China

View:

September 16, 2025

Succession and Strongmen Leaders

September 16, 2025 10:53 AM UTC

In the unexpected scenario of an early death, Putin and Xi have no clear successors, and any new Russia or China leader would have to spend time building domestic strength and compromising on external goals. Erdogan also has no clear successors, which could create political uncertainty. For Trump su

September 15, 2025

China: Broad Based Slowdown

September 15, 2025 7:55 AM UTC

• The latest monthly data from China show a broad based slowdown in the economy, due to the tariffs and structural weakness. Though we keep 2025 real GDP at 4.8%, the underlying trend suggest a slowdown to 4.0% for 2026. China authorities will start to announce fiscal measure

September 12, 2025

Taiwan: Grey Warfare or Naval Quarantine?

September 12, 2025 11:15 AM UTC

· The most likely option for China is to continue the air and naval grey warfare around Taiwan, combined with support for pro-China factions in Taiwan parliament to build pressure for reunification at some stage. With invasion being too high risk for President Xi (with the U.S. main

September 04, 2025

September 01, 2025

Aging: Slow Growth for Some in 2020’s

September 1, 2025 8:35 AM UTC

Population aging always seems to be beyond the market horizon, but the 2020’s are already seeing population aging in some countries. What is the economic impact? Aging is already causing a peak in labor force in China and the EU. Meanwhile, the population pyramid also means less consumptio

August 20, 2025

U.S./China Trade Deal: Slow Progress

August 20, 2025 10:25 AM UTC

· Overall, we would attach a 50% probability to a trade framework deal being announced in Q4, though this is unlikely to be comprehensive and could merely be a collection of measures. Even so, the risk also exists of trade negotiations dragging onto 2026 and then reaching a deal or fa

August 19, 2025

China Slow Diversification: Gold And Others

August 19, 2025 8:05 AM UTC

China’s diversification from U.S. Treasuries appears to be at a slow pace. Gold is the obvious alternative if geopolitical tensions were to rise or skyrocket in the scenario of a China invasion of Taiwan. However, Gold holdings are merely creeping higher and suggesting no urgency from China

August 15, 2025

China Slowdown In July

August 15, 2025 7:03 AM UTC

• Retail sales sluggishness reflects households cautious due to the hit to housing wealth and uncertainty over jobs and wage growth. Investment softness reflects not only residential property weakness, but also a slowdown in government infrastructure. This weakness could see a top up fi

August 13, 2025

China: Echoes of Japan?

August 13, 2025 8:05 AM UTC

Overall, some of China’s private businesses and households are suffering from Japan’s style balance sheet recession. Combined with slowing productivity and a shrinking workforce, this points to slower trend growth in the coming years. However, fiscal stimulus and the clean-up of Loca

August 07, 2025

EM Rates: Domestic Fundamentals Dominate

August 7, 2025 9:30 AM UTC

Once trade is agreed with the U.S., the good fundamentals actually argue for a 10yr Mexico-U.S. spread close to 400bps and this is our favored strategic risk reward for big EM government bonds. In Brazil a case can be made for a 12.75% policy rate end 2026 and 10% in 2027, but this could only mean 1

August 04, 2025

Trump Tougher Posture with Russia

August 4, 2025 8:31 AM UTC

We suspect that Trump will not follow-through with an across the board secondary sanction on importers of Russia oil, as it would freeze U.S./China trade again and could boost U.S. gasoline prices – high inflation is one main reason for Trump’s softer approval rating. Trump could agre

August 01, 2025

Reciprocal Tariffs: Some Hikes, Deals and Delays

August 1, 2025 8:40 AM UTC

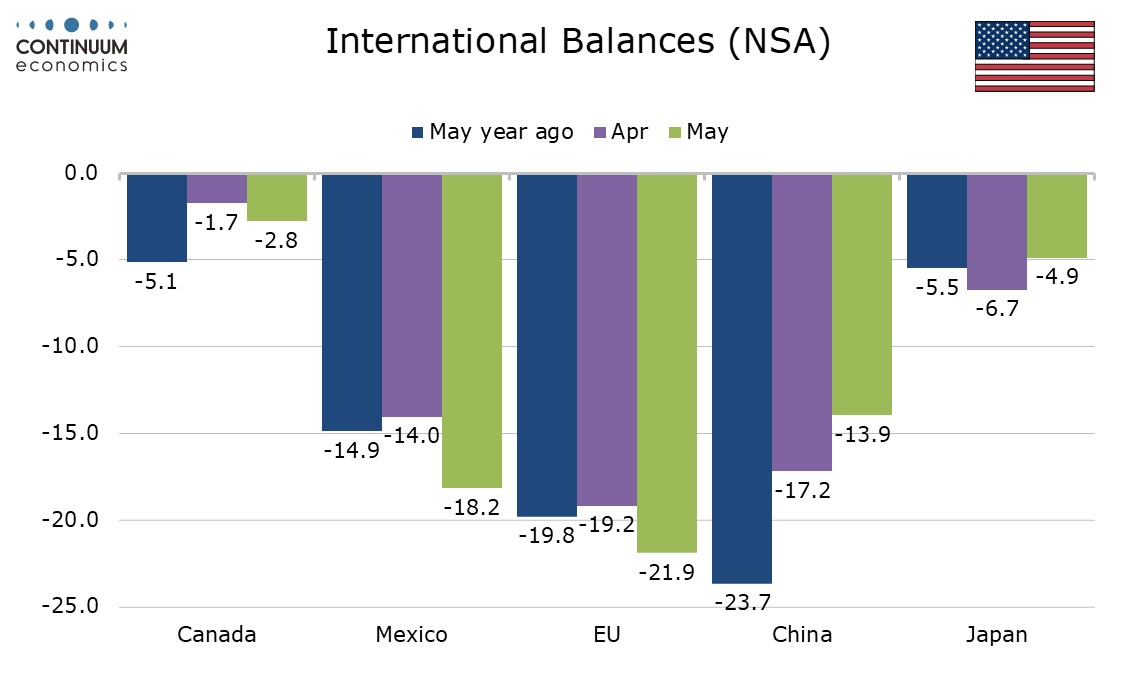

Though high reciprocal tariffs with some countries catches the headline, five of the top 10 countries with large bilateral deficits have reached framework trade deals, two have delays and three have higher tariffs imposed. With exemptions on some USMCA Canada/Mexico goods, plus phones/ semicondu

July 29, 2025

China/U.S. Trade Talks Into the Autumn

July 29, 2025 8:20 AM UTC

· Our baseline (Figure 1) remains that a U.S./China deal will be reached (most likely in Q4), but a moderate probability exists of no deal being done this year and China being stuck with 30% tariffs – the worst-case scenario of still higher tariffs is now less likely with Trump in a

July 28, 2025

Food Glorious Food

July 28, 2025 10:15 AM UTC

· Global food prices should see small increases in the future, as production continues to rise broadly in line with increasing demand driven by population and a rising consumption per person in EM countries. However, China will remain dependent on food imports given it has limited roo

July 24, 2025

EM Currencies with a USD Downtrend

July 24, 2025 10:15 AM UTC

· BRL, ZAR and MXN have been helped by FX carry trades and bond inflows on still wide interest rate differentials. However, actual reciprocal tariff risks are high for all three countries and a wave of profit-taking could be seen. Elsewhere, though we see a U.S./China trade deal by

July 23, 2025

Trump Deals: Japan, Philippines and Indonesia

July 23, 2025 8:26 AM UTC

• Other countries cannot be guaranteed to get a Japan style deal, both as Japan is the key geopolitical ally in the Asia pivot against China and as Trump is keen to agree deals by August 1. India and Taiwan are trying to finalize deals, but the EU is more difficult. China 90 day deadlin

July 17, 2025

Trump’s Tariffs and Markets

July 17, 2025 12:00 PM UTC

The assumption in financial markets is that some trade framework deals will be done by August 1; some countries will make enough progress to be given an extra 30 days and some countries could have higher tariffs implemented. This would be broadly consistent with the average 15% tariff that is widely

July 15, 2025

China: GDP Resilient in Q2, But

July 15, 2025 7:30 AM UTC

• We do see H2 weakness relative to H1, as exports to the U.S. will slow again and the effects of the government consumption trade in programs fades. However, H1 has been higher than our forecasts and thus we are revising 2025 GDP growth to 4.8% v 4.4% previously. We keep 2026 GDP growt

July 14, 2025

Tariffs: Seeking a Trigger for the TACO Trade

July 14, 2025 4:28 PM UTC

It has been fairly clear for some time that 10% represented a likely floor for the eventual Trump tariff regime. However, expectations that Trump would not be willing to go dramatically above that are being tested. A rate in the mid-teens still looks the most likely outcome, as the economic damage t

July 04, 2025

China: Housing Still A Headwind

July 4, 2025 9:00 AM UTC

Last October, China’s government support package has helped turn residential property less negative and our baseline is that residential property will likely deduct around 0.75% from 2025 growth and 0.5% from 2026. However, the risks for the economy could turnout worse than our baseline view on

July 03, 2025

U.S. Assets and Valuation

July 3, 2025 9:30 AM UTC

The U.S. equity market has returned to be clearly overvalued on equity and equity-bond valuations measures and is vulnerable to a new correction in H2 on any moderate bad news (e.g. further economic slowing and corporate earnings downgrades). In contrast, U.S. Treasuries are at broadly fai

July 01, 2025

Trump Tariffs: Poker Face?

July 1, 2025 12:55 PM UTC

Our central scenario (but less than 50%) is towards a scenario of compromise, with some agreements in principle or trade framework deals, delays for most other negotiating in good faith but with one or two countries seeing a reciprocal tariff rise e.g. Spain and/or Vietnam. This could still be fol

June 30, 2025

U.S. and Asia Defense Partners

June 30, 2025 7:30 AM UTC

· Japan, S Korea and Australia could eventually agree to some extra commitment to increase (self) defence spending in the next 5-10 years though perhaps not targets like NATO countries. This could come as part of the trade deal negotiations currently underway. Japan and S Korea

June 25, 2025

EM FX Outlook: USD Less in Favor, but EM Mixed

June 25, 2025 8:05 AM UTC

• EM currencies face cross currents on a spot basis. The USD downtrend against DM currencies can be a positive for undervalued or strong EM currencies. This could benefit the Brazilian Real (BRL), Mexican Peso (MXN) and Indonesian Rupiah (IDR), though moves will be choppy with occasiona

Outlook Overview: Trump’s Fluid Policies

June 25, 2025 7:20 AM UTC

· President Donald Trump still wants to use the tariff tool, and we see the eventual average tariff rate being in the 13-15% area, lowered by deals but increased by more product tariffs. Any lasting legal block on reciprocal tariffs will likely see the administration pivoting towards ot

June 24, 2025

Equities Outlook: Choppy Then 2026 Gains

June 24, 2025 8:15 AM UTC

Though the U.S. equity market has rebounded, we still scope for a fresh dip H2 2025 to 5500 on the S&P500 as hard data softens further to feed into weaker corporate earnings forecasts and CPI picks up and delays Fed easing. However, the AI story is still a positive, while share buybacks

June 20, 2025

China Outlook: Reasonable but Unbalanced Growth Trade

June 20, 2025 7:30 AM UTC

• China GDP growth remains reasonable though unbalanced. Net exports will take a hit from the trade freeze in April/May, with the impact likely to ease in H2 with the trade truce. We attach a 65% probability to a U.S./China reaching a new trade deal that reduces the minimum overall tari

June 16, 2025

China: Retail Sales Reasonable

June 16, 2025 7:25 AM UTC

• Retail sales in May was helped by government trade in programs, but the overall retail sales momentum is reasonable. The industrial production slowdown looks to have been driven by the U.S. tariff chaos in April/May, which has become less adverse after the Geneva trade truce with the U.

June 09, 2025

China Disinflation Rather than Deflation

June 9, 2025 7:27 AM UTC

May China CPI remains negative Yr/Yr, but the breakdown is consistent with disinflation rather deflation. Deflation could end up as a drag on the economy, but while growth remains close to the 5% target and CPI is regarded as disinflation rather than deflation, further policy easing will be slow.

June 05, 2025

June 04, 2025

China Banking Problems

June 4, 2025 8:32 AM UTC

China is suffering a credit demand problem from households overexposed to property and private businesses that are cautious. Meanwhile, the latest IMF banking stress tests shows sections of the banking system remain weak and this is restraining lending. We remain watchful of money and credit tre

June 02, 2025

Trump’s 50% Steel And Aluminum: Negotiating Leverage?

June 2, 2025 7:42 AM UTC

• President Donald Trump increase in steel and aluminum tariffs from 25% to 50% is not just about boosting the steel and aluminum industry. It also a demonstration that Trump remains in control of tariffs and can aggressively change tariffs to increase negotiating leverage. It is a mess

May 29, 2025

Court Stops Trump Reciprocal and Fentanyl Tariff

May 29, 2025 7:18 AM UTC

• The Trump administration will likely follow a multi-track response by appealing the judgement but also fast-tracking section 232 product tariffs for pharmaceuticals and semiconductors. The administration could also consider section 301 or 122 tariffs (the latter 15% for 150 days against c

May 16, 2025

Big EM’s: Cyclical Tariff Hit V Structural Drivers

May 16, 2025 10:00 AM UTC

China, India and Brazil are all seeing cyclical slowdown for varying reasons, with China likely to be hardest hit by adverse net exports due to Trump’s tariff wars. Though financial repression in China can allow further fiscal stimulus, the household sector and residential property investment are

May 15, 2025

U.S./China Trade Truce Reduce Downside and Extra Stimulus Prospects

May 15, 2025 7:15 AM UTC

The alternative hard landing scenario in China has been reduced significantly with the trade truce with the U.S. However, China will still have to cope with a minimum 30% overall tariff, with only around a 10% reduction in the fentanyl tariff likely to be agreed in the coming months. Our baselin

May 13, 2025

Markets: Less U.S. Recession Risk, But Trade Headwinds

May 13, 2025 9:38 AM UTC

Though we had expected a U.S./China trade truce, the terms are more favorable to U.S. growth than we anticipated. Combined with the UK framework deal, we have revised down the probability of a U.S. recession from 35% to 20%. In turn we have revised up the end 2025 and end 2026 S&P500 forecasts t

May 12, 2025

Trump Tariffs: China and UK Precedents

May 12, 2025 8:02 AM UTC

The U.S./China have announced major reductions in reciprocal tariffs to 10% with other measures postponed for 90 days. Though the U.S. is still imposing an extra 20% due to fentanyl, China will likely make some moves that could also help to reduce this. This is in line with our previous thinki

May 08, 2025

USD flows: Trump lifts equites and USD, though signals are mixed

May 8, 2025 4:09 PM UTC

The US-UK trade deal is underwhelming, if welcome. Trump’s suggestion that tariffs on China could be lowered if talks scheduled this weekend go well is giving the USD a more significant lift, though Trump continues to give mixed signals, making tariff threats alongside a suggestion that equities b

May 07, 2025

China Moderate Triple Monetary Easing

May 7, 2025 6:31 AM UTC

• China has announced a 10bps cut in the 7 day reverse repo rate to 1.4%; large than expected 50bps cut in the RRR rate and credit easing via Yuan1.1trn balance sheet quota expansion to counter the slowdown in growth. Combined with the extra equity capital for state banks this will help c

May 06, 2025

Tariff Man

May 6, 2025 8:45 AM UTC

With the U.S. equity market having rebounded, President Donald Trump instinct on tariffs have seen threats of pharma tariffs and a 100% tariff on non U.S. films. Slow progress is also reported on bilateral deals, despite White House PR spin. However, Trump will see pressure rising from three so

May 05, 2025

Markets: China Truce Hopes and More Data

May 5, 2025 8:05 AM UTC

The direction of travel is towards a U.S./China truce followed by postponing/cancelling most reciprocal tariffs and then trade negotiations. While the markets could cheer this as good news, incoming economic data in May and June is the most critical issue. We still see the U.S. imposing an average

April 30, 2025

China South China Sea Tensions

April 30, 2025 10:30 AM UTC

We see recent China activity as part of the normal grey warfare for long-term influence in the South China sea. It has involved the use of China coastguard and militia fishing boats rather than China PLA Navy, though the risk of escalation between the Philippines and China remains. China likely wa

April 28, 2025

US Exit: Lessons From Brexit?

April 28, 2025 8:05 AM UTC

Overall, the U.S. attempt to reshape global trade is unlikely to significantly improve its trade position, but the size and influence of the U.S. may mean it does not get hit in net exports volumes like the UK. Even so, U.S. business investment could be restrained by ongoing uncertainty from the T

April 25, 2025

U.S/China Trade Standoff: Odds Remain Towards Truce

April 25, 2025 7:09 AM UTC

On balance, our baseline still remains a U.S./China trade deal (55-60%) being reached, given Trump deal instincts; China desire for a deal and the economic disadvantage of an economic cold war to the U.S. when it is trying to reset trade with all countries. Timeline is Q4 2025 or H1 2026. An al

April 24, 2025

USD Rebalancing: Some to EM?

April 24, 2025 8:30 AM UTC

Some portfolios rotations towards EM assets will likely be evident, as we see the USD decline is now extending and broadening. However, flows will likely be selective, both given underwhelming EM performance in the last 5-10 years and the uncertainty over how much Trump will reduce reciprocal tari

April 23, 2025

Trump Under Pressure

April 23, 2025 7:15 AM UTC

A deteriorating economic; volatile financial markets and weakening approval ratings are all putting pressure on the Trump administration to do trade deals. However, Trump instincts means he still likes tariffs, while negotiations will not be quick with China restraints and non-tariffs list desired

April 22, 2025

Foreign Official U.S. Treasury Holders: The Kindness of Strangers

April 22, 2025 7:30 AM UTC

Official holdings of U.S. Treasuries show a mixed picture with China, Brazil and Saudi Arabia well off peak holdings. Two drivers of some of these country flows are the peak in global central bank FX reserve holdings in 2021 and an increased holdings of other currencies in the last decade. Neverth

April 17, 2025

Safe Havens Other Than the USD

April 17, 2025 8:30 AM UTC

The USD and U.S. Treasuries are currently not acting like safe havens, as the crisis is U.S. centric with the tariff debacle. 10yr Treasuries can regain safe haven status if a U.S. recession occurs, but U.S. equities are still clearly overvalued versus equity and equity-bond metrics. We prefer Ind