ECB Council Meeting Preview (Jun 5): Much Earlier Sub-Target Inflation Outlook?

What is widely seen as an eighth 25 bp deposit rate cut in the current cycle on June 5 may be overshadowed by the ECB’s implicit if not explicit shift about the outlook thereafter. The door will be left open for a move at the July 24 policy verdict given the array of news (probably negative particularly regarding tariffs) due in the interim. But the impression may be given that a pause may be due after what have been seven successive cuts, this also reflecting what seem to be clearer Council divides over the extent and direction of inflation risks. But the main news may be reflecting much more disinflationary assumptions about interest rates, energy prices and the euro. As a result, the ECB’s updated forecast may show a much earlier (but still sustained) drop in HICP inflation to below targets than the H2 2026 timetable seen in the March forecasts. As this projection should encompass policy rate assumption to well below the 2% rate likely to be put in place in June, it would thus support such market thinking.

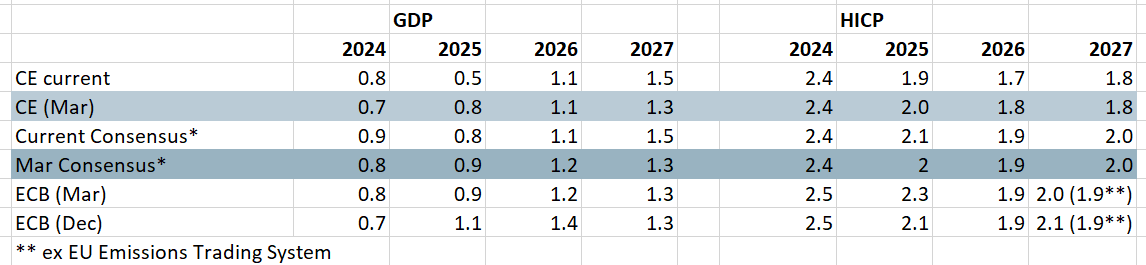

Figure 1: ECB Shifts Down toward Consensus on Growth?

Source: ECB, Bloomberg, CE

Given insight from the the account of the April 16-17 ECB Council meeting, it seems that 25 bp cut was more of a clearly agreed consensus, this papering over continued divides regarding the outlook; the risks from tariffs; and where inflation risks lie. Notably, the hawks specifically, and the Council more generally, accepted that that upside price risks had not vanished with some note made of the rising momentum that had been detected in the PCCI indicators warranted monitoring. In this regard the fact that the PCCI and super core underlying measures have since risen further may perturb some of the Council, and especially so if, in the unlikely event, forthcoming May HICP data does not confirm that the April services surge was purely a statistical and calendar anomaly.

Rhetoric Rationale Detailed

Perhaps the key aspect in the decision last time around was the rationale behind removing the phrase “our monetary policy is becoming meaningfully less restrictive”. We argued at the time that this was entirely appropriate not least given the manner in which financial conditions had been tightening – they have eased of late but remain clearly above those prevailing ahead of the March ECB projections. However, the shift in wording was as much designed to avoid the perception that reaching a neutral level of interest rates was also the end point of the current cycle, which was not necessarily the case, this being important as current policy would be regarded to be at or near neutral by most of the Council.

Revised and Softer Inflation Outlook

Updated ECB forecasts due in June will be based on a market thinking that envisages rate dropping towards 1.5 by mid-2026. That this may result in a softer growth and particularly inflation outlook relegates the usefulness of a supposed neutral policy rate as many other factors – as always – contribute to the inflation outlook. In this regard, much softer, energy price, long-term interest rates and a much higher exchange rate all suggest a greater disinflationary thrust than that seen in the March projections. Indeed, the 5% appreciation of the trade weighted euro may knock some 0.2 ppt from the inflation outlook alone, according to ECB research. ECB thinking also suggests that that a credible monetary policy will lower the pass-through of exchange rate movements to both the real economy and inflation. This means that at the moment, the stronger euro and a downward revision of inflation projections would reinforce the impression of more rate cuts to come.

Of course the outlook is complicated by the direct and indirect impact of tariff uncertainty. By partly explaining our below consensus picture (Figure 1), it is highly likely that come July the ECB may find that the current ramped up U.S. tariffs are even higher, albeit not to the extent of that threated lately by President Trump. But there are other complications not least the German fiscal boost and EU wide defence upgrade, which may persuade the ECB to upgrade its 2027 thinking to match the current consensus even given a current lack of details.

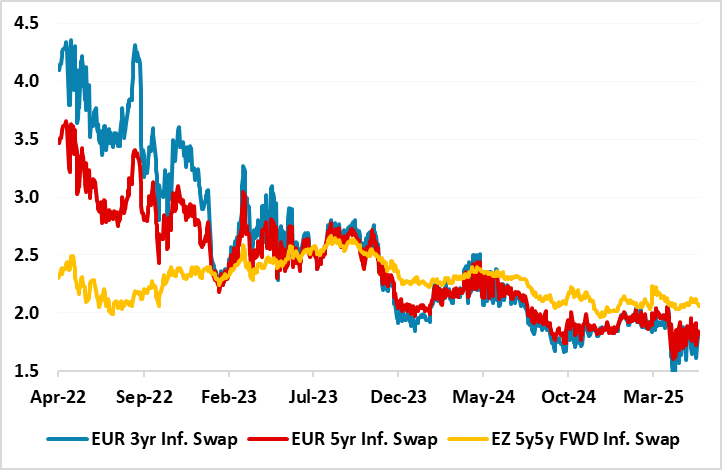

Figure 2: Inflation Expectations Suggest Sustained Drop in inflation Below Target

Source: Datastream, implied inflation outlook from swap rates

Uncertainty – Direct and Indirect Impact

We would underscore that disinflation provides the ECB with the scope to ease policy while weak activity (actual and/or threatened) provides the rationale. But as for our outlook, the increase in downside growth risk the ECB now recognises stem not just from the direct consequences to trade from the U.S. imposed tariffs but also from export diversions and the increasing threats of inter-twined slumping business confidence and capex intentions as well as the surging euro damaging competitiveness, the latter accentuating already tighter financial conditions. All of which suggest to us that the damage that tariffs may accentuate already clear and what has been hitherto largely supply side disinflation. It is noteworthy that the above factors largely explain on-going revisions in market thinking about EZ inflation (Figure 2). As for market thinking about policy we think is fully justified enough to mean 2-3 more 25 bp cuts after and where ECB may even have to revisit the QT outlook.