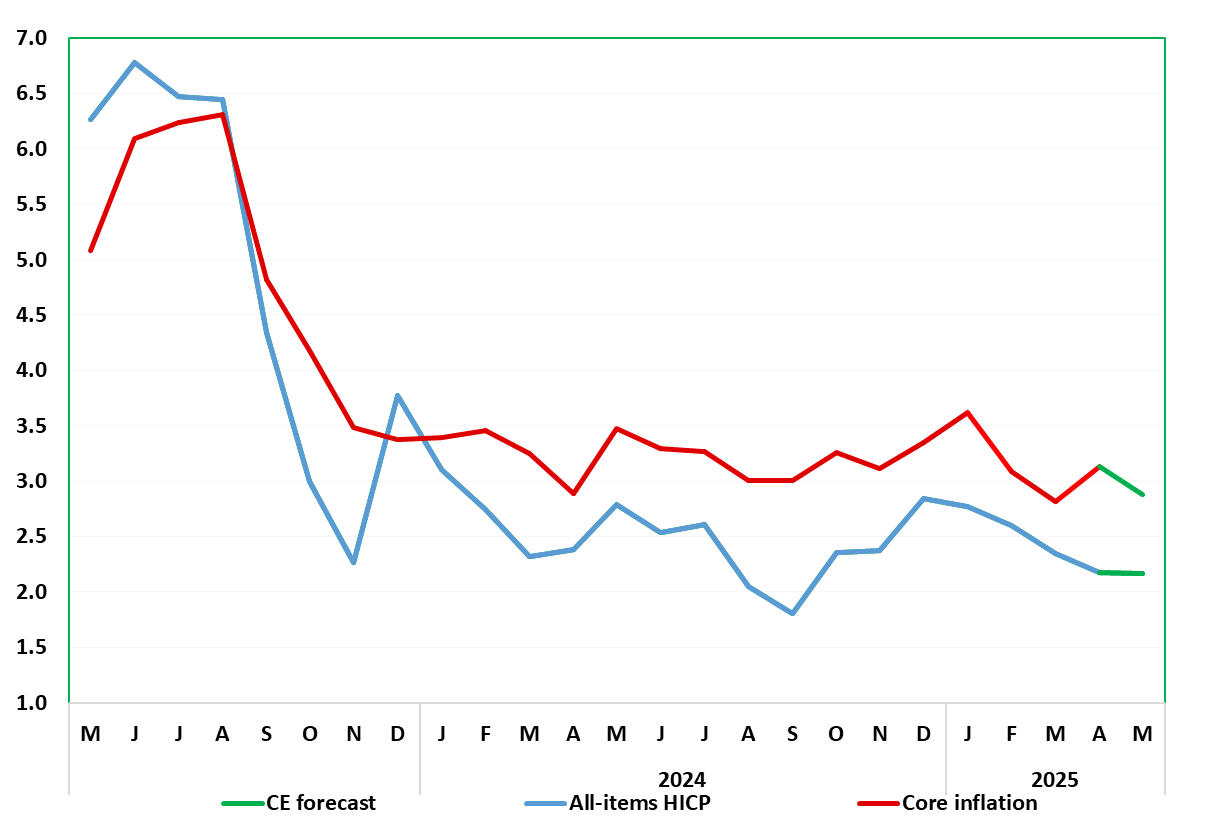

German Data Preview (May 30): Lower Headline as Easter Effect Reverse Services Inflation Surge

Germany’s disinflation process continues, but there have been signs that the downtrend was flattening out and this impression was accentuated by the small (ie 0.1 ppt) drop in the headline in April to 2.2%, still a seven-month low. Most notable amid a drop caused by lower m/m fuel prices, was the pick-up in services inflation which rose for the first time in three months and by a sizeable 0.4 ppt to a seemingly hefty 4.5%. As was the case in April 20129, this was probably caused by the timing of Easter and this effect should reverse in the May data where a drop in the headline will be compounded a by a further m/m fall in fuel prices, this coming alongside a fall in the core rate to a 13-month low of 2.9%. As a result, we see the headline rate back at target of 2.0%!

Figure 1: Inflation Back to Target?

Source: German Federal Stats Office, CE, % chg y/y

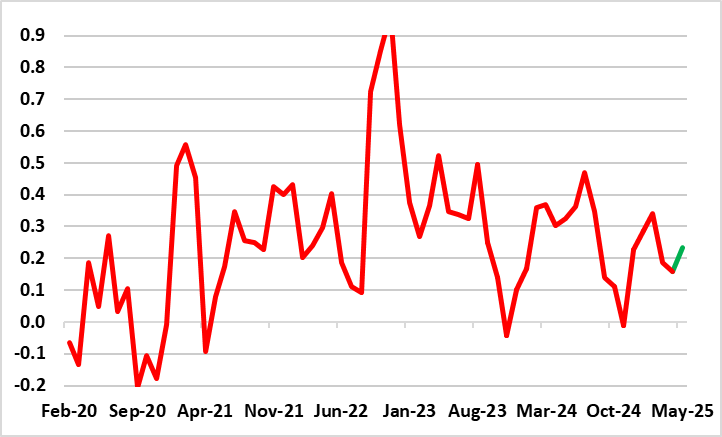

Moreover, perhaps clear disinflation news may be evident in adjusted m/m data which have shown some fresh downtick in core rates, although this may not proceed further in the flash May numbers (Figure 2). Lower fuel prices should see the headline fall further but with risks on both sides from volatile food prices.

Figure 2: Adjusted Core Rate Flattening Out?

Source: German Federal Stats Office, CE, % chg m/m adjusted and smoothed

Looking ahead, we see price gains trending further down and the headline reading dipping below the 2% mark into the summer amid lower contributions from services and energy, the latter mainly fuel prices.