June ECB Council Meeting Account Review: Divides Continue if Not Widen

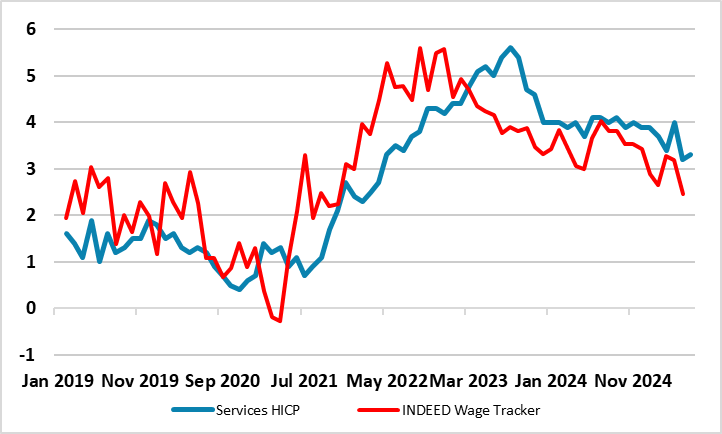

The account of the June 3-5 Council meeting just about left the door open for a move at the July 24 policy verdict given the array of news (probably negative particularly regarding tariffs but also bank lending) due beforehand. But the account adds to the impression we has initially that a pause may be due after what have been seven successive cuts, this also reflecting what may be clear(er) Council divides over the extent and direction of inflation risks – this explaining the sole dissent and even a return of whether policy is neutral or not. Somewhat ironically, the hawks even noted that the euro could weaken and highlighted services inflation risks even though wage trends suggest the opposite risk (Figure 1).

Figure 1: Wage Inflation Back to Pre-Pandemic Pace

Source: ECB, Indeed, CE, % chg y/y

The majority view was that a 25 bp cut at that juncture would protect the “on target” 2% projection for 2027, albeit the account failing to note that projection makes assumptions about energy taxes without which there would be an undershoot. But the impression was that the temporary undershoot in headline inflation at the time of the meeting did not become prolonged, in a context in which further disinflation in core measures was expected, the growth outlook remained relatively weak and spare capacity in manufacturing made it unlikely that slightly faster growth would translate into immediate inflationary pressures. It was argued that cutting interest rates by 25 bp at the current meeting would leave rates in broadly neutral territory, this despite previously ruling out such rhetoric given the risk backdrop. Overall the view that keeping interest rates at their current levels could increase the risk of undershooting the inflation target in 2026 and 2027.

At the same time, a few members saw a case for keeping interest rates at their current levels although only one person ultimately dissented formally. The near-term temporary inflation undershoot should be looked through, since it was mostly due to volatile factors such as lower energy prices and a stronger exchange rate, which could easily reverse. This seems a little ironic given the manner in which the stronger euro surfaced as a key concern at the just-finished Sintra conference and where the June meeting suggested that the euro – rather than the dollar – had recently served as a safe-haven currency.

Admittedly, the euro’s rise may be somewhat less disinflationary. First, the high level of the use of the euro as an invoicing currency limited the impact of the exchange rate on inflation. Second, the pass-through from exchange rate changes to inflation might be asymmetric, that is weaker in the case of an appreciation as firms sought to boost their compressed profit margins.

Otherwise, there was the usual hawkish concern about services inflation remaining above levels compatible with a sustained return to the inflation target, this ignoring the opposing view also voiced that the ever softer wage backdrop points to services inflation softening further (Figure 1). It was also suggested by the hawks that the scenarios presented in the staff projections were likely to underestimate the upside risks to inflation, because tariffs were modelled as a negative demand shock, while supply-side effects were not taken into account. This though ignored the lack of evidence that of any significant broad-based supply-side disturbances.

Our view remains that the official rate setting - even though it has halved in the last year - still understates what are still tight(er) financial conditions. This is despite Council assertions to the contrary. But where we focus on bank lending wariness, this possibly explaining what have been recent weaker shorter-term credit growth dynamics. In addition, we think the ECB is complacent about the labor market given survey data suggesting looming employment reductions. As a result, further easing is on the cards, the question being whether this should start to encompass toning down QT plans too!