Brazil

View:

October 01, 2025

AI/Humanoid Robots and Disinflation?

October 1, 2025 9:40 AM UTC

· Overall, a number of forces from the AI wave will impact inflation. Power demand could push up power prices, but productivity enhancements and product innovation could be disinflationary like Information and Communications technology (ICT). One other key uncertainty on a 1-5 year

September 23, 2025

Outlook Overview: Into 2026

September 23, 2025 8:25 AM UTC

· The critical question is how much the U.S. economy is slowing down with the feedthrough of President Donald Trump’s tariffs to boost inflation and restrain GDP growth, with the effective rate currently around 17% on U.S. imports. Though semiconductor tariffs are likely, the bulk of

Equities Outlook: Correction Then Up In 2026

September 23, 2025 7:15 AM UTC

• The U.S. equity market’s bullishness reflects good corporate earnings reality, buybacks and the AI story. However, we feel that the U.S. economy can deteriorate still further in the coming months, as the lagged effects of tariffs boost inflation and restrain spending/hurt corporate ea

September 18, 2025

Brazil: 15% Well Into 2026

September 18, 2025 6:29 AM UTC

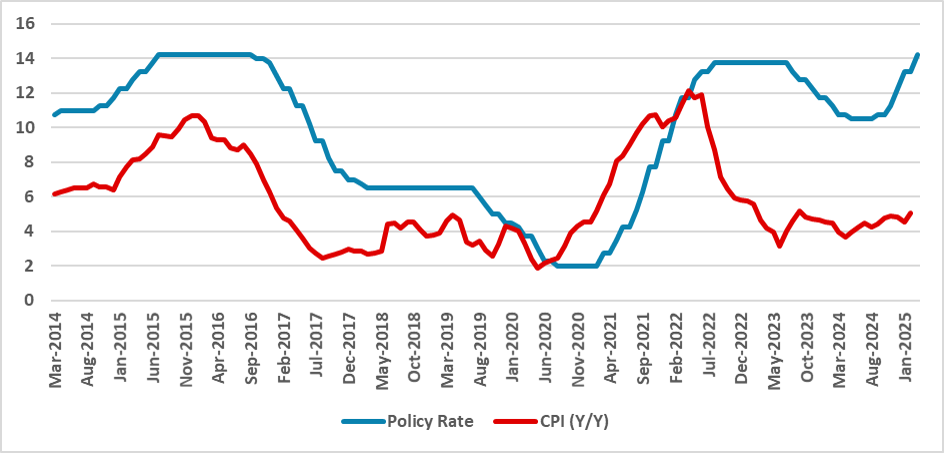

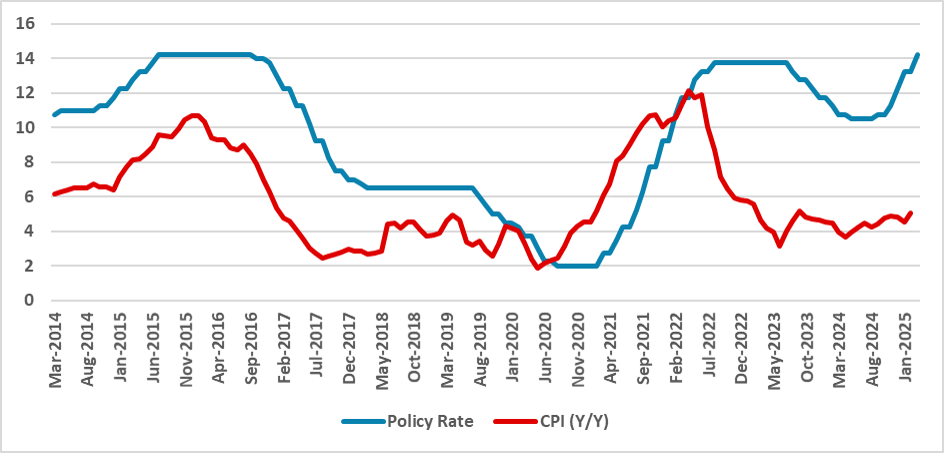

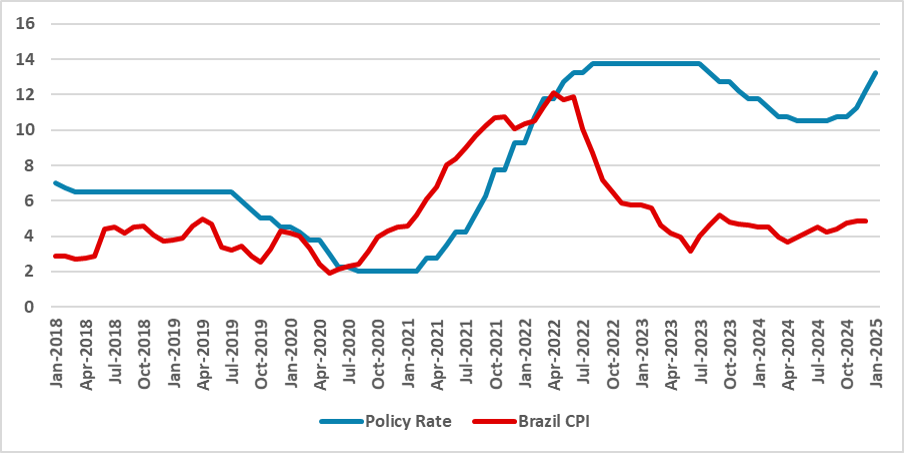

The BCB statement was clear that the deanchored inflation picture still requires interest rates to be kept at current levels for a very prolonged period of time. The consensus for economists is that this will change in Q1 2026 with a 50bps cut, though ideas of December are fading. We suspect it

September 08, 2025

August 07, 2025

EM Rates: Domestic Fundamentals Dominate

August 7, 2025 9:30 AM UTC

Once trade is agreed with the U.S., the good fundamentals actually argue for a 10yr Mexico-U.S. spread close to 400bps and this is our favored strategic risk reward for big EM government bonds. In Brazil a case can be made for a 12.75% policy rate end 2026 and 10% in 2027, but this could only mean 1

July 28, 2025

Food Glorious Food

July 28, 2025 10:15 AM UTC

· Global food prices should see small increases in the future, as production continues to rise broadly in line with increasing demand driven by population and a rising consumption per person in EM countries. However, China will remain dependent on food imports given it has limited roo

July 24, 2025

EM Currencies with a USD Downtrend

July 24, 2025 10:15 AM UTC

· BRL, ZAR and MXN have been helped by FX carry trades and bond inflows on still wide interest rate differentials. However, actual reciprocal tariff risks are high for all three countries and a wave of profit-taking could be seen. Elsewhere, though we see a U.S./China trade deal by

July 03, 2025

U.S. Assets and Valuation

July 3, 2025 9:30 AM UTC

The U.S. equity market has returned to be clearly overvalued on equity and equity-bond valuations measures and is vulnerable to a new correction in H2 on any moderate bad news (e.g. further economic slowing and corporate earnings downgrades). In contrast, U.S. Treasuries are at broadly fai

June 25, 2025

EM FX Outlook: USD Less in Favor, but EM Mixed

June 25, 2025 8:05 AM UTC

• EM currencies face cross currents on a spot basis. The USD downtrend against DM currencies can be a positive for undervalued or strong EM currencies. This could benefit the Brazilian Real (BRL), Mexican Peso (MXN) and Indonesian Rupiah (IDR), though moves will be choppy with occasiona

Outlook Overview: Trump’s Fluid Policies

June 25, 2025 7:20 AM UTC

· President Donald Trump still wants to use the tariff tool, and we see the eventual average tariff rate being in the 13-15% area, lowered by deals but increased by more product tariffs. Any lasting legal block on reciprocal tariffs will likely see the administration pivoting towards ot

June 24, 2025

Equities Outlook: Choppy Then 2026 Gains

June 24, 2025 8:15 AM UTC

Though the U.S. equity market has rebounded, we still scope for a fresh dip H2 2025 to 5500 on the S&P500 as hard data softens further to feed into weaker corporate earnings forecasts and CPI picks up and delays Fed easing. However, the AI story is still a positive, while share buybacks

June 19, 2025

Brazil: Last Hike And Then Long Hold

June 19, 2025 6:33 AM UTC

Though the BCB surprised and hiked by 25bps to 15%, the statement signalled that policy will now go on hold for a very long period. Some economists feel that by year-end, that the BCB will be confident enough to move from very restrictive to restrictive and lower the SELIC rate. We would suspect

June 03, 2025

May 16, 2025

Big EM’s: Cyclical Tariff Hit V Structural Drivers

May 16, 2025 10:00 AM UTC

China, India and Brazil are all seeing cyclical slowdown for varying reasons, with China likely to be hardest hit by adverse net exports due to Trump’s tariff wars. Though financial repression in China can allow further fiscal stimulus, the household sector and residential property investment are

May 08, 2025

Brazil: Reaching the Rate Peak

May 8, 2025 6:43 AM UTC

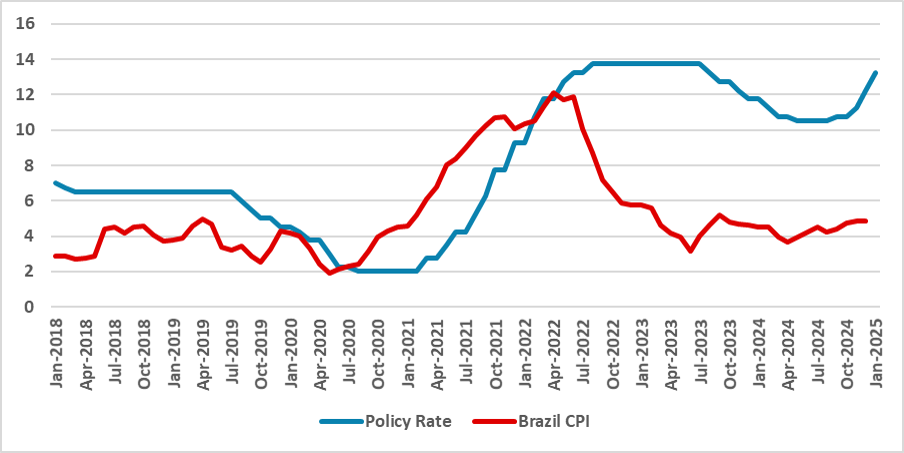

Forward guidance from the BCB after the 50bps hike to 14.75% suggests that we are close to a rate peak, with inflation concerns now cited on both sides. The disinflationary impact of Trump tariffs on global trade and commodity prices is now being watched, as BCB members have signaled over the last

April 24, 2025

USD Rebalancing: Some to EM?

April 24, 2025 8:30 AM UTC

Some portfolios rotations towards EM assets will likely be evident, as we see the USD decline is now extending and broadening. However, flows will likely be selective, both given underwhelming EM performance in the last 5-10 years and the uncertainty over how much Trump will reduce reciprocal tari

April 23, 2025

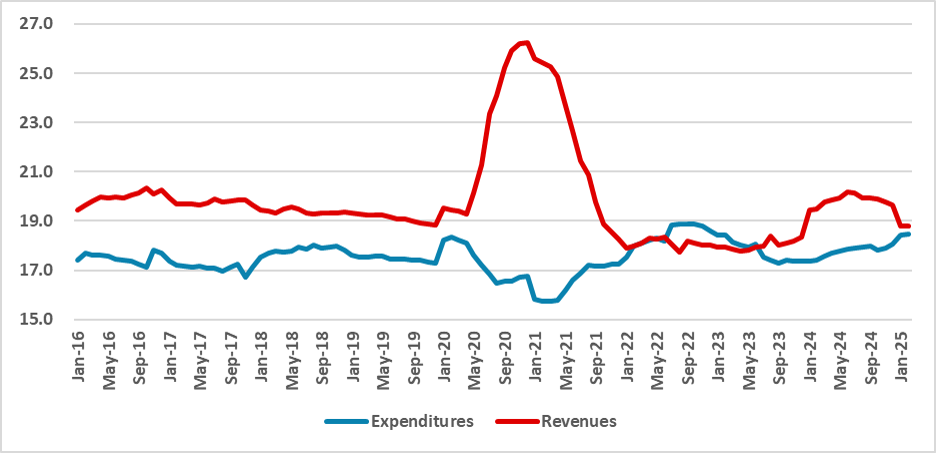

Brazil: Fiscal Result Improves but Structural Changes Remains in Doubt

April 23, 2025 5:57 PM UTC

Brazil’s fiscal data shows slight improvement, with a 0.1% primary deficit by February and a 2024 deficit in line with targets, excluding flood aid. The 2025 goal is a 0% deficit, but structural issues remain. Recent gains stem from reduced court-ordered payments and delayed hiring. However, risin

April 22, 2025

Foreign Official U.S. Treasury Holders: The Kindness of Strangers

April 22, 2025 7:30 AM UTC

Official holdings of U.S. Treasuries show a mixed picture with China, Brazil and Saudi Arabia well off peak holdings. Two drivers of some of these country flows are the peak in global central bank FX reserve holdings in 2021 and an increased holdings of other currencies in the last decade. Neverth

April 15, 2025

Nervous U.S. Long Term Asset Holders

April 15, 2025 8:30 AM UTC

Overall, foreign equity investors can no longer count on U.S. exceptionalism and could face lower long-term corporate earnings growth, which at a minimum will likely slow net inflows. Bond investors also face ongoing policy volatility, which likely means a need for an extra risk premium – t

April 11, 2025

Brazil CPI Review: March Acceleration, Hike Confirmation

April 11, 2025 2:21 PM UTC

March CPI in Brazil rose 0.6%, above expectations, pushing the annual rate to 5.5%. Broad-based price increases, especially in food, signal persistent inflation pressures. Core inflation, notably in services, is well above the BCB’s target, and external volatility adds risk. With activity and cred

April 10, 2025

Trade Deals with the U.S.: Pressures and Obstacles

April 10, 2025 7:17 AM UTC

Pressures to do trade deals include the weaker U.S. economy and higher inflation when it arrives/foreigners becoming nervous of their USD30trn plus holdings of U.S. securities and more crucially risks to Trump and GOP approval ratings from Republican voters. Obstacles to quick trade deals include Tr

April 08, 2025

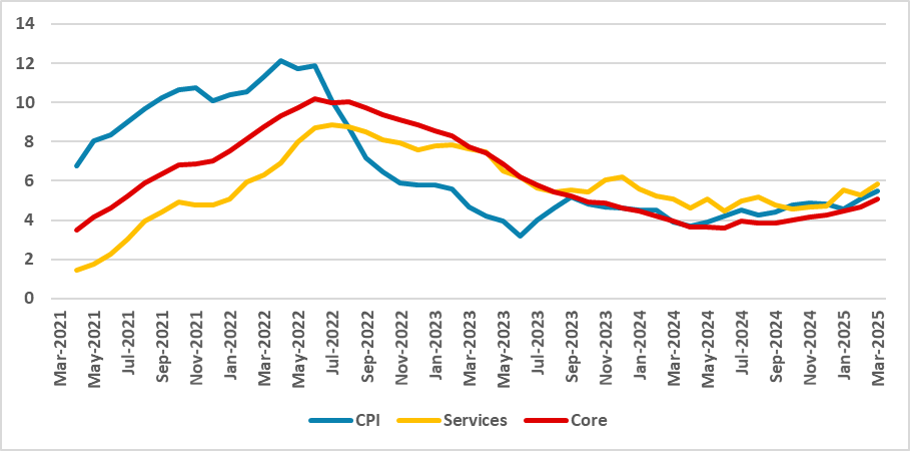

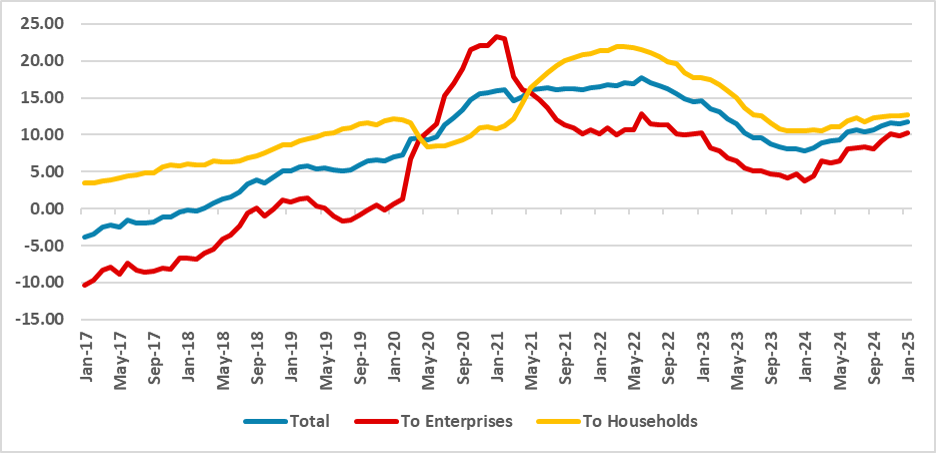

Brazil: Credit Accelerating Despite Higher Rates

April 8, 2025 6:44 PM UTC

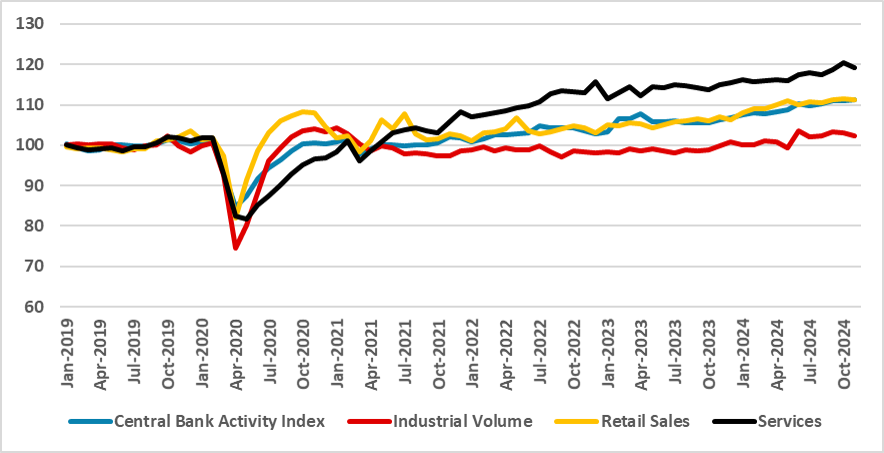

The Brazilian Central Bank (BCB) has resumed raising the policy rate due to persistent inflation concerns, despite expectations of credit deceleration. In contrast, credit has accelerated in recent months, indicating that the credit channel through monetary policy may be compromised, increasing disi

Reciprocal Tariffs: The Hit To Other Countries

April 8, 2025 9:30 AM UTC

Overall, we are still assessing the effects on non U.S. countries from the tariffs being imposed by the U.S. via direct trade/business investment/currency and financial & monetary conditions swings. The impact will be adverse to GDP, but for some major countries could be less than the U.S. How

March 31, 2025

U.S. Trade Surplus Countries: No Special Treatment?

March 31, 2025 9:04 AM UTC

Quick dilutions of tariffs or exemption will likely be slow in coming for countries that the U.S. has trade surpluses with, as the Trump administration are currently more focused on tariffs for tax revenue and trying to switch production back to the U.S. than trade deals. Trade policy uncertainty

March 27, 2025

Car Tariffs Then Lenient Reciprocal Tariffs?

March 27, 2025 8:59 AM UTC

The 25% tariffs on cars underlines that tariffs are not just about getting better trade deals, but in Trump’s view raising (tax) revenue and trying to shift production back to the U.S. Combined with other tariffs being implemented, plus policy uncertainty, we see a moderate overall hit from t

March 26, 2025

LatAm Outlook: Navigating the Uncertainty

March 26, 2025 9:56 PM UTC

· Brazil and Mexico economy are likely to decelerate in terms of growth in 2025, although we see this being stronger in Mexico. Mexico institutional reforms and its close ties with U.S. increases uncertainty for 2025, especially after Trump victory, and the menaces of Trump imposing tar

Outlook Overview: Navigating the Turbulence

March 26, 2025 9:30 AM UTC

· More tariffs will arrive from the U.S. from April with product (car, pharma, semiconductors and lumber) and reciprocal tariffs. President Trump has a 3-part approach to tariffs to raise (tax) revenue; bring production back to the U.S. and get fairer trade deals. This means some of t

EMFX Outlook: Divergence versus the USD

March 26, 2025 9:16 AM UTC

EM currencies will be helped by the ongoing USD downtrend against DM currencies, but prospects also depend on relative inflation differentials versus the USD and starting point in terms of valuations. The Brazilian Real (BRL), Mexican Peso (MXN) and Indonesian Rupiah (IDR) should all make modest s

Equities Outlook: Turbulence Ahead

March 26, 2025 9:05 AM UTC

· U.S. trade wars will likely hurt U.S. growth and raise inflation, with only small to modest Fed easing and a 10yr budget bill that will likely be neutral to negative for the economy. With valuations still very high (Figure 1), we see scope for a correction to extend into mid-year th

March 25, 2025

BCB Minutes: Caution Rather than Optimism

March 25, 2025 10:51 PM UTC

The Brazilian Central Bank (BCB) raised the policy rate by 100bps to 14.25% amid signs of economic deceleration, including slower growth, job creation, and consumption. The BCB highlighted external uncertainties, such as U.S. trade policy, and domestic challenges with rising inflation. It emphasized

March 21, 2025

Trump Product and Reciprocal Tariffs

March 21, 2025 9:00 AM UTC

It appears that we will get bad news from April 2 on extra tariffs before any good news. Firstly, the announcement effect of tariffs for many countries and extra products will hurt U.S. business and consumer sentiment. Secondly, part of the reason for tariffs is extra tax revenue and to try to s

March 19, 2025

BCB Review: Confirming More Hikes

March 19, 2025 10:38 PM UTC

The Brazilian Central Bank (BCB) raised the policy rate by 100 bps to 14.25% and signaled further hikes, likely reaching 15.0% by May, potentially ending the current tightening cycle. The BCB emphasized inflation concerns and strong economic activity, suggesting a hawkish stance. Fiscal policy was n

March 12, 2025

Brazil CPI Review: 1.3% Monthly Growth, with Seasonal Impacts

March 12, 2025 10:43 PM UTC

Brazil's February CPI increased by 1.3%, the highest in 22 years, largely driven by the removal of subsidized electricity bills, which boosted Housing by 4.4%. The year-over-year inflation rose to 5.1%, above the BCB's target. Key contributors included Education (up 4.4%) and Food and Beverages (up

March 10, 2025

Trump and Dollar Policies

March 10, 2025 6:04 AM UTC

The Trump administration could decide to more broadly talk the USD down or less likely try to reach a cooperative Mar A Lago accord with big DM and EM countries. A more cohesive alternative is a forced currency deal for countries to appreciate their currencies to avoid more tariffs and withdraw

March 07, 2025

Brazil GDP: 3.4% Growth in 2024, but Deceleration in Q4

March 7, 2025 10:03 PM UTC

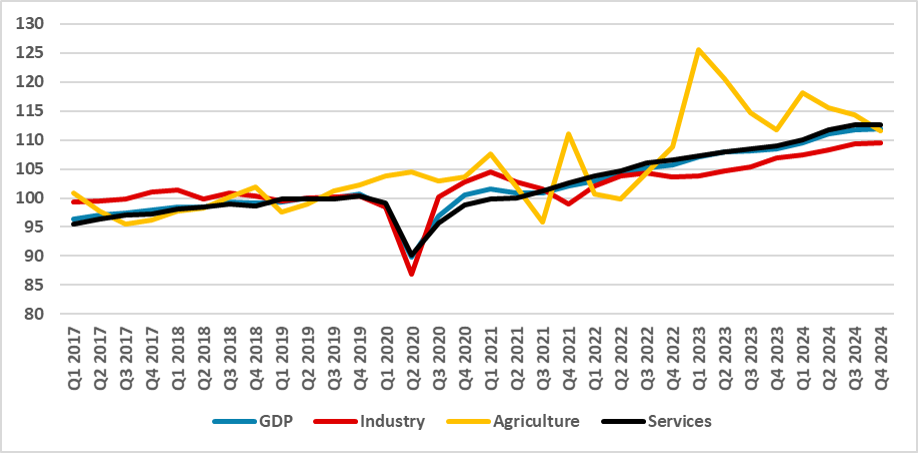

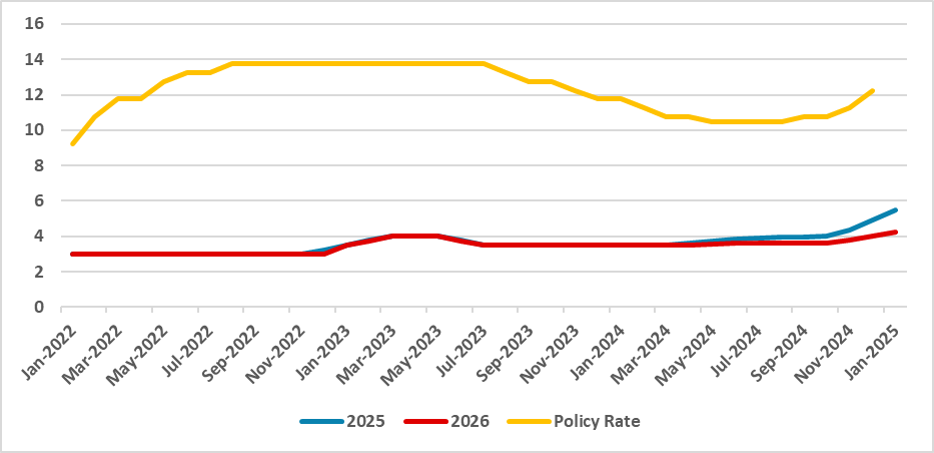

Brazil’s economy grew 3.4% in 2024, exceeding forecasts of 1.6%, with a 0.2% growth in Q4, reflecting a significant slowdown from Q3’s 0.9%. Key sectors like agriculture contracted, while industry and services showed modest growth. Investment and government consumption were the main drivers, tho

March 05, 2025

February 27, 2025

Brazil: Some Deceleration on Labour Markets, But Still Strong

February 27, 2025 7:53 PM UTC

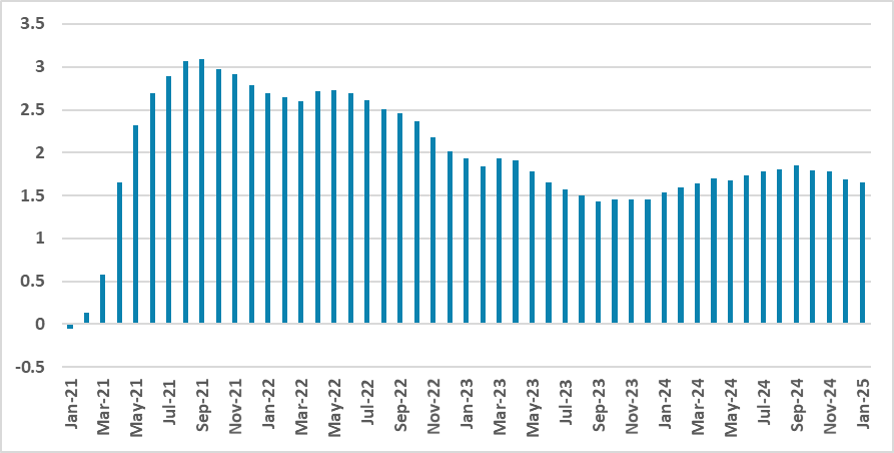

Brazil's labor data through January indicates a slight deceleration in job creation, with annual net formal job growth at 1.6 million, above the 1.4 million registered in July 2023. While the unemployment rate rose slightly to 6.5%, it remains lower than January 2024. Admission salaries are growing

February 18, 2025

Brazil: Activity Strong in Q4 but Some Marginal Deceleration

February 18, 2025 10:04 PM UTC

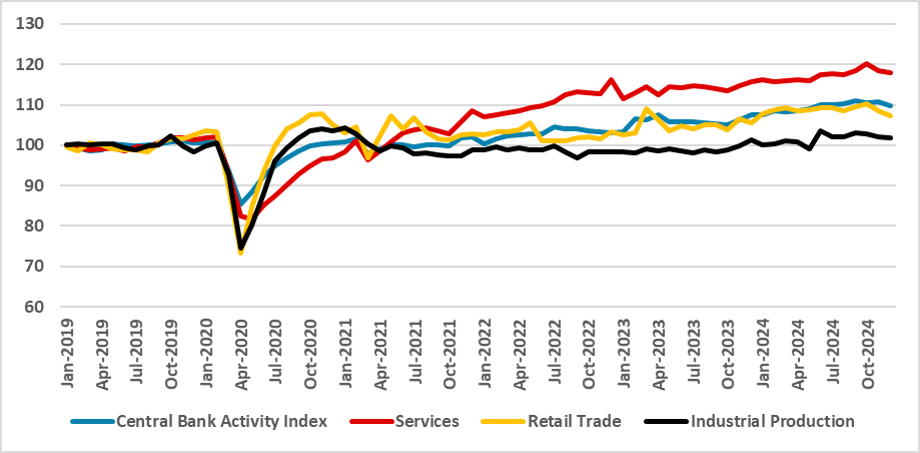

We see Brazilian economy growing 1.0% in Q4 and is expected to expand 3.6% in 2024, surpassing initial forecasts. However, monthly data shows signs of weakness, with contractions in services, industry, and retail trade in in December. Despite tight monetary policy (13.25%), the expected slowdown has

February 17, 2025

Reciprocal Tariffs and Reducing Bilateral Trade Imbalances

February 17, 2025 10:28 AM UTC

· President Trump’s executive order on reciprocal tariffs has not produced much market reaction, both as the proposals will not be delivered to the president until April 1 and the process of Commerce/U.S. Treasury and Homeland Security input is seen reducing the odds of penal tariffs.

February 12, 2025

Brazil CPI Review: Mixed Signs from January Inflation

February 12, 2025 12:33 AM UTC

Brazil’s CPI rose 0.16% in January, lowering Y/Y inflation to 4.5% from 4.8%. A temporary electricity discount drove the decline, while Food (+1%) and Transport (+1.3%) showed worrying increases. Core inflation rose 0.7%, with Services CPI jumping to 5.4%, partly due to seasonal healthcare costs.

February 11, 2025

Trump’s Tariffs: Steel Then Reciprocal and Then Cars

February 11, 2025 1:23 PM UTC

The 25% Steel and Aluminum tariff could have small to modest adverse inflation and GDP growth impacts on the U.S., but the prospect of reciprocal and more product and country tariffs create trade policy uncertainty/supply chain disruption and paperwork problems. This could amplify the impact of

February 04, 2025

BCB Minutes: Detailing the Deterioration

February 4, 2025 6:29 PM UTC

The BCB raised rates by 100bps to 13.25%, signaling another hike in March. External uncertainty remains, but domestic risks worsened, with inflation expectations rising. The BCB stressed fiscal-monetary coordination and warned about policy distortions. Despite markets pricing a 15% rate, we expect s

January 30, 2025

BCB Review: Maintaining the Course

January 30, 2025 6:09 PM UTC

The Brazilian Central Bank (BCB) raised the policy rate by 100bps to 13.25%, signaling another hike in March while monitoring economic data. The statement had a neutral-to-dovish tone, with inflation risks stemming from services CPI, unanchored expectations, and fiscal policy. Market projections see

January 27, 2025

BCB Preview: 100bps Hike Will Buy Some Time

January 27, 2025 7:09 PM UTC

The Brazilian Central Bank is expected to maintain its course with two 100bps hikes, reaching 14.25% by March. Inflation forecasts for 2025 exceed the target, necessitating a firm policy stance. Despite market concerns, new President Gabriel Galípoli is likely to act decisively. The Real’s recent

January 24, 2025

Brazil: Some Deceleration in Services

January 24, 2025 4:48 PM UTC

The Brazilian economy grew over 3% in 2024 despite tight monetary policy. While services (-0.9% m/m), industry, and retail sales weakened in November, agricultural exports and fiscal stimulus boosted overall activity. The Central Bank Activity Index showed marginal growth (0.1%) in October and Novem

January 20, 2025

Brazil Risk Premia and EM Debt

January 20, 2025 8:15 AM UTC

Brazil debt market has two domestic crises rather than a spillover from the U.S. in the form of inflation and fiscal policy. Very restrictive BCB policy can help produce some disinflation and we forecast 4.1% for 2026, which some allow some rate cuts in H2. Brazil risk premium will likely be reduced