U.S/China Trade Standoff: Odds Remain Towards Truce

On balance, our baseline still remains a U.S./China trade deal (55-60%) being reached, given Trump deal instincts; China desire for a deal and the economic disadvantage of an economic cold war to the U.S. when it is trying to reset trade with all countries. Timeline is Q4 2025 or H1 2026. An alternative moderate probability scenario (30-35%) is that negotiations occur but the two sides fail to agree a trade deal, due to large differences on key areas or that a trade truce is not agreed.

The standoff between the U.S. and China over trade remains, with China demanding all unilateral tariffs are removed. What will happen next?

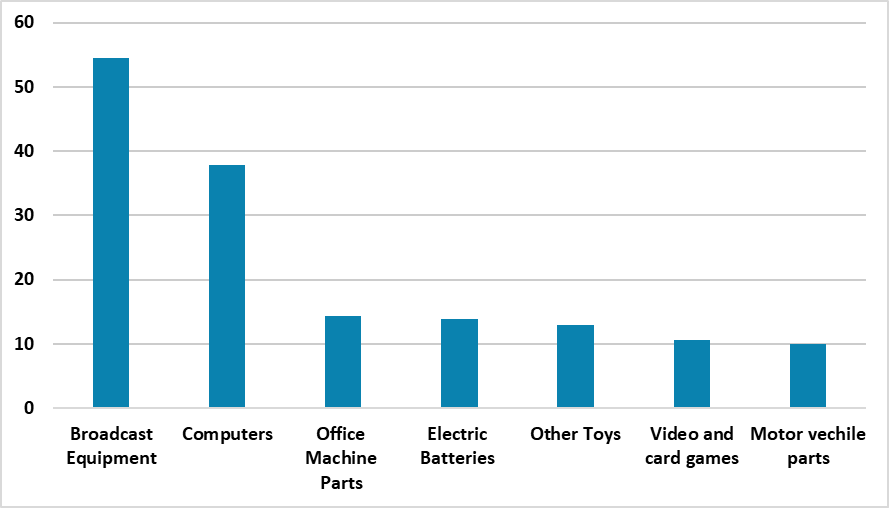

Figure 1: 2023 U.S. Imports from China By Key Products (USD Blns)

Source: BEA/Continuum Economics

The U.S. and China have been showing some flexibility to ease the trade standoff, but the path to a truce remains bumpy. Key points include.

· Trump Lower Tariff Offer. President Donald Trump has hinted at lower tariffs if a deal is struck between the U.S. and China this week, which reflects the growing economic fallout from super high tariffs with China. Once inventories are rundown, production in the U.S. will be impacted in certain sectors given the dependence on parts and intermediate goods from China (Figure 1). This production hit in the U.S. can then hurt employment and income growth as a 2 round effect. The lower tariff for smartphones and electronics already reflects the U.S. inability to diversify away from China in the short-term. As the economy effects on the U.S. worsens and Trump approval ratings softens further, the pressure will intensify for a trade truce with China.

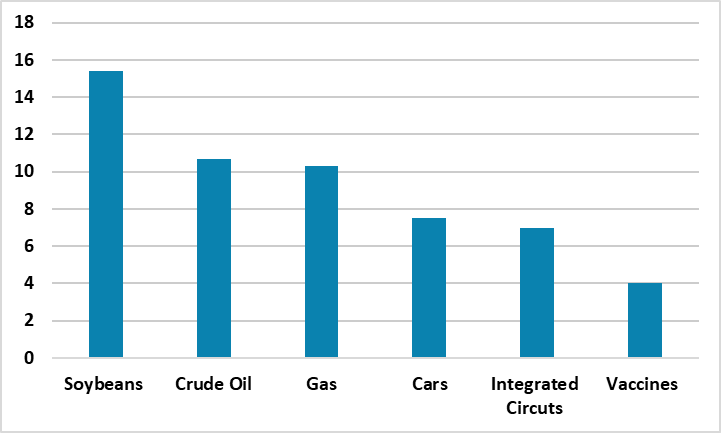

Figure 2: 2023 China Imports from U.S. By Key Products (USD Blns)

Source: BEA/Continuum Economics

· China wants a deal, but acting Tough. China has responded to Trump offer by saying that all unilateral China tariffs should be removed. This could mean a 10% baseline universal tariff and 25% on cars/steel and aluminum like other countries would be acceptable to China. This is likely too low for Trump currently having marched tariffs up to 145%, with reports suggesting that some in the U.S. administration are thinking about 50-60% for China. However, China is hurting as well and considering exempting U.S. imports of hospital goods and ethane from the 125% tariffs. China has also not launched aggressive fiscal stimulus suggesting it still expects the trade hit to be temporary and modest. We feel all of this is posturing by both sides and that an agreed truce will likely be agreed in the next 2-3 weeks with China. This could be a baseline tariff of 20% and/or by exempting more goods from the super high tariffs.

· Taiwan Uncertainty. The one caveat to these economic pressures towards a truce and de-escalation is that President Xi could have decided to have an economic confrontation with the U.S. as part of the long-term strategic struggle with the U.S. Xi will likely want to bring Taiwan reunification onto the negotiation table with the U.S. and try to get a Trump commitment not to intervene in any future China military reunification (here). This means that the standoff is not resolved in 2-3 weeks, but China takes longer or not at all.

This all means that extra uncertainty exists around our baseline that negotiations would start in the spring/summer and a U.S./China trade deal would be reached in Q4 2025/H1 2026. An alternative moderate probability scenario (30-35%) is that negotiations occur but the two sides fail to agree a trade deal, due to large differences on key areas or that a trade truce is not agreed. This would leave an economic hard break between the U.S. and China, which would initially be damaging to both sides. In some ways this would be an economic cold war.

On balance, our baseline still remains a trade deal (55-60%) being reached, given Trump deal instincts; China desire for a deal and the economic disadvantage of an economic cold war to the U.S. when it is trying to reset trade with all countries.