German Data Preview (Jun 30): Calm Before the Storm?

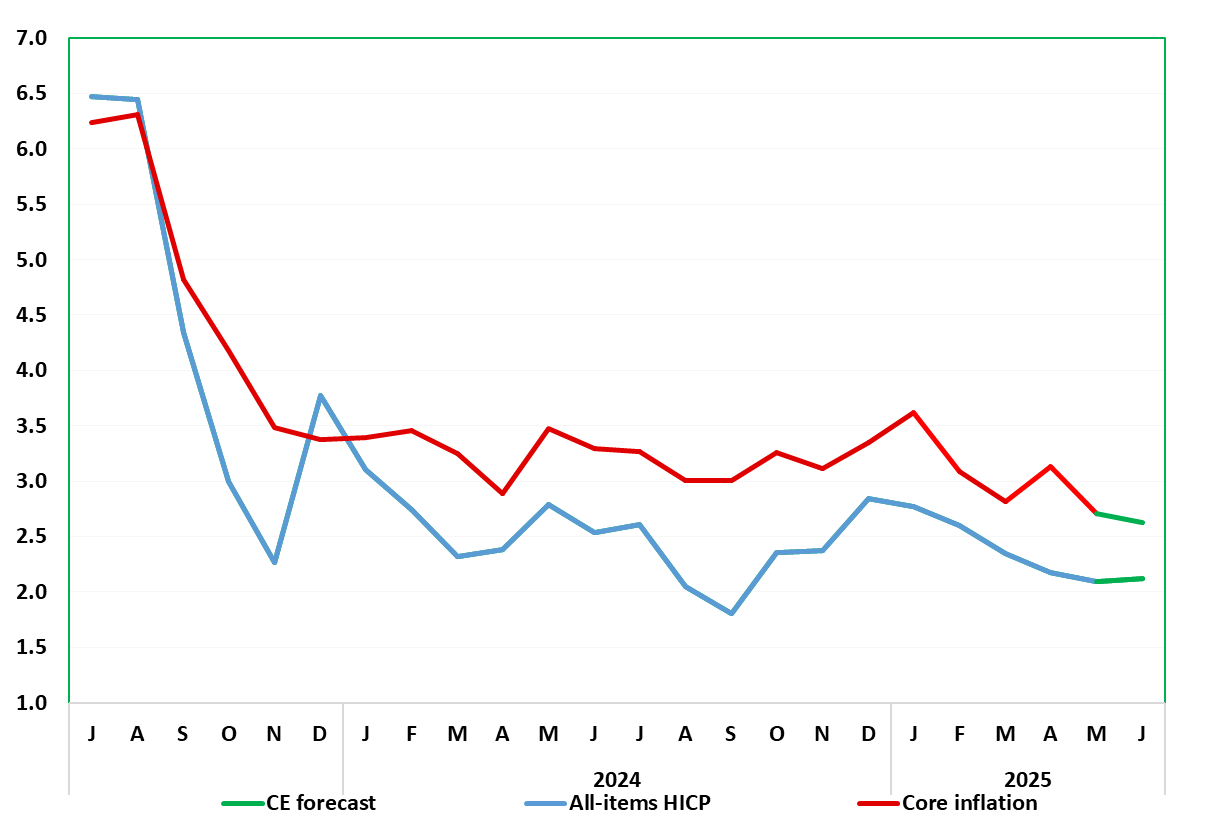

Germany’s disinflation process continues, but there have been signs that the downtrend was flattening out and this impression may have been accentuated by the small and lower than expected (ie 0.1 ppt) drop in the headline in May to 2.1%, still an eight-month low (Figure 1). Adjusted data also suggest disinflation may have stalled (Figure 2). Notably, inflation data elsewhere surprised in the opposite direction, helping Eurozone inflation to slip below target last month. We see little change as far as German HICP is concerned in June, with some upside risks from a further calendar-induced base effect that could hold back any additional drop in services inflation. Thus the unchanged 2.1% June HICP we see, comes with ‘only’ a 0.1 ppt drop in the core to 2.6%, although preliminary data will not provide a breakdown to reveal the latter.

Figure 1: CPI Inflation Almost Back to Target?

Source: German Federal Stats Office, CE, % chg y/y

Most notable amid a drop caused by lower m/m fuel prices but with adverse energy base effects in y/y terms, was the drop back in May HICP services inflation which fell by a sizeable 0.7 ppt to 3.8%. As was the case in 20129, this rise in April and correction back this month was probably caused by the timing of Easter. There may be a further holiday effect in the June numbers which could restrain any further fall in services inflation, albeit one that will unwind in July. We see lower food inflation, but this may also be an upside risk.

The German June data were bolstered by energy prices – mainly due to fuel prices having dipped more last year than this year – am d this may be the case in this time around. But the big issue now emerging is energy prices where the surge in oil prices in the last week or so could add 0.2 ppt-plus to July’s headline figure.

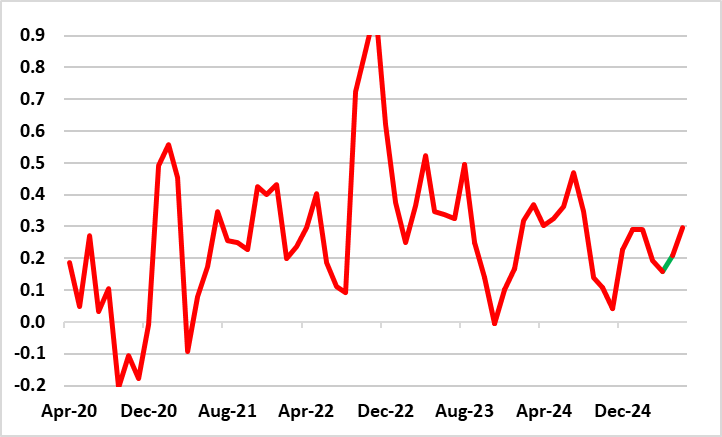

Moreover, perhaps clear disinflation news may be evident in adjusted m/m data which have shown some fresh downtick in core rates, although this may not proceed further in the flash June numbers (Figure 2). In fact, adjusted data also suggest disinflation may have stalled (Figure 2), although this may be more a result of recent calendar aberrations than anything underlying.

Figure 2: Adjusted Core Rate Flattening Out?

Source: German Federal Stats Office, CE, % chg m/m adjusted and smoothed

Looking ahead, we had been seeing price gains trending further down and the German headline reading dipping below the 2% mark into the summer amid lower contributions from services and energy, the latter mainly fuel prices. But as suggested above, this is now under threat and the oil price question may accentuate existing divisions with the ECB Council, something that may be evident in the array if appearances at the ECB Forum on Central Banking next Mon-Wed!