Mexico

View:

September 08, 2025

August 08, 2025

Mexico: Further 25bps Cuts Ahead

August 8, 2025 6:44 AM UTC

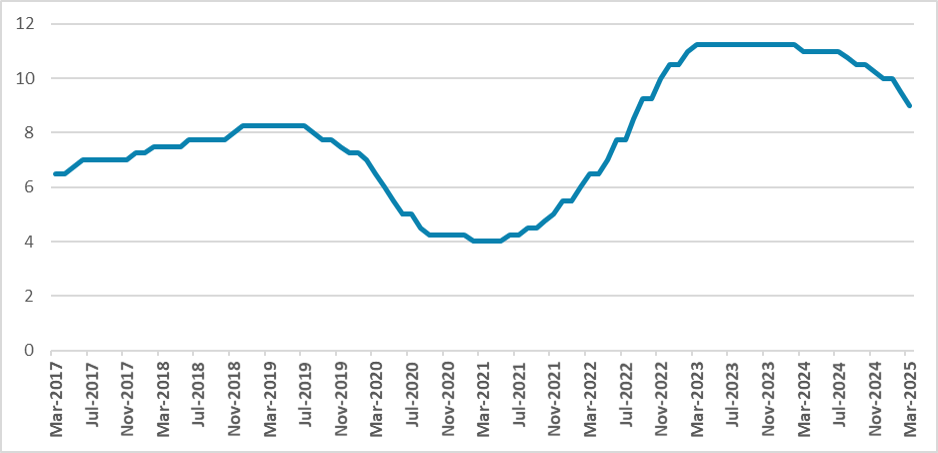

Banxico forward guidance, plus trade policy risks with the U.S. now see us forecasting an end 2025 policy rate at 7.25% with two 25bps cuts in September and December. We now feel that the risks to 2026 growth will encourage Banxico to move the policy rate down to 6.5% by spring 2026 by two 25bps rat

August 07, 2025

EM Rates: Domestic Fundamentals Dominate

August 7, 2025 9:30 AM UTC

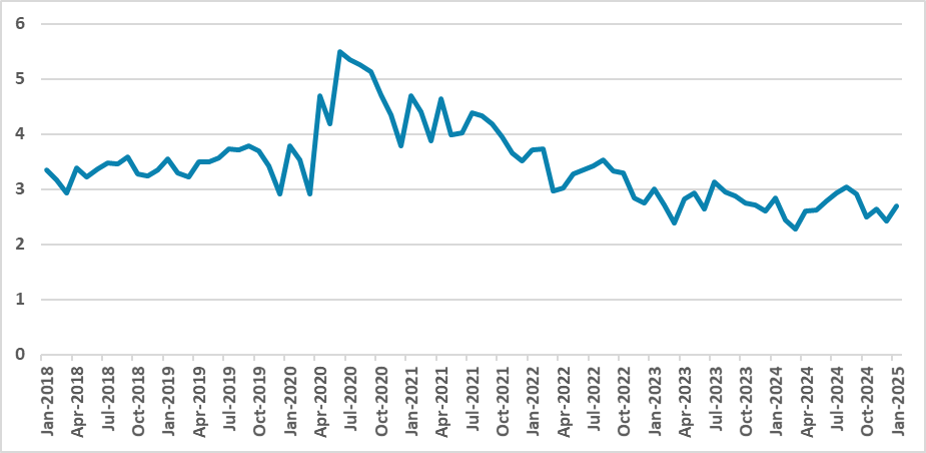

Once trade is agreed with the U.S., the good fundamentals actually argue for a 10yr Mexico-U.S. spread close to 400bps and this is our favored strategic risk reward for big EM government bonds. In Brazil a case can be made for a 12.75% policy rate end 2026 and 10% in 2027, but this could only mean 1

August 04, 2025

Trump Tougher Posture with Russia

August 4, 2025 8:31 AM UTC

We suspect that Trump will not follow-through with an across the board secondary sanction on importers of Russia oil, as it would freeze U.S./China trade again and could boost U.S. gasoline prices – high inflation is one main reason for Trump’s softer approval rating. Trump could agre

August 01, 2025

Reciprocal Tariffs: Some Hikes, Deals and Delays

August 1, 2025 8:40 AM UTC

Though high reciprocal tariffs with some countries catches the headline, five of the top 10 countries with large bilateral deficits have reached framework trade deals, two have delays and three have higher tariffs imposed. With exemptions on some USMCA Canada/Mexico goods, plus phones/ semicondu

July 28, 2025

Food Glorious Food

July 28, 2025 10:15 AM UTC

· Global food prices should see small increases in the future, as production continues to rise broadly in line with increasing demand driven by population and a rising consumption per person in EM countries. However, China will remain dependent on food imports given it has limited roo

July 24, 2025

EM Currencies with a USD Downtrend

July 24, 2025 10:15 AM UTC

· BRL, ZAR and MXN have been helped by FX carry trades and bond inflows on still wide interest rate differentials. However, actual reciprocal tariff risks are high for all three countries and a wave of profit-taking could be seen. Elsewhere, though we see a U.S./China trade deal by

July 23, 2025

Trump Deals: Japan, Philippines and Indonesia

July 23, 2025 8:26 AM UTC

• Other countries cannot be guaranteed to get a Japan style deal, both as Japan is the key geopolitical ally in the Asia pivot against China and as Trump is keen to agree deals by August 1. India and Taiwan are trying to finalize deals, but the EU is more difficult. China 90 day deadlin

July 17, 2025

Trump’s Tariffs and Markets

July 17, 2025 12:00 PM UTC

The assumption in financial markets is that some trade framework deals will be done by August 1; some countries will make enough progress to be given an extra 30 days and some countries could have higher tariffs implemented. This would be broadly consistent with the average 15% tariff that is widely

July 14, 2025

Tariffs: Seeking a Trigger for the TACO Trade

July 14, 2025 4:28 PM UTC

It has been fairly clear for some time that 10% represented a likely floor for the eventual Trump tariff regime. However, expectations that Trump would not be willing to go dramatically above that are being tested. A rate in the mid-teens still looks the most likely outcome, as the economic damage t

July 01, 2025

Trump Tariffs: Poker Face?

July 1, 2025 12:55 PM UTC

Our central scenario (but less than 50%) is towards a scenario of compromise, with some agreements in principle or trade framework deals, delays for most other negotiating in good faith but with one or two countries seeing a reciprocal tariff rise e.g. Spain and/or Vietnam. This could still be fol

June 27, 2025

Mexico: Back Toward Neutral Policy Rates

June 27, 2025 6:56 AM UTC

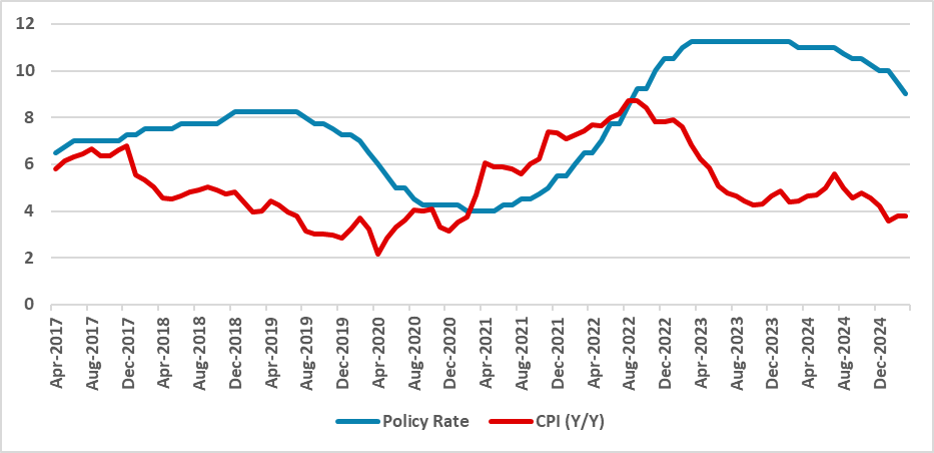

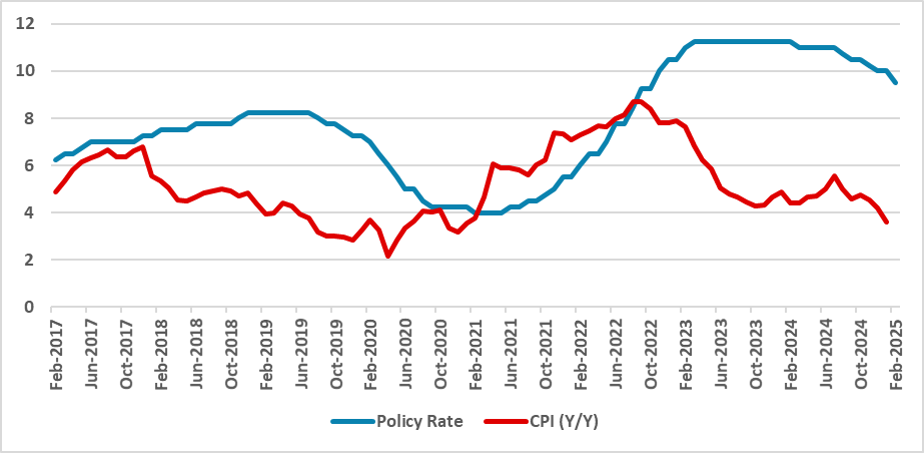

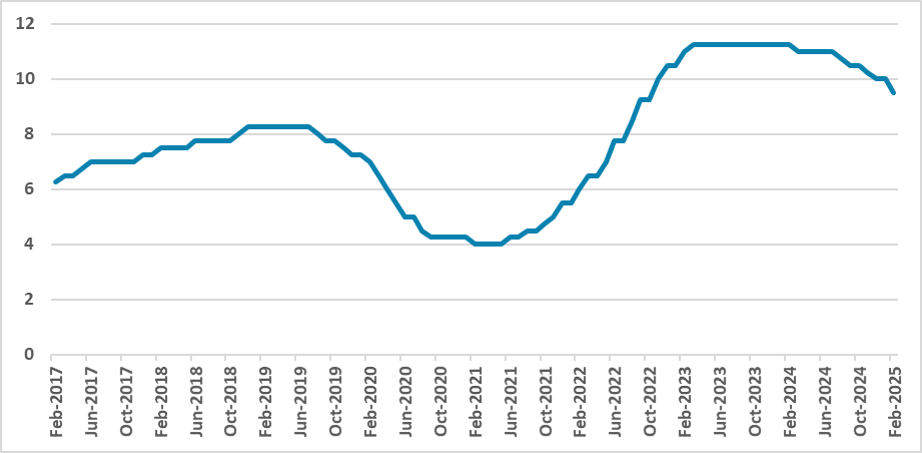

Banxico has cut by 50bps to 8.00%, while also signalling in its statement that further easing will now be data dependent. Our forecast is for easing to move to a 25bps pace and to come once a quarter – most likely in September and December. Some improvement in the monthly inflation trajectory woul

June 25, 2025

EM FX Outlook: USD Less in Favor, but EM Mixed

June 25, 2025 8:05 AM UTC

• EM currencies face cross currents on a spot basis. The USD downtrend against DM currencies can be a positive for undervalued or strong EM currencies. This could benefit the Brazilian Real (BRL), Mexican Peso (MXN) and Indonesian Rupiah (IDR), though moves will be choppy with occasiona

Outlook Overview: Trump’s Fluid Policies

June 25, 2025 7:20 AM UTC

· President Donald Trump still wants to use the tariff tool, and we see the eventual average tariff rate being in the 13-15% area, lowered by deals but increased by more product tariffs. Any lasting legal block on reciprocal tariffs will likely see the administration pivoting towards ot

June 03, 2025

June 02, 2025

Trump’s 50% Steel And Aluminum: Negotiating Leverage?

June 2, 2025 7:42 AM UTC

• President Donald Trump increase in steel and aluminum tariffs from 25% to 50% is not just about boosting the steel and aluminum industry. It also a demonstration that Trump remains in control of tariffs and can aggressively change tariffs to increase negotiating leverage. It is a mess

May 29, 2025

Court Stops Trump Reciprocal and Fentanyl Tariff

May 29, 2025 7:18 AM UTC

• The Trump administration will likely follow a multi-track response by appealing the judgement but also fast-tracking section 232 product tariffs for pharmaceuticals and semiconductors. The administration could also consider section 301 or 122 tariffs (the latter 15% for 150 days against c

April 30, 2025

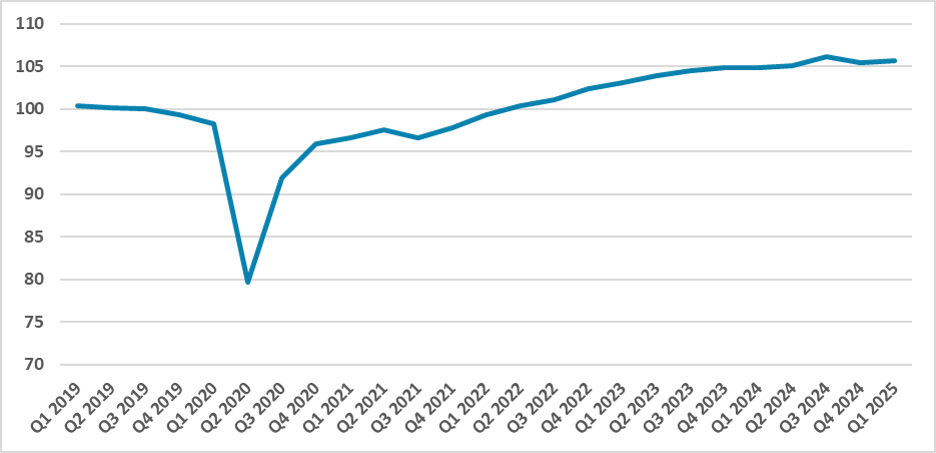

Mexico’s GDP Review: Saved from the Technical Recession, but Growth Slows

April 30, 2025 2:52 PM UTC

Mexico narrowly avoided a technical recession in Q1 2025 with 0.2% GDP growth, driven by a volatile rebound in agriculture. However, industrial output contracted and services stagnated, highlighting a broader economic slowdown. Uncertainty over potential U.S. tariffs and tight monetary and fiscal po

April 24, 2025

USD Rebalancing: Some to EM?

April 24, 2025 8:30 AM UTC

Some portfolios rotations towards EM assets will likely be evident, as we see the USD decline is now extending and broadening. However, flows will likely be selective, both given underwhelming EM performance in the last 5-10 years and the uncertainty over how much Trump will reduce reciprocal tari

April 17, 2025

Banxico Minutes: Comfortable about the Cuts Amid the Volatility

April 17, 2025 2:26 PM UTC

Banxico’s latest minutes confirm a cautious but steady path toward policy normalization, with the policy rate expected to reach neutral levels (7.00–8.00%) in 2025. While the economy shows signs of deceleration and a negative output gap, inflation continues to ease, nearing historical averages.

April 15, 2025

Nervous U.S. Long Term Asset Holders

April 15, 2025 8:30 AM UTC

Overall, foreign equity investors can no longer count on U.S. exceptionalism and could face lower long-term corporate earnings growth, which at a minimum will likely slow net inflows. Bond investors also face ongoing policy volatility, which likely means a need for an extra risk premium – t

April 14, 2025

U.S./China High Stakes Poker

April 14, 2025 7:30 AM UTC

The economic hit from a hard stop in U.S. imports/exports is too damaging for both sides and our baseline is still for a truce and de-escalation, in the coming weeks. This could be negotiations on a new trade deal with a more moderate reciprocal tariff on both sides and the extra reciprocal tariffs

April 10, 2025

Mexico CPI Review: Moving as Expected

April 10, 2025 2:20 PM UTC

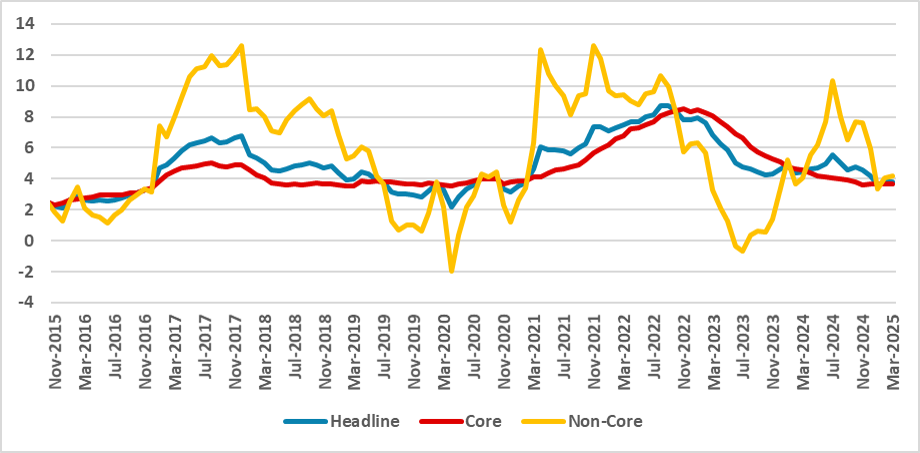

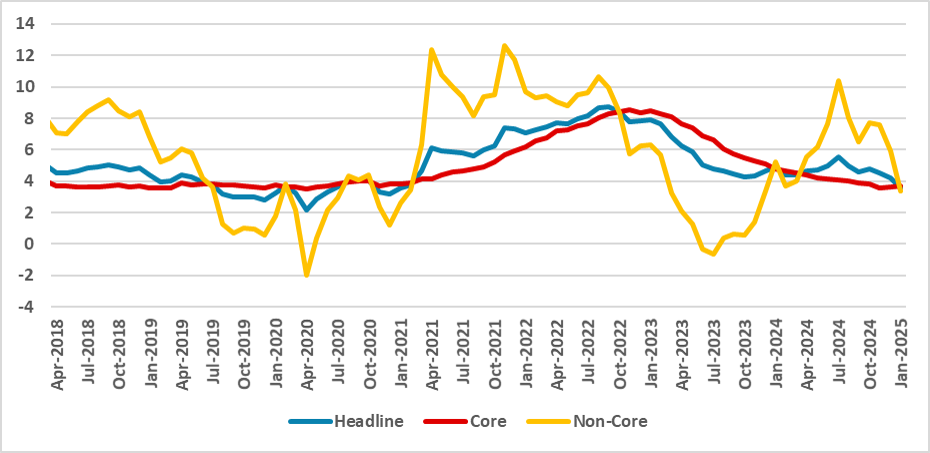

Mexico’s March CPI rose 0.31%, matching expectations but below the historical average. Annual inflation edged up to 3.80%, driven by core components like food and services. Non-core inflation fell due to lower energy prices. Food saw strong gains, while transport costs declined. The narrowing gap

Trade Deals with the U.S.: Pressures and Obstacles

April 10, 2025 7:17 AM UTC

Pressures to do trade deals include the weaker U.S. economy and higher inflation when it arrives/foreigners becoming nervous of their USD30trn plus holdings of U.S. securities and more crucially risks to Trump and GOP approval ratings from Republican voters. Obstacles to quick trade deals include Tr

April 09, 2025

U.S China Trade War: Deal or No Deal Prospects?

April 9, 2025 9:00 AM UTC

The prospect of a trade deal between the U.S. and China are less and likely delayed into 2026, due to the hardline stance of Trump 2.0 due to the extra focus on tariff tax revenue and shifting production back to the U.S. It is still our baseline that a deal will be agreed though we would now see a d

April 08, 2025

Reciprocal Tariffs: The Hit To Other Countries

April 8, 2025 9:30 AM UTC

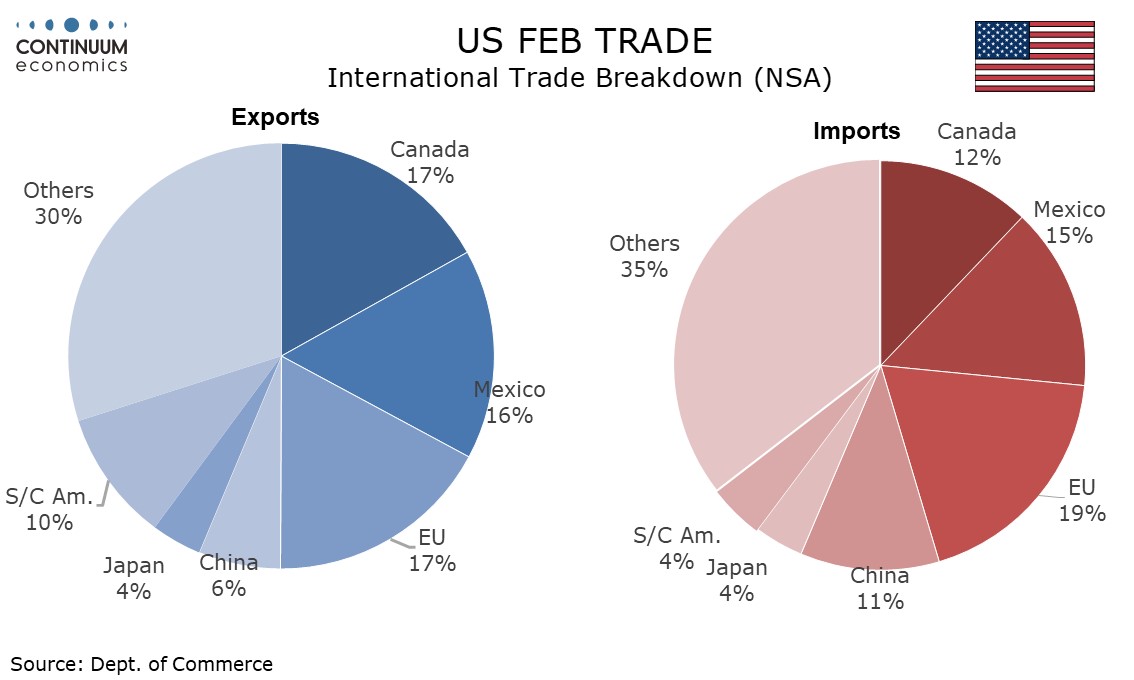

Overall, we are still assessing the effects on non U.S. countries from the tariffs being imposed by the U.S. via direct trade/business investment/currency and financial & monetary conditions swings. The impact will be adverse to GDP, but for some major countries could be less than the U.S. How

April 03, 2025

Mexico: Saved from Tariffs?

April 3, 2025 7:56 PM UTC

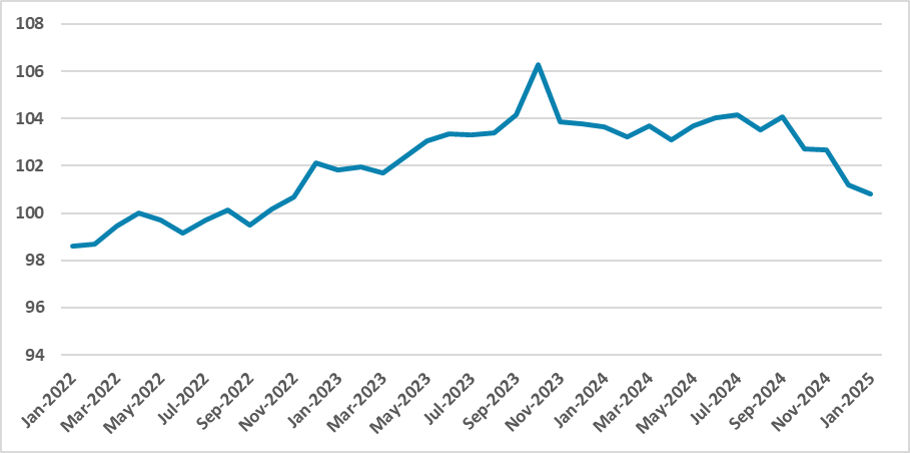

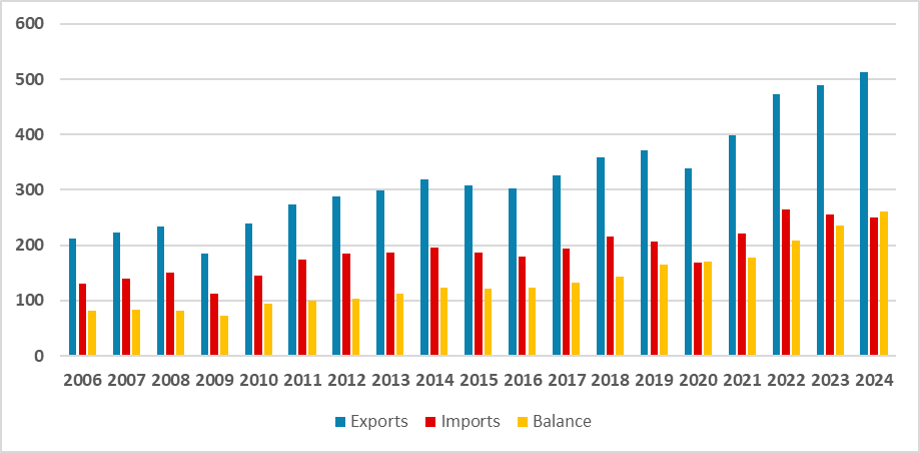

Mexico has avoided reciprocal tariffs but still faces steel, aluminum, and auto tariffs. Authorities are negotiating to exempt goods, though retaliatory tariffs on U.S. imports seem unlikely. Mexico's economy is slowing, with growing recession fears and diminishing nearshoring prospects. The industr

Tariffs: Inflation may be the biggest worry for the U.S.

April 3, 2025 4:12 PM UTC

While surprising the market in their intensity, Trump’s “reciprocal” tariffs were in line with previous threats on most countries, and with Canada and Mexico being treated less harshly that feared, the net surprise is modest to us. However we do feel that inflationary risks have increased furt

March 31, 2025

U.S. Trade Surplus Countries: No Special Treatment?

March 31, 2025 9:04 AM UTC

Quick dilutions of tariffs or exemption will likely be slow in coming for countries that the U.S. has trade surpluses with, as the Trump administration are currently more focused on tariffs for tax revenue and trying to switch production back to the U.S. than trade deals. Trade policy uncertainty

March 29, 2025

Banxico Review: Lowering Rates Amid Tariffs

March 29, 2025 9:29 PM UTC

Mexico’s Central Bank (Banxico) has cut the policy rate by 50 bps to 9%, in line with market expectations. The tone of the communiqué suggests a more dovish stance, with the board moving towards a neutral rate. Inflation has reached its lowest level since 2021, while economic growth has slowed. B

March 27, 2025

Car Tariffs Then Lenient Reciprocal Tariffs?

March 27, 2025 8:59 AM UTC

The 25% tariffs on cars underlines that tariffs are not just about getting better trade deals, but in Trump’s view raising (tax) revenue and trying to shift production back to the U.S. Combined with other tariffs being implemented, plus policy uncertainty, we see a moderate overall hit from t

March 26, 2025

LatAm Outlook: Navigating the Uncertainty

March 26, 2025 9:56 PM UTC

· Brazil and Mexico economy are likely to decelerate in terms of growth in 2025, although we see this being stronger in Mexico. Mexico institutional reforms and its close ties with U.S. increases uncertainty for 2025, especially after Trump victory, and the menaces of Trump imposing tar

Outlook Overview: Navigating the Turbulence

March 26, 2025 9:30 AM UTC

· More tariffs will arrive from the U.S. from April with product (car, pharma, semiconductors and lumber) and reciprocal tariffs. President Trump has a 3-part approach to tariffs to raise (tax) revenue; bring production back to the U.S. and get fairer trade deals. This means some of t

EMFX Outlook: Divergence versus the USD

March 26, 2025 9:16 AM UTC

EM currencies will be helped by the ongoing USD downtrend against DM currencies, but prospects also depend on relative inflation differentials versus the USD and starting point in terms of valuations. The Brazilian Real (BRL), Mexican Peso (MXN) and Indonesian Rupiah (IDR) should all make modest s

March 21, 2025

Trump Product and Reciprocal Tariffs

March 21, 2025 9:00 AM UTC

It appears that we will get bad news from April 2 on extra tariffs before any good news. Firstly, the announcement effect of tariffs for many countries and extra products will hurt U.S. business and consumer sentiment. Secondly, part of the reason for tariffs is extra tax revenue and to try to s

March 10, 2025

Trump and Dollar Policies

March 10, 2025 6:04 AM UTC

The Trump administration could decide to more broadly talk the USD down or less likely try to reach a cooperative Mar A Lago accord with big DM and EM countries. A more cohesive alternative is a forced currency deal for countries to appreciate their currencies to avoid more tariffs and withdraw

March 05, 2025

Mexico: Uncertainty Mounts as Tariffs Are Imposed

March 5, 2025 2:43 PM UTC

Trump's administration has moved forward with 25% tariffs on Mexican imports, citing drug trafficking and migration issues. Mexico’s President Sheinbaum has stated retaliatory measures will be announced on March 9. The tariffs could push Mexico into recession in 2025, although we forecast growth a

Trump Latest Thinking

March 5, 2025 11:07 AM UTC

Bottom line: President Donald Trump signaled that he is committed to tariffs to raise revenue; bring production back to the U.S. and get fairer trade relations. This three part approach will likely shape implementation of further product and reciprocal tariffs from April. However, reports sugges

March 04, 2025

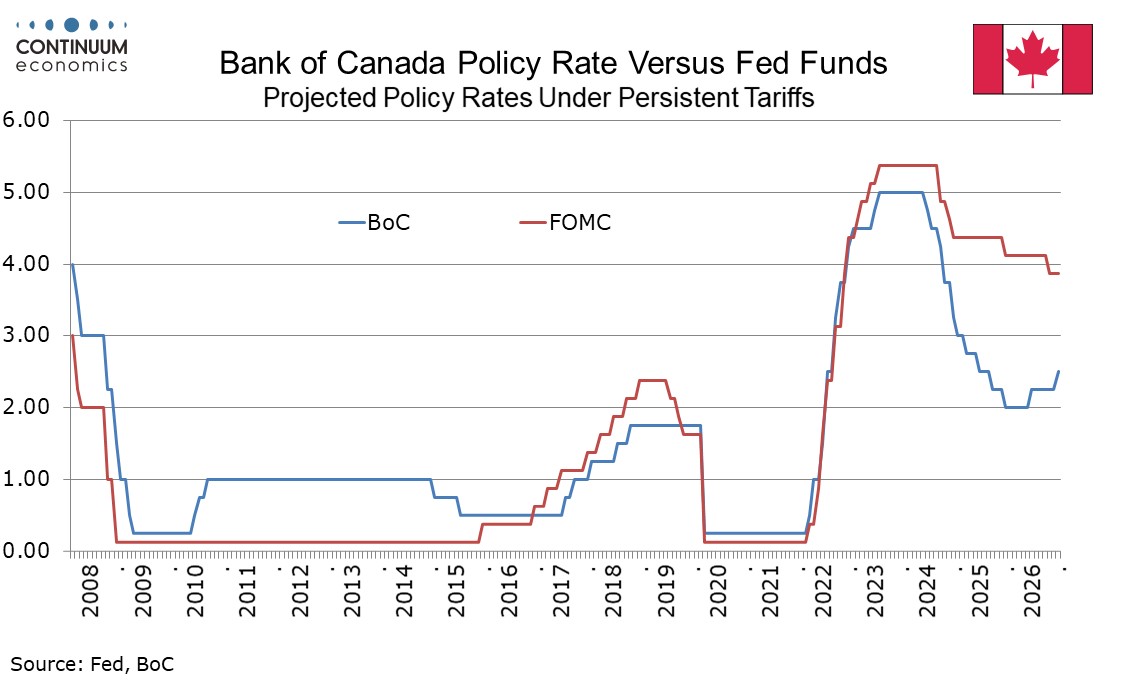

Trump Tariffs: Bad for The U.S. Worse For Canada

March 4, 2025 3:48 PM UTC

When Trump announced 25% tariffs on Canada and Mexico in February, we put up a piece outlining the likely economic consequences, which became dated by the end of the day as Mexico and Canada won a one month delay in return for some concessions at the border. We are now recycling that story, with som

March 03, 2025

Trump Tariffs and U.S. Business and Consumer Sentiment

March 3, 2025 9:02 AM UTC

• Mexico and Canada are trying to frantically find solutions to delay across the board tariffs again, though the U.S. is hinting that the rate could be less than 25%. China extra 10% tariff remains likely, as the U.S. increases trade pressure on China. More tariffs also remain highly

February 28, 2025

Mexico: Labour Market Decelerating as Expected

February 28, 2025 5:53 PM UTC

Mexico's labor market remains strong with an unemployment rate of 2.7%, but signs of deceleration are emerging. Worker affiliation to the pension system and wage growth are slowing, and some job creation stagnation is expected, potentially pushing the unemployment rate above 3%. A technical recessio

February 21, 2025

Banxico Minutes: More Cuts on the Way

February 21, 2025 9:57 PM UTC

Banxico cut the policy rate by 50 bps to 9.5%, signaling a more dovish stance as inflation trends downward. The board cited weak domestic demand and improved inflation prospects but highlighted risks from U.S. policy uncertainty, tariffs, and immigration effects. While most members supported a 50 bp

February 19, 2025

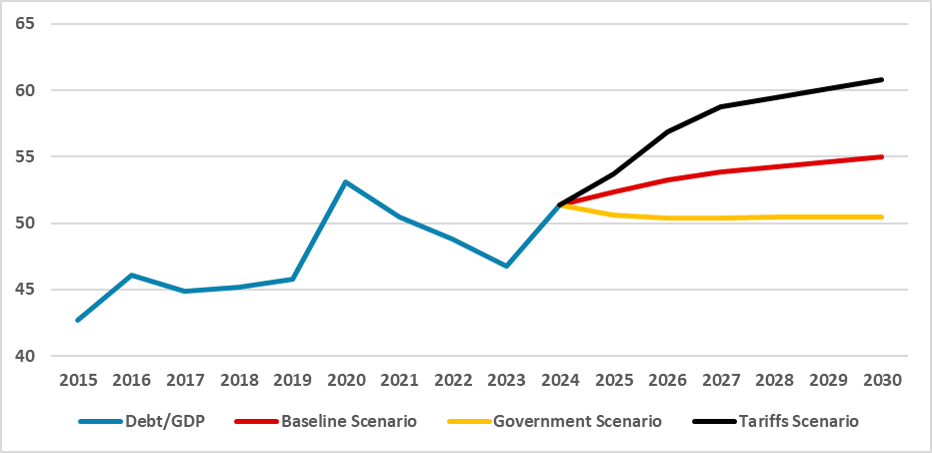

Mexico: Tariffs and Growth Issues Could Impose Fiscal Difficulties

February 19, 2025 10:20 PM UTC

Mexico aims for fiscal consolidation in 2025, relying on revenue growth while freezing most expenditures. However, weak growth could undermine this strategy. Authorities expect 2–3% GDP growth, but our forecast is 1.6%, with a recession risk. A less integrated U.S.-Mexico trade relationship, parti

February 17, 2025

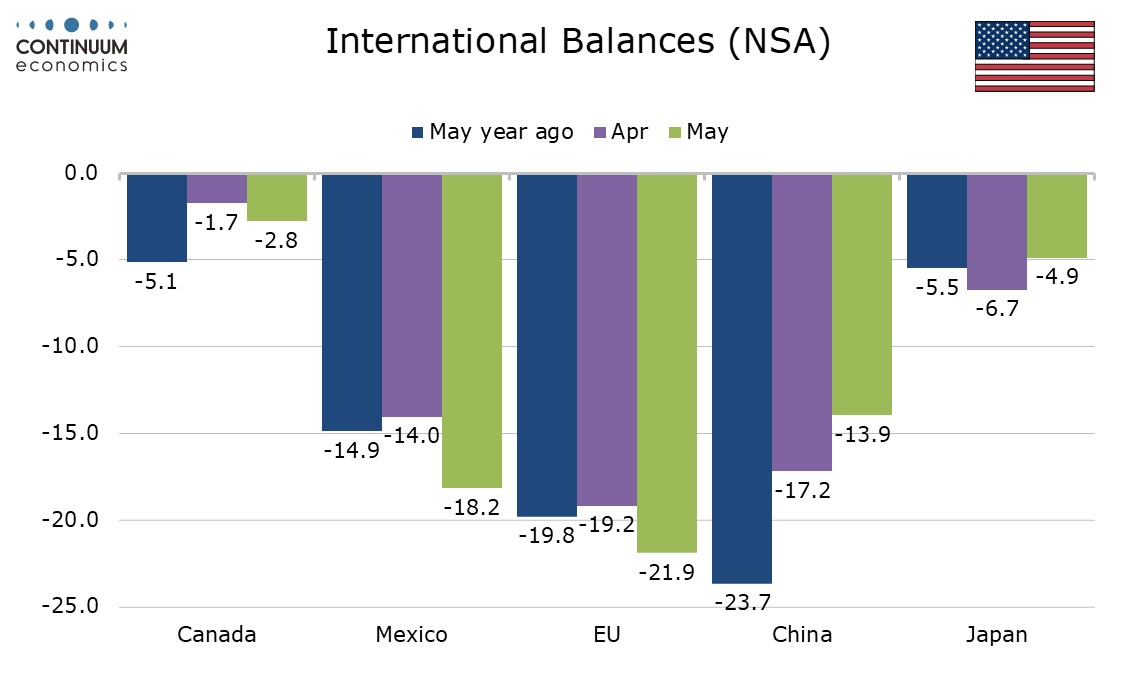

Reciprocal Tariffs and Reducing Bilateral Trade Imbalances

February 17, 2025 10:28 AM UTC

· President Trump’s executive order on reciprocal tariffs has not produced much market reaction, both as the proposals will not be delivered to the president until April 1 and the process of Commerce/U.S. Treasury and Homeland Security input is seen reducing the odds of penal tariffs.

February 11, 2025

Trump’s Tariffs: Steel Then Reciprocal and Then Cars

February 11, 2025 1:23 PM UTC

The 25% Steel and Aluminum tariff could have small to modest adverse inflation and GDP growth impacts on the U.S., but the prospect of reciprocal and more product and country tariffs create trade policy uncertainty/supply chain disruption and paperwork problems. This could amplify the impact of

February 10, 2025

Mexico CPI Review: Inflation Falls as Demand Eases

February 10, 2025 7:14 PM UTC

Mexico’s CPI rose 0.3% in January, below its 0.6% historical average but in line with expectations. Y/Y inflation fell to 3.6%, the lowest since Jan/2021. Core CPI rose 0.4%, with core goods up 0.7% and services up 0.2%. Non-core CPI fell 0.13%, led by a 1.5% drop in agricultural goods. The econom

February 08, 2025

Banxico Review: 50 bps Cut as Expected

February 8, 2025 9:39 PM UTC

Banxico cut the policy rate by 50bps to 10.5%, with a cautious stance and a split vote. Inflation has fallen but remains above target, expected to converge to 3.0% by Q3 2026. Global risks, including Trump’s tariff threats, add uncertainty. Despite economic weakness, some monetary tightening may s