Trump Tariffs and U.S. Business and Consumer Sentiment

• Mexico and Canada are trying to frantically find solutions to delay across the board tariffs again, though the U.S. is hinting that the rate could be less than 25%. China extra 10% tariff remains likely, as the U.S. increases trade pressure on China. More tariffs also remain highly likely from April on car/pharma/semiconductors and then reciprocal tariffs. It seems likely that the U.S. economic narrative will continue shift from solid growth to a softening of growth, but with higher inflation also a risk depending on the scale of tariffs introduced.

President Trump is still considering imposing across the board tariffs on Canada/Mexico and China from March 4. What will happen and what will be the impact?

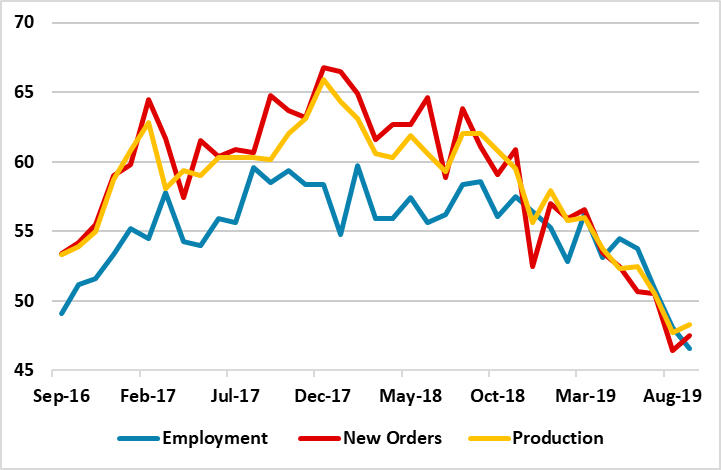

Figure 1: U.S. ISM Manufacturing Slows in 2018

Source: Datastream/Continuum Economics

Weekend interviews with U.S. commerce secretary Lutnick clarify that President Trump is still planning to impose an across the board tariff on Canada and Mexico but the rate will be decided by the President. This leaves open the option of say a 10% tariff rather than a 25% tariff. Meanwhile, Mexico will likely try to get any tariff delayed, with reports that they are considering a tariff against China goods. U.S. Treasury secretary Bessant describes this as an interesting idea. In Canada, reports suggest that the government is unclear what to offer the U.S. to delay tariffs. Meanwhile, U.S. reports suggest that the extra 10% against all China imports is highly likely to be implemented, as U.S./China trade relations remain frosty.

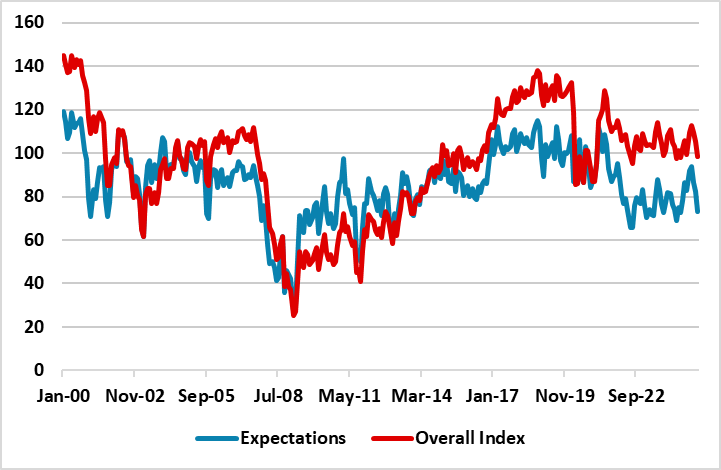

Even if the tariffs are delayed to say April, tariff threats and implementation are already having an impact on business sentiment as seen in the S&P Manufacturing PMI and consumer sentiment in the Conference board survey (Figure 2). The Conference board reports suggests that tariffs and worries over inflation are the key concerns hurting consumer sentiment. Indeed, it remains highly likely that the U.S. will introduce more tariffs in the next 6 months, with reciprocal tariff proposals due to be announced in April; steel and aluminum tariffs implemented March 12 and car/pharma/semiconductors 25% tariff expected in April. This is a broader array of tariffs than Trump 1.0. Trump 1.0 saw a clear souring of business sentiment through 2018 into 2019 (Figure 1), which prompted a softer spell for the U.S. economy. This will likely be repeated in the spring to summer period. DOGE restructuring of some government departments, plus a much slower pace on new immigration into the U.S., will also likely be headwinds to U.S. growth.

Figure 2: Conference Board Consumer Confidence

Source: Datastream/Continuum Economics

It seems likely that the economic narrative will shift from solid growth to a softening of growth, but with higher inflation also a risk depending on the scale of tariffs introduced. A hard landing appears unlikely at this juncture, as the U.S. consumer balance sheet strength means some underlying resilience. However, the bumpiness of the tariff process means that the incoming economic numbers need to be closely watched starting with this week U.S. ISM and employment report.