Brazil CPI Review: Some Deterioration in December

Brazil’s CPI grew by 0.52% in December, ending 2024 at 4.8%, above the Central Bank’s target range (1.5%–4.5%). Key drivers included food (+1.2% m/m) and household spending (+0.7%). Core inflation rose for the fourth consecutive month, reaching 4.3% Y/Y. Elevated inflation is expected in early 2025 due to BRL depreciation and strong economic activity. The Central Bank may raise rates to 15% to stabilize inflation.

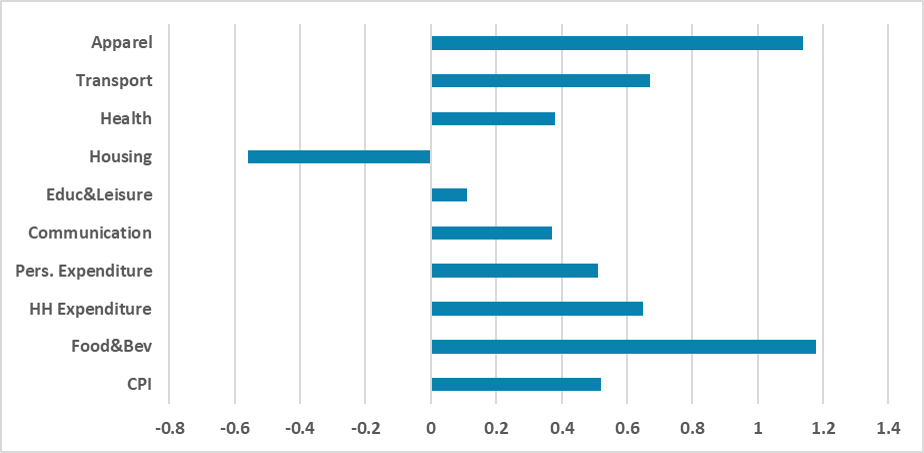

Figure 1: Brazil’s CPI by Group (m/m, %)

Source: IBGE

Brazil's National Statistics Institute has released the CPI numbers for December. The data show that Brazil’s CPI grew by 0.52% in December, in line with market expectations according to a Bloomberg survey. Consequently, CPI ended 2024 at 4.8%, above the Brazilian Central Bank's (BCB) target range (1.5%–4.5%), meaning the BCB has not achieved its goal and will need to write an open letter to the Finance Minister explaining why they missed the target. From 2025 onward, the target will be considered missed if the year-over-year (Y/Y) CPI stays outside the target range for six consecutive months.

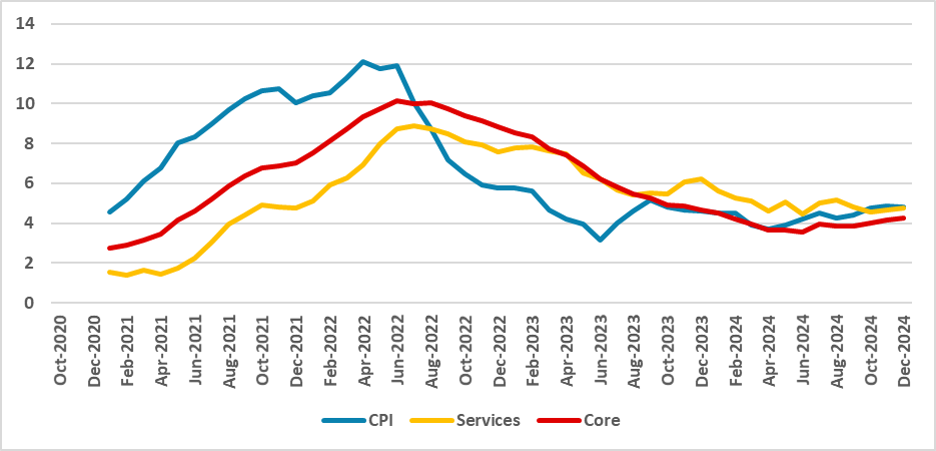

Figure 2: Brazil’s CPI (%, Y/Y)

Source: BCB and IBGE

Among the categories, the biggest variation occurred in the Food and Beverages group (+1.2% m/m), a group highly sensitive to most of the population, driven by rises in meat (+5.2%) and soybean oil (+5.1%). Another category that rose significantly was Household Expenditure, which grew 0.7%, influenced by higher demand during the last month of the year. The Housing group, which dropped 0.5% in December, was influenced by rainfall that boosted hydroelectric capacity, leading to reductions in electricity prices.

In terms of core inflation, there has been some deterioration. The average of core inflation grew by 0.55%, and its Y/Y variation rose to 4.3%, up from 4.1% in November, marking the fourth consecutive month of acceleration. Services grew by 0.6% in the month, with its annual variation reaching 4.7%, also exceeding the BCB's target bands.

Looking ahead, we expect inflation to continue posting elevated numbers. The recent depreciation of the BRL and stronger economic activity will likely keep inflation under pressure, resulting in some increases at the beginning of the year. We forecast that the BCB will likely fail to meet the target under the new rule, as we expect Y/Y inflation to remain above 4.5% during the first six months of the year. We now project inflation to end 2025 at 5.0% in Y/Y terms.

For the BCB, this implies they will need to adopt a more aggressive stance on policy rates, and the board appears unified on this approach. We now anticipate the BCB raising the policy rate to 15.0% in the first half of the year and maintaining it at that level until the end of 2025.