Trump’s Tariffs: Steel Then Reciprocal and Then Cars

The 25% Steel and Aluminum tariff could have small to modest adverse inflation and GDP growth impacts on the U.S., but the prospect of reciprocal and more product and country tariffs create trade policy uncertainty/supply chain disruption and paperwork problems. This could amplify the impact of the cumulative tariffs under president Trump’s administration.

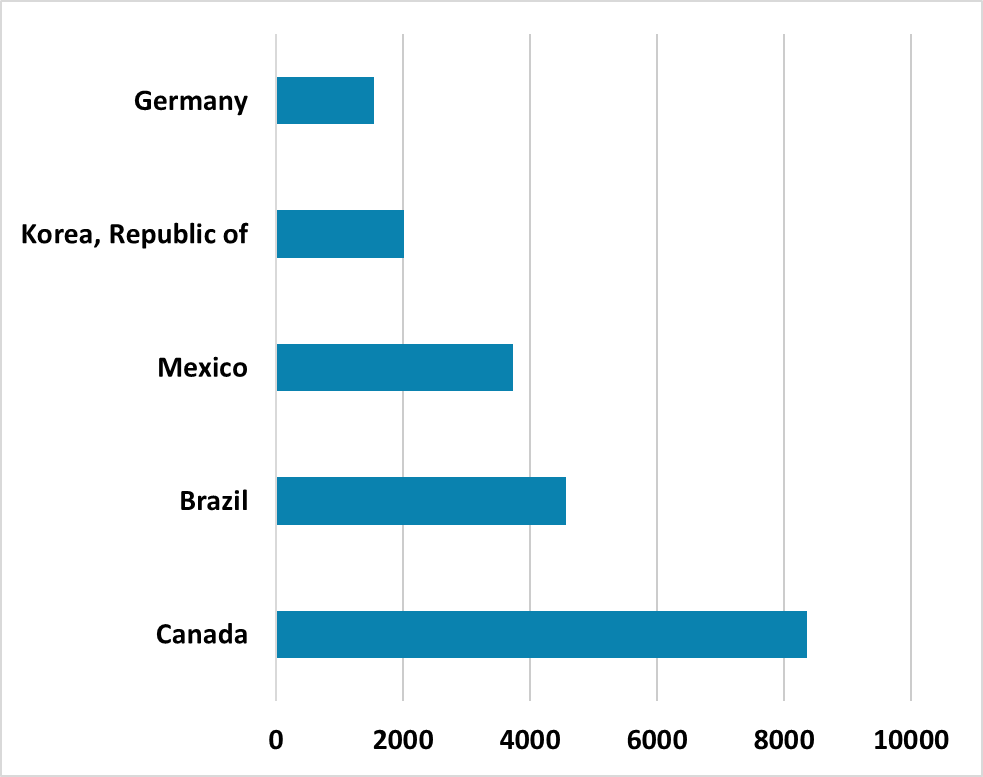

Figure 1: Top 5 Exporters of Steel to U.S. (USD Mlns)

Source: US/Continuum Economics

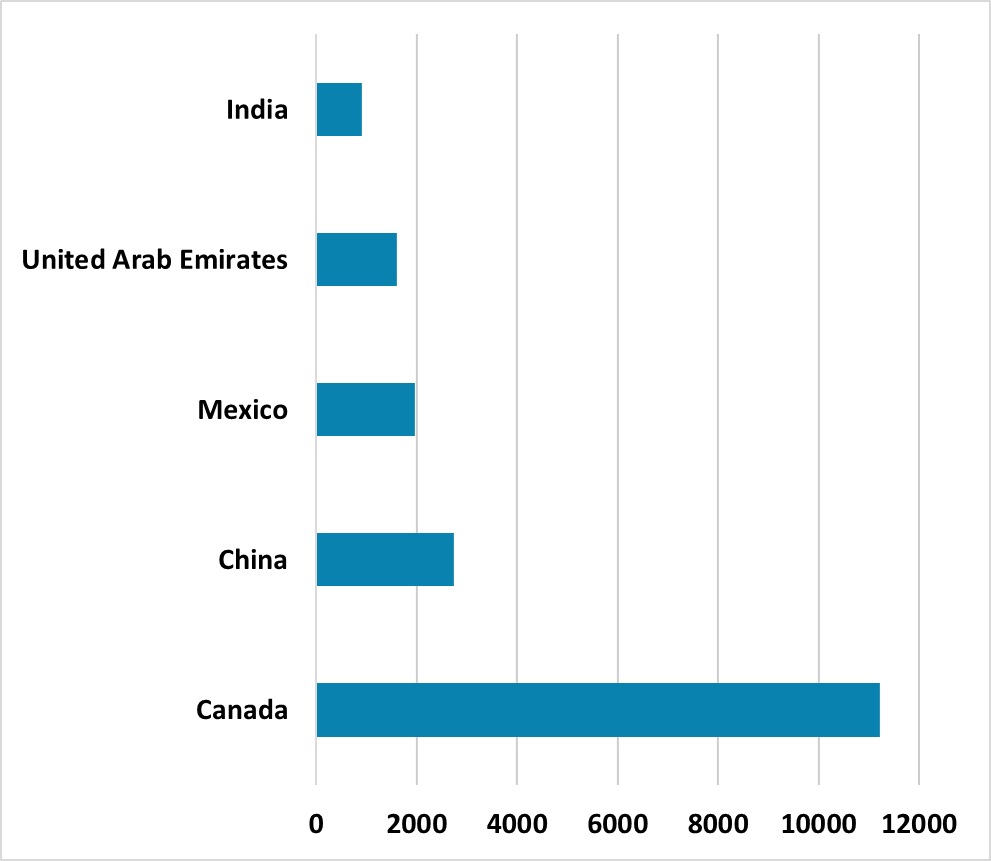

President Donald Trump 25% tariffs on all steel and aluminium imports from March 12 has no exemptions currently, though Trump did hint at an exemption for Australia given plans for imports of U.S. aircraft. Canada will likely be hit hardest as it stands based on 2023 data (Figure 1 and 2). Canada/Mexico and Brazil eventually got exemptions in Trump’s first term and it is possible that a handful of countries could get exemptions if they make trade concessions elsewhere. Meanwhile, the adverse effects could be greater for aluminium as the U.S. still has 25% tariffs on most countries steel imports, while the U.S. also imports a greater proportion of aluminium than steel. This can all feedthrough to higher import prices, increased manufacturing costs and higher end product costs and a small/modest boost to CPI inflation and hit to growth.

Figure 2: Top 5 Exporters of Steel to U.S. (USD Mlns)

Source: US/Continuum Economics

What is clear is that Trump wants to move from threats to actual tariff action. Trump has indicated that reciprocal tariffs will be announced later this week across the board. For example, the U.S. has a 2.5% tariff on EU car imports, while the EU charges U.S. imports at 10%. The U.S. would then lift tariffs on Europe to 10%. This is not all bad news for individual countries, as the EU is thinking of reducing tariffs on U.S. cars to 2.5% as a bargaining tool – India’s Modi has also cut tariffs on certain goods before his visit to Trump this week. However, in aggregate reciprocal tariffs could be a boost to U.S. prices and hurt growth.

On Monday night, Trump also threatened tariffs against certain sectors such as cars. It is unclear what this would be, though Trump has repeatedly attacked EU car imports being in excess of US exports to the EU. It could be that Trump will look at the bilateral trade deficit for cars and ask for this to be reduced or else.

Is this better than universal tariffs at 10%? In terms of size, economists will work out the cumulative tariff effects, but it would not be surprising to see it adding 0.5% to U.S. CPI/PCE inflation. That is enough to mean that the Fed will find it difficult to reach the 2% core PCE inflation target and likely slow and delay easing.

The effects on U.S. growth are not just higher prices hurting consumption/growth. A couple of other factors are worth mentioning.

· Trade policy uncertainty. Trump loves the art of the deal, which means big threats to try to get trade concessions. However, this volatility adds to trade policy uncertainty, which companies do not like and can hurt production and investment in the U.S. Additionally, by using country/product and reciprocal tariffs, the Trump administration is adding to business monitoring costs and uncertainty.

· Supply chains. Supply chains risk being hurt, especially with Canada and the U.S. This can adversely impact U.S. production, as well as in Canada and Mexico.

· Tariff paperwork. The variety of different tariffs planned means implementation for the commerce department and extra paperwork for U.S. exporters and importers. For smaller companies this could be too much trouble and could see withdrawal of some SME U.S. exporters and certain global SME importers stopping – which could require more expensive U.S. producers.

Thus though large-scale econometric models could suggest small to modest adverse effects on GDP growth, a number of channels exist that could amplify the economic effects. We will be watching economic data closely in the coming months.