Foreign Official U.S. Treasury Holders: The Kindness of Strangers

Official holdings of U.S. Treasuries show a mixed picture with China, Brazil and Saudi Arabia well off peak holdings. Two drivers of some of these country flows are the peak in global central bank FX reserve holdings in 2021 and an increased holdings of other currencies in the last decade. Nevertheless, central bank reserve diversification is a slow 5-10 year process traditionally. Even so, two risk factors that could speed up reserve diversification from U.S. Treasuries are a prolonged U.S./China economic cold war (30-35% probability) or Trump making major changes to Fed independence e.g. sacking Powell.

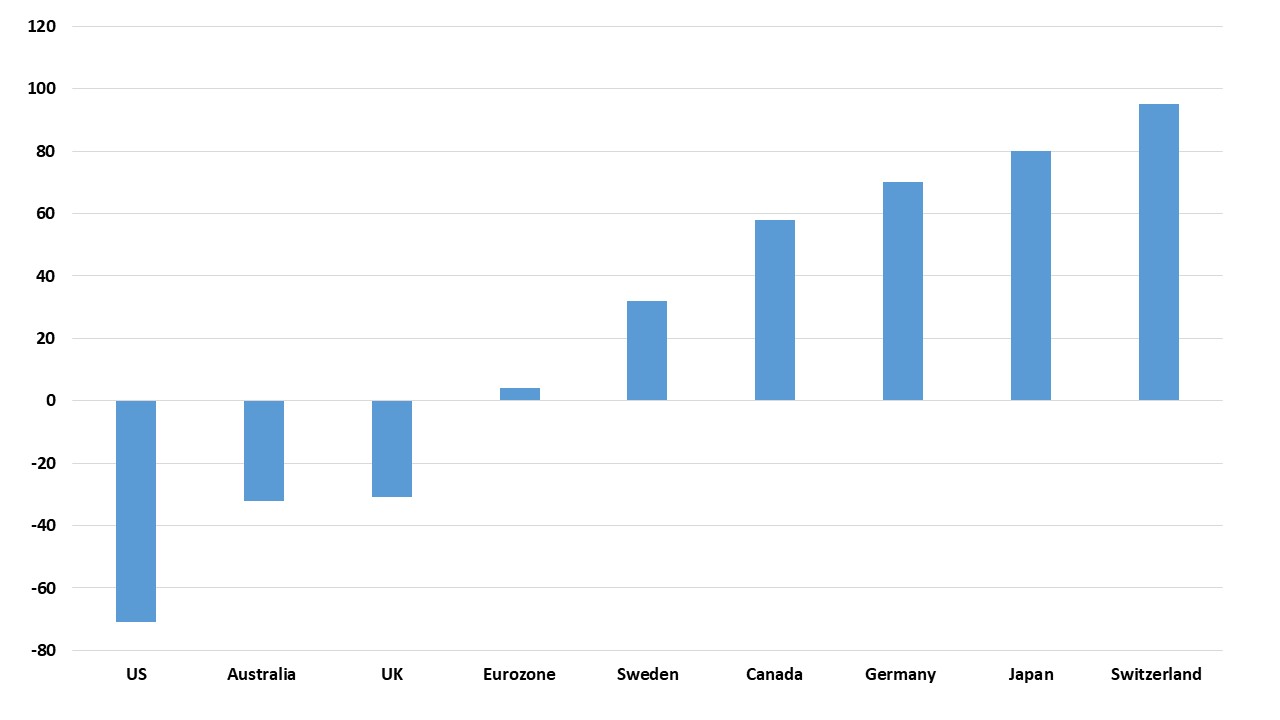

Figure 1: Japan and China U.S. Treasury Holdings (Blns)

Source: Datastream/Continuum Economics

We have highlighted the new vulnerability of additional flows into U.S. equities and bonds and the existing holdings (here) and we are concerned that capital inflows will remain more volatile and ensure that C/A deficit financing comes at an extra cost to the U.S. This is the problem for U.S. equites and the USD, as they are overvalued on long-term measures and makes them vulnerable to reducing overweight U.S. equity positions and hedging of USD downside for all liabilities.

However, U.S. Treasuries have reasonable nominal and real yields and from a 2025 portfolio standpoint the key question is whether a U.S. slowdown or recession is seen. If a shallow recession is seen then we could see 3.25% 10yr yields by end 2025, which would mean 12% total returns in 10yr Treasuries (here). A soft economy but signs of slowing monthly inflation in H2 could still mean +4-5% total returns. Private holders are thinking about these prospective total returns on a currency hedged basis.

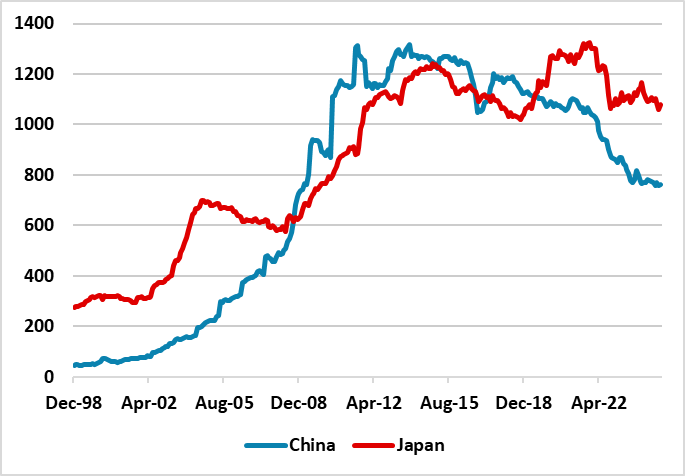

Even so, with heavy net issuance in the U.S., the U.S. needs continued new inflows from overseas as well as domestic buyers and not just keeping the existing foreign holdings unchanged. Foreign accounts held USD8.5trn of U.S. Treasuries according to U.S. Treasury TICS data at end Jan 2025, with foreign official holders being USD3.8trn. Foreign official investors are not just driven by total return prospects, but also the ability to sell for FX intervention, inertia and fear of U.S. sanctions. A lot of focus has been on China’s USD761bln of holdings (Figure 1) and whether they are or could reduce holdings still further. So far no concrete evidence exists of an accelerated rundown, but a risk exists if a truce does not occur in the U.S./China trade war (here). Japan through the BOJ and pension funds/life insurance companies are major holders as well, but off the 2021 highs. However, Japan defense dependency on the U.S. means that the BOJ is highly unlikely to significantly change U.S. Treasury holdings. Brazil and Saudi Arabia are also below their peak holdings (Figure 2), but India/HK and Taiwan are close to peak holdings.

Figure 2: Brazil/India/Saudi Arabia/Taiwan U.S. Treasury Holdings (Blns)

Source: Datastream/Continuum Economics

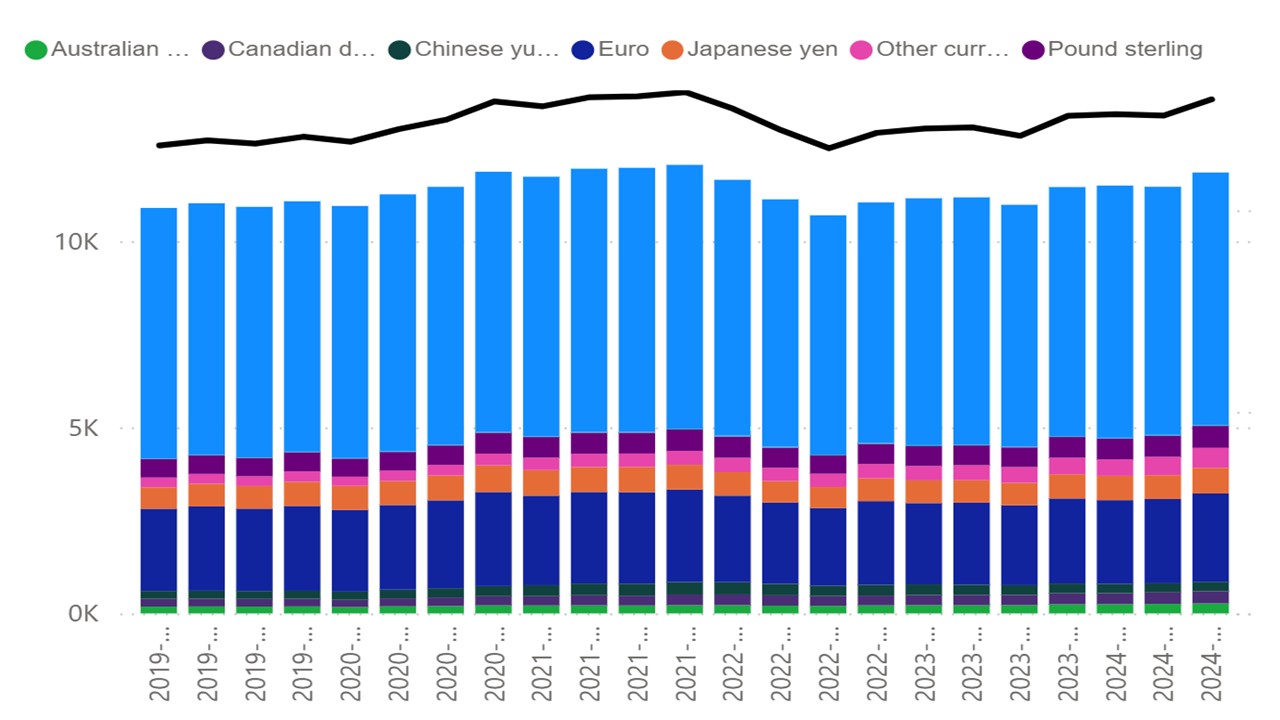

Two drivers of some of these country flows are the peak in global central bank reserve holdings and increased holdings of other currencies in the last decade (e.g. Japanese Yen and Chinese Yuan) – see Figure 3. EM central banks feel a lot more comfortable that their FX reserves are large and able to defend against any non-fundamental depreciation, so why build new FX reserves. The increased use of other currencies partially reflects an overvalued USD and also reserve diversification. The imposition of sanctions on the Russian central bank after the Ukraine invasion has shaken faith in the ability to access FX reserves in an emergency. The erratic nature of the Trump administration means that CEA Miran idea of a forced reprofiling of foreign official Treasury holdings is a tail risk rather than a zero risk (here).

Figure 3: Global Central Bank FX Reserves Have Stopped Rising (Blns) USD in Blue

Source: IMF COFER (here)

Nevertheless, central bank reserve diversification is a slow 5-10 year process traditionally. The Euro at 18.6% of FX reserves does not have the same liquidity as Treasuries or sizeable EZ level fiscal level authority. What could change that is major action by the Trump administration on the Fed e.g. sacking Powell/sacking some Fed appointed board members/increasing the number of FOMC members with Trump followers. The Senate would normally stop any President taking such a disastrous credibility step, but if Trump is faced with a recession he could decide to try and take action against the Fed. Foreign central banks would likely be upset if Trump extends his disruptive instincts to the Fed. The past 30-40 years of central bank independence has helped to reduce real interest rates due to policy predictability and foreign central banks could feel higher real U.S. rates and capital loss risks. Rating agencies would likely also threaten a U.S. downgrade in these circumstances, which would cause foreign pension funds/insurance companies to review U.S. Treasury holdings as well.