U.S. Equities: Hoping for Tariff Negotiations but Fearing Q2 Data

• The U.S. equity market still remains under pressure from the announcement effect of large reciprocal tariffs, though hopes of trade deals could start to soon produce a stabilization of the market later this week. Multi month the U.S. equity market outlook depends on whether a recession is seen or not, as a recession could extend and prolong a selloff. We see slower growth but no recession and this could suggest a market bottom in the 4600-4800 region for the S&P500.

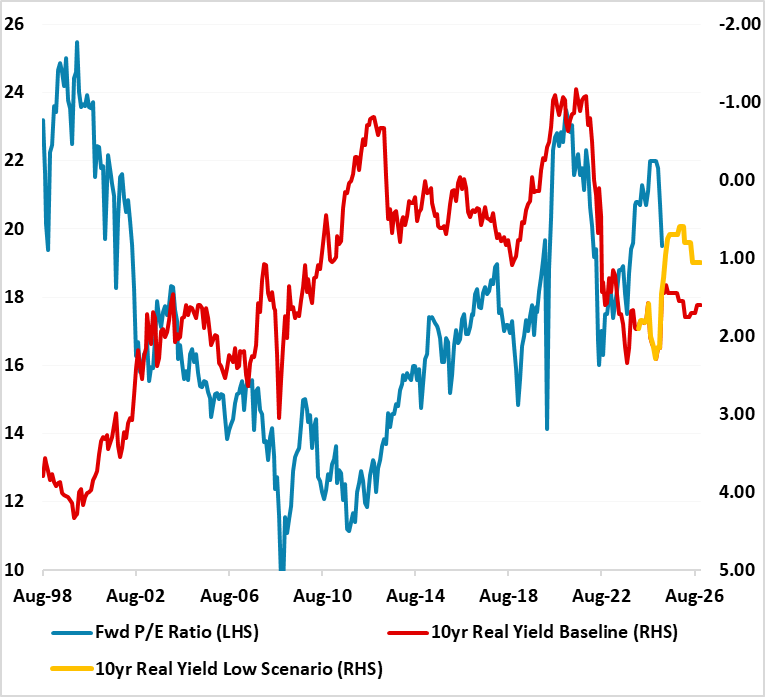

Figure 1: 12mth Fwd S&P500 P/E Ratio and 10yr Real U.S. Treasury Yield Inverted (Ratio and %)  Source: Continuum Economics

Source: Continuum Economics

The U.S. equity market remains under pressure as recession fears spiral and produces position adjustment among hedge funds and end investors. Key points to impact the market from here include.

• Trade Negotiations and Hopes of Lower Reciprocal Tariffs. Administration officials indicate that 50 countries have approached the U.S. to negotiate reciprocal tariffs, which has prompted some hopes that the trade war could be tempered. First, Canada and Mexico escaped reciprocal tariffs, which suggests some sensitivity on trade. However, though the Trump administration has made some optimistic noises about Vietnam’s offer to reduce tariffs to zero, it does not appear that the administration is feeling pressure to make quick U turns. President Donald Trump appeared unconcerned with the selloff in U.S. equities last week and appear willing for now to push the line of pain before gain. On China, administration officials have suggested that a U.S. trade surplus with China would be the basis of negotiations, which is extremely difficult without both a collapse in exports from China to the U.S. and a pre-committed surge in imports from the U.S. – this scenario would also not suit China’s policymakers. If one country can gain concessions on reciprocal tariffs then it will help stabilize U.S. equity market sentiment, as it can raise hopes of other reaching a deal and in turn avoiding a U.S. recession.

• Economic data and hedge fund/end investors reaction. Hedge funds have aggressively cut long positions, as the market movement prompts a rethink. For end investors position adjustment is more a question of whether a U.S. recession is seen or not. For the U.S. economy, tariffs will likely be passed on via higher prices more than squeezed import profit margins and we see around 1% being added to U.S. inflation (here). On our baseline this means a slowdown in U.S. growth but not a recession. Initially higher prices will pause some consumption in the U.S. However, as the year progress, some import substitution is likely to U.S. produced goods. Additionally, imports will also likely slowdown as inventories are run down, as importers had anticipated tariffs and inventories have been build up. This helps net exports from a GDP viewpoint. Finally, the non-partisan tax foundation estimated that the Trump tariffs will raise USD2.9trn over the next decade (here), which will likely led to extra political pressure for offsetting tax cuts beyond the renewal of the 2017 tax cuts. This is a tricky economic backdrop for the equity market, as the Fed are likely to ease cautiously as Powell signaled on Friday. This leaves the U.S. equity market vulnerable in the coming months to a further leg down, as 12mth fwd price/earnings ratio are still overvalued against 10yr real bond yields where the U.S. avoids a recession and the Fed eases cautiously (Figure 1). This could see a bottom in the 4600-4800 area for the S&P500 and a rebuilding to 5700 by end 2025, as more trade deals get done.

• Recession. The U.S. economic environment is uncertain, as the reaction of consumer and businesses could be amplified by the shock to confidence from the higher than expected tariffs and the ensuing economic disruption. Consumption could be paused for longer and business investment delayed and this feeds into slower job/income and domestic demand growth. This can produce the conditions for a shallow recession. For the equity market this would likely push 2025 earnings expectations negative, while the fwd 12mth price/earnings ratio has seen a noticeable derating during previous recessions. This could lead to a deeper and more prolonged U.S. equity market selloff. However, it would likely mean that the Fed cuts aggressively and 10yr bond yields comes down to 3.25%. We have highlighted this alternative real yield scenario in Figure 1 and this could help to produce a bottom to the U.S. equity market, though only once a recession has been in place for a couple of months.