ECB: Time to Reassess and Slow QT?

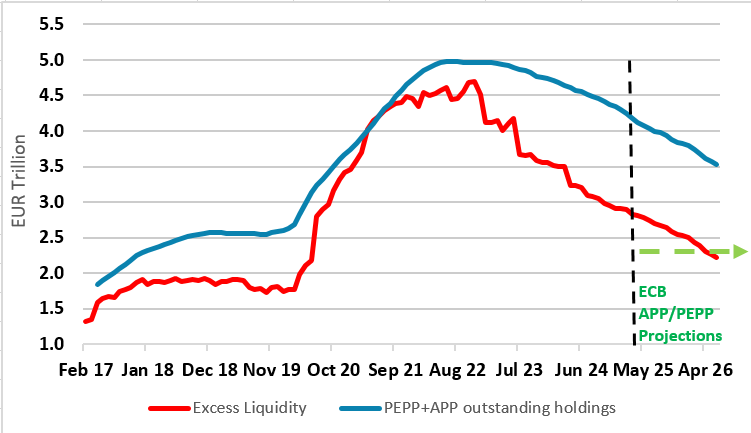

Further ECB easing is on the cards, the question being whether this should start to encompass toning down quantitative tightening (QT) plans too! Notably, the two ppt fall in the discount rate cuts has come against a backdrop where the ECB has continued unconventional tightening by scaling back its balance sheet, more recently this involving QT as the central has not reinvested any of its maturing bond portfolio. The ECB has begun (perhaps belatedly) to acknowledge the negative effects of its QT program, in terms of raising effective borrowing rates and hampering bank lending. But with over EUR 850 of maturing bond due this year and through H2 next year that will not be reinvested, we think there are growing risks to financial stability as reduced banking sector excess liquidity (Figure 1) could accentuate money market volatility. Thus well before excess liquidity drops to possible problem levels, we think that the ECB should at least slow the pace of QT by reinvesting some maturing bonds as it monitors how bank react to an evolving money market regime where liquidity issues move up much more on the ECB agenda.

Figure 1: ECB QT is Reining in Excess Liquidity

Source: ECB, CE

As the latest June ECB projections still encompass a policy rate assumption to somewhat below the 2% rate now put in place, it would thus support such market thinking of one more 25bp cut, this despite the ECB real activity outlook now including rising government investment in defence and infrastructure. But as for our outlook, the downside growth risks the ECB still recognises stem not just from the direct consequences to trade from the U.S. imposed tariffs but also from export diversions and the increasing threats of inter-twined slumping business confidence and capex intentions. Additionally, the surging euro damaging competitiveness, the latter accentuating already tighter financial conditions. All of which suggest to us that the damage that tariffs may accentuate is already clear and adding to disinflation from the supply side. As for market thinking about policy we think is fully justified enough to mean up to two more 25 bp cuts in H2 this chiming with Lagarde’s refusal to make any attempt to assert that easing has ended or that the ECB should wait for lagged monetary policy effects. Moreover, the ECB may/should have to revisit the QT outlook.

QT Damage

We have repeatedly noted that some ECB council members have begun to accept the collateral economic damage that QT has been doing in both offsetting conventional easing and thereby tightening financial conditions. In fact ECB Board member Piero Cipollone has overseen ECB research which shows that the composition of central bank reserves is very important for banks’ lending ability. The research estimates that debt portfolio holdings under the ECB’s asset purchase programme (APP) and pandemic emergency purchase programme (PEPP) will decrease by around a further EUR 500 billion in 2025. This is associated with a possible EUR75 billion decline in credit supply, ie between 0.5% and a full ppt in terms of a hit to private sector credit growth rates. To put this into perspective, it is roughly equivalent to the amount of loans that banks granted to non-financial corporations in 2024.

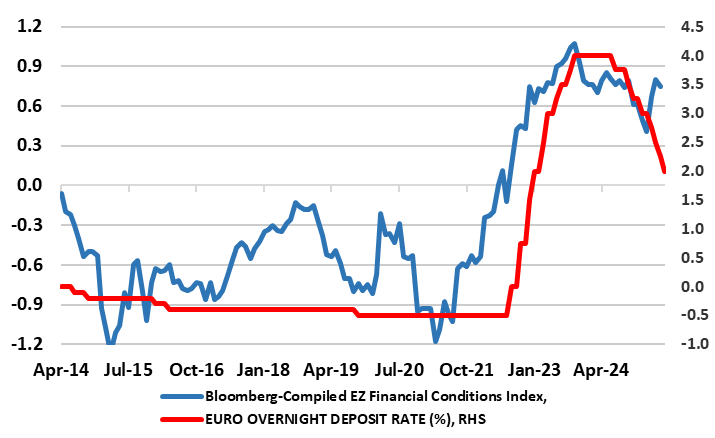

More candidly, while ECB policy rate cuts exert downward pressure primarily at the short end of the yield curve, quantitative tightening has been exerting upward pressure on long-term maturities and, to a lesser extent, intermediate ones. This serves to tighten financial conditions. Indeed, according to ECB research, a EUR 1 trn reduction in bond holdings (ie broadly what has occurred to date) may raise long-term risk-free interest rates by about 35 bp, with this increasing to around 50 bp given the planned further scaling back of the ECB’s bond holdings through the rest of 2025 and into 2026. This possibly helps explain the recent and fresh divergence between (falling) policy rates and (increasing) financial conditions (Figure 2).

Thus provides some macroeconomic rationale for revisiting the scale of current QT plans, if not very much reining them in. But there are other more market and financial stability reasons too. As the ECB has admitted, that as it navigates an increasingly complex economic landscape, the transition from abundant to less ample excess liquidity represents an inflection point that also requires close monitoring.

This is increasingly relevant as the ECB continues the normalisation of its balance sheet, partly to regain policy space and refill this part of its tool box. The main ECB balance sheet reduction to date has come from all targeted liquidity refinancing operations (TLTROs) maturing, but the ECB's asset portfolio still holds some EUR 4 trn in bonds, contributing to around EUR 2.7 trn of current excess liquidity in the banking system. This is defined as defined as each bank’s current account balance at the central bank plus the deposit facility balance, minus minimum reserve requirements and the marginal lending facility balance.

Given the planned continued suspension of re-investments of both PEPP and APP holdings (the ECB has not actually made any active sales of its bond portfolio), we envisage a further EUR 300 bln will roll off during the rest of 2025 and even more so into 2026. This is based on the ECB’s computed estimates of expected monthly redemption amounts for the APP and PEPP. All else equal, this will reduce excess liquidity by the same amount. As a result, as Figure 1 shows, excess liquidity could end this year below EUR 2.5 trn, and below EUR 2 trn by mid-2026. There is nothing particularly notable about such levels of excess liquidity, albeit EUR 2 trn was around the level prevailing prior to the pandemic.

Figure 2: Policy Rates and Financial Conditions Diverging

Source: Bloomberg, ECB

Over the medium to long term, the amount of excess liquidity would therefore be determined by bank demand with the ECB supplying reserves through fixed rate tender procedures with full allotment. This would incentivise banks to bid in the refinancing operations. The decline in excess liquidity would strengthen this incentive. If so, the main refinancing operations rate may possibly to play a bigger role over the longer term even compared with the discount facility.

But as the Cipollone research suggests, while the above is the plan, any such a decline in excess liquidity nevertheless warrants careful monitoring, as it could exert additional tightening pressures on financial and financing conditions, potentially exceeding the intended policy stance even well before it gets back to the levels prevailing before the pandemic. With this mind we envisage that by the autumn the ECB may be flagging a slowing in Qt, this encompassing some return to reinvesting bonds, and possibly being a topic that may emerge more overtly as soon as at the (Jun 30-Jul 2) ECB annual Sintra Forum on Central Banking which is scheduled to discuss ‘adapting to change: macroeconomic shifts and policy responses’. If money market tensions were to emerge, then the ECB could also consider at least a temporary stop in QT.