Trade Deals with the U.S.: Pressures and Obstacles

Pressures to do trade deals include the weaker U.S. economy and higher inflation when it arrives/foreigners becoming nervous of their USD30trn plus holdings of U.S. securities and more crucially risks to Trump and GOP approval ratings from Republican voters. Obstacles to quick trade deals include Trump administration desires for tariff tax revenue to fund extra tax cuts and a desire to shift production back to the U.S. Aggressive U.S. demands for no bilateral trade deficit and major non-tariff barrier concessions will also have to be softened to agree trade deals. Overall, we feel that the reciprocal tariffs will likely be lowered for certain countries to the 10% minimum or below and that new product tariffs could be delayed, which is likely to mean that an average 25% tariff gets watered down to around 12-15%. However, this is still a major hit to the U.S. economy.

The U.S. has paused extra reciprocal tariffs beyond the 10% baseline for 90 days except for China and 75 countries have approached the U.S. about trade deals. What are the pressures and obstacles to trade deals?

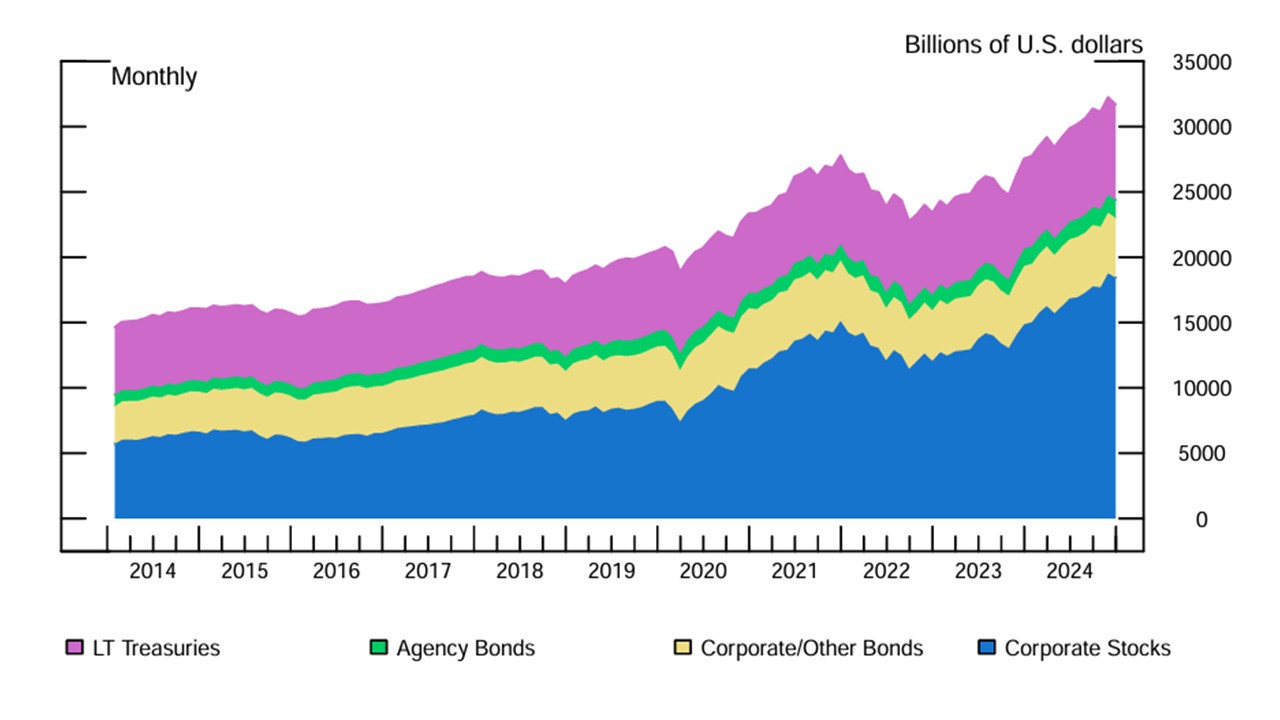

Figure 1: Foreign Residents' Holdings of U.S. Long-term Securities by Security Type (USD Blns)

Source: Fed (here)

With a 90 day period until July 9, trade negotiations will start with up to 75 countries excluding China. Trump press conference on Wednesday suggested that the spread of financial instability to the U.S. Treasury market was a key reason for the partial U turn on reciprocal tariffs. Key pressures to eventually do trade deal include

· Hit to the U.S. economy/cautious Fed/no net fiscal stimulus. Though the immediate impact of tariffs has been scaled back, the U.S. has still imposed 25% on steel, aluminum and car/car parts, 25% on Canada and Mexico non USMCA compliant goods, 10% on the rest of the world and 125% on China (we would expect a U.S./China trade war truce in the coming weeks, which will likely rollback a large portion of the 125% tariffs, but a trade deal will take time (here)). This still means a big direct economic impact, which is amplified by the uncertainty caused by lack of trust in the Trump’s administration trade policy. A wave of price rises should start to hit with April data to be released in May, which will likely slow the U.S. economy down, but also boost inflation (here). The volatility in the U.S. equity market will likely also curtail consumption among high income and wealthy groups. However, the Fed will not cut aggressively if the economy merely slows to below trend growth, though it would if the data suggest a recession was occurring. Fed Powell was clear last Friday that the Fed is in a wait and see mood, though still with expectations that cautious easing will occur this year. While the Fed feel that the tariff boost to CPI will be temporary, they will likely want to see the monthly CPI and PCE numbers in Q3 after the expected jump in Q2 monthly numbers. Meanwhile, GOP deficit hawks in the House mean that the reconciliation process is stalled and aggressive fiscal simulation remains unlikely. The tax foundation has estimated that the full U.S. tariffs could raise USD2.9trn over 10yr (here), which allows scope for USD275bln on extra tax cuts but this is unlikely to now be fully implemented. The 10yr budget bill is still likely to be negative to neutral for the economy. All of this could put further pressure on the Trump administration to do reasonable trade deals.

· Foreign asset holders jitters. The flip side of persistent U.S. current account deficit is that the U.S. has accumulated more liabilities to foreign holders than U.S. entities. The latest IMF external asset report estimates a net international investment deficit end 2023 of 70.7% and gross liabilities of 194% of GDP. Some of this is in financial assets with Figure 1 showing that foreigners hold of U.S. equities have surged significantly since 2019 and holdings of bonds remain huge. China is also a large holder of U.S. bonds and could speed up diversification if a U.S./China trade war turns into a cold war (here). Overall foreign asset holdings have surged in the post GFC period where U.S. exceptionalism in key sectors, economic outperformance and stability of U.S. institutions helped to attract huge portfolio inflows. Some private sector portfolios will continue to reduce overweight U.S. equity portfolios, as questions are raised about adverse and volatile U.S. policymaking under the Trump administration. Meanwhile, some foreign central banks will likely slow accumulation or reduce U.S. Treasury holdings. Though CEA Miran’s idea of forced maturity extension is unlikely (here), Trump Wednesday comments shows he is worried by any policy error driven rise in 10yr U.S. Treasury yields leading to a wider U.S. financial crisis. This less upbeat view from foreign investors can restrain U.S. financial markets multi quarter and confound Trump administration thinking that the current market pressures are temporary.

· US Voters. This is perhaps the key pressure point for the Trump administration to be reasonable on trade deals in the next 90 days. If U.S. voter dissatisfaction with Trump increases, then this would be a concern for the November 2026 mid-term elections where the Republicans could lose the House. A recession could even put the Senate in play. If non MAGA Republicans disapproval grows then this could set political alarm bells in the Trump administration. Initially this could see the Trump deflection policy rolled out e.g. The Fed are to blame for the economic downturn and the jump in inflation. However, it would likely lead the administration to seek reasonable trade deals with key partners and further softening the hit from tariffs.

However, a number of obstacles still exists to quick trade deals to soften the scale of tariffs that have been introduced by the U.S. or could in the future

· Trump’s three pronged strategy means mixed messages. Last week President Donald Trump talked about trade deals, but then a couple of hours later also talks about shifting production back to the U.S. and raising tariff tax revenue. This is a three pronged strategy that differs from Trump 1.0 when trade deals were the prime objective. This wider set of objectives likely means that some reciprocal and product tariffs (remember that certain products have separate tariffs e.g. steel/cars and potentially pharma/semiconductors/lumber in the future) are permanent but that some scope exists to reduce the scale of reciprocal tariffs from the maximum towards the average minimum of 10% -- some friendly countries may be able to now negotiate below 10%, if Trump feels under renewed economic/financial and voter pressures. It is also unclear whether the Trump administration will now impose 25% product tariffs on pharma, semiconductors and lumber in the next 90 days, as the mood shift towards trade deals. Bessant/Musk desire for trade deals is countered by Navarro and Greer hardline stance that tariff revenue and shifting production back to the U.S. are critical. Though Bessant appears to be more influential at the moment, the prospect remains for mixed communications from the Trump administration that sustains trade policy uncertainty.

· Zero trade deficit/non-tariff barrier demands. Israel offers for zero tariffs has initially not impressed Trump, while the EU offer of zero tariffs on cars and industrial goods has also been initially rejected (here). The Trump administration still appears to be unclear about what priority it wants. Trump says he regards any U.S. trade deficit with any country as unacceptable, which is problematic for other countries when it a large pct of GDP. Additionally, as part of any trade deals, the U.S. wants to see relaxation of non-tariffs barriers as well as lower tariff rates than those just introduced. These include VAT distortions, food/car and other product standards, legal requirements, customs procedures, bans on certain U.S. goods, diversity policies in foreign countries and many more according to Peter Navarro (here). Some scope exists to reduce non-tariff barriers, but the EU for example will not scrap VAT or significantly lower car safety and emissions or food standards. The one counterpoint to make is that Trump can pivot position significantly, as we have just seen with the 90-day delay and this could see the U.S. softening its demands. The other consideration is that some in the administration have said that the U.S. could ask for extra payment for security defence. Trump could ask Europe to pay some of the large cost each year involved in the defence on Europe ex Ukraine like Japan already does. He is also asking for Europe to buy much more LNG.

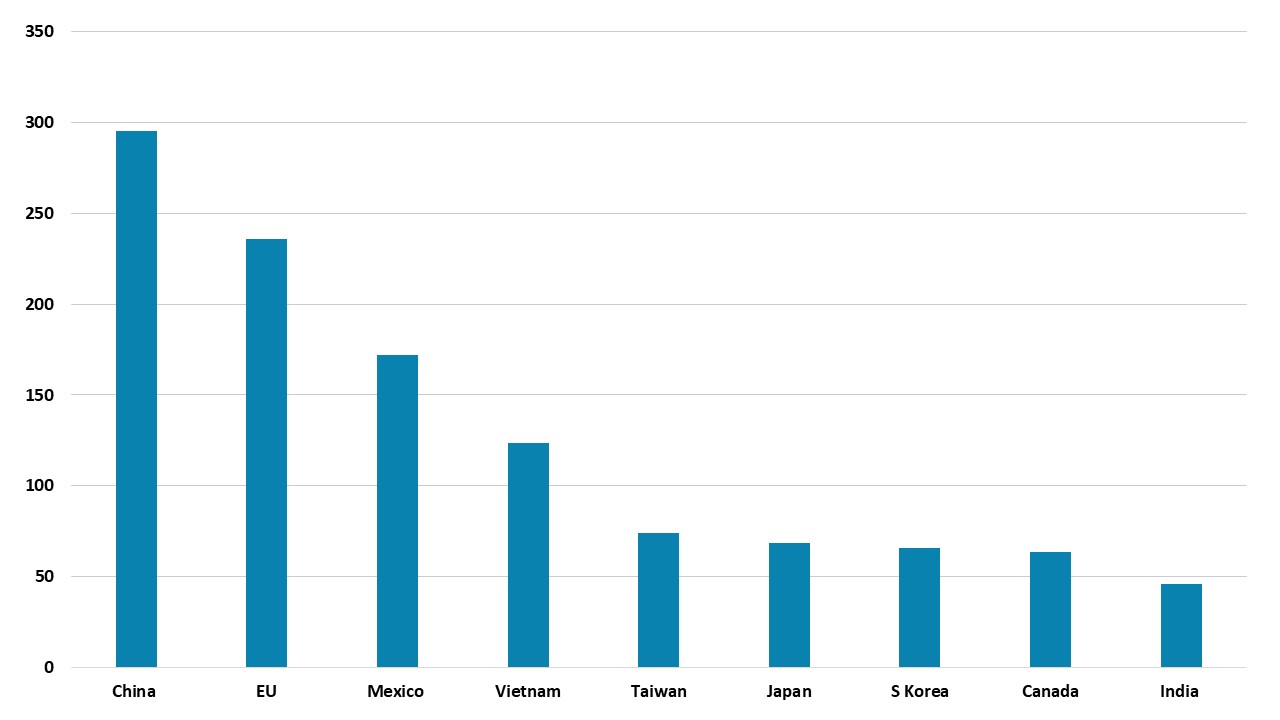

Figure 2: 2024 Bilateral Trade Position with U.S. (USD Blns)

Source: BEA/Continuum Economics

The crisis of the last week now means that Trump has tilted towards doing trade negotiations in the next 90 days and this includes China if a truce can be agreed. Negotiations with friendly partners such as Japan, S Korea, Israel, India or the UK should be watched closely. Financial markets should be cautious about extrapolation any trade deal progress to all countries. The Trump administration will likely be slower on a trade deal with China and any negotiations could fail to bridge the gaps (here). Negotiations with the EU will also be tricky, as EU decision making is slower than the U.S. and major red lines exist on non-tariff barriers or U.S. demand for huge purchases of natural gas. Finally, friends and foe regard the Trump administration as untrustworthy, which could prolong negotiations and mean only modest areas of agreement rather than a full scale trade deal. This matters as the overall trade deficit are dominated by China, EU and Mexico (Figure 2). Overall, we feel that the reciprocal tariffs will likely be lowered for certain countries to the 10% minimum or below and that new product tariffs could be delayed, which is likely to mean that an average 25% tariff gets watered down to around 12-15%. However, this is still a major hit to the U.S. economy.