US Exit: Lessons From Brexit?

Overall, the U.S. attempt to reshape global trade is unlikely to significantly improve its trade position, but the size and influence of the U.S. may mean it does not get hit in net exports volumes like the UK. Even so, U.S. business investment could be restrained by ongoing uncertainty from the Trump administration tariff drama and foreign equity investors will likely remain less willing to invest in the U.S. The biggest lesson from Brexit is that stubborn politicians can pursue the wrong policy for years. Trump is unlikely to abandon tariffs completely and the best case is a 10% average tariffs and base case 15% average versus the current 20% effective.

In some ways the US is exiting from the existing global trading system and trying to reshape the situation. Does Brexit have any lessons for the U.S.?

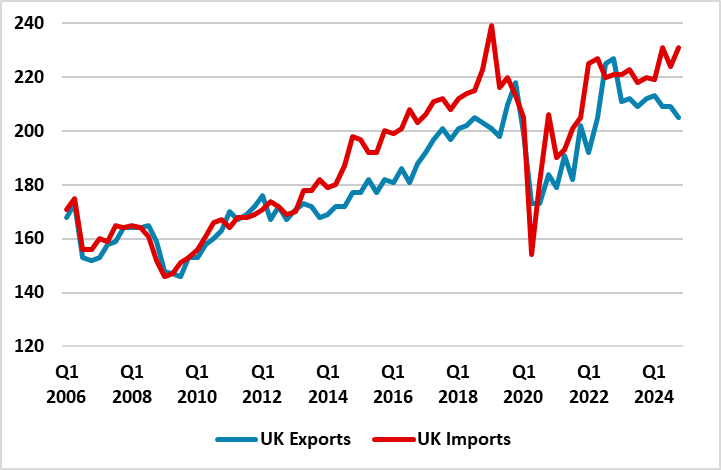

Figure 1: UK Exports and Imports of Goods and Services (GBP Blns)

Source: Datastream/Continuum Economics

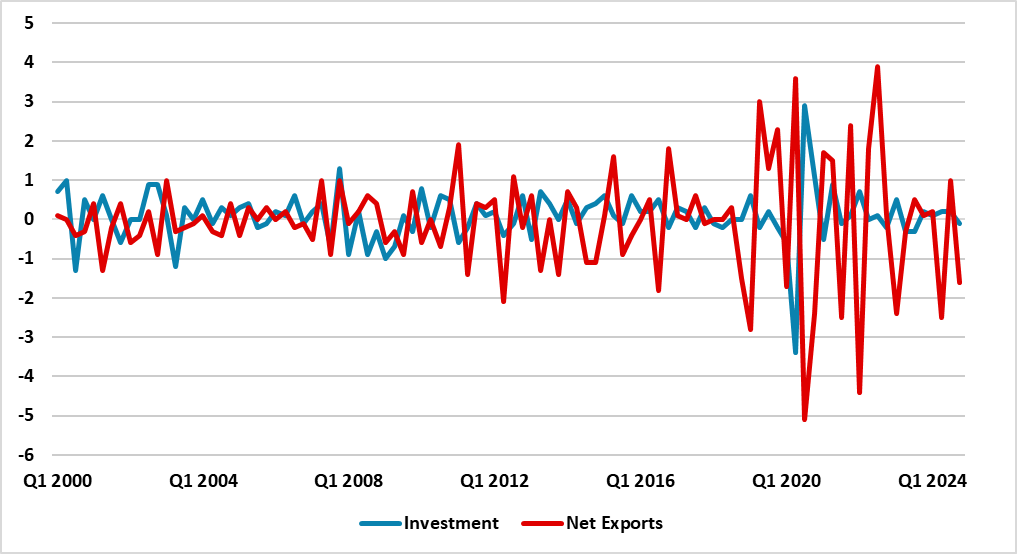

· Trade Improvement Not Guaranteed. The UK decided that it wanted to weaken its trade relationship with its main trading partner the EU, for political reasons; to control legal immigration and striking new trade deals with faster growing economies. The result has been sluggish exports versus imports (Figure 1) and less of a contribution from net exports to GDP growth (Figure 2). The scale and breadth of U.S. tariffs have made the U.S. an unreliable trade partners for the rest of the world and in some ways the Trump administration has decided to exit the current world trade system to try and reconfigure. Comparative advantage means that import substitution will likely be more costly and hurt U.S. competitiveness; trade deals will likely be partial rather than with radical restructuring and U.S. export growth will be hurt by buyers’ anti-Trump views. It is not clear to us that U.S. net exports will contribute more to growth, but the U.S. size may mean it does not get hit in net exports like the UK. The difference is that the U.S. is first suffer a negative supply shock that pushes up in inflation and will then see a 2 round negative demand shock. The UK saw a negative demand shock and then a 2 round negative supply shock.

Figure 2: Fixed Investment and Net Exports Contribution to Real GDP Growth (%)

Source: Datastream/Continuum Economics

· Business Investment Also Hurt. Brexit in the UK did see a lower contribution to GDP growth from business investment and it also became more volatile (Figure 2). Trump hopes that import substitution will trigger new business investment in the U.S. This could happen for some goods, but others will likely see higher prices hurt demand and trend GDP growth in the coming years. Additionally, tariffs are not business friendly and hurt profit margins. Meanwhile, the implementation has been erratic and prone to uncertainty that hurts business planning. This saps business confidence and willingness to invest.

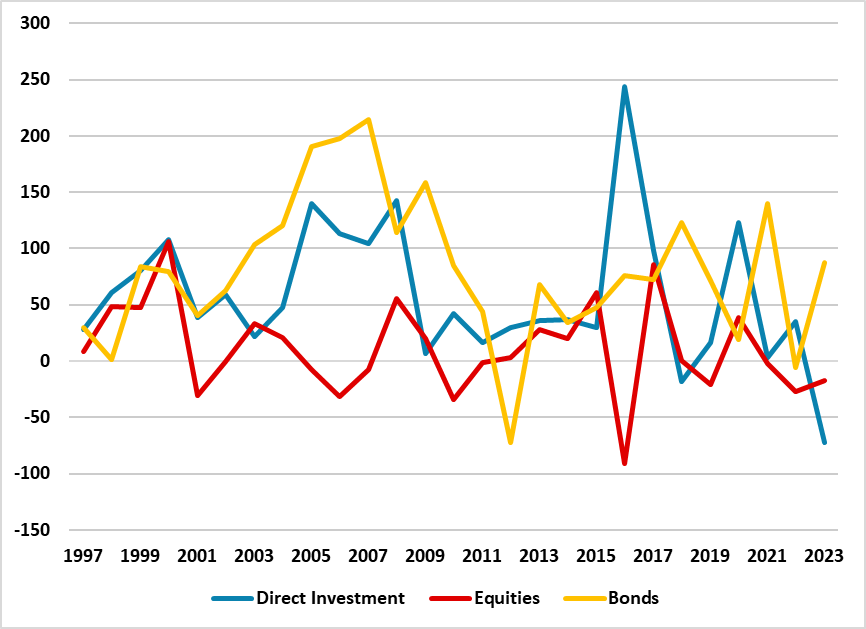

Figure 3: UK Capital Account Financing (GBP Blns)

Source: UK Pink Book/Continuum Economics

· FDI and Equity Inflows Slowed. Figure 3 shows that after the 2016 Brexit vote foreign direct investment and net equity portfolio flows slowed. The UK economy was seen to be less of pro-growth environment than pre 2016. U.S. exceptionalism in corporate profit growth is also now being questioned after the Trump tariffs. We would feel that the overweight position in U.S. equities does mean that net equity inflows slow into the U.S. and at times we could see net portfolio outflows occurring (here). In the UK case, net bond inflows did not really change. The lessons for U.S. debt are less clear, as global investors and central banks (here) own USD14trn and net inflows could also slow unless the U.S. keeps 2% plus real yields. The U.S. dominant safe haven role has also been brought into question (here). The pound also slumped sharply in 2016. We look for a further decline in the USD from its still overvalued position, though the dominance of the USD use in invoicing could cushion the fall.

· Stubborn Politicians. The Brexit vote in 2016 was followed by years of political chaos around whether the UK should go for a soft or hard Brexit in 2020. The resulting answer in 2020 was a hard Brexit, which has hurt net exports and business investment growth. 2025 under a Labour government is expected to see an agreement with the EU back towards a softer Brexit, though falling short of customs union or single market entry. Further partial Trump U-turns on tariffs are likely and we see prospects of a trade truce and lower effective tariffs with China (here). Even so, Trump is unlikely to abandon tariffs, both as he believes in the tax revenue; that they can pressure trade deals and shift production back to the U.S. Best case is a 10% average tariffs and base case 15% average versus the current 20% effective. Trump is unlikely to abandon tariffs in this term, with stubbornness curbing the lessons from the reality of slower U.S. growth. Trump could also try to overthrow the Freedom caucus in the House of Representative and try to aggressively stimulate via fiscal policy, but rating agencies and the bond market would not be happy about such an outcome and Trump has shown he is fearful of the bond market.

Overall, the U.S. attempt to reshape global trade is unlikely to significantly improve the trade position, but the U.S. size and influence may mean it does not get hit in net exports like the UK. Even so, U.S. business investment could be restrained by ongoing uncertainty from the Trump administration’s tariff drama and foreign equity investors will likely remain less willing to invest in the U.S. The biggest lesson from Brexit is that stubborn politicians can pursue the wrong policy for years. Trump is unlikely to abandon tariffs completely and the best case is a 10% average tariffs and base case 15% average versus the current 20% effective.