ECB Preview (Jul 24, Part One): Labor Market Looking Softer than Council Thinking

The next ECB Council meeting decision on Jul 24 looms but where market (understandably) sees no further cut, at least at that juncture. Indeed, the ECB may signal signs of economic resilience albeit noting that the added uncertainty emanating from the latest U.S. tariff threat warrants more circumspection than immediate policy action. But that perceived resilience we think is misplaced, in particular given its complacent view on financial conditions and credit growth. But in this first part of an ECB preview we concentrate on the ECB’s over-optimism about the EZ labor market, which we think is neither tight nor robust.

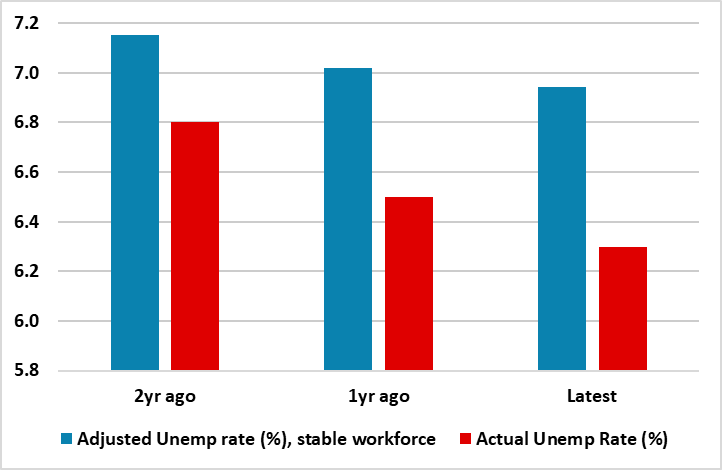

Figure 1: Record-Low Jobless Rate More Supply Than Demand-Driven

Source: Eurostat, CE

First, the ECB position on the labor market. Its view is that higher real incomes and a robust labour market will allow households to spend more. Supporting this contention, the account of the last (June 3-5) Council meeting pointed to employment having increased by 0.3% in Q1 while the unemployment rate had remained broadly unchanged largely at a record low of 6.2% in April. There were, however, some downside qualifications acknowledged; demand for labour continued to moderate gradually, as reflected in a decline in the job vacancy rate and subdued employment PMIs. Moreover, workers’ perceptions of the labour market and of probabilities of finding a job had also weakened, according to the latest Consumer Expectations Survey. However, we think these qualifications are both understated and incomplete.

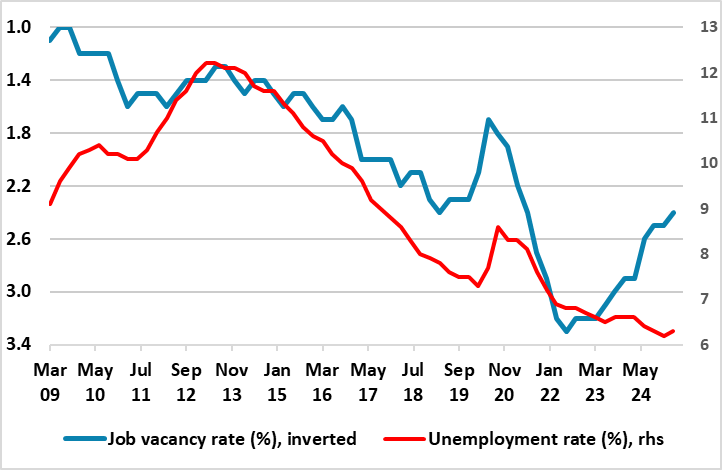

Indeed, rather than a robust labor market where the near record low jobless rate is a reflection of demand, the opposite is more the case. As a Figure 1 shows, in what is purely illustrative, if the denominator in computing the jobless (ie the workforce) is left at the level seen two years ago, we see that the ensuing adjusted jobless rate falls a year and two years after would be both much smaller and less rapid than the actual jobless rate. This is even more evident in Figure 2 which shows the vacancy rate that the ECB referred to relative to the jobless rate. The vacancy rate (very much a reflection of employer’s’ demand for workers) has been falling for the last two years, thereby deviating from the on-going drop in the jobless rate and further highlighting how the latter is very much supply driven.

Figure 2: Falling Vacancy Rate Suggests Already Waning Labor Demand

Source: Eurostat

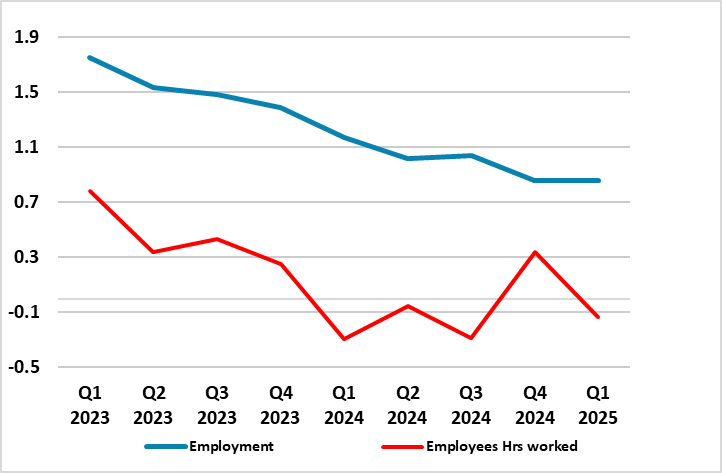

This reflects a view we have underscored repeatedly in recent years amid the recovery from the pandemic, namely that the EZ is unique among the DM world in having seen not just a rise its workforce but one that is actually stronger and faster that prior to COVID. This is one factor why we think EZ wage pressures have subsided so clearly into 2025 chiming with the drop in HICP inflation and why, in turn we question the extent to which the labor market is delivering higher real incomes. These doubts are reinforced by a deeper insight into labor market dynamics of late, namely hours worked which have largely been falling, thereby inhibiting take home pay. This is a result of what has been labor hoarding by EZ companies in recent years, something that partly explains waning labor demand at the current juncture.

Figure 3: Slowing Jobs Growth and Falling Hours Worked

Source: Eurostat, % chg y/y

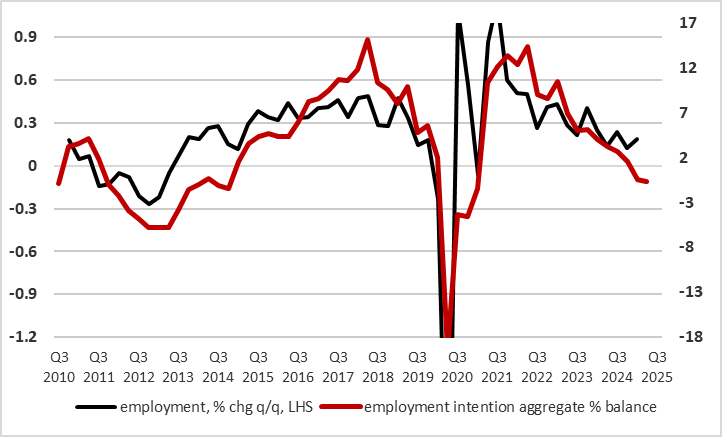

In fact, the evidence is growing that rather than slowing the jobs picture has gone into reverse, at least according to the most topical business survey data such as the PMI that the Council account referred to. But other survey data paint a similar, if not bleaker picture. Aggregating European Commission survey data from the three main sectors regarding employment intentions suggest that companies may now be shedding labor not adding to it.

Figure 4: Employment Intentions Turning Negative

Source: European Commission, CE – aggregate comprises services, manufacturing and construction

One question here is this a reflection of current uncertainty but also whether it partly reflects banks becoming more cautious amid the current environment, this being something we will discuss and detail in the second part of the ECB preview due later this week. But in the meantime, we would not overstate labor market weakness; instead just highlight two issues. Firstly, assessing conditions purely looking at the jobless rate can give misleading messages. Secondly, an ECB projection of 1%-plus consumer spending rise into 2027 based on solid employment gains leading to both real income gains and a falling savings rate are too optimistic