Eurozone: The Tail Wagging the Dog?

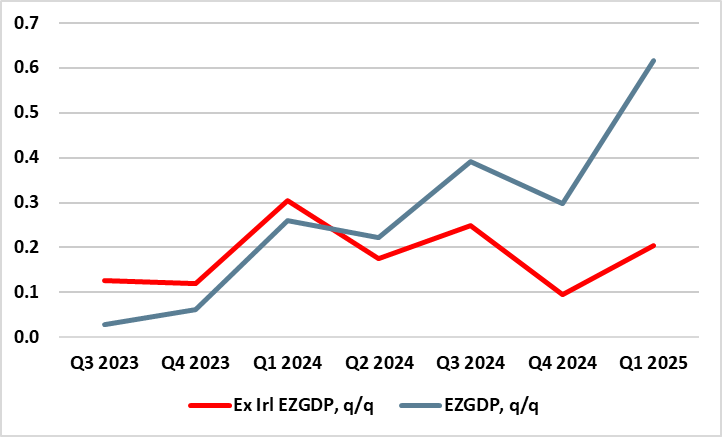

Given what now looks to have been an outstanding first quarter, the ECB’s assertion at this month’s Council press conference that it is a good position to navigate the uncertain conditions looks more tenable. After all, GDP jumped 0.6%, twice the previous estimate. But this is no indicator of underlying activity, predicated as it was on both a further surge in Irish GDP as well as what was widely expected to be a quarter in which the EZ economy as a whole enjoyed an export jump in anticipation of the US tariff imposition from April. The latter jump is likely to reverse in this and coming quarters – the ECB actually point to a contraction in Q3. But this uncertain and volatile backdrop in no one-quarter aberration; the EZ has been very dependent upon Ireland for the last year, the latter accounting for half the y/y growth seen into Q1 (Figure 1). This is unstable and unsustainable and to us suggests that the jump in GDP will have made little inroad in the EZ output gap. Regardless, the data do suggest a marked pick-up in productivity growth has occurred of late, which may be somewhat more persistent given the labor hoarding the EZ economy has seen in the last few years.

Figure 1: EZ Growth With and Without Ireland - Two Different Stories!

Source: Eurostat

Indeed, with EZ y/y growth up to 1.5% in Q1, and employment rising half that, productivity (in term of output per employee) rose to 0.8%, twice what the ECB has pencilled in for the while for 2025 and more in tune with its 2026-27 projections. Moreover, productivity in term of output per hour was even more impressive as hours worked have hardly risen in the last year, this possibly a result of labor hoarding. If the latter is so, it does suggest perhaps a more sustained productivity rise as any further rise in activity is unlikely to be based around significant employment advances.

Regardless, an export led Q1 GDP jump is far from unique to the EZ as far as W Europe is concerned. In Switzerland, GDP jumped 0.5%, this on the back of a jump in goods exports (mainly pharmaceutical sales to the U.S.) that boosted the economy by two ppt for a second successive quarter. The UK saw something even higher, albeit its export sales based more around other goods, such as vehicles. And the EZ joined in the party as Ireland produced another quarter of export and GDP is estimated to have grown by 9.7% in the quarter, driven significantly by a rise of 9.4% in exports of both goods and profits. In context, Irish Gross National Product, which is a measure of economic activity that excludes the profits of multinationals, decreased by 2.1% in the quarter. But the Irish GDP surge is not purely a Q1 phenomenon, as the economy has seen four successive string advances. Indeed, without these, EZ GDP growth would actually have slowed or moved sideways as it would be half the reported 1.5%, this despite Ireland being less that 5% of the EZ!

Overall we caution about extrapolating from recent W European strength – if the EZ joined the party, it must remember that parties to not last! This is especially so in the current context where the U.S. is hardly interested in granting Europe early or advantageous trade deals.