U.S./China High Stakes Poker

The economic hit from a hard stop in U.S. imports/exports is too damaging for both sides and our baseline is still for a truce and de-escalation, in the coming weeks. This could be negotiations on a new trade deal with a more moderate reciprocal tariff on both sides and the extra reciprocal tariffs postponed for 90 days or cancelled. A 30-35% probability still exists that no deal will be reached and a hard break between China and the U.S. economically will kick in.

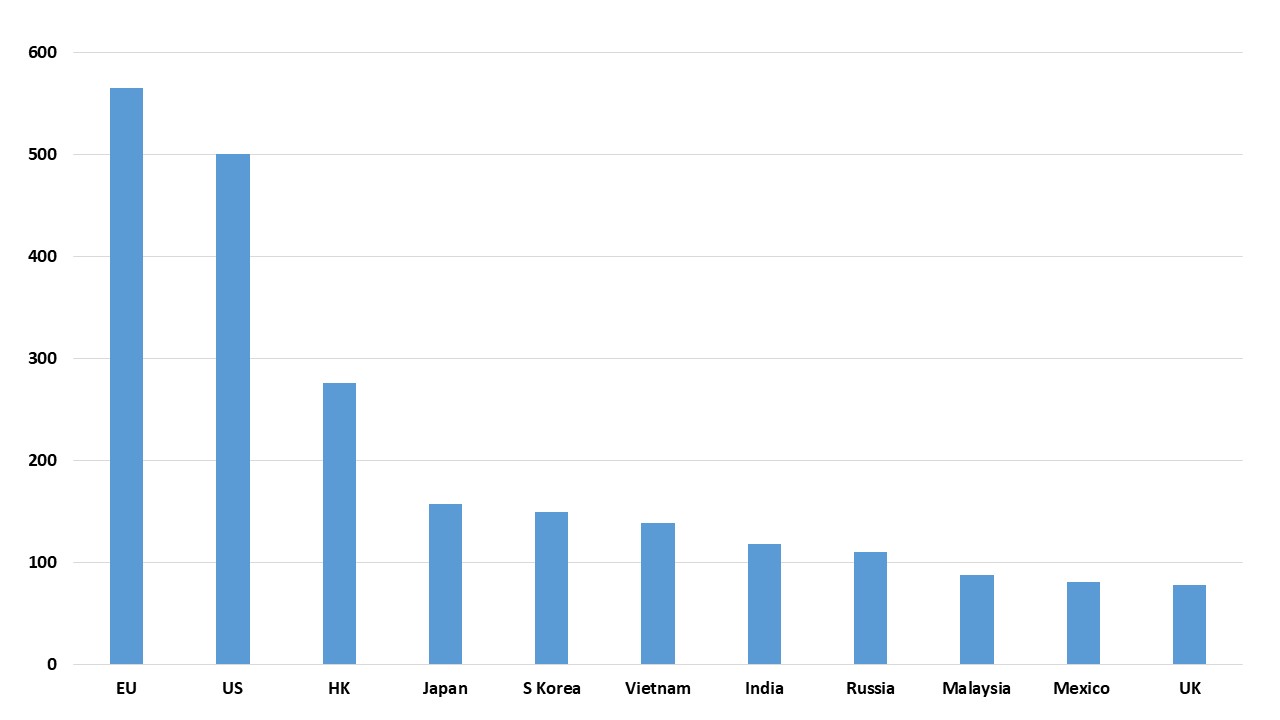

Figure 1: China Exports by Country 2023 (USD Blns)

Source: Comtrade

China on Friday raised tariffs on the U.S. to 125%, while the U.S. has imposed tariffs of up to 145% on China imports. This is producing a temporary hard stop to U.S. imports from China and China imports from the U.S. What started off as a trade war is becoming an economic cold war. China has however signaled that this is the last increase, as both sides reflect on the damage and look for a route towards de-escalation and hopefully a partial removal of some of reciprocal tariffs.

From the U.S. side the 145% is classic Trump maximist implementation, but the 25% Canada and Mexico and global reciprocal tariff ex China were then lowered or restricted a few days afterwards. However, reflecting the pain, the U.S. has decided that the 145% will not apply to phones/computers and some other electrical goods and they will be at 20% on a temporary basis. Trump also says he wants to do a trade deal. Without a deal, a hard stop to U.S./China trade would cause a supply chain crisis in the U.S., as China ships a lot of intermediate goods and parts as well as finished goods. It would take time to switch to domestic producers, while U.S. companies and consumers would also still face tariffs with other countries. China could also easily buy U.S. exports from other countries, as they are mainly oil/LNG/chemicals and soybeans and the last one could hit the politically vocal U.S. farmers. Finally, China could accelerate reserve diversification from U.S. Treasuries (here) and we know that Trump is worried about rising U.S. 10yr yields from the partial U turn on reciprocal tariffs.

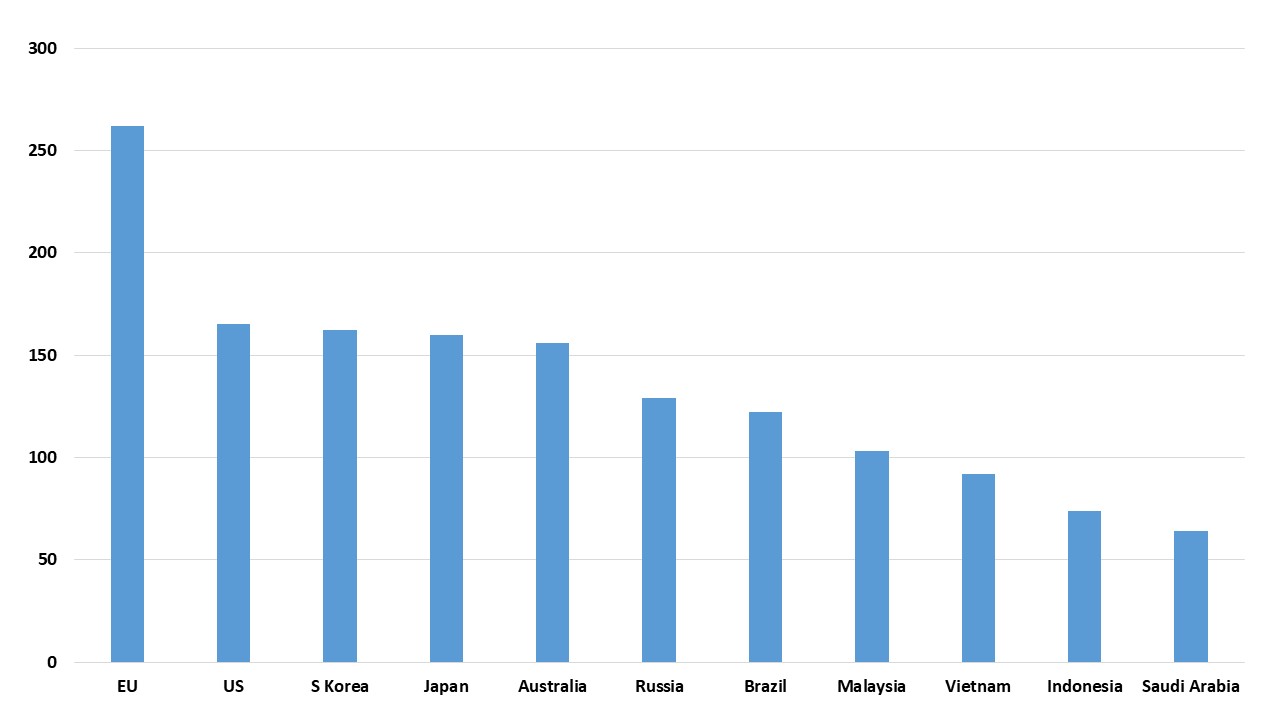

Figure 2: China Imports by Country 2023 (USD Blns)

Source: Comtrade

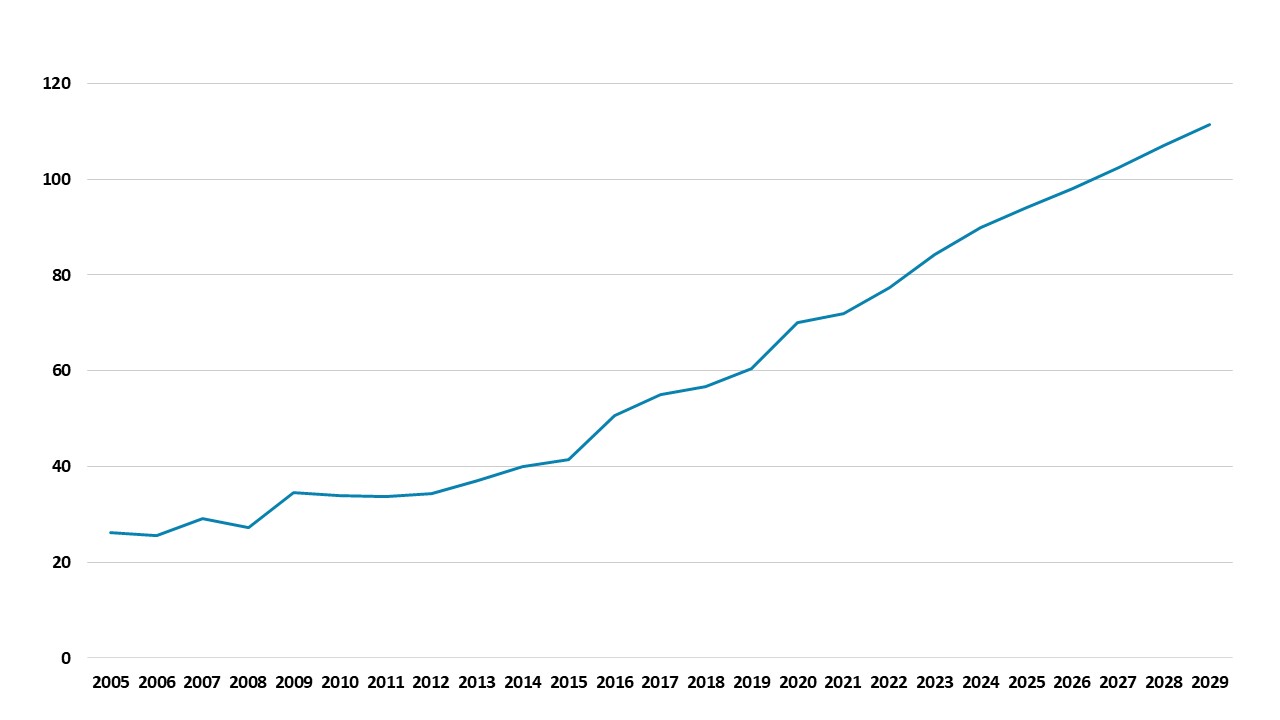

From China viewpoint, the stance all year has been quick negotiations to improving a phase 1 deal (here). If a hard stop to U.S. exports occurs, then this could be a USD500bln direct hit to China’s economy, as it would be difficult to direct goods elsewhere given sluggish demand or shift exports through 3 countries – the U.S. is looking at capping Chinese content through the likes of Mexico and Vietnam. Intra-Asia trade could also slow as well due to global trade uncertainties, while China private sector business confidence would take a further hit. This could knock 2% off China growth in terms of exports, but from a overall GDP standpoint around 1-1.5% depending on whether U.S. imports are replaced or not. This would knock our 4.5% GDP forecast down to 3.0-3.5%. This is a big hit for China and they do not have fiscal space to aggressively ease fiscal policy. Fiscal easing in 2025 has been below expectations at around Yuan2.5trn. Part of the reason is that the authorities feel constrained by the wider surge in government debt (Figure 3) than the official figures show. China authorities also constantly worry about the total government/corporate and household/GDP that has surged since 2007 to over 300% and above the U.S. and EZ.

Figure 3: China Government Debt/GDP (%)

Source: IMF/Continuum Economics (IMF central measure article IV Aug 2024)

This means that the U.S. and China both have good reasons not to want a prolonged hard and disruptive stop to China/U.S. trade. The last 10 days look like a high stake poker game, before negotiations. This would all argue for a de-escalation, which could be negotiations on a new trade deal with lower reciprocal tariff on both sides and the extra reciprocal tariffs postponed for 90 days or cancelled – Trump did the latter in 2019. This could occur as soon as this week.

The one caveat to these economic pressures towards a truce and de-escalation is that President Xi could have decided to have an economic confrontation with the U.S. as part of the long-term strategic struggle with the U.S. Xi will likely want to bring Taiwan reunification onto the negotiation table with the U.S. and try to get a Trump commitment not to intervene in any future China military reunification (here). This means that the standoff is not resolved in 1-2 weeks, but China takes longer. Overall, we still attach a 30-35% probability that no deal will be reached and a hard break between China and the U.S. economically will kick in.