ECB Council Meeting Review: Easing Window Stays Open

This widely seen 25 bp deposit rate cut (to 2.0%) now means the previous degree of tightening has been effectively halved. Notably, it comes alongside an ECB policy and economic outlook/bias little changed from that of recent months. The door is thus left open for a move at the July 24 policy verdict given the array of news (probably negative particularly regarding tariffs but also bank lending) due in the interim. But we get the impression given that a pause may be due after what have been seven successive cuts, this also reflecting what may be clear(er) Council divides over the extent and direction of inflation risks – this explaining the apparent dissent. Regardless, the ECB’s updated forecast show a much earlier drop in HICP inflation to below target, albeit with largely unchanged forecasts at around target for 2027 and what are also largely unchanged growth assumptions. Further easing is on the cards, the question being whether this should start to encompass toning down QT plans too!

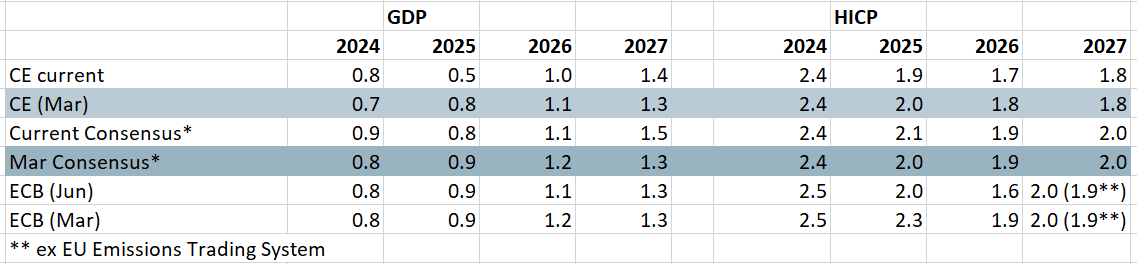

Figure 1: ECB Shifts Little on Growth?

Source: ECB, Bloomberg, CE

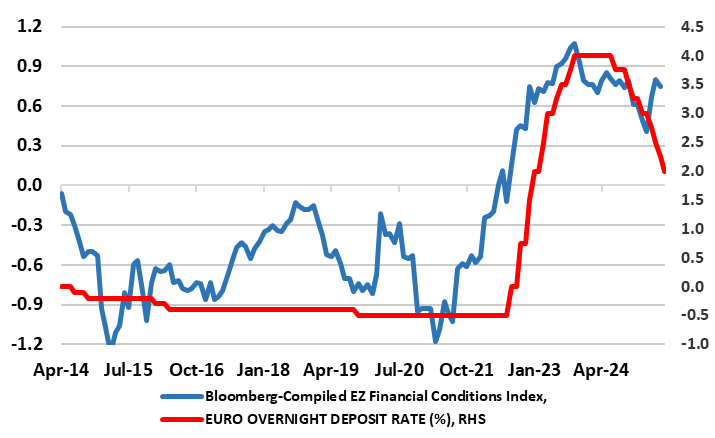

As these ECB projections still encompass policy rate assumption to somewhat below the 2% rate now put in place, it would thus support such market thinking, this despite the ECB real activity outlook now including rising government investment in defence and infrastructure. We think this latter thinking may be too positive, at least until 2027 not least given very difficult fiscal positions in many countries. The ECB also draws comfort that more favourable financing conditions should make the economy more resilient to global shocks, this puzzling when conditions have actually tightened of late (Figure 2), only partly due the exchange rate.

Thus we do not go along with the ECB stance that policy and the EZ economy is in a good position and we would point to the array of downside risk that the ECB pointed as being increasing reality, all based around tight financial conditions and protracted uncertainty. Thus we still see a much softer 2025-26 growth picture one that delivers a similar inflation outlook into next year but then stays below target through 2027 (with or without assumptions about energy taxes). What is clear is a diminishing cost and price pressure backdrop, the former highlighted by the ECB now talking of wages growth moderating ‘visibly’. Moreover, and possibly to the opposition of the hawks, the various alternative ECB scenarios largely conclude that added trade tensions would be more disinflationary rather than stoking supply pressures.

Figure 2: Policy Rates and Financial Conditions Diverging

Source: Bloomberg, ECB

Reassessing All Aspects of Policy?

We would underscore that disinflation provides the ECB with the scope to ease policy while weak activity (actual and/or threatened) provides the rationale. But as for our outlook, the downside growth risks the ECB still recognises stem not just from the direct consequences to trade from the U.S. imposed tariffs but also from export diversions and the increasing threats of inter-twined slumping business confidence and capex intentions as well as the surging euro damaging competitiveness, the latter accentuating already tighter financial conditions. All of which suggest to us that the damage that tariffs may accentuate already clear and what has been hitherto largely supply side disinflation. As for market thinking about policy we think is fully justified enough to mean up to two more 25 bp cuts in H2 this chiming with Lagarde’s refusal to make any attempt to assert that easing has ended. Moreover, the ECB may/should even have to revisit the QT outlook.

Indeed, as for the latter we have repeatedly noted that elements of the ECB have begun to accept the collateral economic damage that QT has been doing in both offsetting conventional easing and thereby tightening financial conditions. In fact, according to ECB research, a EUR 1 trillion reduction in bond holdings (ie broadly what has occurred in the last two years) may have raised long-term risk-free interest rates by about 35 bp – this possibly helping explain the recent and fresh divergence between (falling) policy rates and (increasing) financial conditions (Figure 2 again). The latter may be coming alongside tighter conditions from ever warier banks, who seem increasingly reluctant to lend as they reduce their risk tolerance and raise their perception of risk amid increased scrutiny of corporate borrowers particularly exposed to exports to the United States. This will make the next ECB bank lending survey due two days before the July 24 Council meeting all the more interesting and potentially policy enhancing. But there are more reasons for the ECB to reassess the QT outlook!

QT Needs Reassessing?

In this regard, there are now other more market and financial stability reasons too. As the ECB has admitted, that as it navigates an increasingly complex economic landscape, the transition from abundant to less ample excess liquidity in the banking sector represents an inflection point that also requires close monitoring.

This is increasingly relevant as the ECB continues the normalisation of its balance sheet, partly to regain policy space and refill the tool box. But current QT plans would result in possibly destabilising tensions in the money markets as excess liquidity into 2026 would be set to fall below the levels prevailing before the pandemic. With this mind, we envisage that by the autumn the ECB may be flagging a slowing, if not an end, to QT, this encompassing some return to reinvesting bonds. While no mention of such issues has yet been made by the ECB, this topic may emerge more overtly as soon as the (Jun 30-Jul 2) ECB annual Sintra Forum on Central Banking which is, after all, already scheduled to discuss ‘adapting to change: macroeconomic shifts and policy responses’.