U.S. Trade Surplus Countries: No Special Treatment?

Quick dilutions of tariffs or exemption will likely be slow in coming for countries that the U.S. has trade surpluses with, as the Trump administration are currently more focused on tariffs for tax revenue and trying to switch production back to the U.S. than trade deals. Trade policy uncertainty also increases with the array of tariffs being used by the Trump administration for trade and non-trade purposes (country/product/reciprocal/secondary).

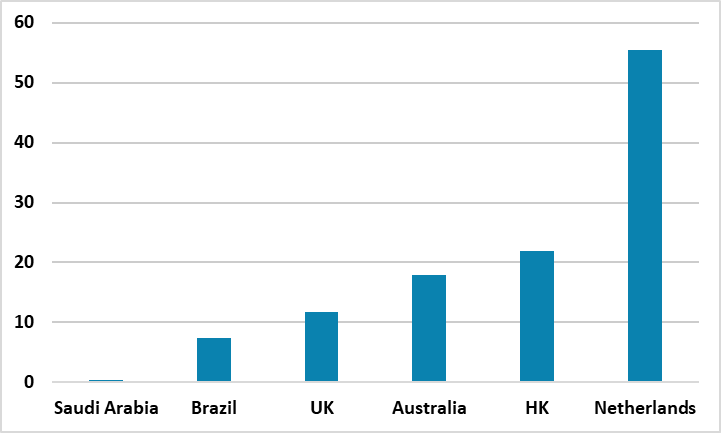

Figure 1: U.S. Trade Surplus with Select Countries 2024 (USD Blns)

Source: BLS/Continuum Economics

The U.S. has trade surpluses with some countries (Figure 1), which would normally argue for a softer approach from the Trump administration than countries that the U.S. runs a persistent large trade deficit. However, the reciprocal tariffs for this week will hit all countries looking at news reports, with UK officials for example acknowledging that the UK will be hit be reciprocal tariffs like everybody else. The question is what size these tariffs will be and whether a trade deal can quickly be negotiated to dilute the tariffs. News reports have seen a shift in the administration thinking over the structure of the reciprocal tariff from high/medium/low to Trump latest idea of lenient. We will have to see on Wednesday what that means. The Trump administration is still planning 25% product tariffs on lumber and then pharma and semiconductors. In terms of negotiations with the U.S. to dilute tariffs, this is easier said than done. Trump shows an openness to this provided it is worth the U.S. interest, which on a country by country basis could be tricky to agree. Additionally, the U.S. has more incentive to negotiate trade deals with countries that it runs a large trade deficit with or are in the top 10 of U.S. export destinations e.g. China/Canada/Mexico. Finally, the Trump administration is also putting a lot of emphasis on tariffs for tax and to shift production back to the U.S., as well getting better trade deals. Quick dilutions of tariffs or exemption will likely be slow in coming.

Trump love of tariff aggression is also not far from the surface. EU plans for a 50% tariff on American bourbon triggered a threat of 200% tariff on EU wine/spirits. More serious is Trump new focus on secondary tariffs with an across the board 25% tariff for countries that import Venezuelan oil, as this is a penal tax that will curtail purchases of Venezuelan oil. This same 25% across the board threat has now been used by Trump against Russia if it does not agree a ceasefire deal. The oil market has not really reacted, as OPEC+ are planning to increase production already but it is one to watch for the oil market. However, it has a wider economic impact, as trade policy uncertainty also increases with the array of tariffs being used by the Trump administration for trade and non-trade purposes (country/product/reciprocal/secondary). This impact global trade, but also business investment as well and the high policy uncertainty is a headwind to growth for our 2025 and 2026 views outlined in the March Outlook (here).