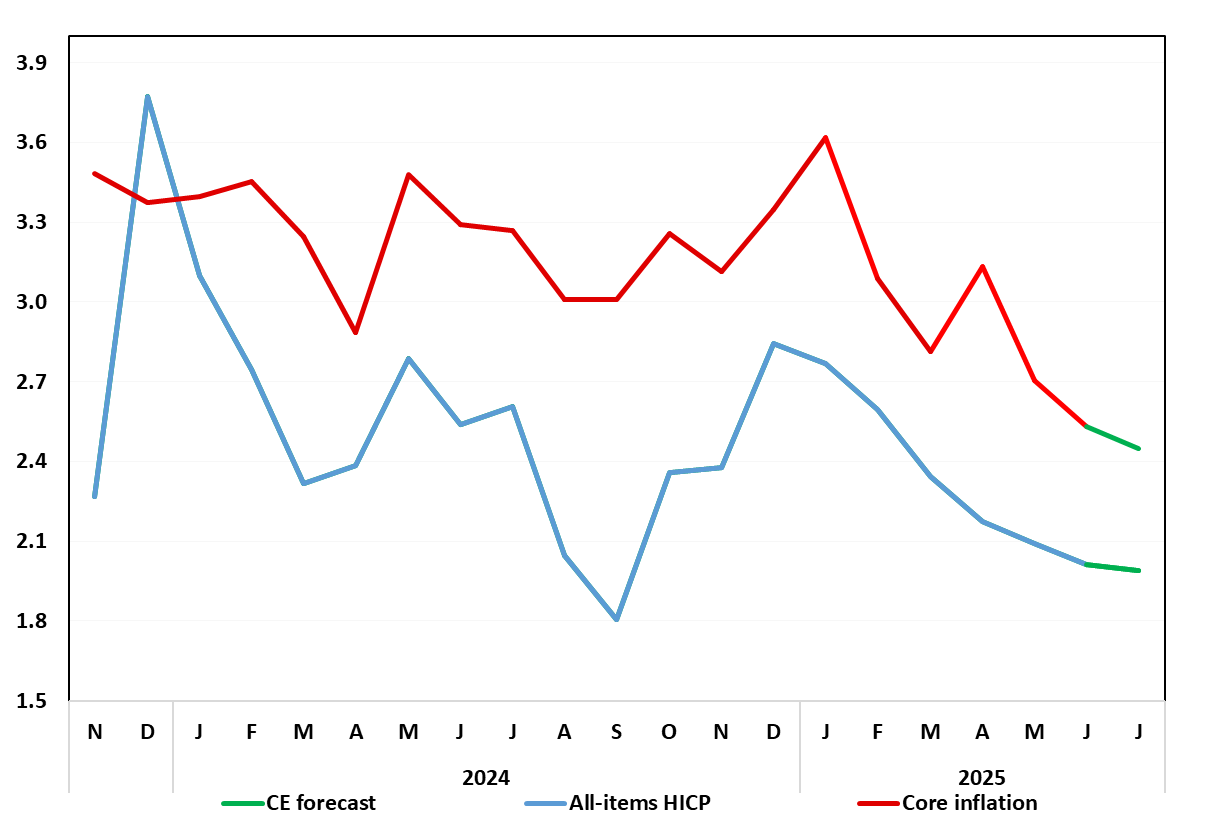

German Data Preview (Jul 30): Services Inflation to Slow Further?

Germany’s disinflation process continues, with the lower-than-expected June preliminary numbers refreshing and reinforcing this pattern, with a 0.1 ppt drop to 2.0%, a 10-mth low (Figure 1)! But we see no further drop in the July preliminary numbers largely due to adverse energy base effects - but with a further slowing later this quarter and into Q4. Notably, adjusted data perhaps still suggest disinflation may have stalled (Figure 2), albeit with a core rate largely consistent with the 2% target. Regardless what we note was the surprise and marked fall in food price inflation alongside a small further drop in services inflation, the latter posing a downside risk as further calendar-induced base effect unwind]. Thus, the July CPI we see comes with ‘only’ a 0.1 ppt drop in the core to 2.4%.

Figure 1: CPI Inflation Back at Target?

Source: German Federal Stats Office, CE

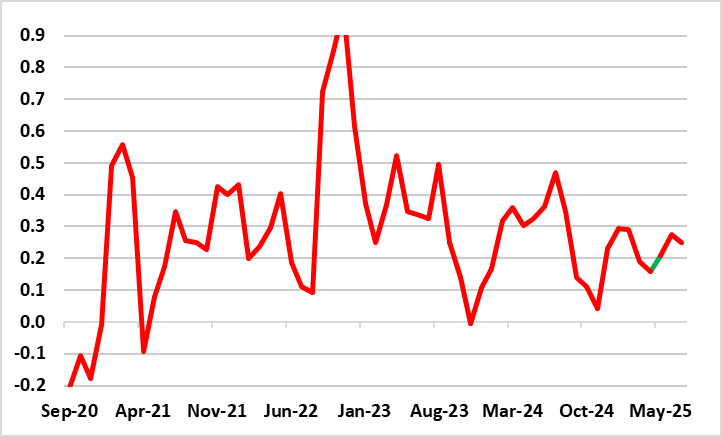

The German June data were bolstered by energy prices – mainly due to fuel prices having dipped more last year than this year – and this may be the case in this time around – actually some small m/m rise seems to have occurred. Moreover, perhaps clear disinflation news may be evident in adjusted m/m data which have shown some fresh downtick in core rates, although this may not proceed discernibly further in the flash July numbers (Figure 2). In fact, adjusted data also suggest disinflation may have stalled (Figure 2), although this may be more a result of recent calendar aberrations than anything underlying. In fact, an unwind of a further calendar distortion could pull services and core back down in July (and not temporarily), this factor too explaining what looks like fresh price pressures in seasonally adjusted short-term m/m movements

Figure 2: Adjusted Core Rate Flattening Out?

Source: German Federal Stats Office, CE, % chg m/m seasonally adjusted and smoothed

Looking ahead, we had been seeing price gains trending further down and the German headline reading dipping below the 2% mark into the summer amid lower contributions from services.