EZ HICP and ECB Strategy Review: Headline Up to Target as Services Inflation Rises Back?

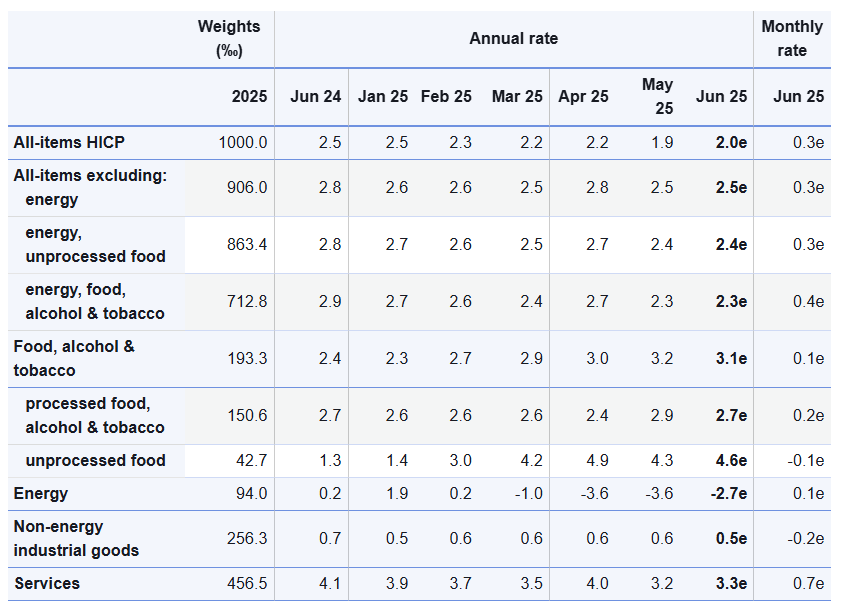

Despite its updated its monetary policy strategy detailed yesterday, inflation – now at target – is very much a side issue for the ECB at present, albeit with oil prices possibly accentuating Council divides. Admittedly, the flash June HICP rose a notch to 2.0% matching the -consensus, but up from May’s eight-month low and below-target 1.9% (Figure 1). More notably, having jumped 0.5 ppt to 4.0% in April, very probably due to the impact of the timing of Easter affecting airfares and holiday costs, services inflation fell back to a 27-mth low of 3.2%, mirroring a similar Easter effect in 2019, Indeed, as a result, the core rate dropped to 2.3%, the lowest since Oct 2021. However, adverse energy basis effects and a further calendar distortion pull services back up in June (again temporarily), this factor too explaining what looks like fresh price pressures in seasonally adjusted short-term m/m movements. But the core stayed at 2.3%!

Figure 1: Headline Back Below Target as Services Rise Reverses

Source: Eurostat, % chg y/y and m/m

ECB Updates Monetary Policy Strategy – Subtly!

The data come just after the ECB updated its monetary policy strategy. Little of note emerged although the central banks did underline that the likes of trade tensions, other “structural shifts” and increasing use of artificial intelligence make the world more volatile and therefore inflation targeting more difficult amid what may be increasing supply shocks. If there are any shifts they are small suggesting that the strategy emphasised the risk of sudden but persistent increases in inflation, albeit still adhering to a symmetric stance but where the risks of risk of deflation may have receded. We think such thinking in playing down deflation risks ahead is a little premature and reflects the fact that the Council is still fighting the last (high) inflation battle but where scenario analysis will be used more – although already in use. The first regular monetary policy meeting of the Governing Council applying the updated strategy will be held on 23-24 July 2025, with the next assessment expected in 2030.

As for recent HICP swings, Easter effects may have been behind the jump in April unprocessed food inflation too, and also reversed in May but where calendar effects failed to prevent a small fall back in June. Even so, holiday related price distortions reoccurred into June, this possibly explaining services inflation ticking higher again, albeit temporarily as was the case the last time such calendar effects were evident in Apr-Jun 2019..

That April services data may have caused some prevarication within the ECB while some Council hawks may still cite the recent pick-up in supercore and PICC inflation as a cause for concern, alongside more debatably worries related to a fragmentation of global supply chains which they suggest could raise inflation by pushing up import prices while a boost in defence and infrastructure spending could also raise inflation over the medium term. NB such worries will have been diluted by a fresh fall in supercore and PICC inflation last month while global supply gauges, such as that computed by the NY Fed, still show no sign of anything but sideways, if not downward pressure, on prices! Moreover, while the Q2 HICP met ECB thinking at 2.0%, the core cam in 0.1 ppt lower at 2.4%!

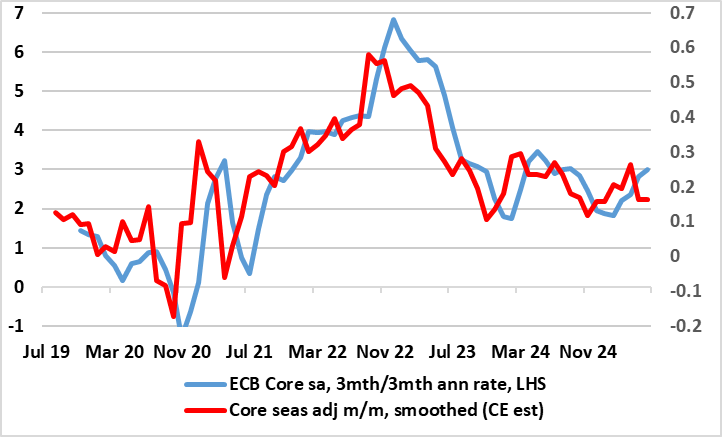

Notably, the softer services message seen in the May data was evident even in shorter-term price momentum data where such 3-mth averages still encompass the April surge and the June jump. Even so, short-term core inflation has slowed and is running around target (Figure 2).

Figure 2: Core Inflation Already Around Target in Shorter-Term Dynamics?

Source: Eurostat, ECB, CE - ECB rate is 3mth annualised

As we have noted previously, there are some signs in retailing surveys suggesting disinflation may have stalled. But this may be of increasing secondary importance to most of the ECB Council as a) inflation is already consistent with target; b) cost pressures are under control and may indeed be easing when it comes to softening wage inflation possibly helped by a swelling workforce and c) a fresh and more demand driven disinflation could be triggered by what seems to be a weaker real economy backdrop that could also exacerbate financial stability risks and which risks being accentuated on the downside by a possible trade war. We see Headline inflation dropping back below target until base effects kick in September but when a more protracted fall below target is likely and where the core edges down to around 2% by year-end.