China Outlook: Reasonable but Unbalanced Growth Trade

• China GDP growth remains reasonable though unbalanced. Net exports will take a hit from the trade freeze in April/May, with the impact likely to ease in H2 with the trade truce. We attach a 65% probability to a U.S./China reaching a new trade deal that reduces the minimum overall tariff to 15-20% imposed by the U.S. -- most likely to be implemented in 2026. AI/High-tech manufacturing and infrastructure investment also provide momentum for growth, while consumption is stabilising at modest levels. We are thus revising up 2025 GDP growth from 4.2% to 4.4%. We maintain the 2026 forecast at 4.5%, as the net exports and residential property headwinds will likely lessen.

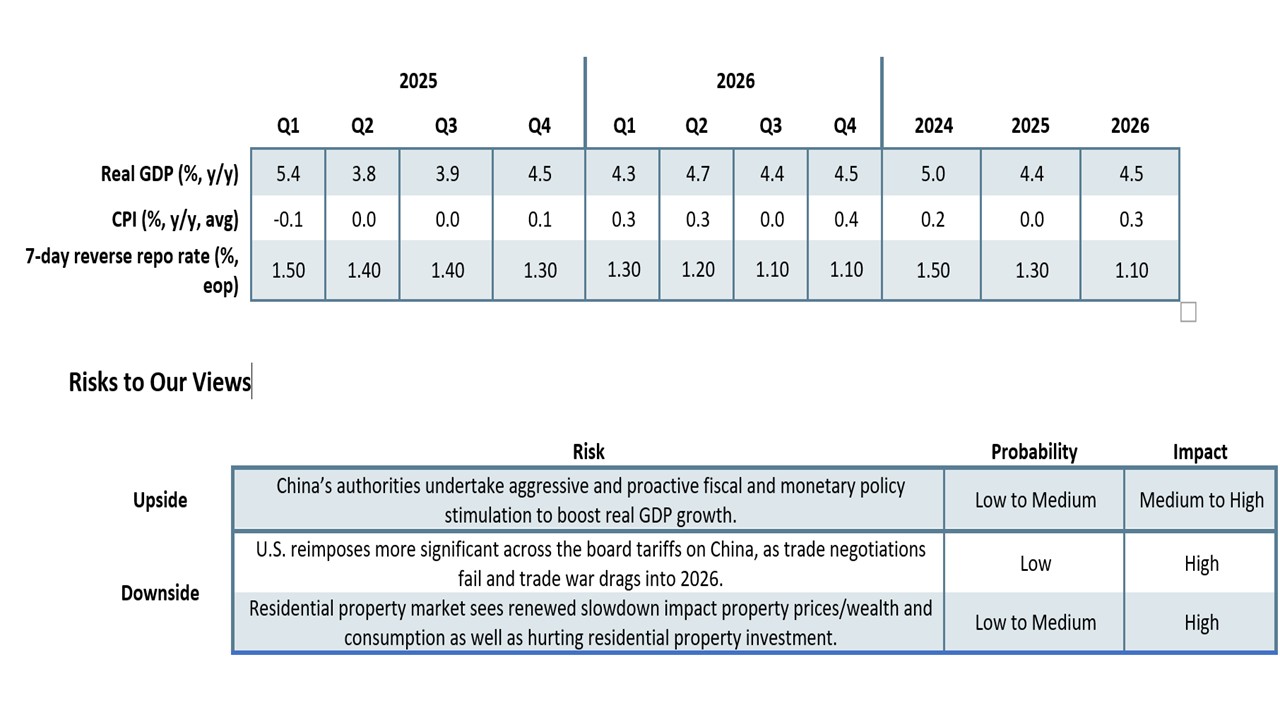

• However, an excess of production over domestic demand means that unbalanced growth continues to cause aggressive disinflation. We now forecast 0.0% for 2025 CPI inflation and 0.3% for 2026. The negative GDP deflator reflects problems in dividing nominal GDP and political desires to hit the 5% real GDP target.

• Further fiscal stimulus beyond March’s NPC measures will be required to achieve a 5% GDP target. Some of this will likely be delivered, but we are unsure whether sufficient stimulus will be seen. Elsewhere, monetary easing is restrained by a desire not to hurt banks profit margins and financial stability. We now look for only one further 10bps 7-day reverse repo rate cut in Q4 2025 and then 20bps in mid-2026 down to 1.1%. We then see the PBOC going on hold. • Risks to the Outlook. U.S./China do not agree a trade deal and tariffs are left at 30% or raised to super high levels, that hurt China net exports and risks a 3.0% growth outcome. Alternatively, a surprise early invasion of Taiwan, though we see this as 5% probability before 2027 (here).

Our Forecasts

Source: Continuum Economics

China growth is trending just below 5%, with the probability of downside risks lower provided that a U.S./China trade deal is eventually reached, but the economy still remains unbalanced. Key points to note

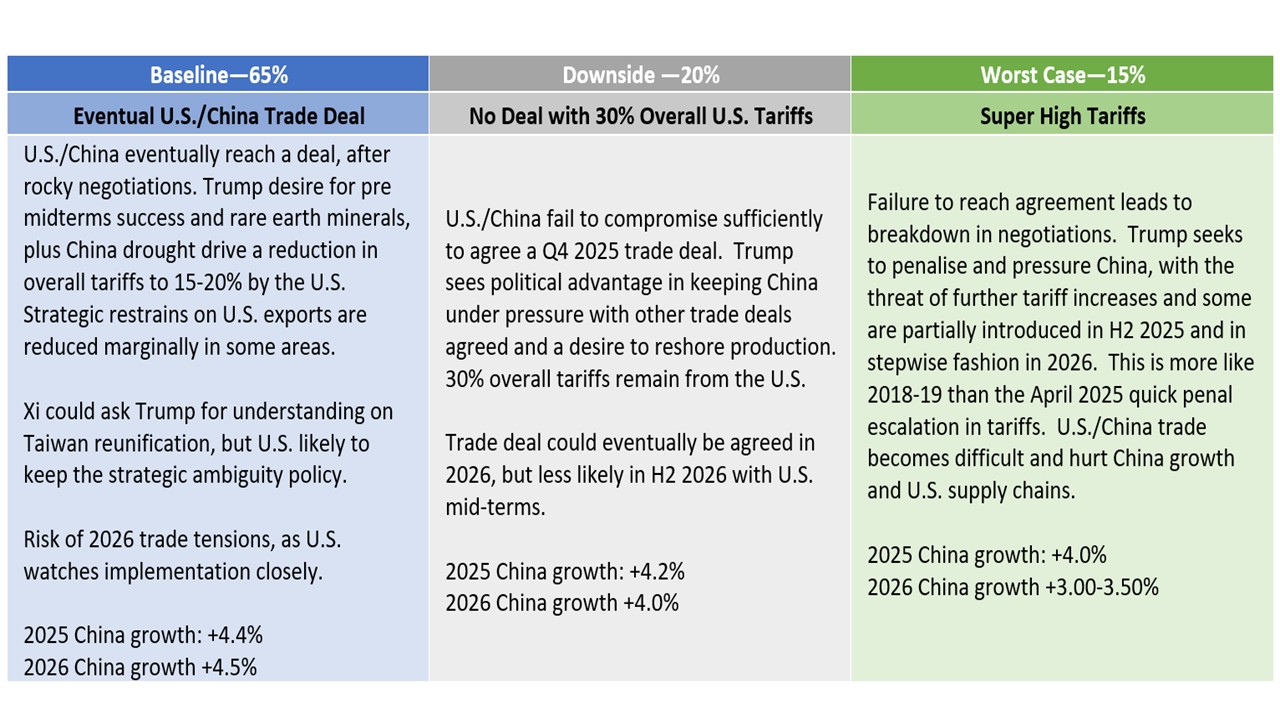

• Net exports. The trade truce in Geneva means that exports to the U.S. have restarted and the fragile nature of U.S./China relations means that an incentive now exists to speed exports to the U.S. at the current 30% tariffs. In terms of a trade deal, the U.S. and China want to avoid a hard break in trade, due to supply chain problems and the hit to growth. However, negotiations will likely be prolonged like 2019, as the U.S. wants more commitments than the phase 1 deal. Even so, Trump has to show progress before the November 2026 mid-terms, while also having a weakness for China rare earth minerals. China also needs to import more food given the current drought. A compromise by both sides is likely in the end and we attach a 65% probability to a deal being reached (Figure 1). This would most likely be Q4 2025. This would mean that net exports are a drag on 2025 GDP growth, especially Q2, but would become less adverse into 2026. However, the other two scenarios are for no deal (Figure 1), as the U.S. and China could find it difficult to reach the necessary compromises. This could be with either 30% tariffs or super high tariffs, which would have adverse consequences for the economy – the latter would see a hard landing to 3% GDP growth.

Figure 1: U.S./China Trade Scenarios

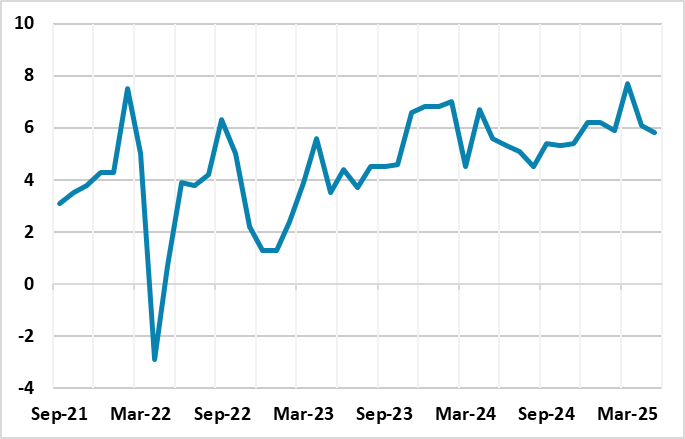

• AI/High-tech production/Infrastructure spending. AI and High-tech manufacturing production remain a bright spot for China’s economy. U.S. bans have seen innovation, which helps China domestically but also in exports as well. Though China tech sector is not a global match for the U.S. tech sector, it can cause competition in certain verticals – especially with more competitive pricing than the U.S. The 10yr budget bill also abandons U.S. efforts in green technology to China global benefit. Meanwhile, the March NPC provided comfort of extra central government infrastructure spending, which is needed as a positive support for GDP growth. Additionally, the ongoing clean-up of local government and Local Government Financing Vehicle (LGFV) balance sheets will likely mean that local infrastructure becomes more positive into 2026.

Figure 2: Industrial Production Yr/Yr (%)  Source: Datastream/Continuum Economics

Source: Datastream/Continuum Economics

• Consumer spending moderate. Retail sales are benefitting from government trade in programs but consumer spending is imbalanced rather than across the board with intermittent softness in consumer discretionary and post COVID catch up spending having been completed. Overall, consumer spending remains moderate rather than strong, with consumer sentiment remaining poor. Households are worried about the slump in the housing market and also weak employment and income growth. Though weak employment growth has been amplified with the April trade freeze with the U.S., exports to the U.S. can see a partial recovery with the trade truce. Meanwhile, though the authorities are trying to show a more business friendly attitude, improvement in hiring and income will likely be slow for most private businesses as we are not seeing a return to the high growth years of 1990-2019.

• Residential property less negative. The residential property sector is becoming less of a negative drag on GDP growth. The collapse in new construction means the flow of new complete homes is getting closer to the sale of properties, while house price declines are slowing in tier 1 and 2 cities. However, the overhang of complete and uncomplete homes remains large, especially in tier 3 cities. This can mean divergence between tier 1 and 2 cities versus tier 3. Households are also cautious about purchases of residential property, as the 2021-23 period has scarred psychology. Overall, the data suggests that nationally the housing market has not reached bottom. Residential property will likely deduct around 0.75% from 2025 growth and 0.5% from 2026. Overall, though we see a hit to GDP from net exports, U.S./China trade is unlikely to see a freeze on our baseline and will gradually recover into 2026. Additionally, residential property investment will be less of a drag on GDP in 2025 and 2026, though overall the data suggests that nationally the housing market has not been reached bottom. AI/High-tech manufacturing, plus existing extra infrastructure spending should provide an underpinning to GDP growth. The AI and high-tech manufacturing momentum are enough, alongside our view of eventual U.S./China trade deal, to led us to revise up 2025 GDP growth from 4.2% to 4.4%. We keep 2026 at 4.5%, as the headwinds will likely lessen next year and consumption is sustained at a modest pace. China still faces aggressive disinflation however (here). We forecast 0.0% for 2025 CPI inflation and 0.3% for 2026, which reflects the excess of production over consumption. Nevertheless, we do not yet see signs that real sector purchases are being delayed by low/weak CPI inflation and this is not CPI deflation. Though the GDP deflator has seen persistently small negative in recent quarters, we see this as being the split of nominal GDP boosting real GDP at the cost of pushing the GDP deflator into negative territory. Real GDP remains more politicised than other data points, especially as weak GDP would be a sign of weakness in China/U.S. trade negotiations.

Fiscal and Monetary Policy

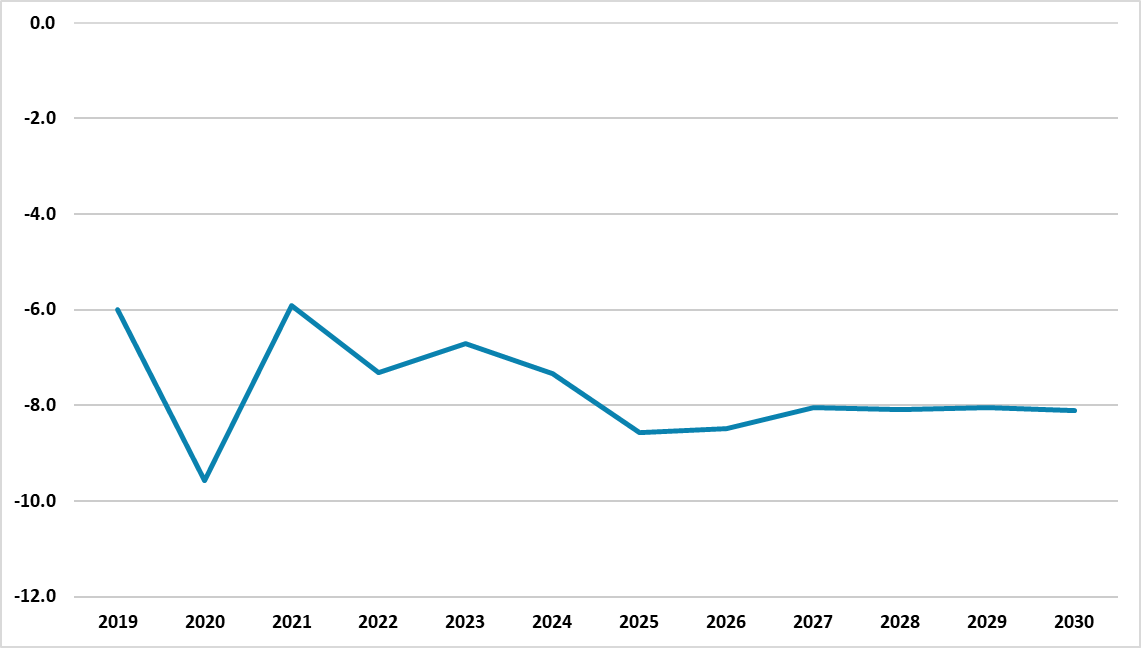

Further fiscal stimulus beyond March’s NPC measures will be required to achieve a 5% GDP target. Some of this will likely be delivered, but we remain unsure whether this will be sufficient. Firstly, the authorities are not in a hurry to actually deliver fiscal stimulation, both as growth is around 5% rather than well below and they want to keep a fiscal reserve in case growth sees more of a deterioration. Secondly, there remains a concern in policy circles that the government deficit and debt trajectory mean only moderate fiscal space, with the authorities’ action suggesting that they believe the IMF estimate for the general government trajectory (Figure 3). One of the key problems is that tax/GDP remains low compared to other middle-income countries.

Figure 3: China Government Deficit/GDP (%) Source: IMF Fiscal Monitor (April 2025)

Source: IMF Fiscal Monitor (April 2025)

In terms of monetary policy, the authorities’ action continues to not be reflected in interest rate and RRR reduction, which arrive at a modest and slow pace. China banking system interest margins are being undermined by official rate cuts (here) and this is restraining the pace and magnitude of rate cuts. Additionally, internal PBOC opposition to ultra-low interest rates and QE remains significant, as seen with the struggle to stop government bond yields going lower over the last 12 months. We now look for only one further 10bps reduction in the seven-day reverse repo rate and 50bps further in the RRR rate in 2025. We see 20bps of reduction in the seven-day reverse repo rate in 2026 and 50-75bps reduction in the RRR rate. The PBOC also feels less pressure with M2 growth rebounding, with the Yuan500bln capital injection to the six state banks likely to be helping credit supply. Meanwhile, the Yuan is less of a binding constraint on monetary policy, as the USD has entered a multi-year downtrend.