Eurozone: Waging War on Wages

After a protracted period of elevated EZ cost and price pressures, a reversal seems to be very much underway. Headline and underlying HICP inflation have moved back toward target, but to reinforce this downtrend there are an increasing array of softer cost pressure signals. ECB wage tracker and Indeed monthly wage updates have offered a series of reassuring signals of late, these now accentuated by the more formal ECB negotiated wage figure for the last quarter. All inter-related, these not only buttress the soft(er) inflation backdrop and outlook, but may help temper the existing worries among ECB hawks regarding upside price risks from either/both tariffs and services.

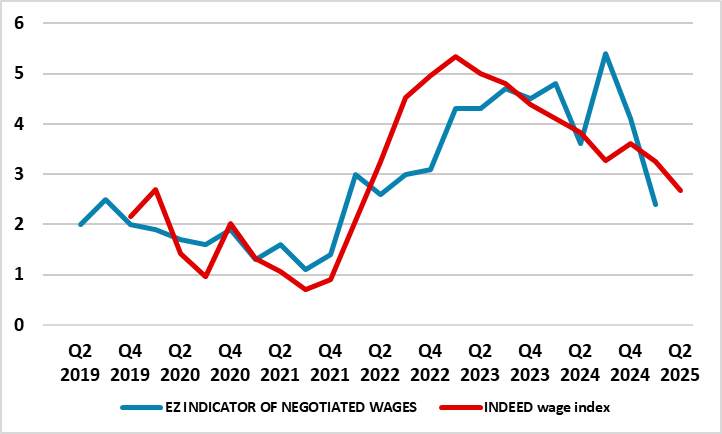

Figure 1: Negotiated Wage Growth Slumps - Chimes with Other Labor Cost Signals

Source: ECB, Eurostat, Indeed, % chg y/y

ECB-compiled data on negotiated wages slowed to 2.4% y/y in Q1, down from 4.1% at the end of 2024, also having halved in just six months and to the lowest in almost four years. Notably, such data is volatile but is now at a pace of wage growth that, even with anaemic productivity growth of below 1%, would be consistent with the 2% HICP target. The fact that the negotiated wage numbers chine with other labor costs indicators (Figure 1) is all the more reassuring, not least as the semi-projections of the ECB’s Wage Tracker survey actually suggest a further slowing by year end towards wage growth of 1%.

A backdrop and outlook of soft(er) wages pressures is perhaps more important at this juncture for the ECB as the hawkish element of the Council still suggest a higher than otherwise probability that any trade shock would be inflationary beyond the short term, in view of the destructive effects of breaking up global value chains and the likely tariff retaliation EZ governments may incur. This is possible but there is stretched logic in this hawkish camp also suggesting that while the inflationary effects of the proposed tariffs might differ for the United States and Europe, in the end inflation developments in the two economies have been and may remain quite synchronous. If so, there is no reason why rather than EZ inflation facing upside risks, U.S inflation may instead fall to that of the EZ; after all, disinflation is evident in many parts of the world, not least China. Regardless, the point is that softer EZ wage trends would obviously act as an offset to any such tariff-induced upside risks.

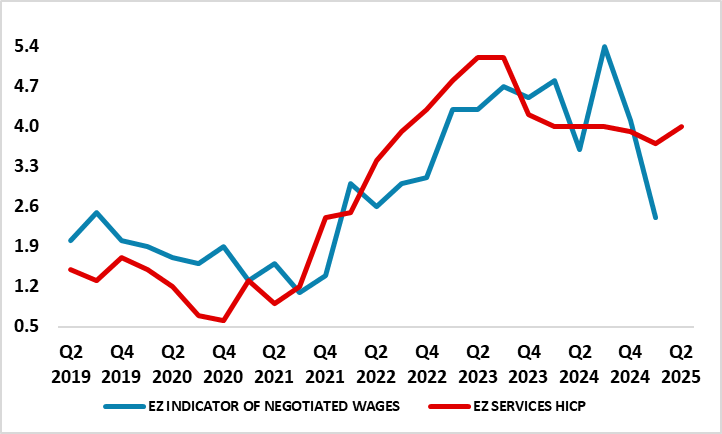

But there is further argument in which softer wage data are important. Recent EZ HICP data have been dogged by resilient services inflation, not least the pick-up (but probably Easter-distorted) April data. But with services much more dominated by wages in terms of the costs backdrop than manufacturing, softer wage pressures are all the more reassuring in suggesting that hitherto elevated services inflation will succumb in due course – as Figure 2 very much illustrates - NB given emerging weakness in services surveys this outlook even more likely!.

Figure 2: Negotiated Wage Growth Slumps Suggest Softer Services Inflation Ahead

Source: ECB, Eurostat, % chg y/y

All of which is important to the ECB policy outlook; as we have underscored of late while growth risks may provide the rational for further monetary easing, it is the price backdrop and outlook that provides the rationale.