USD flows: Trump lifts equites and USD, though signals are mixed

The US-UK trade deal is underwhelming, if welcome. Trump’s suggestion that tariffs on China could be lowered if talks scheduled this weekend go well is giving the USD a more significant lift, though Trump continues to give mixed signals, making tariff threats alongside a suggestion that equities be bought.

The US-UK trade deal leaves a baseline of 10% tariffs in place, but the UK auto and steel industries have received some relief and US exporters have received some benefits. Trump is suggesting the deal will be the first of many, but is also saying that it is not a template for other countries, while stating that 10% is probably the lowest end for a tariff. This seems consistent with our view that tariffs will end up averaging around 15%, though that will require tariffs on China coming down significantly from current extreme levels.

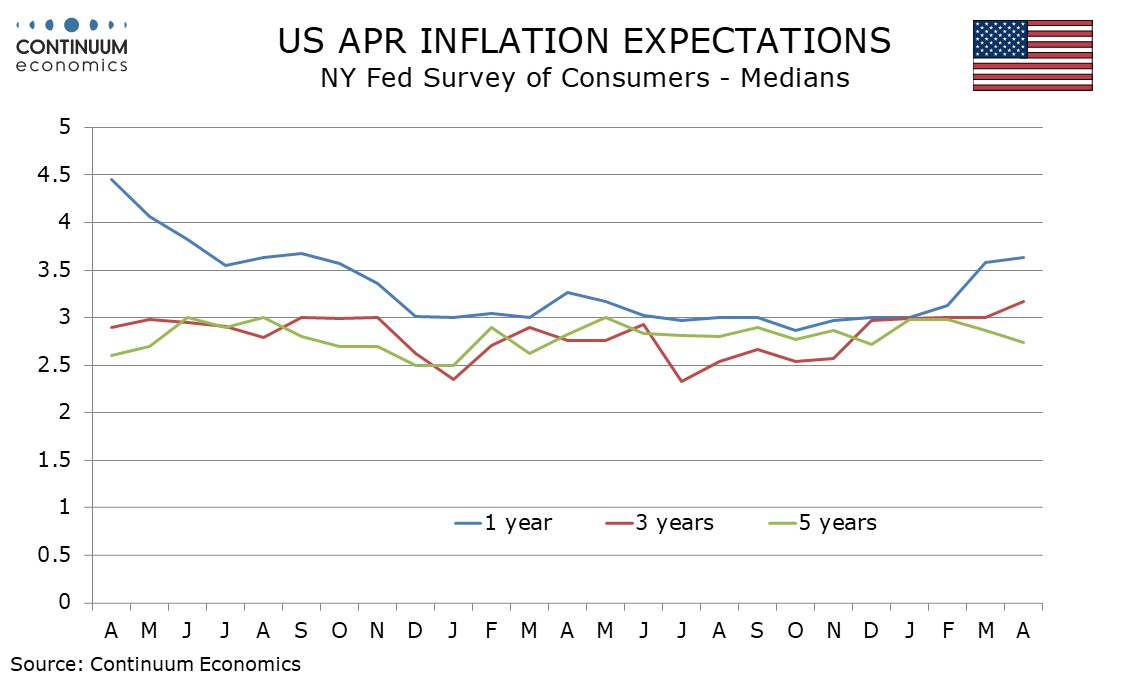

Tariffs still look sure to do some economic damage, but hopes are rising that this will fall short of a recession with the inflation bounce moderate and temporary. Consumers remain concerned, with today’s New York Fed survey showing 21-year inflation expectations up further to 3.63% in April from 3.58% in March, and the 3-year view more worryingly up to 3.17% after four straight months near 3.0%. Still, the 5-year view is coming down, now at 2.74% from 2.86% in March and 2.98% in February.