DM Rates: Slowdown Debate Trump’s Independence Question for Now

U.S. Treasury spreads versus other DM government bond markets or 10-2yr U.S. Treasuries are not yet showing a risk premium from the Trump administration attacks on the Fed and economic data. Debate over whether the U.S. is seeing a soft or hard landing are reemerging and this will dominate the outlook for U.S. Treasuries, though we still look for further yield curve steepening in most scenarios. Worst case outcomes on Fed independence could see a risk premium, but more noticeable in the steepness of the U.S. Treasury curve.

A lot of fund managers and economists have voiced concern about Fed independence and now the sacking of the BLS chief. What impact will it have on U.S. Treasuries?

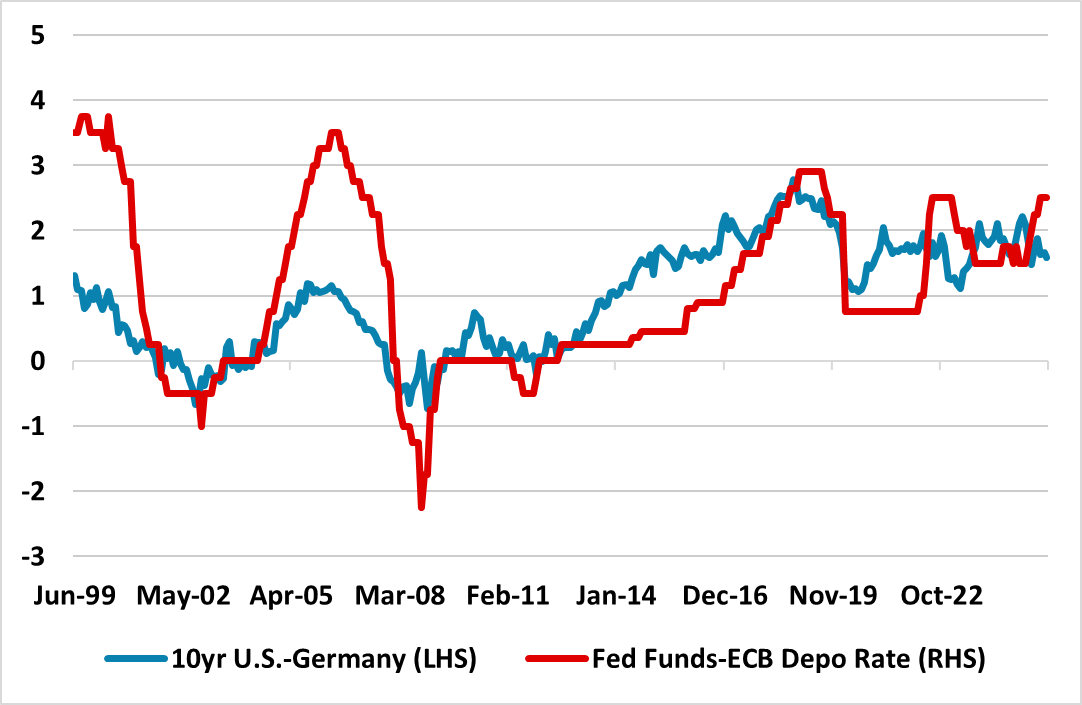

Figure 1: 10yr U.S. Treasuries versus Bunds versus Fed Funds-ECB Depo Rate (%)

Source: Datastream/Continuum Economics

Traders/Fund managers and economists are concerned with the ongoing Trump administration attacks on the Fed and now the sacking of the BLS chief. However, for now debate over the U.S. economic cycle dominates with the July employment report showing a soft employment picture but steady unemployment rate.

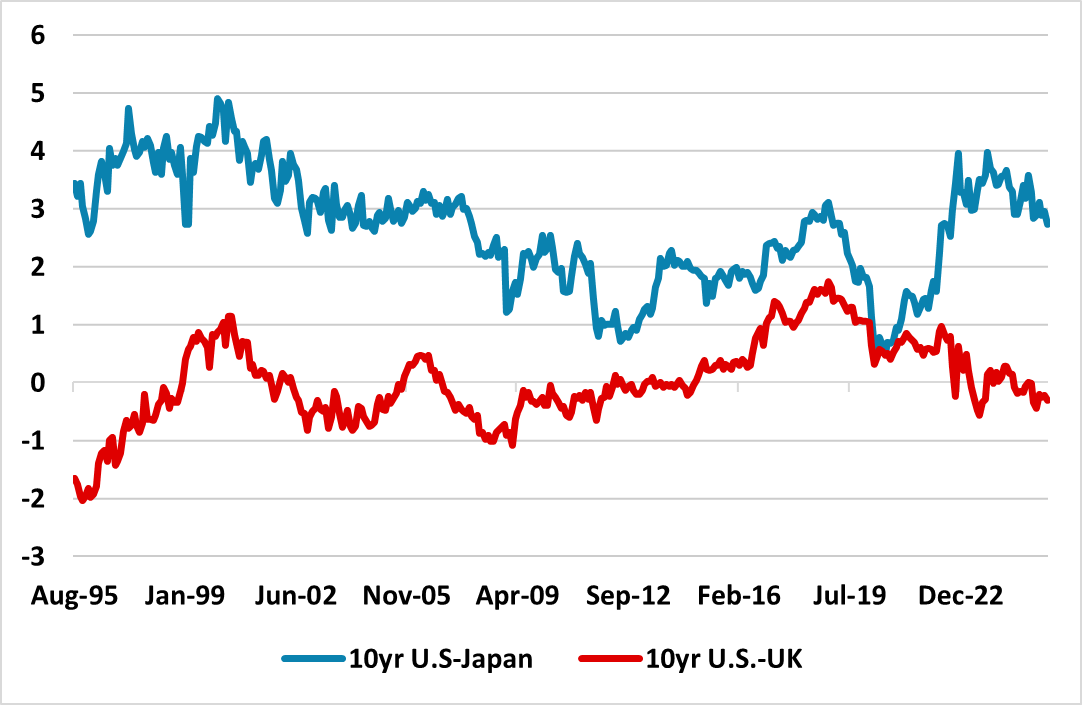

Comparing the U.S. Treasury market with other major DM bond markets shows normal behavior and risk premia for now. 10yr U.S. Treasury-Bunds are actually currently below the relative policy rate spread (Figure 1), but this likely reflects market expectations of more Fed easing in the next 12-18 months than the final 25bps discounted for the ECB. Figure 2 shows that 10yr U.S. Treasury versus JGB’s and UK Gilts have not blown out, with the Treasury-JGB spread narrowing with BOJ tightening. Additionally, we have calculated that the QT supply pressures in the EZ/Japan and UK (here) make net supply to the market equal or greater than the U.S. where the Fed are undertaking small U.S. Treasury QT. Risk premia for Trump Fed attacks are not evident across government bond markets, though it has impacted sentiment towards the USD versus DM currencies this year.

Figure 2: 10yr U.S. Treasuries versus Gilts and JGB’s (%)

Source: Datastream/Continuum Economics

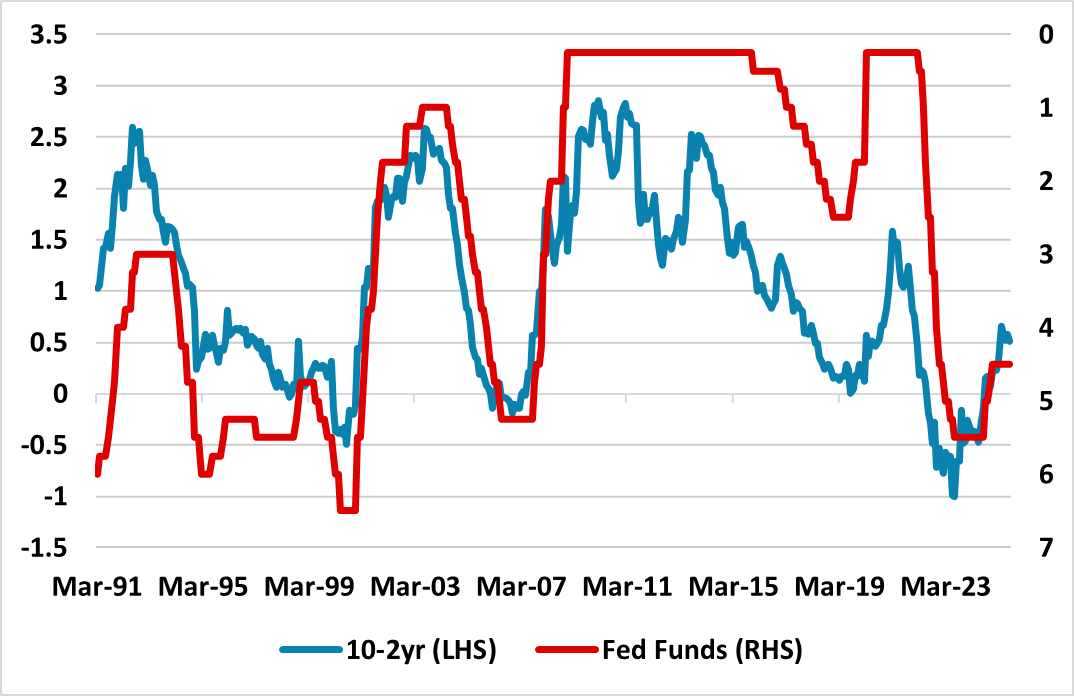

Meanwhile, the 10-2yr yield curve is not showing any real risk premia for Fed and data independence worries, with the current steepness of the curve consistent with market anticipation that the Fed will ease to 3.0-3.5% by end 2026 (Figure 3). The two dissenters are likely to be joined by other pushing for a September Fed cut based on interpretation of the data and means a September cut is possible and will swing with data in the next 7 weeks. More important, if the domestic demand trend slows from just above 1% to stagnation, then the mood can switch in the Fed towards pushing the Fed Funds rate down to 2.5% or below to avoid recession. This can produce more yield curve steepening but a 10yr yield down to 3.5% (see our alternative scenario here).

Figure 3: 10-2yr U.S. Treasuries (%)

Source: Datastream/Continuum Economics

However, the question over data independence will grow. DOGE job cuts have already impacted data collection, while response rates have become more volatile post COVID. The question is whether a new BLS head spins the data the way that the Trump administration wants or whether the integrity of the data is compromised. We feel it is more likely to be an attempt to spin data differently.

The Fed independence question is also serious. While it appears unlikely that Powell will be forced out, Trump will likely appoint a replacement from governor Kruger that will add to the two dissenter voices. If this person is Kevin Hassett/Kevin Warsh or Scott Bessant, they could act like a shadow chair and influence market expectations. They could also agitate for quicker and deeper rate cut reductions towards the 3% neutral rate and distort Fed communications. However, actual decision making will remain dominated by the FOMC voters, who will want to maintain Fed independence and will be driven by the data. If the economic data shows a hard landing then the majority of the FOMC can take an objective data driven view to cut rates quickly, but if the data does not then it is more likely Fed policy easing will be gradual – our baseline is for 100bps over the next 18 months and stop above the neutral rate. The 10yr budget bill will be stimulative in 2026 taking some weight off Fed policy.

The situation is fluid at the moment, as the market would be more comfortable with Warsh or Waller as the next Fed chair than Hassett and also as Trump does not appear to be considering radical options (e.g. adding more governors to the FOMC to load the voting). Worst case outcomes could see a risk premium, but more noticeable in the steepness of the U.S. Treasury curve. However, it is also fluid for data reasons and the impact of the cumulative tariff increases, which can shape the Fed debate.

I,Mike Gallagher, the Director of Research declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.