Trump Tariffs: Bad for The U.S. Worse For Canada

When Trump announced 25% tariffs on Canada and Mexico in February, we put up a piece outlining the likely economic consequences, which became dated by the end of the day as Mexico and Canada won a one month delay in return for some concessions at the border. We are now recycling that story, with some edits. A Trump climbdown looks less likely this time, though he remains as unpredictable as ever. Canada and Mexico face recessions and the US looks likely to see growth significantly reduced with some acceleration in inflation, making it difficult for the Fed to provide significant support to a slowing economy. For the Bank of Canada however, downside economic risks look set to outweigh upward risks to inflation.

The US economic outlook will take a hit

In the United States, the most obvious impact of the tariffs will be higher prices. Full pass through would lift inflation by over 1% but Canadian and Mexican attempts to remain competitive are likely to provide some restraint. What pass through there is will be felt quickly, delivering some strong U.S. monthly inflation data starting in March. This will reduce real disposable income and weigh on consumer spending, and also reduce potential for Fed easing. Recessions in two large neighbors will reduce demand for US exports even without what appears to be a strong desire on the part of Canadian consumers to boycott US-made goods. Still, Canadian retaliation at this point is quite modest and carefully targeted, and even with an escalation scheduled in one month will impact barely a quarter of US exports to Canada.

In our December outlook we expected US GDP to rise by 2.5% in 2025 with each quarter above 2.0%. While it is still too early to say how long the tariffs will persist, GDP growth close to 1.0% would be likely if they do through the year. We expected core PCE prices to rise by 2.4% in 2025. Should the tariffs persist, 3.0% may be a conservative estimate. Tariffs on the EU, which look likely in April, could lift the inflation outlook still further. With China also facing tariffs, a majority of US imports will be impacted.

Central Banks to Weigh Slower Growth and Higher Inflationary Risk

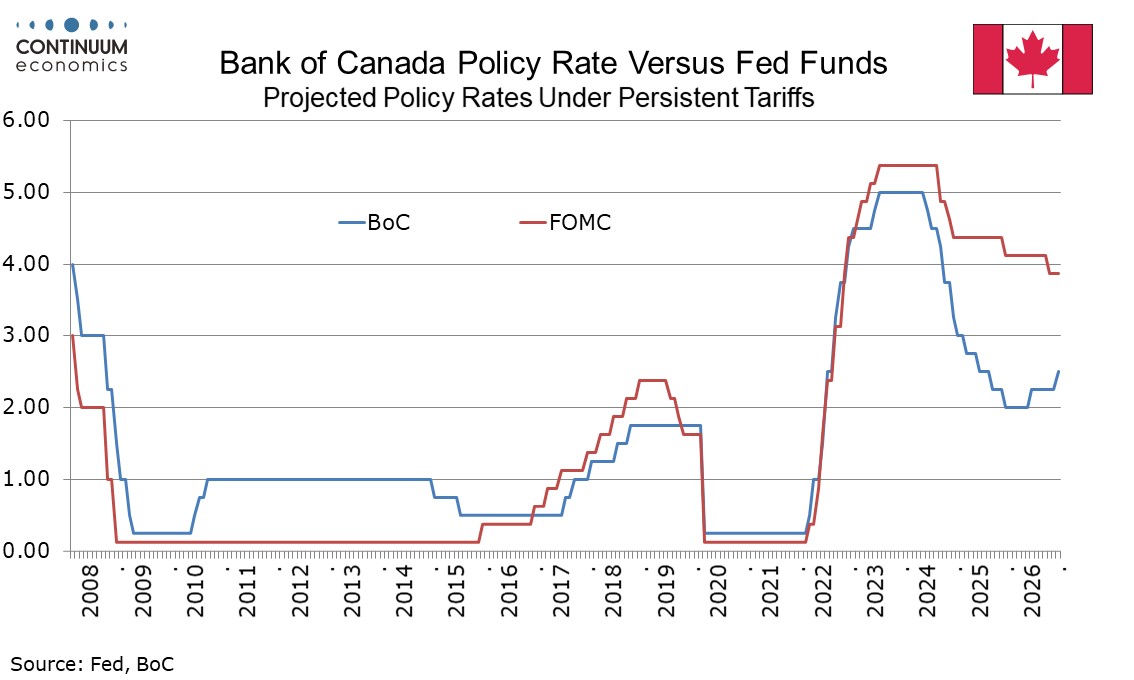

FOMC communication has been giving a message that easing will be delayed if inflation remains stubborn and the labor market remains tight, but would be seen if the labor market weakens or inflation falls unexpectedly fast. Tariffs are likely to lift inflation but will also do some damage to the labor market, putting the Fed in a difficult position, though reduced immigration should keep the rise in unemployment modest. Leaving rates stable would be an easing in real terms if inflation rises. Inflationary data is however likely to see the acceleration concentrated in goods and if services inflation continues to ease the goods price hikes may be seen as a one-time issue. Our current view has the FOMC easing once in 2025, in Q4, and twice in 2026, in Q2 and Q4. This still seems reasonable, though risk leans to the upside in 2025 given inflationary risks and to the downside in 2026 once tariffs drop out of the yr/yr comparison.

Trump’s motivations are difficult to understand rationally, and his backing down quickly for some token concessions at the border from Canada and Mexico, as was seen in February, is not to be ruled out. However, having made concessions once and getting only a one month delay in return, Canada in particular may be reluctant to try to appease Trump a second time. Trump will have more to say in his address to Congress tonight, but he appears committed to tariffs, perhaps in part because of difficulties Republicans in Congress are finding in paying for his tax cuts. It may also be that Trump genuinely believes that trade deficits are always bad and that removing them would provide a painless boost for the United States’ economy. If he persists in this belief against mounting evidence there may be no swift resolution.

Canada facing recession

For Canada, estimates of a 4% hit to GDP may be exaggerated, with potential cushions from a weaker CAD, and fiscal and monetary policy. Still, an economy that seemed to have returned to a 2% plus pace of GDP growth assisted by BoC easing now looks set to decline in 2025, probably by close to 1.0%. Canada could ease the pain to itself by keeping retaliation limited, but that would not be in line with where Canadian public opinion is, and an election is due this year. Canada, with a budget deficit near 2% of GDP, less than a third of that of the US, has scope for fiscal stimulus.

Bank of Canada Governor Macklem has stated that a trade war would weaken growth and boost prices and that the BoC cannot lean against both simultaneously. We feel that with the hit to growth likely to be larger than the lift to inflation the BoC will take on a more dovish stance, and that rates will fall as low as 2.0% this year from the current 3.0% rather than bottoming at 2.5% as we had previously expected. Given that they are weighing competing risks, the BoC’s will likely move gradually, with one 25bps move in each quarter (though a move in March would be the second move in Q1 following the easing seen in January). If the situation stabilizes, 2026 may see the BoC edging policy back towards neutral.