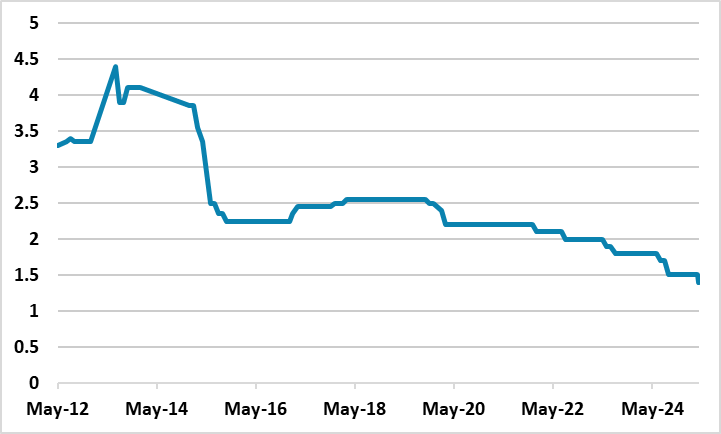

China Moderate Triple Monetary Easing

• China has announced a 10bps cut in the 7 day reverse repo rate to 1.4%; large than expected 50bps cut in the RRR rate and credit easing via Yuan1.1trn balance sheet quota expansion to counter the slowdown in growth. Combined with the extra equity capital for state banks this will help credit supply but is only likely to produce a modest boost to private business and household credit demand. Thus we keep the 2025 GDP growth forecast at 4.2%.

Figure 1: China 7 day Reverse Repo Rate (%)

Source: BEA/Continuum Economics

Source: BEA/Continuum Economics

China multiple easing is a repeat of the strategy used in September, with simultaneous reduction in the 7 day reverse repo rate and a 50bps cut in the main RRR rate. This was supplemented by a 25bps cut in the housing provident loans and RRR from 5% to zero for auto finance companies. Additionally, the PBOC expanded balance sheet quota by Yuan300bln for science and technology; Yuan500bln for consumption and elderly care and Yuan300bln for small and micro company lending. Combined with the Yuan500bln of extra equity capital announced in March for major state banks this should boost credit supply in the economy, which has been weak by China’s standards with M2 growth only 7%.

However, credit demand in the private sector remains weak and may not see the normal response to increased credit supply and cheaper loan rates. The household sector sentiment remains weak due to the property market shakeout. Though the pace of tier 1 and 2 house price falls is slowing, the average house price to income ratios remains very high. Meanwhile, tier 3 cities are still suffering for a large excess of supply and falling house prices, which is hurting sentiment. While housing construction will be less of a negative headline in 2025, the housing market has not bottomed and net housing loans will remain weak. Meanwhile, private sector business investment has been weak, with SOE more favored by the authorities. With the export crisis caused by the penal tariff war with the U.S., private businesses are reluctant to borrow. SOE will likely respond by increasing borrowing, but this is insufficient in itself to by a gamechanger.

However, we will likely see more fiscal easing by the summer and the trade war with the U.S. will likely deescalate. High level talks for a trade truce will occur this weekend in Geneva and this will likely lead to a postponement of most reciprocal tariffs and then property trade negotiations (here). A trade deal could eventually be reached, but is likely late 2025 or H1 2026 given the big difference in positions between the U.S. and China. Thus we keep out 2025 GDP forecast at 4.2%.