ECB Preview (Jul 24, Part Two): Policy Pause Despite Tighter Financial Conditions

The next ECB Council meeting decision on Jul 24 looms but (as we noted in the part one preview) markets (understandably) sees no further cut, at least at that juncture. However, we think that the ECB will ultimately still have to ease further - two more 25 bp cuts in H2 - and would not even rule out a move this month if Tuesday’s updated bank lending survey (BLS) adds to existing concerns (Figure 1). Indeed, over and above what we think is over-optimism regarding the labor market, we think that the ECB has a complacent view on financial conditions and credit growth (Figure 2). But for the Council it is likely that this time around the added uncertainty emanating from the latest and extended U.S. tariff threat (Figure 3) warrants more circumspection than immediate policy action. But in this second part of an ECB preview we concentrate on a fragile financial backdrop noting bank worries about the outlook seen in the last BLS that may already be seeing softer credit growth.

Figure 1: Firm Loan Demand Weaker as Credit Standards Edge Higher

Source: ECB April BLS

It is likely that the updated BLS will play an important role in shaping ECB thinking this month, albeit unlikely decisively as it may (again) offer mixed messages. Indeed, in April’s BLS, the ECB will have drawn comfort from signs that credit demand and supply for EZ households continued to improve. But it also pointed to worrying signs in regard to firms. In particular, it showed a further (admittedly more modest) tightening in actual and expected credit standards and a fresh fall in company’s credit demand (Figure 1) with smaller firms also facing increasing rejection rates in pursuit of loans. The rationale from banks was clear; higher perceived risks related to the general economic outlook with the tariff threat evident amid increased scrutiny of corporate borrowers particularly exposed to exports to the U.S. Moreover, the BLS pointed to economic and geopolitical uncertainties as a dampening factor for firms’ longer-term planning and thus capex plans. Thus the tariff threat was taking a toll on banks’ willingness to lend and firm’s appetite to borrow even in March, ie well before the possible scale and breadth of the tariff threat emerged.

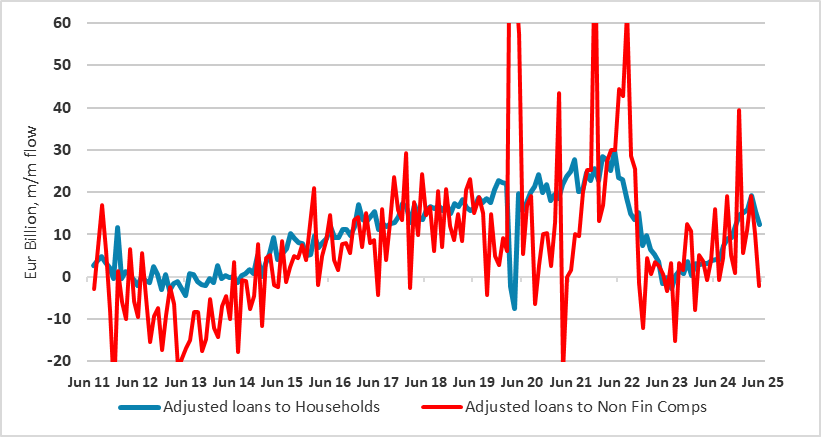

Figure 2: Credit Growth Already Softening Afresh – Especially on the NFC side

Source: ECB

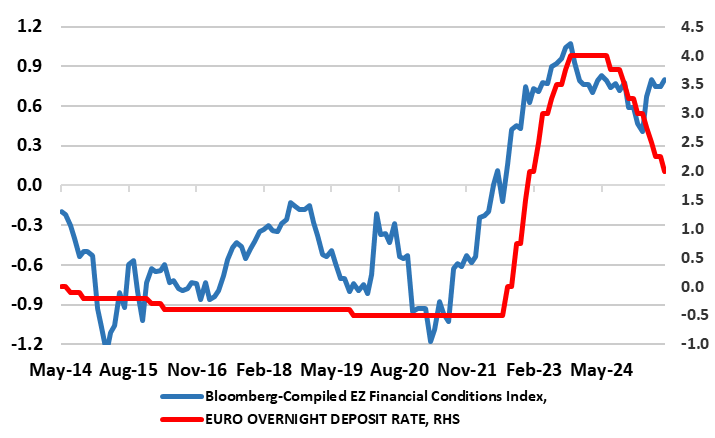

And importantly, these concerns raised by banks may already be having a tangible negative impact. Indeed, while official credit growth data showed adjusted credit growth stable at 2.8% y/y in May (as President Lagarde may underline in her press confernce), this masked a clear m/m softening, in both households but particularly non-financial company (NFC) credit (Figure 2). Admittedly, this may be just more volatility but we (instead still) think this reflects banking wariness as highlighted in the BLS as well as what seems to be tighter financial conditions as opposed to a loosening in the latter that the ECB seem to discern, despite evidence to the contrary (Figure 3).

Figure 3: Policy Rates and Financial Conditions Diverging

Source: Bloomberg, ECB

This tightening in financial conditions may also reflect another worrying message evident in the BLS – namely that QT is not as neutral as the ECB has been alleging. In fact, the BLS was very clear that the reduction in the ECB’s monetary policy asset portfolio has had a negative impact on both the market financing conditions and liquidity positions of EZ banks – this being something we have highlighted and think will trigger an ECB response in terms of slowing QT possibly in H2 this year.

Overall, we see the combination of a less robust labor market and tight(er) financial conditions helping explain our below consensus (sub-1%) GDP outlook into 2026 and an ensuing persistent undershoot of the 2% inflation remit. This we think will trigger two more 25 bp discount rate cuts by year end, this view reinforced if the ECB has to revisit its also optimistic tariff assumption where a rate of 10% is its baseline (Figure 4).

Figure 4: The ECB Current Tariff Scenarios

Source: ECB June forecasts - baseline sees GDP growth of 0.9% (25), 1.1% (26) & 1.3% (27)