EZ HICP Preview (Jul 1): Headline Stays Below Target as Services Inflation Rises Back?

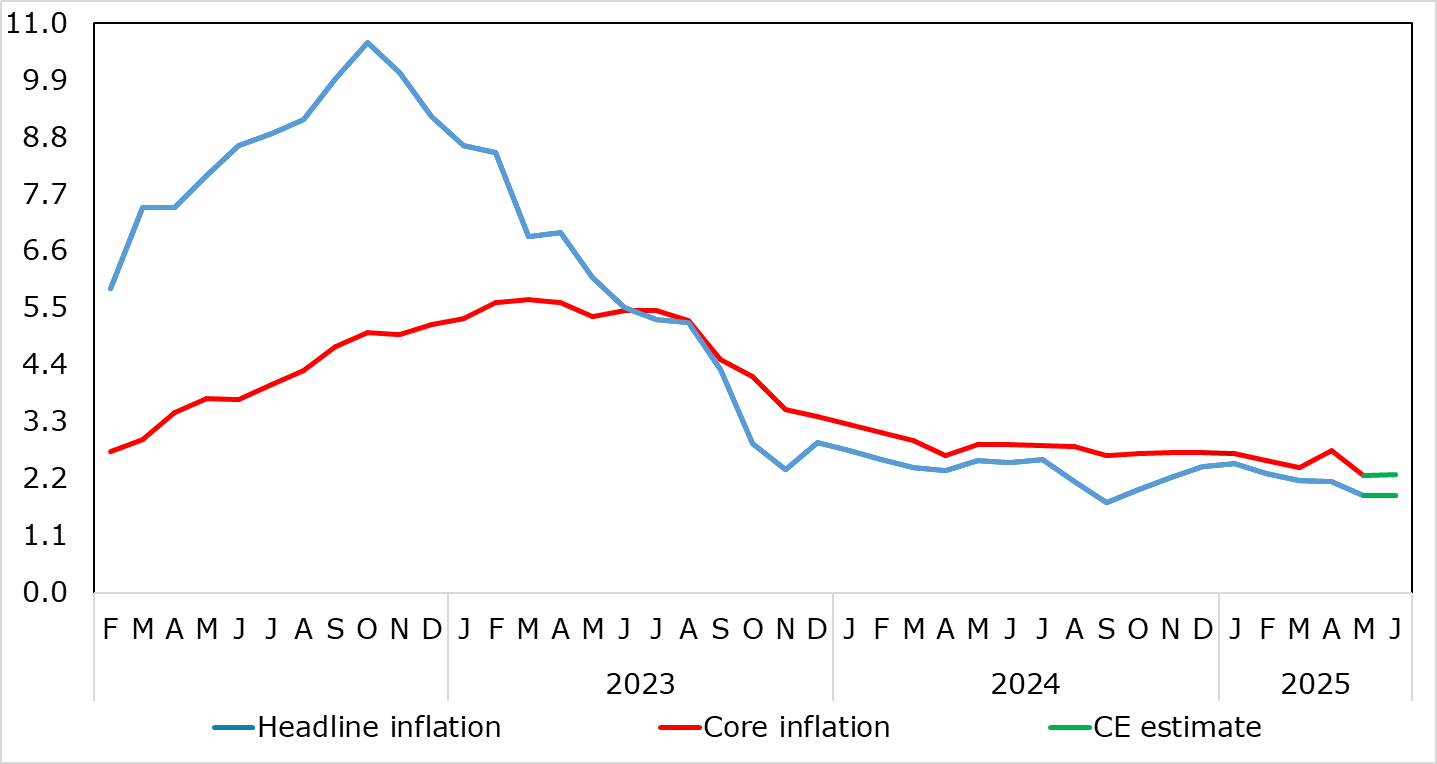

Inflation – now below target – is very much a side issue for the ECB at present, albeit with oil prices possibly accentuating Council divides. Indeed, we see the flash June HICP staying at May’s below-consensus, eight-month low and below-target 1.9% (Figure 1). More notably, having jumped 0.5 ppt to 4.0% in April, very probably due to the impact of the timing of Easter affecting airfares and holiday costs, services inflation fell back to a 27-mth low of 3.2%, mirroring a similar Easter effect in 2019, Indeed, as a result, the core rate dropped to 2.3%, the lowest since Oct 2021. However, adverse energy basis effects and a further calendar distortion may pull services and core back up in June (again temporarily), this factor too explaining what looks like fresh price pressures in seasonally adjusted short-term m/m movements.

Figure 1: Headline Back Below Target as Services Rise Reverses

Source: Eurostat, CE, ECB

Easter effects may have been behind the jump in April unprocessed food inflation too, and also reversed in May. That April services data may have caused some prevarication within the ECB while some Council hawks may still cite the recent pick-up in supercore and PICC inflation as a cause for concern, alongside more debatably worries related to a fragmentation of global supply chains which they suggest could raise inflation by pushing up import prices while a boost in defence and infrastructure spending could also raise inflation over the medium term. NB such worries will have been diluted by a fresh fall in supercore and PICC inflation last month while global supply gauges, such as that computed by the NY Fed, still show no sign of anything but sideways, if not downward pressure, on prices!

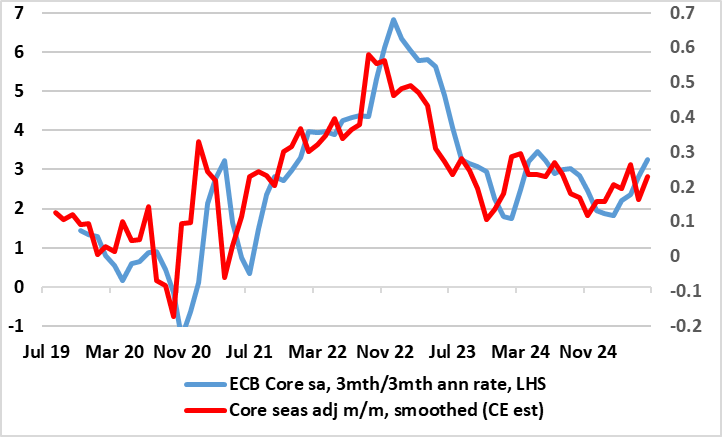

Notably, the softer services message seen in the May data was evident even in shorter-term price momentum data where such 3-mth averages still encompass the April surge and the anticipated June jump. Even so, short-term core inflation has slowed and is running around target (Figure 2). Even so, holiday related price distortions may reoccur into June, possibly pulling services inflation higher again, albeit temporarily – we see a 0.2 ppt rise and a possible notch higher move in the core to 2.4% but with the Q2 outcome coming in just below ECB thinking.

Figure 2: Core Inflation Already Around Target in Shorter-Term Dynamics?

Source: Eurostat ECB, CE