2yr Germany and ECB Expectations

· Money markets are putting too much weight on ECB communications and we feel that a softening labour market/financial conditions and more tariffs from the U.S. will be enough to shift the ECB to deliver two final 25bps cuts in H2 2025. Though the 2yr Germany to ECB depo rate spread will likely go to a premium by end 2025, we do not see a major widening in 2026. Excess liquidity and macro conditions should mean a 25bps premium versus the ECB depo rate.

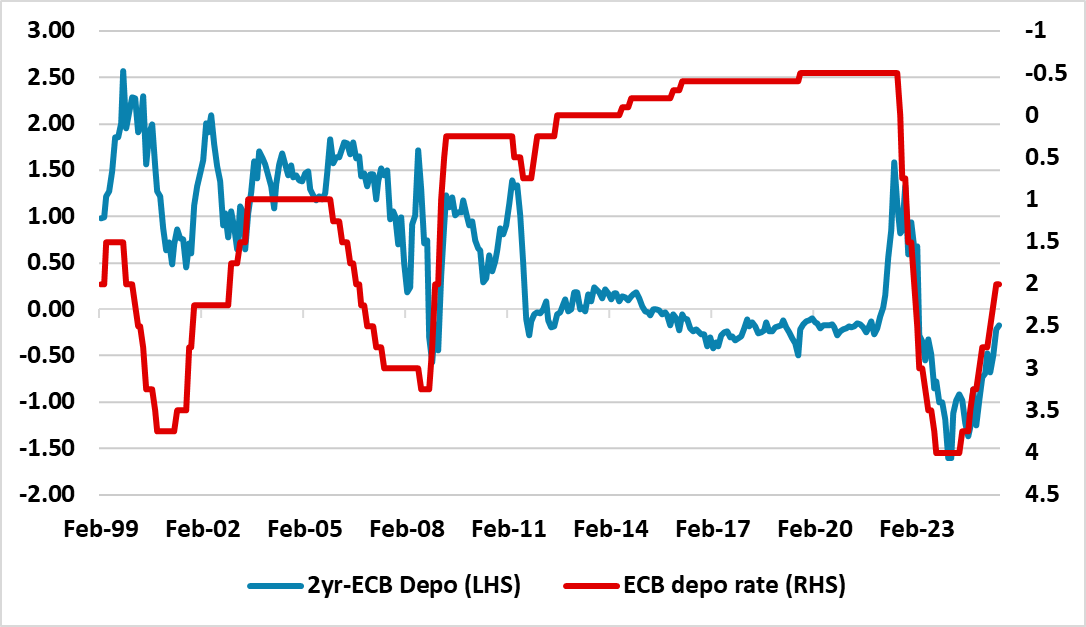

Figure 1: 2yr-ECB Depo Rate and ECB Depo rate Inverted (%)

Source: Datastream/Continuum Economics

Market expectations of further ECB easing are waning with ECB communications and the 2yr Germany to ECB depo rate spread can become more volatile. Key points to note.

· ECB communications. The July 24 ECB meeting will be watched closely for further ECB communications, but a repeat of the June stance of data dependency but nearer the end of the easing cycle will likely be evident. Markets have already adjusted with money market futures discount only one 25bps cut at the December meeting and then a prolonged pause in 2026 before a 25bps hike in 2027. Traders and fund managers are also starting to think about what happens to 2yr yields once the ECB signals that policy rates have bottomed. Normally 2yr yields move to a premium versus the ECB depo rate at the end of an easing cycle, as the market swings to think about the next rate cycle and the risk of higher rates. At the end of the 2003 easing cycle, 2yr Germany went to 150bps v the ECB depo rate (Figure 1).

· Labour/credit and tariffs for more cuts? We feel it would premature to start playing for 2yr Germany moving quickly to a premium versus the ECB depo rate. Financial markets and economists are putting too much weight on ECB communications on a multi-month basis. Reviewing the macro picture we still feel that the ECB is underestimating the scale of labour market softening (here) and also tight financial and credit conditions (here). These provide economic arguments for further disinflation, which alongside a soft economy can build the consensus in the council for a H2 rate cut. However, the hawks could still resist pressure to cut rates further. Tariffs that the EU faces could add an important economic and political argument to encourage ECB easing. President Trump is reported to want an agreed 15-20% reciprocal tariff rate with no lower quota rate for EU cars, which is unacceptable to the EU consensus and will likely see the EU talking more about countertariffs. The EU problem is that they are not in a rational negotiations and Trump likely wants to hit one major country with tariff on August 1 to pressure other countries (here). The EU stance means approximately 50% risk that Trump could impose higher reciprocal tariffs on August 1. This could be 30% or alternatively 20% with a threat that they will go to 30% on September 1 – this would be classic Trump pressure. A 20% tariff would be an economic shock that the ECB has to factor in.

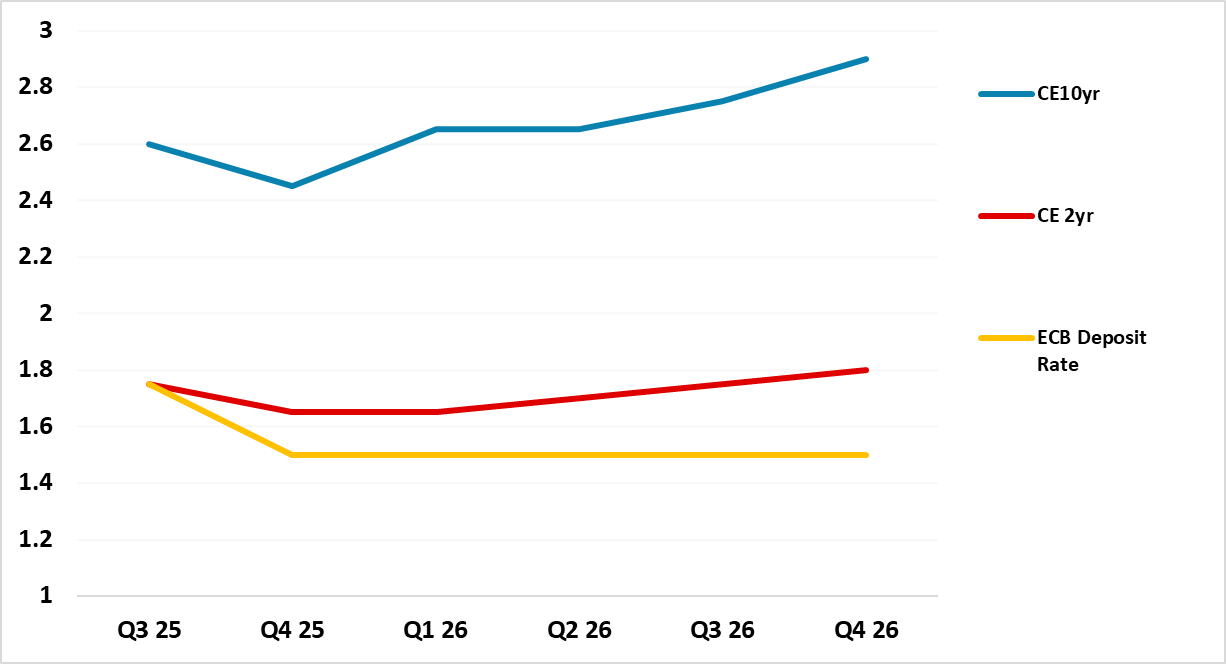

· H2 cuts then 2026 pause. Overall, we look for 25bps cut at the September and December meetings. Then we see the ECB going on hold throughout 2026. This can mean a further small decline in 2yr German yields (Figure 2) in H2 2025. However, we see it falling less than the ECB depo rate and we expect a positive spread to be established by end 2025. This spread can widen in 2026. The 1999-2007 experience saw a large positive spread between 2yr and ECB depo rate. We would argue for a low spread in 2026, based on the ECB keeping large excess liquidity to keep EONIA controlled and also a small gap than normal versus the refi rate. 25bps on 2yr Bunds v ECB depo rate seems about right, unless the economic arguments were to grow for an early 2027 tightening – unlikely in our view.

Figure 2: ECB Deposit Rate, 2 and 10yr Germany Forecasts (%)

Source: Continuum Economics