German Data Review: Lower Headline Services Surge Reverses

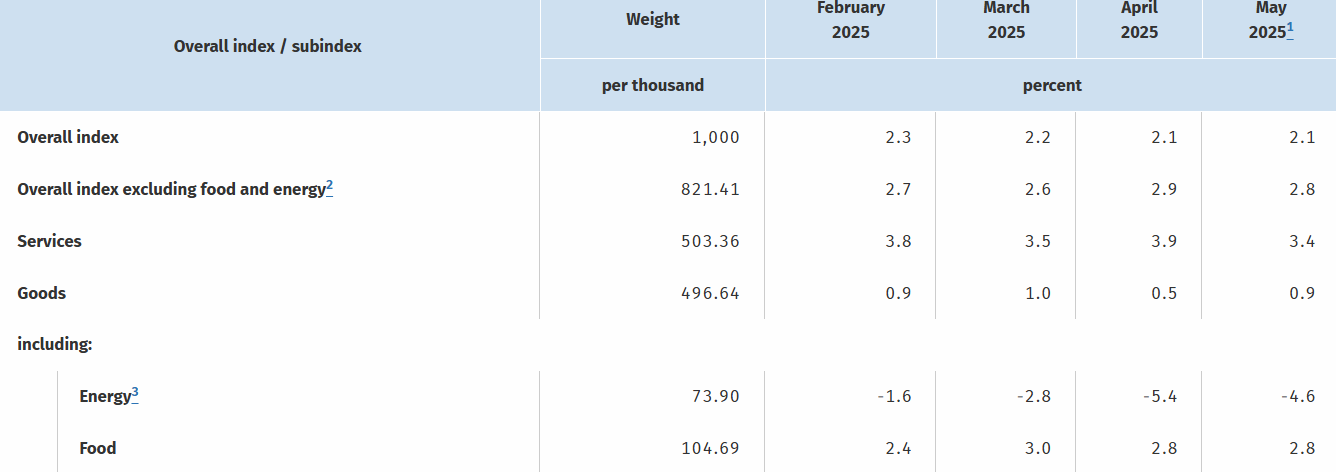

Germany’s disinflation process continues, but there have been signs that the downtrend was flattening out and this impression may have been accentuated by the small and lower than expected (ie 0.1 ppt) drop in the headline in May to 2.1%, still an eight-month low. Most notable amid a drop caused by lower m/m fuel prices but with adverse energy base effects in y/y terms, was the drop back in services inflation which fell by a sizeable 0.5 ppt to 3.5%. As was the case in 20129, this rise in April and correction back this month was probably caused by the timing of Easter. As a result, and given downside inflation surprises elsewhere, we see the Eurozone headline rate down (due Jun 3) to an eight-month low of 1.9% helped by rounding and a further m/m fall in fuel prices!

Figure 1: CPI Inflation Almost Back to Target?

Source: German Federal Stats Office, % chg y/y

Unlike the downside surprises seen in France and Spain as fat as May inflation data goes, the German data showed some stickiness, mainly the result of energy base effects that meant the CPI actually stayed at 2.1%, now with the HICP rate having converged. The German data were bolstered by energy prices – mainly due to fuel process having dipped more this time last year than this year – this is not the case for EZ inflation data and one reason why we still point a drop to at least o the 2% target, if not below, in flash data due next Tuesday.

Looking ahead, we see price gains trending further down and the German headline reading dipping below the 2% mark into the summer amid lower contributions from services and energy, the latter mainly fuel prices.