Trump Under Pressure

A deteriorating economic; volatile financial markets and weakening approval ratings are all putting pressure on the Trump administration to do trade deals. However, Trump instincts means he still likes tariffs, while negotiations will not be quick with China restraints and non-tariffs list desired by the U.S. This could mean that outline deals are only agreed with a number of countries by end June, rather than full deals.

President Donald Trump is under pressure to deliver trade deals and avoid a recession, which is prompting blame shifting to the Fed. How will trade deals progress?

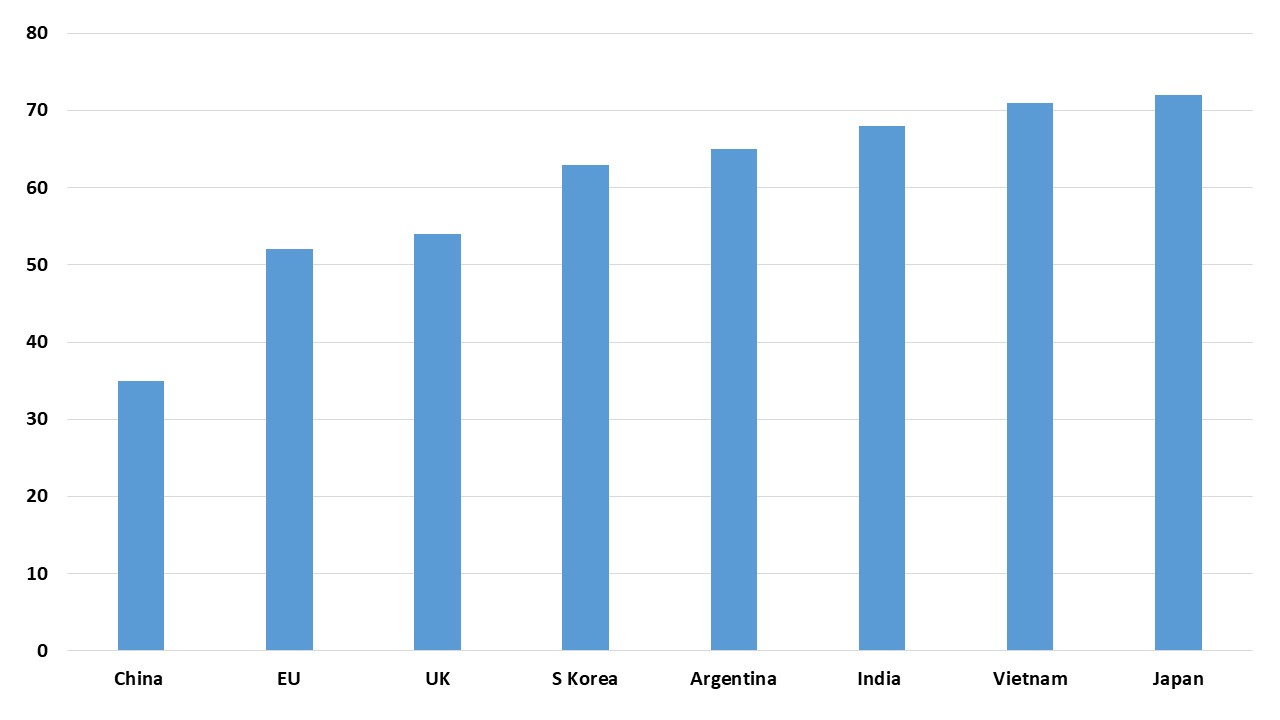

Figure 1: Betting Odds For A Trade Deal by End June (%)

Source: Polymarket

U.S. PR spin over potential trade deals is a lot more optimistic than briefing from other countries, with Japan suggesting the next set of key discussions are in May; India hoping for a deal by September and the EU saying that negotiations are currently going nowhere. The Trump administration optimism reflects a fear that the tariff tsunami will not only slow the economy but could cause a recession, due to the direct tariff effects and the impact on business confidence and hiring/investment. Trump blame and threats towards the Fed are typical deflection tactics. What next?

Trade deals will still likely be agreed or agreed in principle for a number of countries by the summer (Figure 1), as the Trump administration remains under three fold pressure from the economic numbers; financial markets (here) and U.S. voters approval ratings. Growth will likely slow and inflation pick-up with the April and May releases and in turn hit Trump’s approval ratings. However, quick progress to a trade deal faces a number of obstacles (here). Firstly, for now Trump still believes that the U.S. economy can benefit long-term from a shift of production back to the U.S. and increased tariff (tax) revenue for tax cuts. Last week he was still insisting on the 10% minimum, though the 25% pharma and semiconductors tariff risk has been pushed back by deciding to go to consultation first. Secondly, China is playing poker with Trump (here) by not caving into U.S. pressures. The new U.S. tactic is to sign trade deals with Japan, India, Vietnam and S Korea first, which will include restrictions on China reexports through these countries. This will likely slowdown deals. Finally, U.S. negotiators are asking for non-tariff concessions and sectoral commitments, which makes negotiations more complex. This could mean that outline deals are only agreed with a number of countries by end June, rather than full deals. The Trump administration could be pressured to delay extra reciprocal tariffs until October. We also remain of the view that the next couple of weeks will likely see China and the U.S. agreeing a truce (here); a 90 day delay in U.S./China extra reciprocal tariffs (but not the 20% already implemented) and trade negotiations. All of this is consistent with our view that around 15% tariffs are the most likely to be implemented versus the current 20%. Trump on Tuesday hinted in this direction. This is still a hit to the U.S. economy.

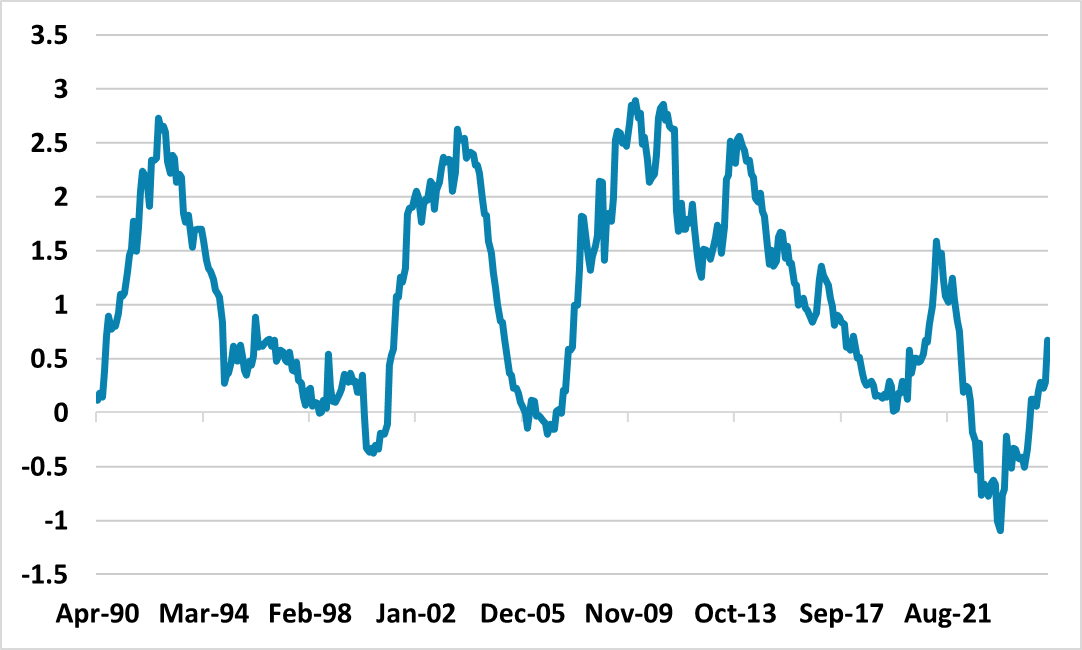

Figure 2: 10-2yr U.S. Treasury Curve (%)

Source: Datastream/Continuum Economics

Trump could compound the damage if he actually sacked Fed chair Powell, as an act of retribution. A new Fed Chair would also not be able to guarantee aggressive easing from the Fed, as other FOMC voters would still be guided by GDP v inflation prospects. Global holders of U.S. Treasuries (here) would still question the administration attack on Fed independence and this could cause a further steepening of the 10-2yr U.S. yield curve (Figure 2). This could further dent foreign equity holders view of U.S. exceptionalism and see further reduction in overweight U.S. equity positions and the USD (here). It is more likely that Trump keeps on blaming the Fed chair and the Fed to deflect pressure, but this can still cause unease among investors. Already on Tuesday, Trump appeared to backtrack for now over Powell threats. All of this will be forgotten if the economic data shows the U.S. economy actually heading to recession, as the Fed would then likely cut aggressively and we would see 10yr U.S. Treasury yields down to 3.25%. However, it would intensify pressure on the U.S. equity market and the USD.