Sweden Riksbank Preview (Dec 18): Policy to be Unchanged and little Move in Projections?

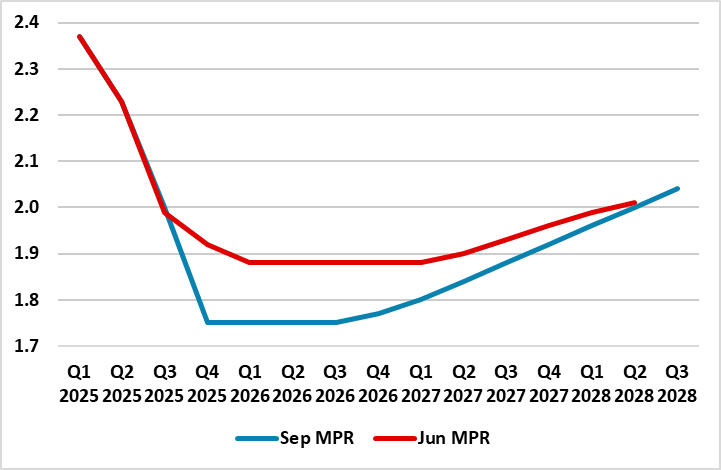

As we anticipated in our review, the Riksbank Board will be very pleased with the data flow since its last and very probably final rate cut on Sep 23 (to 1.75%). GDP saw a strong and unexpected Q3 showing of over 1% q/q while previously troublesome CPI data have softened appreciably thereby confirming (both our and Board) suspicions that the summer spike was aberrant. Admittedly, that GDP pick-up may be aberrant too, not least given the still gloomy message from the Riksbank’s own business survey and what are still soft labor market and monetary numbers. Thus the existing Board promise of no change was adhered last time around, and will repeated again for this December verdict. Against this almost certain unchanged policy picture, the focus will be on the updated projections, albeit these still likely to be little changed too. Regardless, we still do not see any looming policy reversal, as we see this current policy rate (1.75%) staying in place through 2027, ie a little longer than the Riksbank (Figure 1).

Figure 1: Riksbank Policy Rate Outlook

Source; Riksbank Monetary Policy Report (MPR)

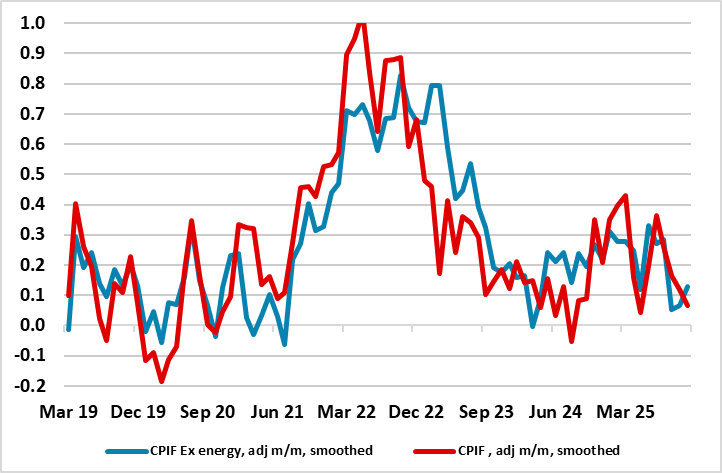

Indeed, it now seems all the clearer that the CPI spike seen in the July data was aberrant even though it partly persisted into August – flash November data (Nov 6) showed a very decisive drop for targeted CPIF inflation to 2.3% y/y, from 3.1% in October. The majority of this drop is explained base effect regarding electricity price. Even so, the flash estimate for CPIF excluding energy (CPIFXE) surprised to the downside, not only showing a resumption of gradual declines, but falling significantly to an 11-month low of 2.4% from 2.8% last month. Thanks to these declines, inflation fell back roughly in line with the Riksbank's forecast from its September monetary policy report. To us, the underlying picture is even more reassuring as smoothed adjusted m/m figures (not as probe to volatility via base effects) show most measures of underlying inflation ate rates consistent with, if not below, target (Figure 2)

But the real economy backdrop is still puzzling. Despite an apparent 1%-plus q/q Q3 GDP jump (twice Riksbank thinking), the economy still looks soggy, not least in the labor market. But the Riksbank will note the results if its own survey, which underscores that Swedish companies describe the economic situation as a long and protracted slump that has not improved since the spring and where industrial activity has weakened. In particular, the survey stresses that high unemployment is also weighing on expectations and is described as “the biggest challenge”. In addition, many respondents wonder whether households will continue to be cautious about consumption for a longer period. As a result, the subdued mood is reflected in the Business Survey indicator, which summarises the Riksbank’s Survey’s results. The indicator has weakened since May and remains below its historical average, as it has done since the end of 2022.

Figure 2: Core Inflation Running Nearer Zero?

Source; Stats Sweden, CE

It is against this background where we see the Riksbank adhering to its already above consensus GDP outlook, albeit with the Q3 numbers precipitating some upward revisions from the 1.1% outlook offered in September – we see an outcome nearer 1.8%, this also being the forecasts we envisage for the coming two years. This is well below the Riksbank’s thinking of 2.5 and 2.1% respectively, but where even these still suggest a persistent negative output gap. We think the Board will be reluctant to make any changes to its policy outlook; this currently envisages a tightening cycle beginning into early 2027 but even then with no more than 25 b hike though the year.

I,Andrew Wroblewski, the Senior Economist Western Europe declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.