DM Country Research

View:

January 05, 2026

Venezuela: Oil and Geopolitics

January 5, 2026 12:02 PM UTC

· Venezuela’s oil production will likely take years to increase substantively due to poor infrastructure, the need for substantive investment, and a lack of democratic political stability. In terms of geopolitics, operations in Venezuela reinforce the Trump administration’s pivot

January 02, 2026

Bessent: New Fed Inflation Range and Dropping Dots?

January 2, 2026 11:30 AM UTC

U.S. Treasury Secretary Bessent over the Christmas period suggested that the Fed should shift to targeting an inflation range and drop the quarterly dots. What impact would this have? Such a change would give the Fed more flexibility on the margin, but not significant. This could make communicat

December 30, 2025

U.S. Consumption Vulnerable to Asset Market Hit

December 30, 2025 8:42 AM UTC

Overall, we see consumption growth prospects as being modest for 2026, as low to middle income households still struggle with the cost of living crisis. Additionally, the slowdown in immigration is causing less overall employment gains and in turn less absolute increase in real income and consumptio

December 23, 2025

U.S. Q3 GDP: Better Than Expected, But

December 23, 2025 1:54 PM UTC

Q3 GDP came in better than expected due to a big net export contribution to growth. Gross domestic purchases at 2.7% were more in line with expectations, with mixed performance in key expenditure sectors. We see growth slowing in Q4, with net exports unlikely to repeat the Q3 outcome and consume

December 22, 2025

December 19, 2025

EZ HICP Preview (Jan 7): Is Services Inflation Problematic?

December 19, 2025 11:10 AM UTC

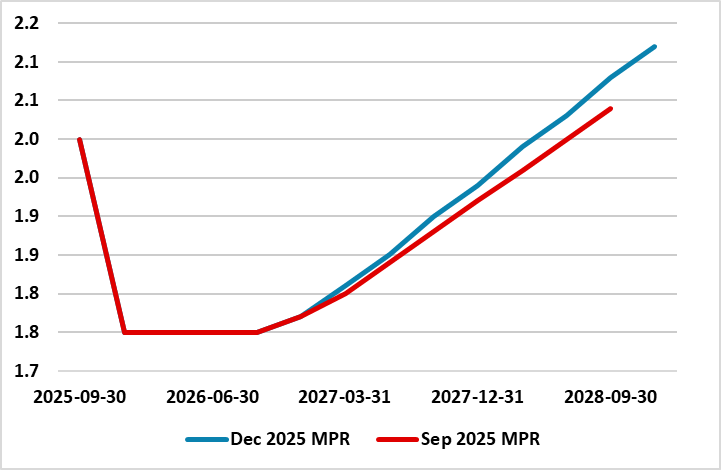

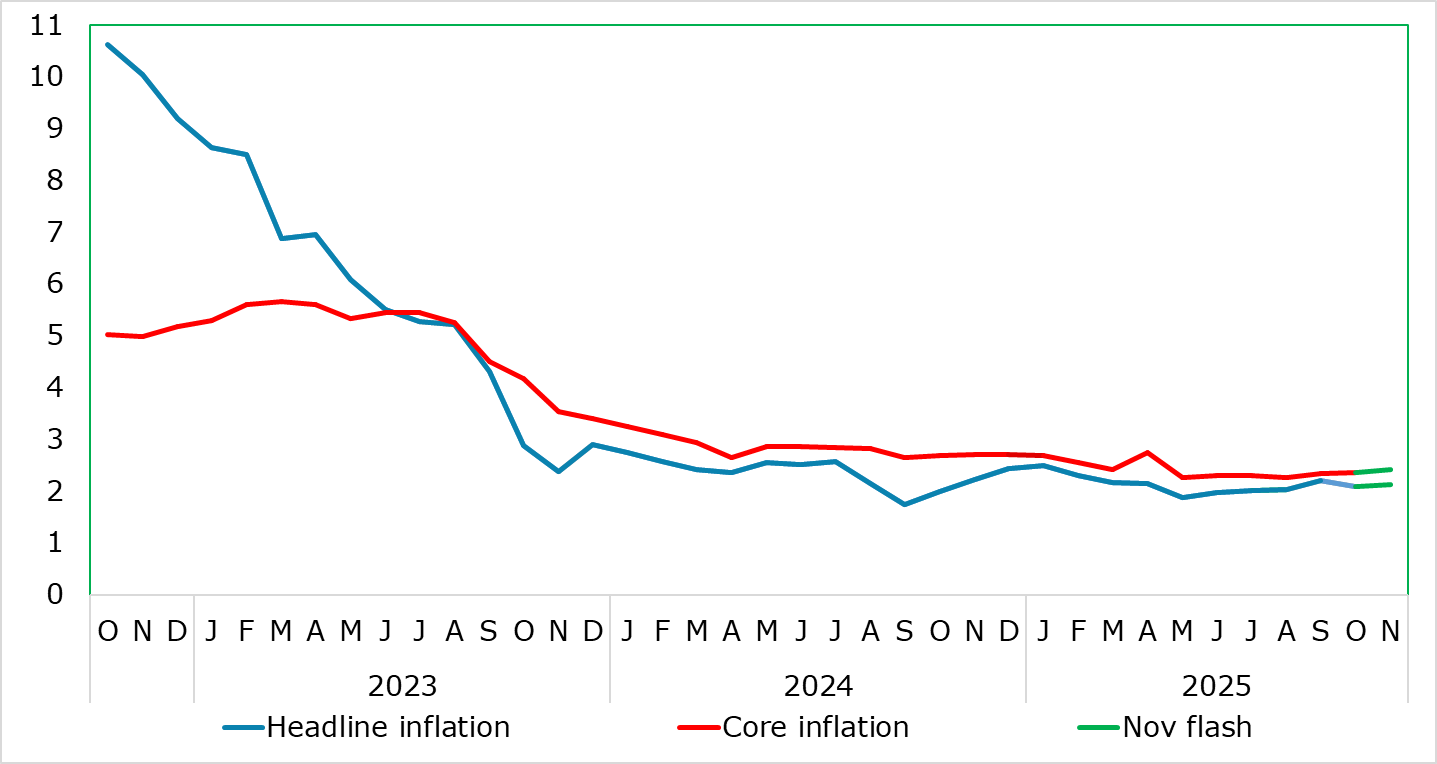

HICP inflation has been range bound for the last 5-6 months between 2.0% and 2.2% with the November and October numbers in the middle of that range. But we see the headline rate falling out of that range in December to 1.9%, this preceding what may be a short-lived fall toward 1.5% in H1 2026. Som

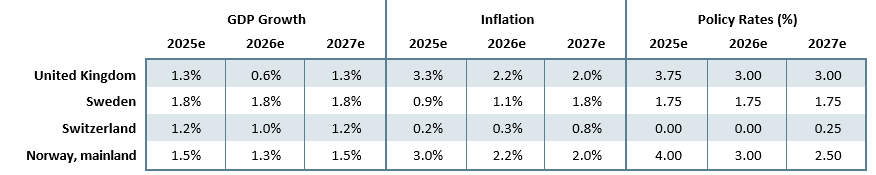

Western Europe Outlook: Underlying Price Pressures Ebbing

December 19, 2025 9:34 AM UTC

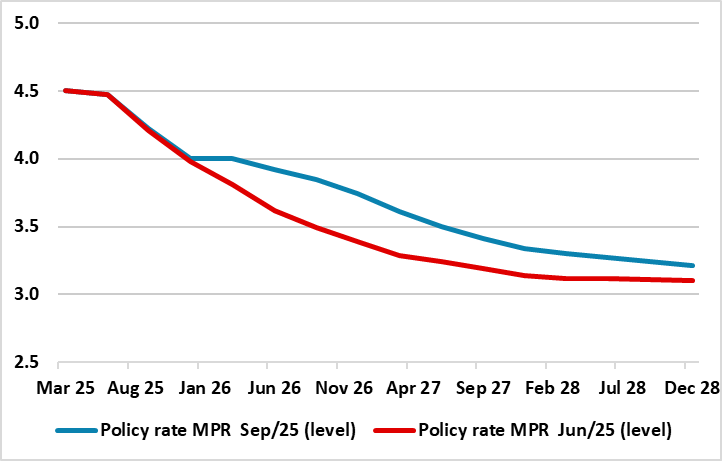

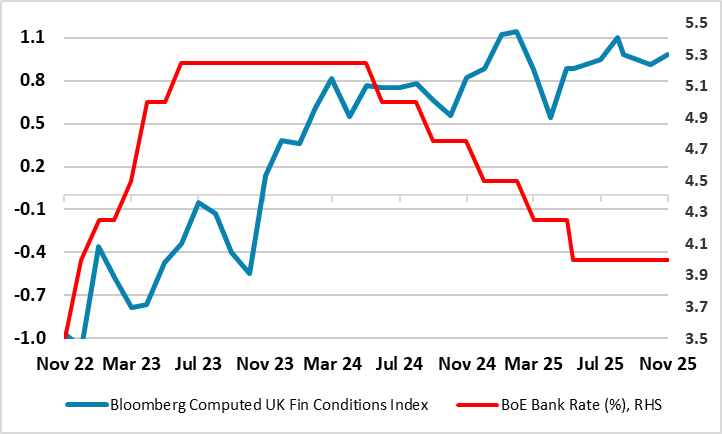

· In the UK, we have upgraded 2025 GDP growth by 0.1 ppt to 1.3%, but pared back that for next year by a two notches to a very sub-par 0.6%. We think the weak(er) labor market will accentuate somewhat refreshed disinflation allowing the BoE to ease further in 2026 by around 75 bp to 3.0

Japan Outlook: Putting One Foot in Front

December 19, 2025 7:15 AM UTC

· Private consumption growth is hindered by negative real wage in Q3 2025 yet Japan continues to demonstrate the structural change in both higher business price/wage setting and consumer behavior. Early signs for 2026 spring wage negotiation are upbeat and should see wage growth at

December 18, 2025

ECB Review: On Hold Message to Convert to Easing on Disinflation

December 18, 2025 3:09 PM UTC

· The ECB increased its 2026 GDP and inflation forecast and appears happy with current policy rate levels. However, still tight financial conditions, plus easing wage growth, point to disinflation and growth disappointment. We see this switch the ECB from an on hold message to easin

BoE Review (Dec 18): Splits More Entrenched?

December 18, 2025 12:41 PM UTC

That the BoE delivered a sixth 25 bp rate cut (to an almost three-year low of 3.75%) was hardly in doubt. But we were surprised that amid the recent run of weak data, that there were (again) four dissents with Governor Bailey switching sides. Notably, in a clear combative overtone, at least some

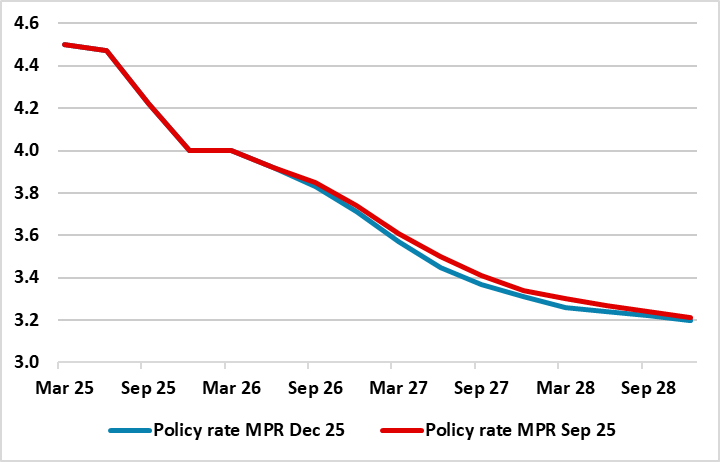

Norges Bank Review: Still Far Too Cautious Despite Clear Output Gap

December 18, 2025 9:40 AM UTC

As expected, no change in policy and little shift in rhetoric and/or outlook was the message from the Norges Bank’s latest verdict. After two 25 bp cuts this year (to 4.0%), this month saw a second successive unchanged verdict with the policy outlook also retained (Figure 1). This was consistent

Sweden Riksbank Review: On Hold and For Some Time Ahead?

December 18, 2025 8:54 AM UTC

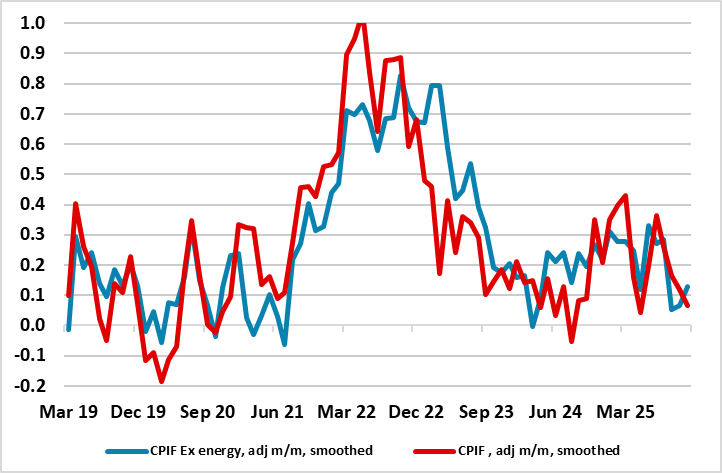

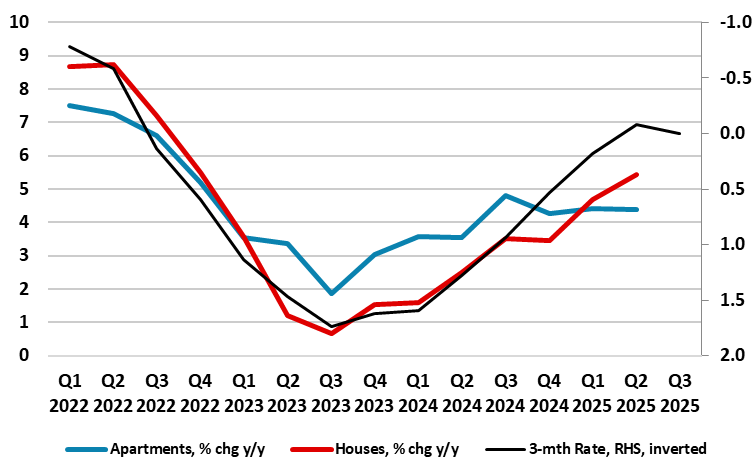

As widely anticipated, the Riksbank kept policy on hold with the key rate left (again) at 1.75%. It does seem as if the Riksbank Board is (very) pleased with the data flow since its last and very probably final rate cut on Sep 23. GDP saw a strong and unexpected Q3 showing of over 1% q/q while p

December 17, 2025

DM Rates Outlook: 2026 Yield Curve Steepening Before 2027 Flattening

December 17, 2025 9:21 AM UTC

· Multi quarter, we still look for 50bps of further Fed easing by end 2026, which will likely initially bring 2yr yields down to 3.35%. However, once the Fed Funds rate get closer to 3.0-3.25% and the assumed slowdown turns into a soft landing, the 2yr will likely move to a premium ve

Outlook Overview: Turbulent Times

December 17, 2025 7:44 AM UTC

· The U.S. slowdown remains in focus as the lagged effects of President Trump’s tariff increases continues to feedthrough, though our baseline is for a 2026 soft-landing. The Supreme court will likely rule against part of Trump’s reciprocal tariffs, which will create short-term

UK CPI Review: Down More Than Expected from Likely Peak?

December 17, 2025 7:38 AM UTC

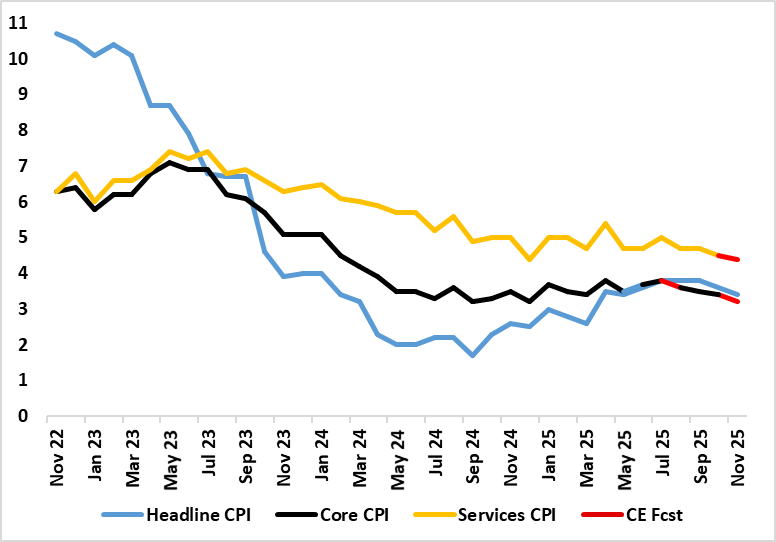

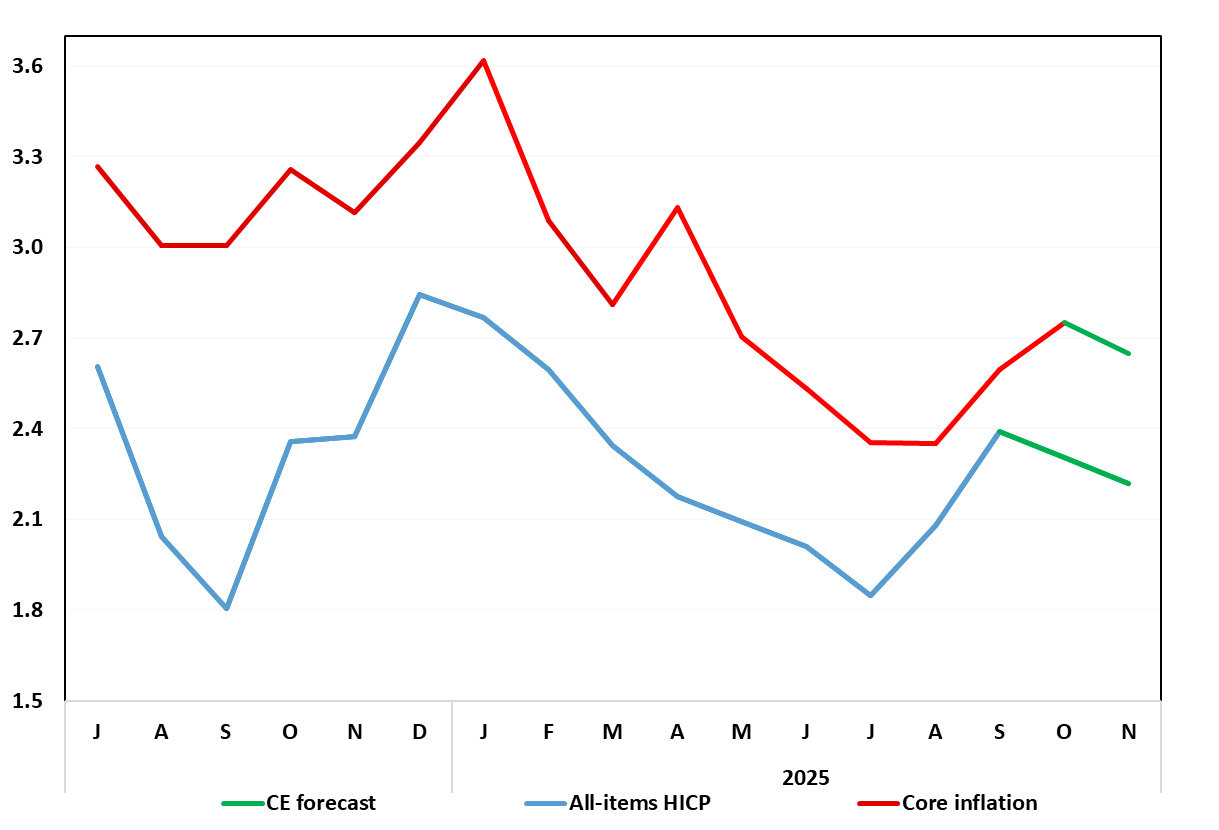

A clear downside surprise adds to the wealth of data suggesting a reining of price and cost pressures. This November result makes it more likely that the September CPI outcome will prove to be the CPI inflation peak. Indeed, although October figure fell a little less than the consensus by 0.2 pp

December 16, 2025

Commodities Outlook: A Balancing Act

December 16, 2025 10:15 AM UTC

Global oil demand is expected to be modest, with weak consumption in the U.S. and China, while India will support demand in 2026 and 2027. Non-OPEC supply is expected to expand moderately in 2026, whereas OPEC’s policy will respond to demand but remains puzzling. Supply trends in 2027 are likely t

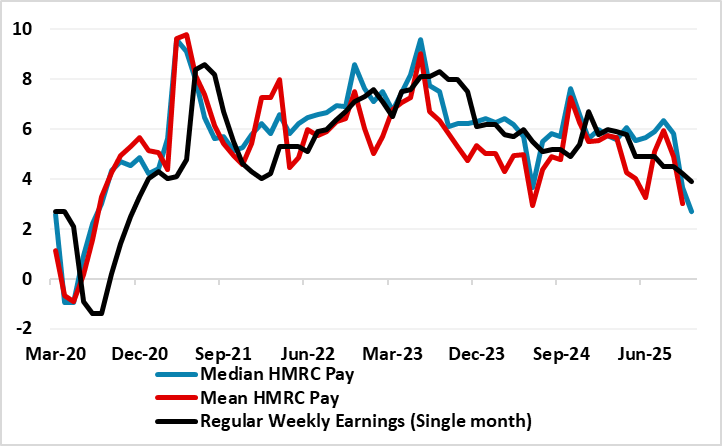

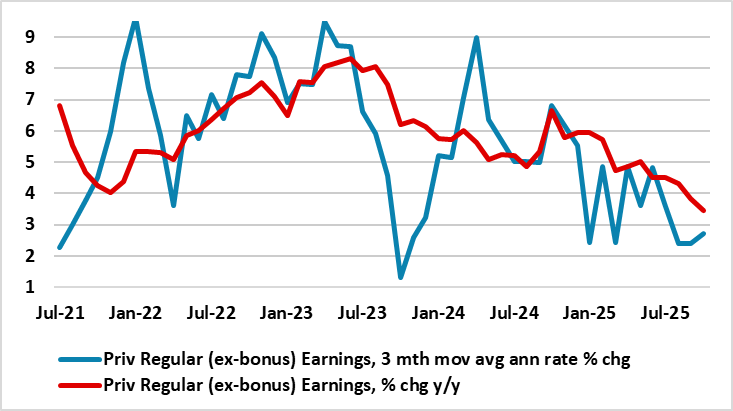

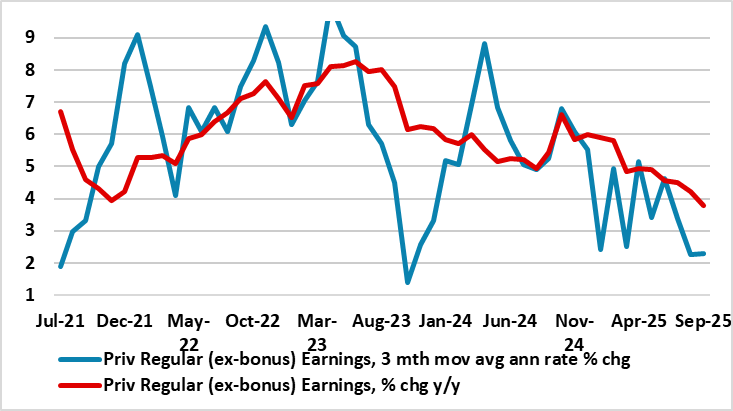

UK Labor Market: Job Losses Weighing Even More Clearly on Wages

December 16, 2025 8:06 AM UTC

Adding to the array if weak activity updates of late, there are increasing signs that the labor market is haemorrhaging jobs more clearly and broadly with fresh and deeper falls in the more authoritative measure of jobs covering payrolls. Indeed, private sector payrolls are still falling, down alm

December 12, 2025

U.S. Outlook: Consumers Vulnerable, but Recession Unlikely

December 12, 2025 4:38 PM UTC

• US GDP growth is likely to look solid in Q3 2025 supported by resilient consumer spending, but with slowing employment growth and resilient inflation weighing on real disposable income that will be difficult to sustain. However, while consumers look vulnerable, business investment looks h

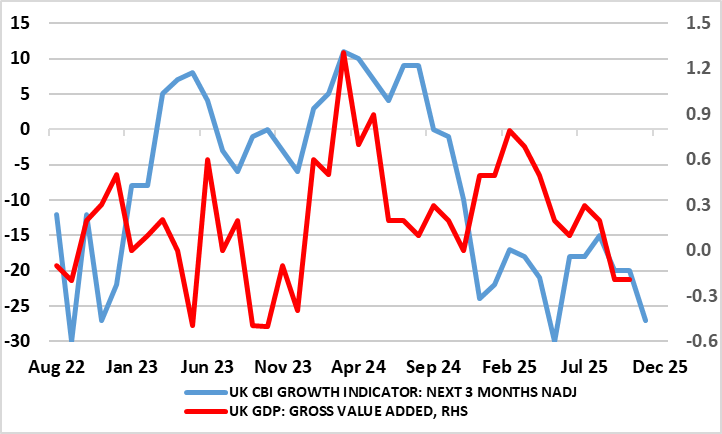

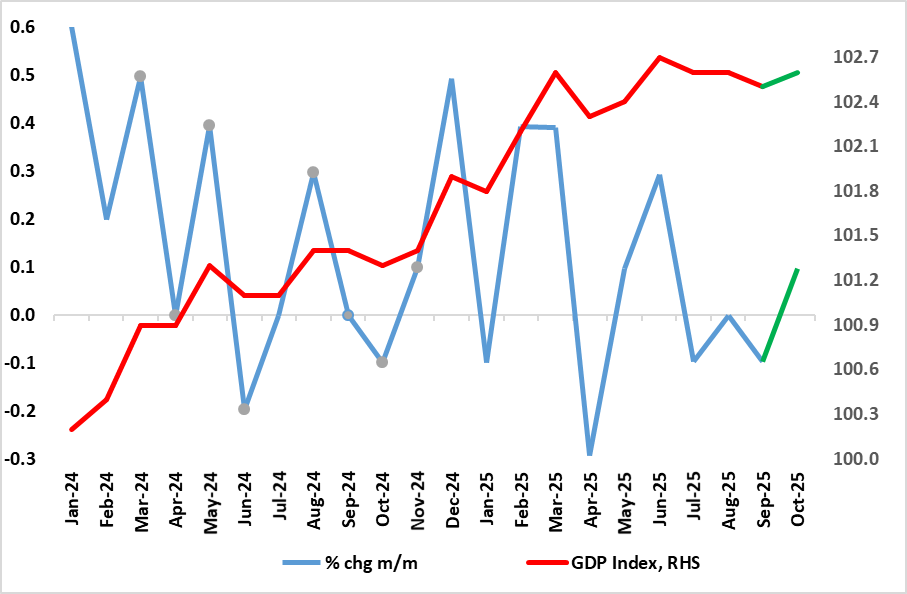

UK GDP Review: Underlying and Headline Economy Negative, Fragile and Listless

December 12, 2025 7:47 AM UTC

As we have underlined, GDP has hardly moved since March and this became even clearer with the October GDP release, the question being whether weakness is getting more discernible and significant. Indeed, it has fallen in three of the last four months (Figure 1), and where the unexpected further 0.

December 11, 2025

Eurozone Outlook: Running to Keep Fiscally Still?

December 11, 2025 10:09 AM UTC

· Amid what may still be tightening financial conditions and likely protracted trade uncertainty, we retain our below consensus activity forecast for 2026 but see a fiscally driven pick-up into 2027. However, the picture this year appears to be slightly better but the economy has actual

Swiss SNB Review: Preserving Ammunition

December 11, 2025 9:39 AM UTC

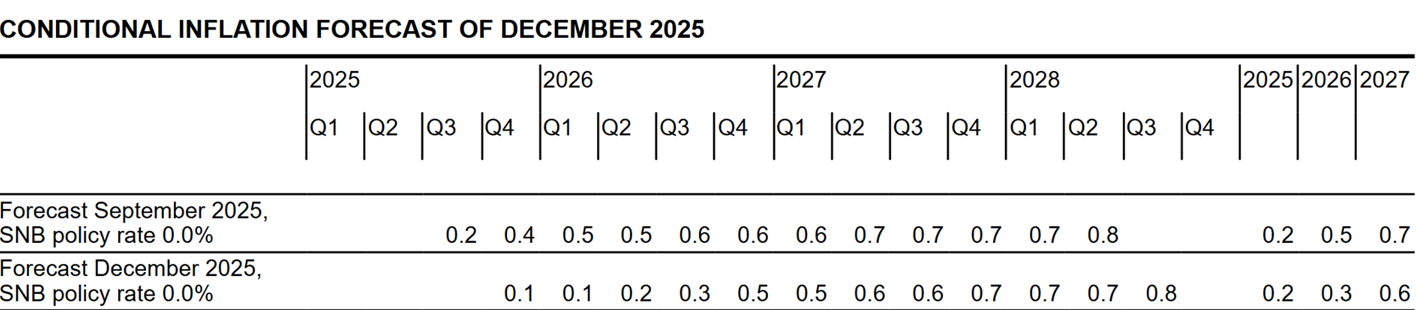

Although the tone of the economic outlook was a little perkier, the latest SNB analysis saw no real change. Policy was unchanged, as widely expected, with little shift in the forecast fir either growth or inflation. Overall it sees medium-term inflation at 0.6% (Figure 1), this despite a gloomy

December 10, 2025

Fed: Slower 2026 Easing

December 10, 2025 8:34 PM UTC

Powell in the press conference made clear that the Fed is now in a wait and see mood, with policy rates entering a broad measure of neutral policy rates. This means further weakening in labor demand and then consumption would be required to prompt an early 2026 cut. We are less upbeat than the Fed

Norges Bank Preview (Dec 18): Still Far Too Cautious

December 10, 2025 9:17 AM UTC

No change in policy and little shift in rhetoric was the message from the Norges Bank’s latest verdict. After what was to some a surprise (and seemingly far from a formality) move in September, in which the Norges Bank cut is policy rate by a further 25 bp to 4.0%, we see no change at the loomin

December 09, 2025

BoE Preview (Dec 18): How Big a Split?

December 9, 2025 11:29 AM UTC

That the BoE will deliver a fifth 25 bp rate cut (to 3.75%) on Dec 18 is almost certain, even after a Budget that did not accentuate current emerging demand weakness. The question is whether the MPC vote will be as close as the 5:4 split seen last month but with Governor Bailey switching sides.

Americas First: New National Security Strategy

December 9, 2025 8:40 AM UTC

· The new NSS at one level reads like a Trump/MAGA current list of topics and desires, that may not translate into policy or a major shift of military assets. Trump has blown hot and cold on Europe and China over the past 12 months and could shift again. Nevertheless, the NSS does r

ECB Preview (Dec 18): Still in Good Place – or Even Better?

December 9, 2025 7:52 AM UTC

A fourth successive stable policy decision will be the almost inevitable outcome of the ECB Council meeting verdict on Dec 18, with the discount rate left at 2.0%. The likely unanimous vote will mask splits about whether policy has troughed or not, this mainly a result of differences within the Co

December 08, 2025

Sweden Riksbank Preview (Dec 18): Policy to be Unchanged and little Move in Projections?

December 8, 2025 1:18 PM UTC

As we anticipated in our review, the Riksbank Board will be very pleased with the data flow since its last and very probably final rate cut on Sep 23 (to 1.75%). GDP saw a strong and unexpected Q3 showing of over 1% q/q while previously troublesome CPI data have softened appreciably thereby confir

UK CPI Preview (Dec 17): Down Further from Likely Peak?

December 8, 2025 9:43 AM UTC

It does seem as if the September CPI outcome will prove to be the CPI inflation peak. Indeed, although October figure fell a little less than the consensus to 3.6%, the looming November numbers may show a same-sized fall to 3.4%, a six-month low. We see the core rate seen also dropping 0.2 ppt b

December 04, 2025

China/Japan: The Australia Playbook or Grey Warfare

December 4, 2025 10:05 AM UTC

China will likely escalate pressure on Japan to back down over it less pacifist stance on self-defense, as it wants to drive a wedge between Japan and the U.S. One option is to repeat the 2020 copybook when China banned coal imports from Australia for 3 years. A 2nd alternative is grey warfare a

UK GDP Preview (Dec 12): Underlying Economy Fragile and Listless

December 4, 2025 9:55 AM UTC

As we have underlined, GDP has hardly moved since March and this is un likely to change with the October GDP release. Indeed, it has fallen in two of the last three months (Figure 1), albeit where some recovery should be in store for the current quarter as the September numbers were hit (temporari

SNB Preview (Dec 11). Still Staying at Zero – And For Some Time?

December 4, 2025 8:10 AM UTC

Along with just about everyone, we see unchanged SNB policy when it gives it next quarterly assessment on Dec 11. It is likely to retain what were modest growth outlook for this and next year and still see inflation nearer zero than the 2% upper target (figure 1). But this will be enough to just

December 02, 2025

EZ HICP Review: Services Inflation Still Problematic?

December 2, 2025 10:51 AM UTC

With what were previously unfavourable energy-related base effects reversing, EZ inflation edged down 0.1 ppt to 2.1% in October, largely in line with consensus thinking, but with the main core rate stable at 2.4%. This reversed in the flash November numbers in what was an outcome a notch above bo

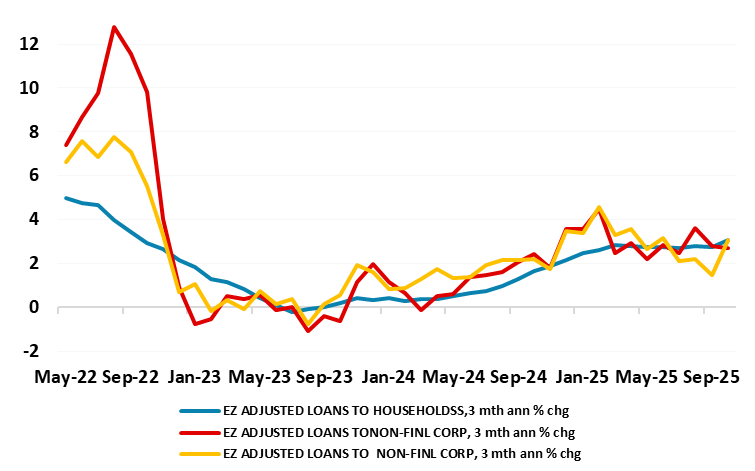

UK: BoE Offers Financial Boost?

December 2, 2025 8:05 AM UTC

In its updated financial policy report which included fresh bank stress tests, the BoE Financial Policy Committee (FPC) is reducing bank capital requirements. This very seems to be designed to encourage bank to lend and may reflect what have been modest, if not flagging, numbers regarding actual p

New Dovish Fed Chair and U.S. Yield Curve

December 2, 2025 1:00 AM UTC

· The initial knee jerk reaction if NEC Hassett is nominated as Fed chair would be for further yield curve steepening in the 10-2yr area. Even so, the dynamics of FOMC voting could mean that Hassett as Fed chair in itself does not deliver more Fed easing. This is already evident with

November 28, 2025

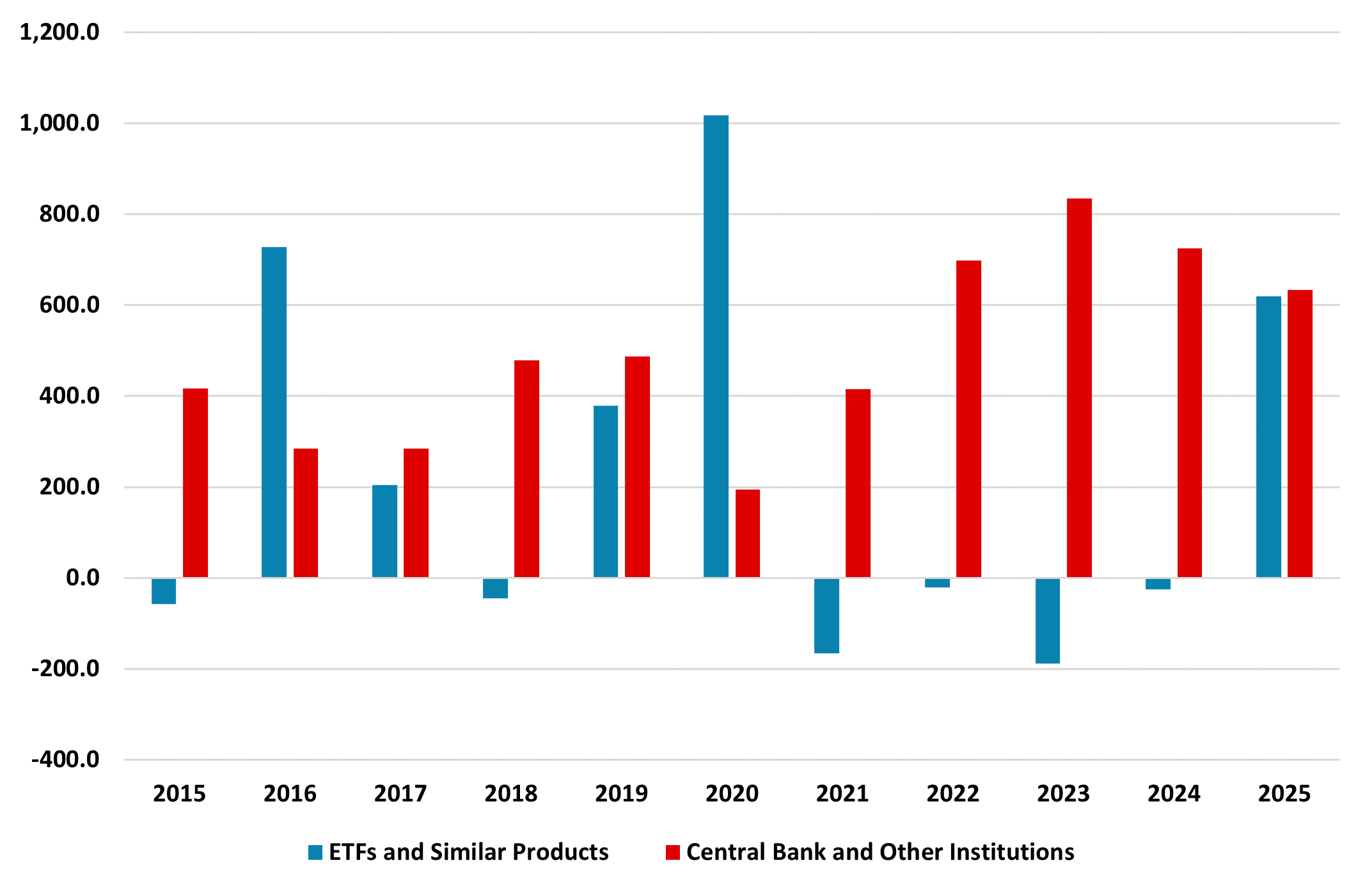

China’s Hidden Gold Buying: Why?

November 28, 2025 1:05 PM UTC

Speculation has been growing in the gold market that the surge in unrecorded gold purchases could be linked to China.

Overall, some unreported buying of gold by China could have occurred in 2025 and also in 2022-24. This could be a combination of wanting to avoid upsetting Trump during a tense U.S.-C

November 27, 2025

USMCA Renegotiation: Hostage To Trump

November 27, 2025 2:55 PM UTC

• Trump could decide to go on an early offensive over the July 2026 USMCA review or could wait until after the November congressional elections to act tough given it could cause new cost of living fears for U.S. voters. This could mean that at times the USMCA negotiations are upsetting fo

ECB: Financial Stability Review Less Complacent than Council?

November 27, 2025 1:36 PM UTC

The ECB is clearly split about whether policy has troughed or not, this mainly a result of differences within the Council as to where inflation risks lie. Regardless, as the account of the Oct 29-30 Council meeting chimed with comments from the meeting’s press conference, it does seem to us as i

November 26, 2025

UK Budget Review: Deferring the Fiscal Pain?

November 26, 2025 2:01 PM UTC

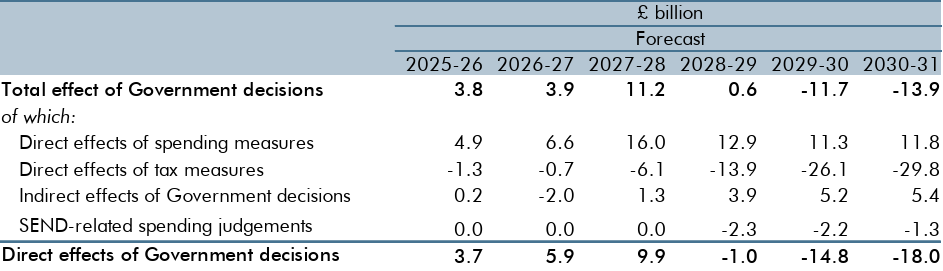

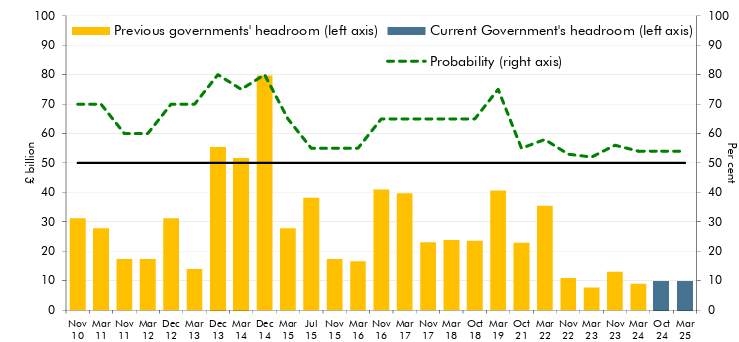

The Budget looks something of a fudge, with no fiscal tightening until 2028 suggesting policy changes very much back-loaded (Figure 1) and puzzlingly timed to take effect in what may be the lead-up to the next general election. The immediate the result is actually a modest boost to GDP growth in t

U.S. Corporate Bonds Into 2026

November 26, 2025 10:15 AM UTC

· Though U.S. corporate bond spreads are tight, absolute yield levels are reasonable due to higher U.S. Treasury yields than most of the post GFC period. The main risk remains of a U.S. recession, though economic data is more consistent with a soft landing and we have reduced the prob

November 24, 2025

EZ HICP Preview (Dec 2): Services Inflation Less Problematic?

November 24, 2025 2:19 PM UTC

The HICP inflation picture has clouded somewhat of late at least to some. With what were previously unfavourable energy-related base effects reversing, EZ inflation edged down 0.1 ppt to 2.1% in October, largely in line with consensus thinking, but with the main core rate stable at 2.4%. The latte

Japan Aging: Consumption Lessons for Eurozone/China?

November 24, 2025 10:55 AM UTC

· China will likely suffer slowing consumption from population aging in the coming years, as consumption per head falls for over 55’s and large scale immigration is not a likelihood. China’s household wealth is also heavily concentrated in falling illiquid residential property. Chin

German HICP Preview (Nov 28): Headline and Core To Edge Down Further?

November 24, 2025 9:00 AM UTC

Germany’s disinflation process hit a further and more-than-expected hurdle in September, as the HICP measure rose 0.3 ppt for a second successive month, thereby even more clearly up from July’s 1.8% y/y, that having been a 10-mth low. But a notch of this rise was reversed in the October number

November 21, 2025

U.S. Asset Inflows After April’s Trump Tariffs

November 21, 2025 8:00 AM UTC

· Net foreign portfolio inflows have not been hurt by Trump’s April tariff drama, with the AI and tech boom attracting new equity inflows. Flows could become more volatile with a U.S. equity bear market or recession, but these are modest risk alternative scenarios rather than high r

November 19, 2025

UK CPI Review: Down from Likely Peak?

November 19, 2025 7:50 AM UTC

It does seem as if the September CPI outcome (a third successive and lower-than-expected outcome of 3.8%) will prove to be the inflation peak. Indeed, the just released October figure fell a little less than the consensus but in line with BoE thinking, to 3.6%, helped by favourable energy base eff

November 18, 2025

UK Budget Outlook (Nov 26): The Fiscal Blame Game – Yet Again!

November 18, 2025 3:09 PM UTC

If not the most keenly awaited Budget for some years, Chancellor Reeve’s updates on Nov 26 is certainly the one that has attracted the most speculation and from all sides. What is clear is that amid several factors, a marked fiscal tightening is in store. This though now seems as if it will be

Markets 2026

November 18, 2025 10:30 AM UTC

· The Fed, ECB and BOE will likely drive further 10-2yr government bond yield curve steepening, with 10yr Bund yields rising due to ECB QT and German fiscal expansion. 10yr JGB yields are set to surge through 2%, as BOJ QT remains excessive and underestimated. The BOJ could partiall