China GDP: Good Q1 Start, but 2025 Could Be 4.2% or 3.3%

• The March data releases from China alongside the Q1 GDP figures show a good start for 2025. However, underlying domestic demand is soft and Q2 will see a big hit from the U.S. tariffs already introduced. Our baseline (here) remains for a truce in the coming weeks and a scale back of 145% U.S. tariffs to around the 20% area and then for trade negotiations to begin. No reduction in reciprocal tariffs in an alternative scenario would likely mean 3.3% GDP growth in 2025.

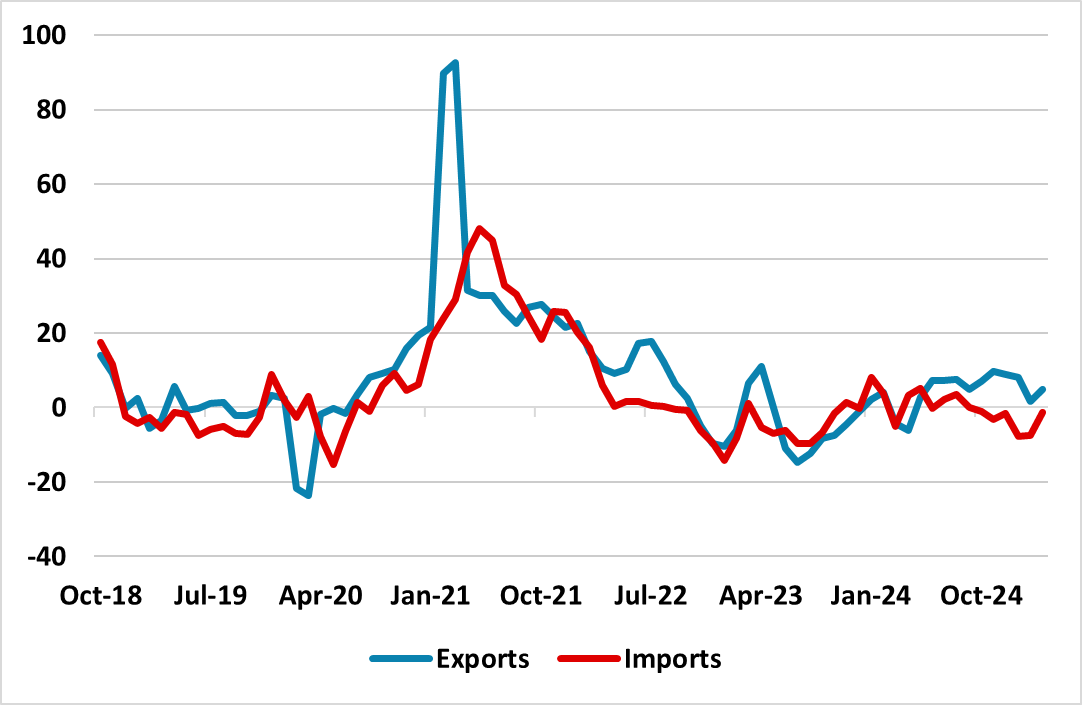

Figure 1: China Exports and Imports 12mth Yr/Yr 2MMA (%)

Source: Datastream

The March data releases from China alongside the Q1 GDP figures show a good start for 2025. Highlights include the 7.7% Yr/Yr industrial production surge helped by a 10.7% growth for high tech manufacturing. Retail sales at 5.9% Yr/Yr was better than expected helped by government subsides, with a 35% Yr/Yr surge in household appliances sales. This helped Q1 GDP to come in at 5.4% Yr/Yr. It is worth noting however that the Yr/Yr YTD figures for industrial production and retail sales were lower at 6.5% and 4.6%.

The recent healthy March export figures will also likely helped industrial production and GDP, as China exports rushed to export to the U.S. ahead of anticipated tariffs. Data from the housing sector also suggested that the pace of home sales and price declines was slowing, though we still look for residential investment to reduce 2025 GDP by 0.75-1%. While Q1 is a good start to 2025, the data also shows that retail sales outside of areas with government subsidies are mixed. The contrast between negative Yr/Yr car sales and 11.5% car production underlines the excess production in the economy. The GDP deflator also remains negative reflecting the soft nature of domestic demand. Q2 will also see a hit from the tariffs already introduced by the U.S. The lower 20% rate for phones/semiconductors and electrical goods means that some exports to the U.S. will still flow, but goods facing 145% are already seeing less shipments and factory layoffs in April (a White House facsheet late Tuesday suggests this will be increased to 245%). This excess export production cannot really by fully shifted domestically, given the soft domestic demand. Though imports will slow, the swing in exports will likely be greater and hence the hit from net exports. Additionally, the authorities fiscal stimulus in reality is focused on infrastructure spending. Though the authorities have talked about boosting income and consumption, the policy measures implemented are modest for households. Thus we look for 3.2% Yr/Yr in Q2 GDP, with the April tariff shock dominating.

H2 depends on what happens with the U.S./China trade war. Our baseline (here) remains for a truce in the coming weeks and a scale back of 145% U.S. tariffs to around the 20% area and then for trade negotiations to begin. The economic impact will hit China harder than the U.S. from the super high tariffs, but pressure on Trump will intensify (here) as the U.S. economic deteriorate; inflation rises and his approval ratings are hit further. In this baseline we are revising down out 2025 growth outlook from 4.5% to 4.2%, which also assumes an additional Yuan2trn of fiscal stimulus, pressure on large banks to lend and 30bps of 7-day reverse repo cuts – the first likely arriving in May after the late April politburo meeting. However, we do attach a 30-35% probability that no trade deal will be reached and a hard break between China and the U.S. economically will kick in. In this alternative scenario the damage to net exports and then employment/income and consumption is greater. We would forecast 3.3% growth in this scenario.