Nervous U.S. Long Term Asset Holders

Overall, foreign equity investors can no longer count on U.S. exceptionalism and could face lower long-term corporate earnings growth, which at a minimum will likely slow net inflows. Bond investors also face ongoing policy volatility, which likely means a need for an extra risk premium – though slowdown versus hard landing is still the critical issue for yield forecasts. All of this likely means that some current foreign holdings could be reduced. These could be replaced by hot money or other investors, but they would likely require extra risk premia in U.S. markets or a lower USD. Capital inflows will remain more volatile and ensure that C/A deficit financing comes at an extra cost to the U.S.

Foreign holders of U.S. securities totaled USD31.3trn based on U.S. Treasury and Fed data end June 2024. What will happen in 2025 and beyond with the volatile policymaking from the Trump Administration?

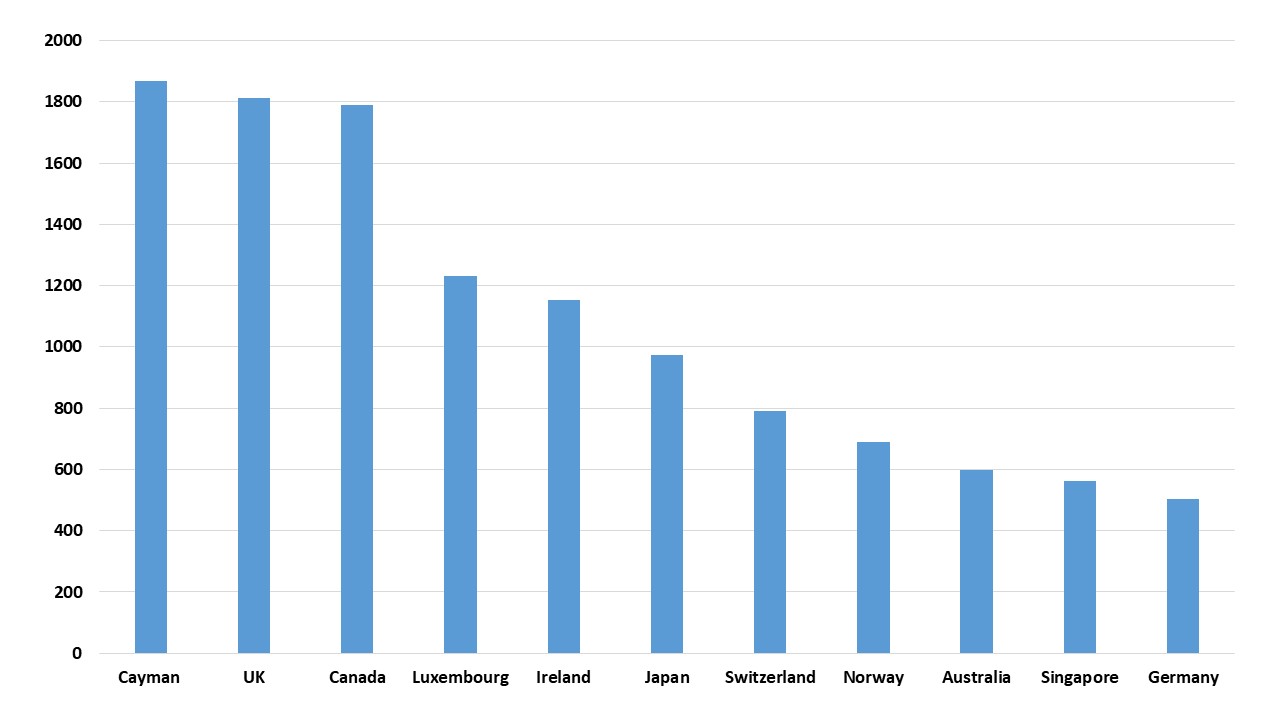

Figure 1: U.S. Current Account to GDP (%)  Source: Datastream

Source: Datastream

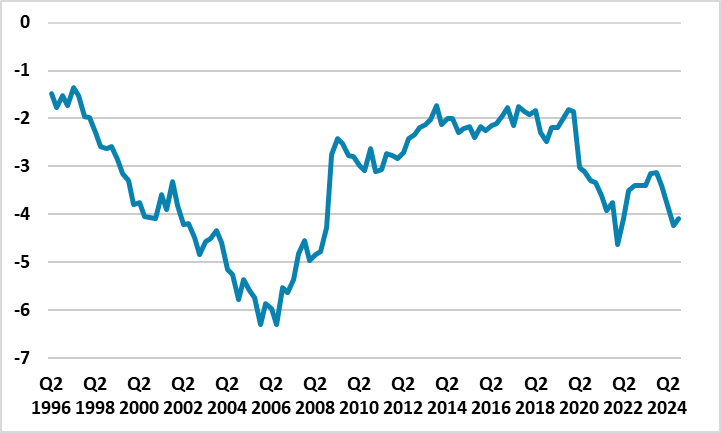

The persistent U.S. C/A deficit (Figure 1) means that the U.S. needs foreign inflows in terms of portfolio, hot money deposits and direct investment inflows to offset the outflow from the current account. These flows cumulatively have led to a large excess of foreign holdings in the U.S. that has seen the U.S. net international investment deficit surge in the past decade (Figure 2). U.S. economic/asset performance and consistent policymaking have helped this surge. Some of this is now being undermined cyclically and structurally. Slow U.S. growth or a mild recession is not necessarily a long-term challenge, as foreign investors would normally switch exposure from equities to bonds until the bottom of the recession. However, the Trump administration’s policies could damage both the long-term growth/corporate earnings prospects and policy perceptions.

Figure 2: Net International Investment Deficit/GDP (%) Source: St Louis Fed

Source: St Louis Fed

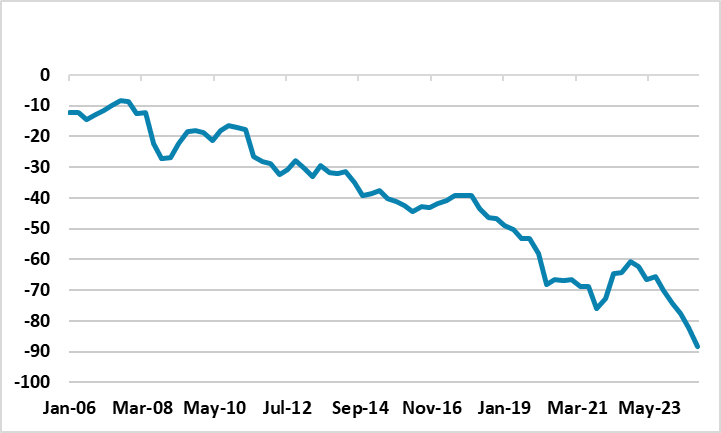

A lot of the USD17trn U.S. equity holdings come from DM economies (Figure 3), where portfolio decision making is decentralized and driven by expected returns. Long-term corporate earnings growth in the U.S. is now less certain with the Trump administration tariffs trying to rework supply chains and bring them back on shore. This could cause extra costs to companies including higher labor costs in the U.S., which squeezes long-term corporate earnings growth. Additionally, the erratic and volatile decision making over tariffs raise questions for foreign equity investors over policy certainty in the U.S. This all makes it difficult for foreign investors to justify overvalued U.S. fwd price/earnings ratio if 5yr expected returns start to be trimmed, especially if the USD is going down rather than up multi-year.

Figure 3: Foreign Countries Equity Holdings (USD Blns)

Source: U.S. Treasury (here)

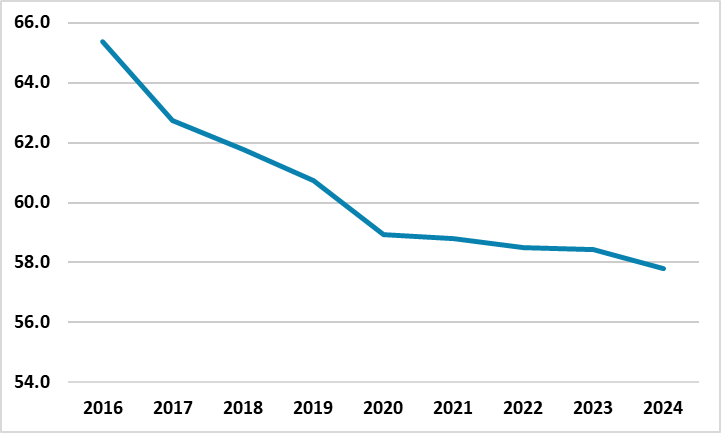

Foreign countries also own USD12.9trn of U.S. long-term bonds, which is mainly U.S. Treasuries at USD8.5trn (here) but also includes sizeable agency/ABS and corporate bond holdings. Portfolio managers will be asking whether the 2025 hit to GDP growth and inflation boost becomes ingrained multi-year, which would mean a higher inflation trajectory and a worse budget deficit/GDP trend. For now breakeven inflation rate suggest that financial markets see the inflation pick up as temporary, while also taking comfort that the GOP deficit hawks in the House of Representative are restraining the 10yr fiscal bill impact on future budget deficits. However, the inability of long-dated Treasuries to sustain yield declines when U.S. equities sold off sharply on the reciprocal tariff announcements will raise questions about U.S. Treasuries being an effective hedge and whether portfolios need to be more globally diversified away from U.S. fixed income. Long-dated bond holders will also be concerned by the destructive nature of tariffs and also the volatility surrounding decision making by the Trump administration and whether this means an extra term premium at the long-end and a steeper curve. Foreign holders are not significantly concerned about Trump verbal pressure on the Fed so far, but any major changes to the Fed would cause new bond market concerns. In terms of foreign official holdings of U.S. Treasuries they total USD3.8trn. Foreign central banks have been diversifying away from USD in recent years, but the pace has slowed (Figure 4). The decision making process from foreign central banks also tends to be multi-year and slow rather than rapid. China could speed up USD reserve diversification or use some excess FX reserves to support the economy, but there is no confirmation of a change in pace from China so far. We also feel that the U.S./China trade war will reach a truce in the coming weeks and deescalate (here). For now slow diversification is likely the best working assumption for foreign official holdings.

Figure 4: Foreign Country Total Security Holdings (USD Blns)

Source: IMF COFER

Source: IMF COFER

Overall, foreign equity investors can no longer count on U.S. exceptionalism and could face lower long-term corporate earnings growth, which at a minimum will likely slow net inflows. Bond investors also face ongoing policy volatility, which likely means a need for an extra risk premium – though slowdown v hard landing is still the critical issue for yield forecasts. All of this likely means that some current foreign holdings could be reduced. These could be replaced by hot money or other investors, but they would likely require extra risk premia in U.S. markets or a lower USD. Capital inflows will remain more volatile and ensure that C/A deficit financing come at an extra cost to the U.S.