U.S China Trade War: Deal or No Deal Prospects?

The prospect of a trade deal between the U.S. and China are less and likely delayed into 2026, due to the hardline stance of Trump 2.0 due to the extra focus on tariff tax revenue and shifting production back to the U.S. It is still our baseline that a deal will be agreed though we would now see a deal that only partially reverse new tariffs and likely coming in 2026. The risk of an early watering down of reciprocal tariffs on China is likely less than other countries. A 35-40% probability exists that no deal will be reached and a hard break between China and the U.S. economically will kick in.

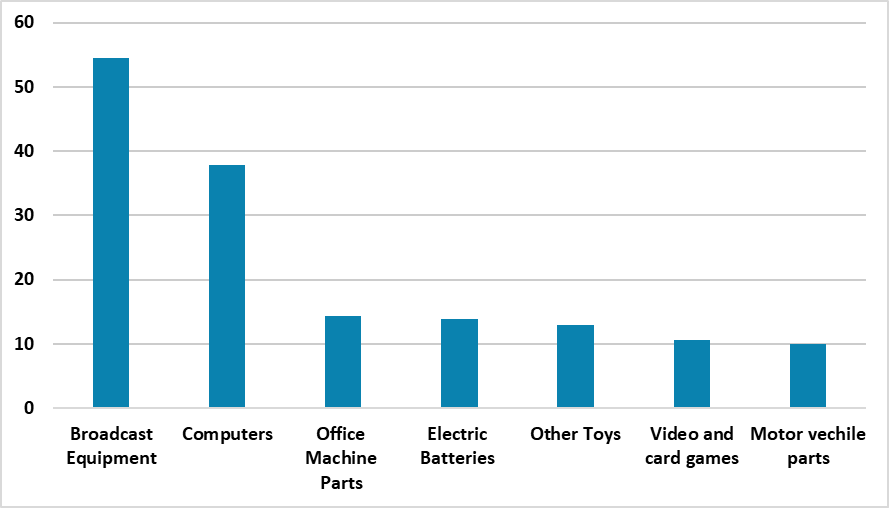

Figure 1: 2023 U.S. Imports from China By Key Products (USD Blns)

Source: BEA/Continuum Economics

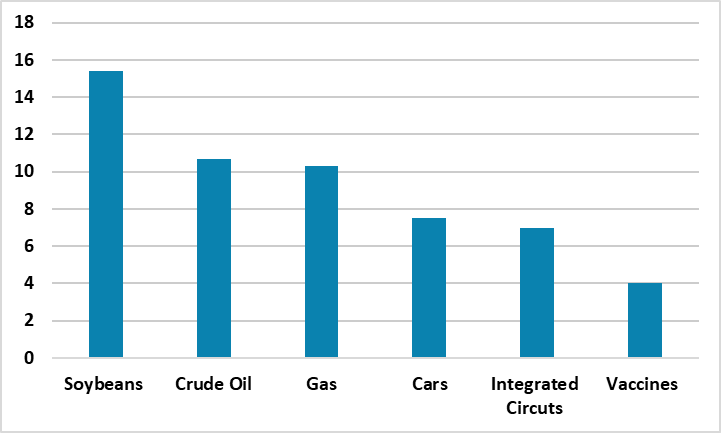

Figure 2: 2023 China Imports from U.S. By Key Products (USD Blns)

Source: BEA/Continuum Economics

U.S. President Trump has a special dislike of China with an extra 54% cumulative across the board tariffs on top of 2018/19 measures before the extra penalty 50% bringing a cumulative extra 104%. This is a U.S./China trade war, but does this mean no deal or that a deal will eventually be made.

• China wants a deal, but acting Tough. China initial response to the 10% across the board tariffs on the fentanyl pretext was modest counter tariffs designed to deescalate towards high level trade negotiations. Reports out of Beijing have suggested all year that China has been looking at revising the phase 1 trade deal agreed in 2019 to be more favorable to the U.S. However, China has been hit by a further 10% across the board tariffs and 34% reciprocal tariff – with the final portion likely to be implemented April 9. With the U.S. acting so tough, China has decided to escalate with a 34% retaliatory tariff. Politically China does not want to cave into U.S. pressure and tactically in this round has decided to act tough. China and President Xi wants to talk trade with the U.S. as equals, rather than bending to U.S. demands to eliminate the trade surplus with the U.S. This has seen some tough words from China. However, Trump threat on an extra 50% tariff if China does not back down is being countered by China threats to curb agriculture imports and Hollywood films from the U.S., rather than more aggressive threats to rapidly sell remaining U.S. Treasury holdings. Even so, to act tough China has gone for a further 50% to bring extra tariffs on U.S. goods to 84%. On balance, we still feel that China preferred route remains towards a revised trade deal.

• Trump China motives. In terms of bilateral trade deficits, Trump focus has been on the big 4 China, EU, Mexico and Canada. China has special focus for Trump, both as a raising global power but also Trump feels it shows the worst of unfair trade practices. In 2019, Trump escalated with tariffs and preannounced higher tariffs to get China to the negotiation table and a truce was called to allow negotiations after a face to face Trump/Xi meeting. This sequence could play out again, if Trump wants to get a phase 2 trade deal from China. However, Trump 2.0 has been more aggressive than 1.0 when trade deals were the end game. Trump 2.0 also wants to raise tariff tax revenue and shift production back to the U.S. and reports have suggested that the U.S. wants to eliminate the bilateral trade deficit with China as an objective. We may not reach a truce for many months on the China front, irrespective on what happens bilaterally with 70 other countries e.g. Japan/Vietnam/UK.

• Deal or no Deal. This would require a huge drop in exports to the U.S. from China, without the ability to redirect production through 3rd countries such as Vietnam and Mexico. U.S. goods imports from China were USD439bln in 2024 versus exports of goods to China of USD144bln. The product breakdown is broader for imports from China (Figure 1) versus China imports from the U.S. (Figure 2). It would also likely require a large increase in imports by China from the U.S., which would have to occur through government commitments for purchases of agriculture and energy. This is a tough demand for China, as exports to the U.S. would not easily be directed elsewhere with the EU alert to any dumping of China exports. It could also intensify a domestic excess of China production over domestic demand and this could intensify disinflationary pressures. On extra imports from the U.S., this is something that China could agree on a moderate basis like 2019, though counterbalanced by not becoming too dependent on the U.S. in agriculture or energy. However, China would struggle to achieve a large increase in imports, both due to strategic opposition to being too dependent on the U.S. and as private sector demand for expensive U.S. goods cannot be guaranteed.

This all means that extra uncertainty exists around our baseline that negotiations would start in the summer and a trade deal would be reached in Q4 2025/H1 2026. An alternative moderate probability scenario (33-40%) is that negotiations occur but the two sides fail to agree a trade deal, due to large differences on key areas. This would leave an economic hard break between the U.S. and China, which would initially be damaging to both sides. In some ways this would be an economic cold war. This would hurt the U.S. and China, as well as global trade. Perversely this could make Trump less aggressive with Canada and Mexico. On balance, our baseline still remains a trade deal (60-65%) being reached, given Trump deal instincts; China desire for a deal and the economic disadvantage of an economic cold war to the U.S. when it is trying to reset trade with all countries. However, such a deal would not reverse all new 2025 tariffs, but likely just water down the 34% across the board reciprocal tariffs. Additionally, negotiations could drag on through H2 2025 and mean that a deal is not reached until 2026.