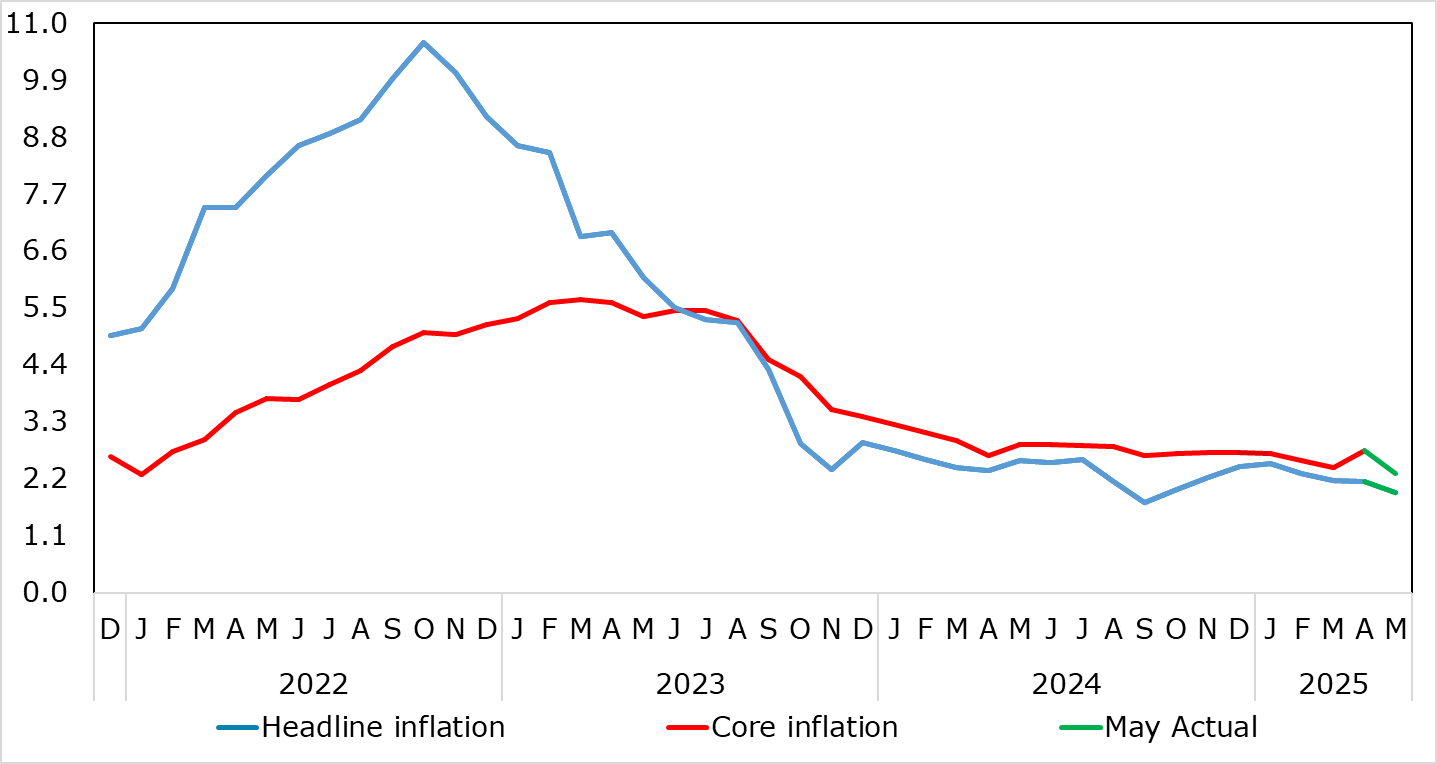

EZ HICP and Labor Market Review: Headline Back Below Target as Services Inflation Reverses Easter Effect

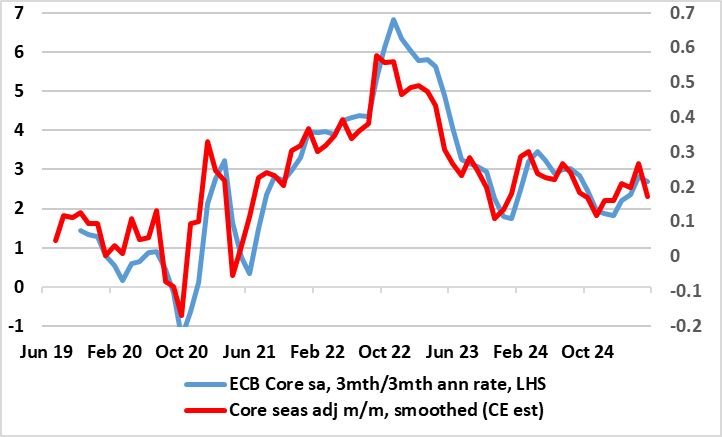

EZ HICP inflation met our below-consensus expectation in dropping to an eight-month low and below-target 1.9% (Figure 1) helped by rounding and a further m/m fall in fuel prices. More notably, having jumped 0.5 ppt to 4.0% in April, very probably due to the impact of the timing of Easter affecting airfares and holiday costs, services inflation fell back to a 27-mth low of 3.2%, mirroring a similar Easter effect in 2019, Indeed, as a result, the core rate dropped to 2.3%, the lowest since Oct 2021 with seasonally adjusted short-term m/m movements very much underscoring not only recent disinflation, but echoing an on, if not below, target recent trend in core inflation. (Figure 3). Regardless, we see headline HICP inflation staying around the May outcome for the next few months even with some upside risks from fresh holiday distortion in June numbers!

Figure 1: Headline Back Below Target as Services Rise Reverses

Source: Eurostat, CE, ECB

Source: Eurostat, CE, ECB

Easter effects may have been behind the jump in April unprocessed food inflation too, and also reversed in May. That April services data may have caused some prevarication within the ECB but the expected June rate cut looks even more on the cards given this softer services trend, something chiming with softer wage pressure data seen of late. Admittedly, some hawks may still cite the recent pick-up in supercore and PICC inflation as a cause for concern, alongside more debatably worries related to a fragmentation of global supply chains which they suggest could raise inflation by pushing up import prices while a boost in defence and infrastructure spending could also raise inflation over the medium term. NB global supply gauges, such as that computed by the NY Fed, still show no sign of anything but downward pressure on prices!

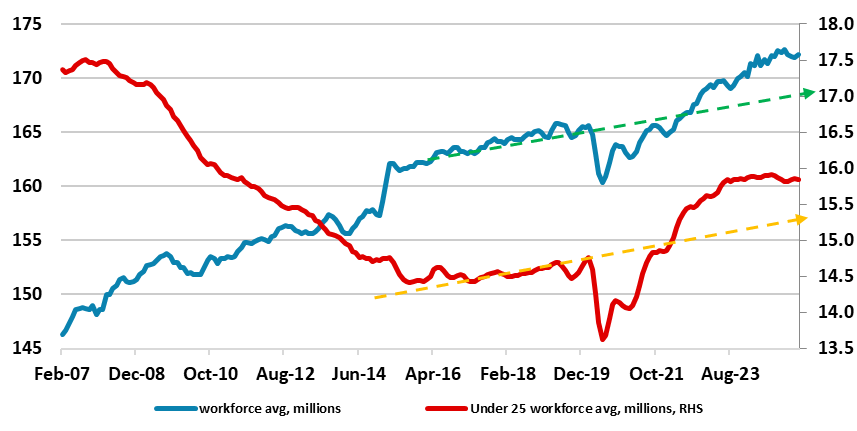

Figure 2: Workforce Continues to Grow – Older Entrants the New Factor?

Source: Eurostat, CE

Regardless, these HICP data arrived alongside April labor market numbers which showed a revision up in March to the jobless total but then a drop back in April, possibly also an Easter distortion. Regardless, the low jobless rate comes alongside a continued and above-trend increase in the workforce, this possibly being a major factor in the manner in EZ wage inflation has been falling. What is notable, is that the pick-up in the workforce has shifted away from younger entrants (ie 25 and under) to older members (Figure 2), the question being whether this is being driven by a need to repair/boost ailing spending power, something that chimes with a recent ECB survey showing EZ households having continued concern about their finances enough to rein in spending.

Notably, the softer services message seen in the May data was evident even in shorter-term price momentum data where such 3-mth averages still encompass the April surge at least for the time being. Even so, short-term core inflation has slowed and is running around target (Figure 3). Even so, holiday related price distortions may persist into June, possibly pulling services inflation higher again, albeit temporarily.

Figure 3: Core Inflation Already Around Target in Shorter-Term Dynamics?

Source: Eurostat ECB, CE

As we have noted previously, there are some signs in retailing surveys suggesting disinflation may have stalled. But this may be of increasing secondary importance to most of the ECB Council as a) inflation is already consistent with target; b) cost pressures are under control and may indeed be easing when it comes to softening wage inflation possibly helped by a swelling workforce and c) a fresh and more demand driven disinflation could be triggered by what seems to be a weaker real economy backdrop that could also exacerbate financial stability risks and which risks being accentuated on the downside by a possible trade war. And it is the latter factor that seems to be driving policy now, this over and beyond any consideration of reaching a neutral policy setting, not least as financial conditions have tightened of late despite the lowering of policy rates.