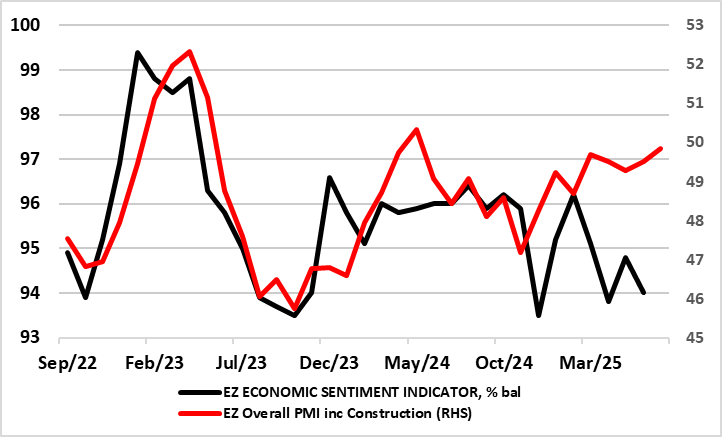

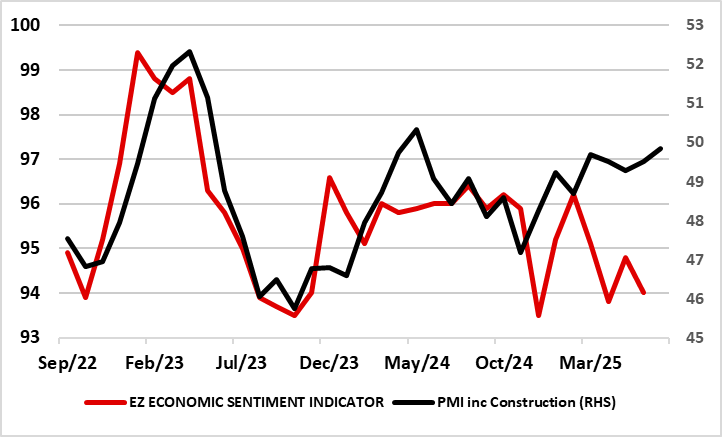

To suggest that recent EZ real economy indicators, such as today’s August PMI flashes, have been positive would be an exaggeration. But, at the same time, the data (while mixed and showing conflicts - Figure 1) have not been poor enough to alter a probable current ECB Council mindset that the ec

August 20, 2025

German Data Preview (Aug 29): Base Effects to Pull Headline Back Up - Temporarily?

August 20, 2025 1:39 PM UTC

Germany’s disinflation process continued, with the lower-than-expected July HICP numbers refreshing and reinforcing this pattern, with a 0.2 ppt drop to 1.8% y/y, a 10-mth low (Figure 1). This occurred in spite of adverse energy base effects albeit these likely to feature even more strongly in t

August 18, 2025

U.S. Strategic Fiscal Comparisons

August 18, 2025 9:05 AM UTC

The U.S. short average term to maturity is a structural fiscal weakness if higher rates lift U.S. government interest costs close to the nominal GDP trend. Hence, Trump’s pressure for fiscal dominance of the Fed to deliver lower policy rates and reduce U.S. government interest rate costs. Howeve

August 05, 2025

DM Rates: Slowdown Debate Trump’s Independence Question for Now

August 5, 2025 9:50 AM UTC

U.S. Treasury spreads versus other DM government bond markets or 10-2yr U.S. Treasuries are not yet showing a risk premium from the Trump administration attacks on the Fed and economic data. Debate over whether the U.S. is seeing a soft or hard landing are reemerging and this will dominate the outlo

August 04, 2025

EZ HICP and Jobs Review: Headline at Target as Services Inflation at Fresh Cycle-low

August 4, 2025 8:25 AM UTC

HICP, inflation – still at target – is very much a side issue for the ECB at present, albeit with the likes of oil prices and tariff retaliation and a low but far from authoritative jobless rate (Figure 3) possibly accentuating existing and looming Council divides. Regardless, despite adverse

July 31, 2025

German Data Review: Services Inflation Slows Further?

July 31, 2025 12:39 PM UTC

Germany’s disinflation process continues, with the lower-than-expected July preliminary HICP numbers reinforcing this pattern, with a 0.2 ppt drop to 1.8%, a 10-mth low (Figure 1)! This occurred in spite of adverse energy base effects. Regardless, there was some reversal of June’s surprise and

July 30, 2025

DM Household Sluggish Borrowing

July 30, 2025 10:45 AM UTC

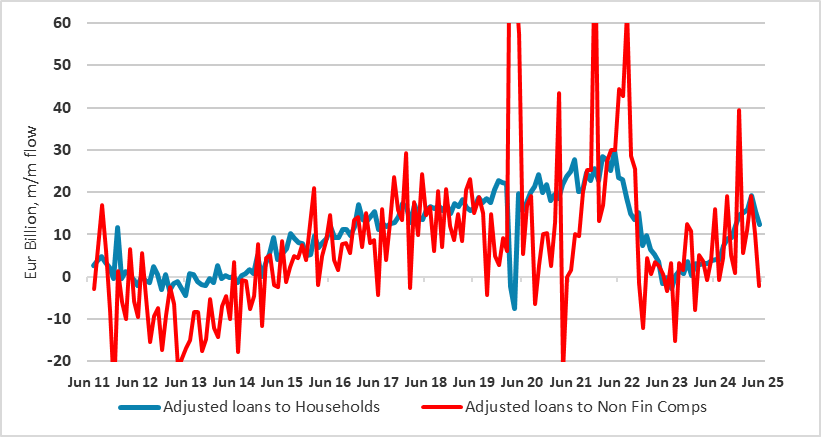

· Overall, restrained credit supply from banks; abundant employment/income or wealth for most households but restrained financial conditions for low income households could have restrained household lending growth to GDP. However, the surge in government debt and ensuing fear of fut

Eurozone Flash GDP Review: Resilience or Irrelevance?

July 30, 2025 9:52 AM UTC

As we highlighted in our preview, for an economy that has seen repeated upside surprises and above trend growth, now some 1.4% in the year to Q2, GDP data do not seem to have had much impact is shaping, let alone dominating, ECB policy thinking. We think this will continue to be the case even after

July 29, 2025

EZ Real Economy – Diverging Sentiment Indictors Complicate Outlook

July 29, 2025 9:26 AM UTC

The ECB contends that the EZ economy has shown resilience of late. Maybe so, albeit where GDP data (likely to average a satisfactory 0.3% q/q performance so far this year) are probably offering a misleading picture of underlying trends in real activity. Indeed, recent GDP data gains have been pr

July 28, 2025

U.S.-EU Trade Agreement: More a Framework Than a full Deal

July 28, 2025 9:08 AM UTC

In what seems to have been a fully-fledged political capitulation to the U.S. the EU, it seems, is accepting an agreement that would see an almost-blanket reciprocal 15% tariff on its exports to the U.S. But there still some imponderables, not least the range of sectoral concessions, whether EU me

July 24, 2025

ECB Review: Policy ‘On Hold’ Leaves Easing Door Open

July 24, 2025 1:48 PM UTC

Given the uncertainty overhanging policy makers worldwide, let alone in the EZ, the ECB was always likely to revert to stable policy after seven consecutive cuts which have taken the discount rate to its current 2%. In a much shortened statement, but which was more willing to highlight disinflatio

July 23, 2025

EZ HICP Preview (Aug 1): Headline at Target as Services Inflation at Fresh Cycle-low?

July 23, 2025 10:35 AM UTC

HICP, inflation – now at target – is very much a side issue for the ECB at present, albeit with the likes of oil prices and tariff retaliation possibly accentuating Council divides. Despite adverse energy base effects, we see the flash July HICP staying at June’s 2.0% but up from May’s eig

July 22, 2025

DM Rates: QT adds to Budget Deficits Pressures

July 22, 2025 10:05 AM UTC

· Heavy issuance due to the U.S. budget deficit, plus Fed rate cuts will help further yield curve steepening in H2 2025. In EZ and UK, ECB and BOE QT is large and amplifies the amount of debt that the rest of the market has to absorb, which will also drives yield curve steepening al

Eurozone Flash GDP Preview (Jul 30): A Pause that Does Not Refresh?

July 22, 2025 9:13 AM UTC

For an economy that has seen repeated upside surprises and above trend growth of 1.5% in the year to Q1, GDP data do not seem to have had much impact is shaping, let alone dominating, ECB policy thinking. We think this will continue to be the case even where the looming Q2 data may show a modest con

July 21, 2025

German Data Preview (Jul 30): Services Inflation to Slow Further?

July 21, 2025 12:49 PM UTC

Germany’s disinflation process continues, with the lower-than-expected June preliminary numbers refreshing and reinforcing this pattern, with a 0.1 ppt drop to 2.0%, a 10-mth low (Figure 1)! But we see no further drop in the July preliminary numbers largely due to adverse energy base effects -

2yr Germany and ECB Expectations

July 21, 2025 10:07 AM UTC

· Money markets are putting too much weight on ECB communications and we feel that a softening labour market/financial conditions and more tariffs from the U.S. will be enough to shift the ECB to deliver two final 25bps cuts in H2 2025. Though the 2yr Germany to ECB depo rate spread w

July 16, 2025

ECB Preview (Jul 24, Part Two): Policy Pause Despite Tighter Financial Conditions

July 16, 2025 1:07 PM UTC

The next ECB Council meeting decision on Jul 24 looms but (as we noted in the part one preview) markets (understandably) sees no further cut, at least at that juncture. However, we think that the ECB will ultimately still have to ease further - two more 25 bp cuts in H2 - and would not even rule o

July 15, 2025

ECB Preview (Jul 24, Part One): Labor Market Looking Softer than Council Thinking

July 15, 2025 8:45 AM UTC

The next ECB Council meeting decision on Jul 24 looms but where market (understandably) sees no further cut, at least at that juncture. Indeed, the ECB may signal signs of economic resilience albeit noting that the added uncertainty emanating from the latest U.S. tariff threat warrants more circum

July 14, 2025

EU Blindsided by Latest Tariff Threat

July 14, 2025 6:56 AM UTC

Having announced over the weekend a 30% “reciprocal” tariff from August 1 on EU exports to the U.S., the EU seems to be a state of somewhat shock, wary that months of negotiations have failed, let alone succeeded in reducing the tariff threat from the original 20%. In response, European Commis

July 09, 2025

Eurozone: Damage Limitations on Tariffs, Uncertainty to add to Banks' Caution??

July 9, 2025 9:37 AM UTC

It remains unclear just how much of a movable feast the new U.S. tariff deadline of Aug 1 actually is. Trade deals with the US were supposed to be agreed by today, or face the reciprocal tariffs as outlined in April. But that has now been deferred to, with US Treasury Secretary Bessent, hinting ac

July 03, 2025

June ECB Council Meeting Account Review: Divides Continue if Not Widen

July 3, 2025 12:24 PM UTC

The account of the June 3-5 Council meeting just about left the door open for a move at the July 24 policy verdict given the array of news (probably negative particularly regarding tariffs but also bank lending) due beforehand. But the account adds to the impression we has initially that a pause

U.S. Assets and Valuation

July 3, 2025 9:30 AM UTC

The U.S. equity market has returned to be clearly overvalued on equity and equity-bond valuations measures and is vulnerable to a new correction in H2 on any moderate bad news (e.g. further economic slowing and corporate earnings downgrades). In contrast, U.S. Treasuries are at broadly fai

July 02, 2025

DM Central Banks: Overlooking Lagged 2021-23 Tightening and QT?

July 2, 2025 8:30 AM UTC

We are concerned that DM central banks are underestimating the lagged impact of 2021-23 tightening and ongoing QT, which impacts the transmission mechanism of monetary policy. Central banks need to consider cyclical and structural issues, but also need a more rounded view of the stance and implica