Markets: China Truce Hopes and More Data

The direction of travel is towards a U.S./China truce followed by postponing/cancelling most reciprocal tariffs and then trade negotiations. While the markets could cheer this as good news, incoming economic data in May and June is the most critical issue. We still see the U.S. imposing an average 15% tariff rate, which can hurt growth and boost inflation and uncertainty exists over how bad this could be. This means that though risky assets could extend short-term, the USD and U.S. equity market still remain vulnerable as data comes in over the next 2 months.

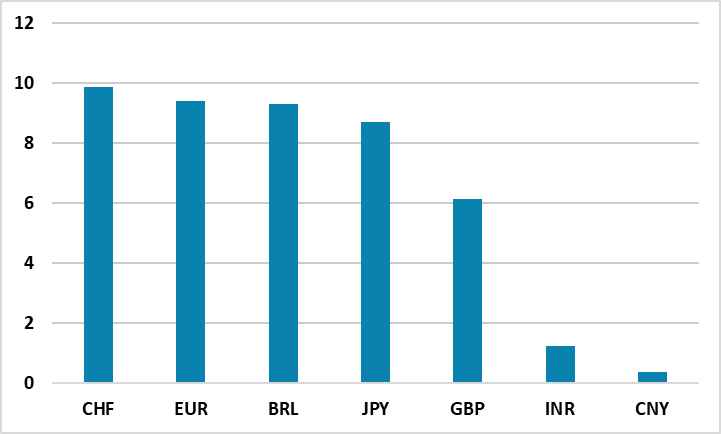

Figure 1: Performance Major Currencies versus USD YTD (%)

Source: Datastream/Continuum Economics

Source: Datastream/Continuum Economics

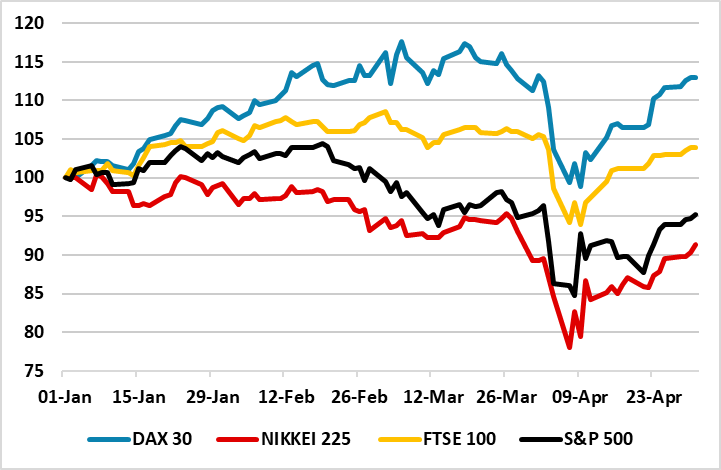

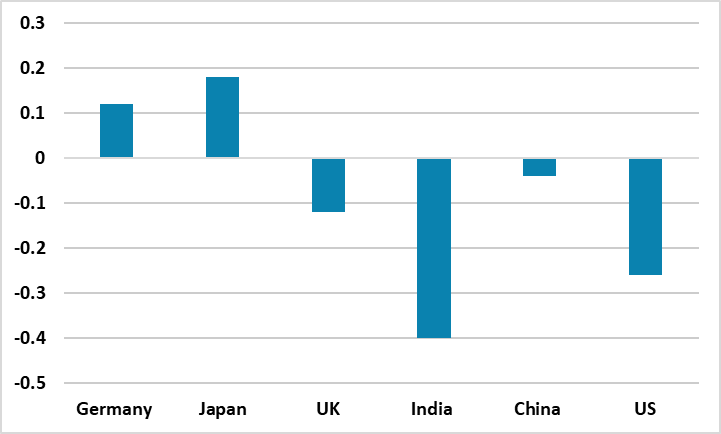

Reports that China is considering possible trade talks with the U.S. has helped risk sentiment over the last week, with risk on has also been helped by good results from some of the Magnificent 7. We feel that the pain for China from penal tariffs with the U.S. is too great and that the direction of travel is towards a truce followed by postponing/cancelling most reciprocal tariffs and then trade negotiations (here). The U.S. certainly wants a truce amid reports of a sharp slowdown in ports traffic and sentivity from the White House over Amazon considering clarifying tariffs in labels. However, while China may be comfortable with the same tariffs as other countries (10%), Trump may not be willing initially to back down that far. In the end a truce will likely occur in May. This could mean that the USD recovers some more lost ground, given the scale of losses against DM currencies this year (Figure 1) and catch up of U.S. equities with other DM equity markets (Figure 2). The U.S. Treasury market also looks like it is reacting more normally to risk (Figure 3), though the yield curve will still maintain it’s steepness reflect foreign investors long-term concerns (here).

Figure 2: DM Equity Markets YTD (%)

Source: Datastream/Continuum Economics

Source: Datastream/Continuum Economics

Figure 3: 10yr Government Bond Yield Change YTD (bps)

Source: Datastream/Continuum Economics

However, we still feel that a U.S./China trade deal will take 6-9 months, while with other countries trade deals will not fully reverse all tariffs implemented this year. We maintain the view that the average effective rate later this year will likely be around 15%, rather than 10% or lower. This produces a stagflation shock.

Thus though progress toward a China trade truce will likely be seen as good news, the U.S. economy will still be hit be tariff implementation and the uncertainty created by tariff announcements and partial U turns. Though the Q1 U.S. GDP data was distorted by imports, the Q1 PCE inflation number was disappointly high but March was lower. However, the jobs market largely remains comfortable up to mid-April (here). This means that economic data will be the critical market issue through May and June. Our baseline is for a slowing in the U.S. economy; higher inflation and a cautious Fed. However, the risks are skewed to the downside, which underlines the critical needs to read data and develop the economic/inflation view.

This can restrain the rebound in the USD, as it remains overvalued against DM currencies and we look for 1.20 and 135 end 2025 for EUR/USD and USD/JPY, even on only moderate economic damage to the U.S. It is worth noting that a difference of view exists between U.S. investors and non U.S. investors. U.S. investors home bias has left them viewing tariffs, as a cyclical hit with the structural AI story remaining in place. On a slowdown to 1% GDP growth this should provide support from around 5200 on the S&P500 (here). However, non U.S. investors increasingly feel that U.S. exceptionalism has peaked and though the AI story is good, that they are overexposed to U.S. equities and the USD. Portfolio adjustment and extra currency hedging can benefit certain DM currencies and assets (here), with selective opportunities in EM (here). In contrast the U.S. Treasury market is reasonable valued with a positive yield curve and 2% plus real yields for 10yr U.S. Treasury. We see modest positive returns in the remainder of 2025 (here), with a central band around 4.00-4.50% for the 10yr yield. If a recession is seen, then cyclical economic and Fed easing would dominate and we can see 10yr yields to 3.25%.