Safe Havens Other Than the USD

The USD and U.S. Treasuries are currently not acting like safe havens, as the crisis is U.S. centric with the tariff debacle. 10yr Treasuries can regain safe haven status if a U.S. recession occurs, but U.S. equities are still clearly overvalued versus equity and equity-bond metrics. We prefer India and EZ/UK equities for the remainder of 2025. The USD is also still clearly overvalued and the Japanese Yen (JPY) is significantly undervalued on a long-term real exchange rate basis. We see USDJPY still reaching 135 by end 2025 and 125 by end 2026. A major risk off phase would likely accelerate this move. We also like the EUR (Euro) generally and also as a safe haven. This less favorable outlook for U.S. equities/USD has seen us revise end 2025 EURUSD from 1.15 to 1.20.

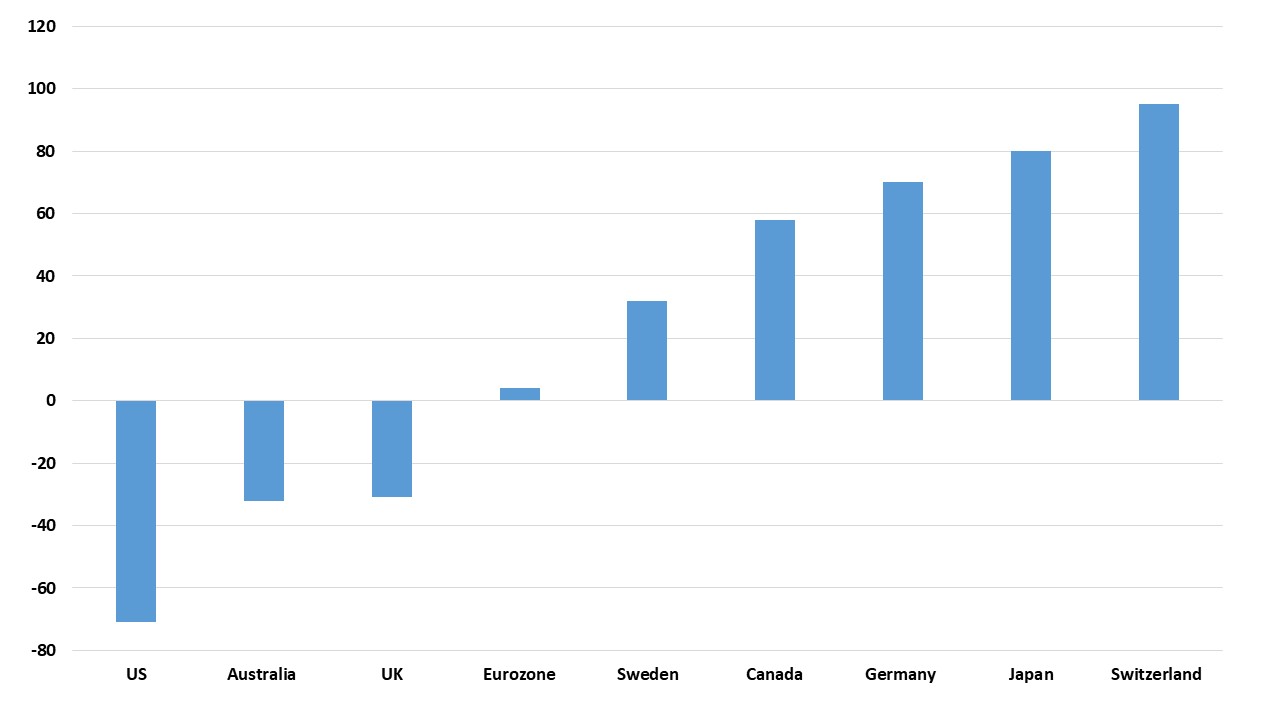

Figure 1: 2023 Net International Investment Positions/GDP (%)

Source: IMF ESR 2024

The USD is not seeing it normal safe haven status in the recent Trump reciprocal tariff inspired sell off in equity markets and risk, as the epicenter of policy and market turbulence is the U.S. The age of U.S exceptionalism has been severely dented for global equity investors and with the U.S. Treasury market not acting as the normal portfolio hedge against U.S. equities. Capital inflows will remain more volatile and ensure that C/A deficit financing comes at an extra cost to the U.S. (see our recent article ). What are the alternative safe havens?

One way of looking at this is external strengths or weakness in the shape of the net international investment/GDP (the stock of asset and liabilities). Figure 1 shows that Japan and Switzerland top the list of major DM currencies, with Germany not far behind – the Eurozone small surplus reflects deficits for France and other Eurozone countries. If investors from these countries reduce excess holdings in U.S. equities, then some could initially return home to European and Japanese cash or bonds. Medium term equity portfolios will likely hold less overweight positions in the U.S. and rotate to equity markets with good long-term return forecasts (based on dividend yield/earnings growth and valuations) which favor India, EM, Europe equities. The case for Europe is also helped by the muddle through strategy on U.S. tariffs of trying to get a trade deal and not joining China in a major trade war with the U.S. (here). European geopolitical risks are also modest, as European governments accelerate defense spending to make up for the Trump administration’s long-term reduction in forces in Europe. Japan is also trying to be a friendly negotiator with the U.S. to get a low set of tariffs.

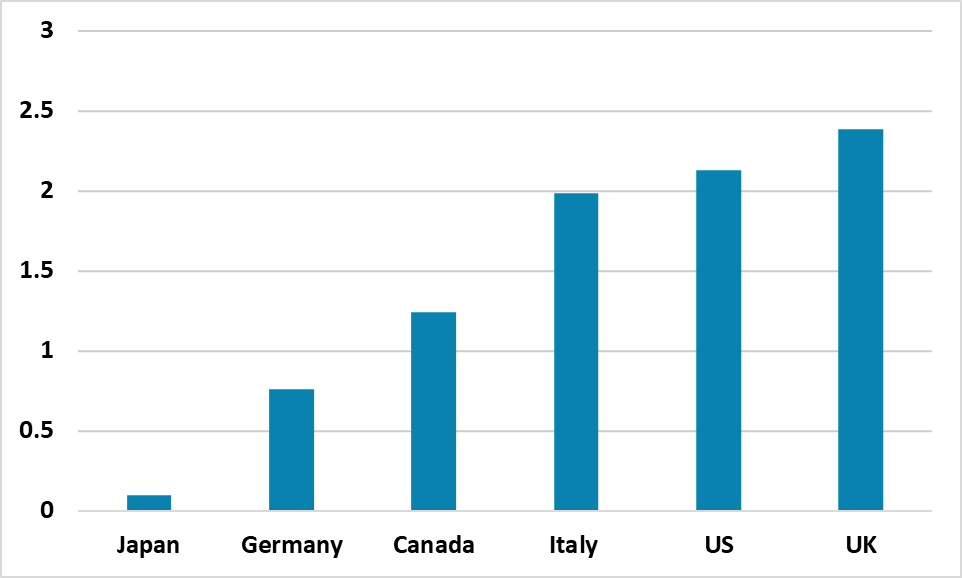

Figure 2: 10yr Government Bond Real Yields using Breakeven Inflation Rate (%)

Source: Bloomberg/Continuum Economics

For long-term bond investors the starting nominal and real yield are important. 10yr U.S. Treasuries have a reasonable real yield of over 2%, as investors expect the boost to inflation from tariffs to be transitory. If 2 round inflation effects were to be larger than expected, then nominal yields in the U.S. would likely rise further. However, from a 2025 portfolio standpoint the key question is whether a U.S. slowdown or recession is seen. If a shallow recession is seen then we could see 3.25% 10yr yields by end 2025 (here), which would mean 12% total returns in 10yr Treasuries. Other major DM government bond markets on a recession would likely see smaller total returns, while the risk of U.S. recession is potentially higher with the U.S. imposing tariffs of all countries. Risk reward in Treasuries could still favor U.S. Treasuries for hedged portfolio investors in 2025. Some further long-term diversification could occur away from Treasuries but this is likely a multi-quarter story (here), given the partial U turn on tariffs reduces the intensity of the trade war.

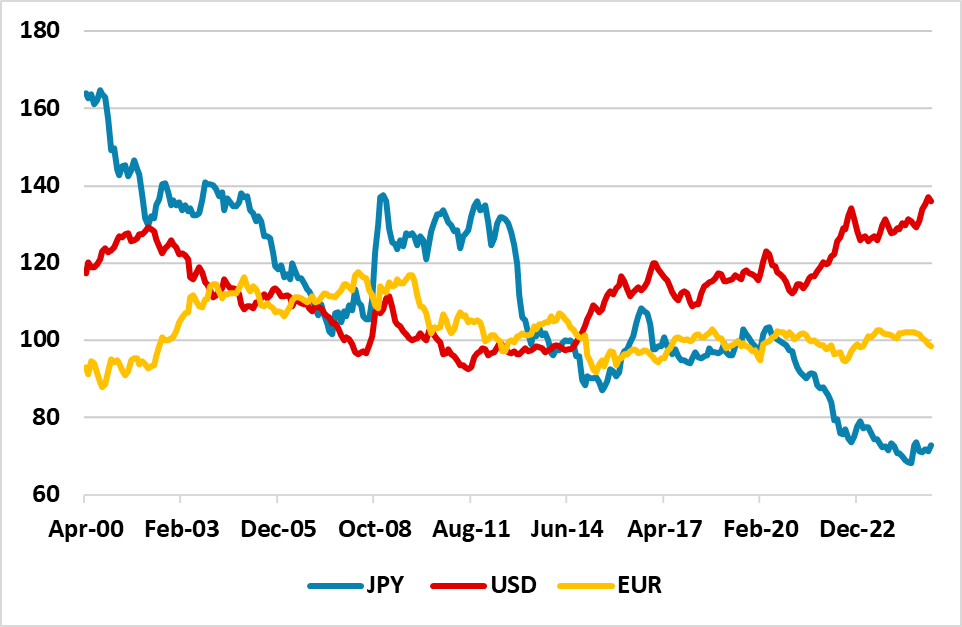

Figure 3: Real Broad Effective Exchange Rates (%)

Source: Datastream/Continuum Economics

The other dimension is whether a safe haven is under or overvalued on a long term basis, as undervaluation can mean currency gains. Figure 3 looks at real effective exchange rate measures for broad CPI adjusted trends and levels. The USD is still significantly overvalued on a broad basis, while the JPY remains noticeably undervalued versus the 25 yr average. Though the nominal EUR is currently high, the real effective exchange rate is close to the average and the EUR still has room to rise this year against the USD to 1.20 and 1.25 end 2026 – we estimate EUR/USD longer term fair value around 1.30. We see scope for the JPY rebound to continue further with 135 USD/JPY end 2025 and 125 for end 2026.