Reciprocal Tariffs and Reducing Bilateral Trade Imbalances

· President Trump’s executive order on reciprocal tariffs has not produced much market reaction, both as the proposals will not be delivered to the president until April 1 and the process of Commerce/U.S. Treasury and Homeland Security input is seen reducing the odds of penal tariffs. However, uncertainty still exists and the EU in particular is at real risk of threats and implementation in the spring.

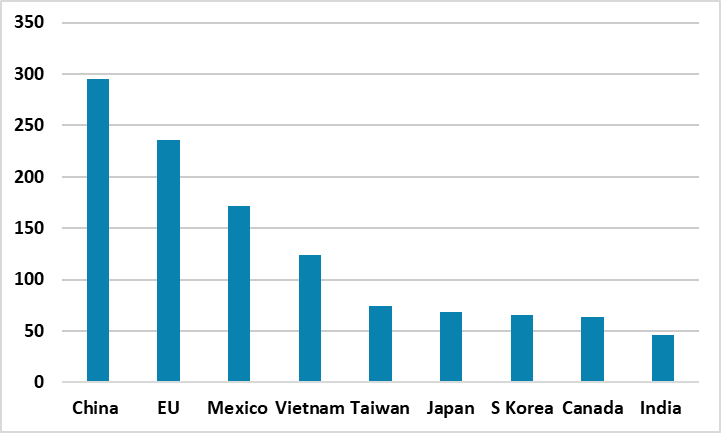

Figure 1: 2024 Bilateral Trade Position with U.S. (USD Blns)

Source: BEA/Continuum Economics

President Trump’s executive order on reciprocal tariffs has not produced much market reaction, both as proposals will not be delivered to the president until April 1 and the process of Commerce/U.S. Treasury and Homeland Security input is seen reducing the odds of penal tariffs. Additionally, once proposals have landed in April, the guidance is that negotiations will be done first for countries with large trade surpluses with the U.S. (Figure 1) rather than across the board global implementation. Room for negotiations and de-escalation exists. Uncertainty still exists however on a number of issues and countries.

· Tariffs, VAT and non-Tariff barriers. Looking purely at tariffs would mean fewer reciprocal tariffs for DM countries than EM countries. However, the Commerce department will also take account of non-tariffs barriers and currency manipulation is setting reciprocal tariffs. The White House factsheet (here) also highlights closed markets for U.S. food e.g. U.S. shellfish from 48 states to the EU. Other countries also have regulations that slows U.S. export growth as well. Finally, VAT is cited as a restraint on U.S. exports, though it is unlikely that a 15-20% VAT rate would mean an extra 15-20% slapped on U.S. reciprocal tariffs – though the U.S. will likely dismiss counterargument that VAT is a domestic tax and applies to all goods irrespective of country of production. Indeed, reciprocal tariffs raise the possibility of tariffs being imposed on some services as well as goods - the U.S. has the digital services taxes that have been explored or implemented by many European countries.

· Anti-EU. The White House factsheet also highlights higher EU car import tariffs and unreciprocal digital service taxes imposed on U.S. tech giants by France. Trump has no time for the EU, despite some times positive views on select European countries. He regards the EU as very nasty and the driver of unfair trade practices that hurt the U.S. Meanwhile, Vice president Vance’s speech at the Munich conference also showed a cultural clash with perceived left-wing EU. In April, Trump personally will likely threaten the EU with extra reciprocal tariffs, which will not quickly draw a negotiated response from the EU and EU countries to buy more U.S. military hardware and LNG (here). European countries also feel let down by the U.S. over the Ukraine war negotiating stance and the realisation that the U.S. wants Europe to take control of its own defence, which is causing a crisis in the EU. This could prompt a U.S./EU trade war and delay an eventual U.S./EU trade deal to reduce the bilateral deficit.

· China. China targeted counter tariffs in response to the 10% Fentanyl tariff reflects the desire for all issues to be negotiated at the same times, with China officials preferring a revised phase 1 trade deal (here). The U.S. does not appear willing to now hold talks until the reciprocal tariffs against China are drafted for April. Trump will want to be involved in this as well, given his interest in China. China could do a targeted counter to any reciprocal tariffs actually implemented, but also push to get down to negotiations in late spring.

· Canada/Mexico. Mexico is about immigration and the bilateral trade position, but Canada is not just about trade but also a wider difference between the Trump administration and Canada. Aside from immigration and Fentanyl, one objective is revising the USMCA that is scheduled for review in 2026. March and April are key dates. It does not like Canada and Mexico will get exemption on steel and aluminium tariffs, but it is uncertain whether Trump will threaten the 25% across the board tariff again in March or try to reach a less aggressive approach of agreeing USMCA review in mid-2025.

· Others. Other countries will be hopefully that the countries above take all the focus and negotiations can take place with the Commerce department rather than being led by President Trump. Trump will certainly cite some trade problems, as occurred in the friendly meeting between Trump and India PM Modi last week but could leave most of the design of potential reciprocal tariffs and negotiations to the Commerce department.